Earnings Season Chatter Confirms AI-Driven Workforce Disruptions Keep Soaring

With nearly all S&P 500 companies now reported, Goldman analysts combed through third-quarter results, earnings calls, and related data and found an uptick in layoff discussions. The ongoing softening in the labor market points to a growing share of layoffs now linked to AI (though still a minority).

Goldman analyst Ronnie Walker outlined the key takeaways from this past earnings season about the labor market: rising layoffs, the growing influence of AI on workforce strategies, and easing wage pressures all signal a shifting labor landscape.

Here's a snippet of Walker's note:

The Q3 earnings season also brought renewed concern about the health of the labor market, as mentions of layoffs in earnings calls increased, as did other leading indicators of layoffs. Exhibit 5 shows that most of the components of our layoff tracker, which includes mentions of layoffs on earnings calls, have increased notably in recent months.

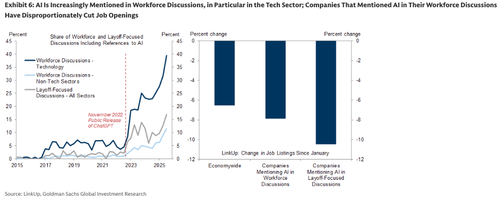

Investors were also focused on whether there might be a growing imprint on the labor market from AI adoption. While a minority of the layoffs discussed this earnings season were attributed to AI, the gray line in the left panel of Exhibit 6 shows that the AI-related share has increased notably this year and reached just over 15% in Q3. The blue lines in the same chart show that the share of discussions about broader workforce strategies that include AI has also increased, especially in the tech sector. And while we still find a limited impact from AI on the labor market at the economywide level, the companies discussing AI in the context of their workforce or layoffs indeed appear to be pulling back disproportionately on hiring: the right panel of Exhibit 6 shows that these companies have cut their job openings more sharply this year than the average public company.

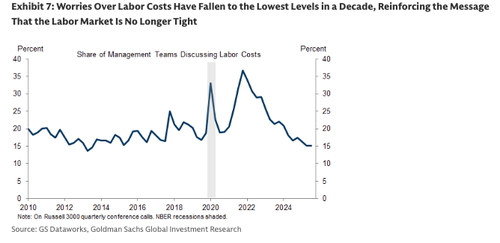

The rebound in job growth in the long-delayed September employment report quelled fears that this summer's labor market deterioration had accelerated during the period without official data. That said, company commentary broadly confirmed that job growth remains tepid and the labor market is softer than just before the pandemic. This increase in slack has reduced the prevalence of labor costs as a theme across earnings calls: Exhibit 7 shows that mentions of wages and labor costs have fallen to the lower end of the pre-pandemic range.

. . .

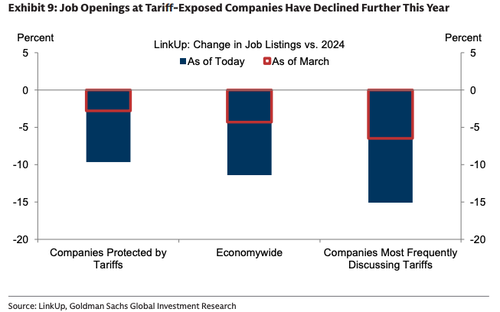

Similar to last quarter, some companies said that they planned to reduce costs by hiring less, reducing headcount, or pursuing productivity-enhancing initiatives (such as investing in AI solutions). And similar to last quarter, we find that companies with greater exposure to tariffs and policy uncertainty have sharply reduced their job openings this year (Exhibit 9). On the flip side, we find that companies receiving protection from foreign competition have reduced their job openings by slightly less than the public company average.

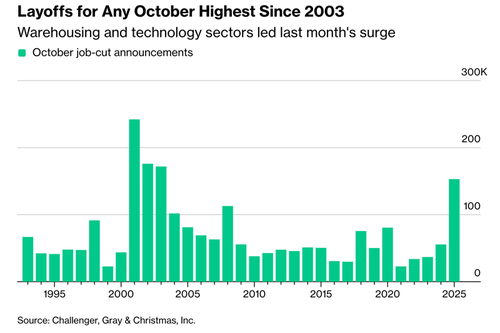

Softening labor market conditions and AI impacts come as no surprise, as the latest report from outplacement firm Challenger, Gray & Christmas showed that layoffs were the highest since 2003 in October.

Challenger warned in the report, "This is the highest total for October in over 20 years, and the highest total for a single month in the fourth quarter since 2008. Like in 2003, a disruptive technology is changing the landscape."

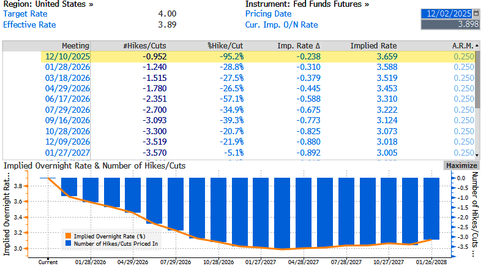

The takeaway is that the labor market was already softening by late summer, as cost-cutting reshaped corporate labor structures amid the need to correct pandemic-era overhiring in an environment of increasing AI adoption. This is a clear sign of continued loosening in the labor market as traders price in a 95% chance of a 25bps cut at next week's FOMC.

In a separate but recent note, JPMorgan analysts pointed out, "The market is weighing a weaker labor market and potential spending vs. evidence on the efficacy (and ROI) of AI plus productivity gains."

The share of AI-driven job displacement is poised to accelerate next year - and there's little doubt it will become a major topic in the coming midterm election cycle.

The full GS report is available exclusively for ZeroHedge Pro subscribers here.