First Victims Of 'Great Memory Crunch' Emerge As Data Centers Soak Up Global Supply

The latest Amazon price check shows Crucial Pro DDR5 64GB RAM has surged to a new high of $736 (even as high as $790), up from just $145 just six months ago. The spike comes as hyperscalers aggressively soak up global memory supply, leaving smartphone, PC, and other consumer-electronics makers that rely on high-bandwidth memory facing an acute shortage and hyperinflating costs.

Amazon price-tracking website CamelCamelCamel shows a parabolic price surge in Crucial Pro DDR5 64GB RAM, rising from $145 to $790 in just six months. Anyone building a gaming PC to power a trading station must be furious, as the greatest memory crunch of our time is now underway and could worsen in the months ahead.

One month ago, we cited Goldman analyst Maho Kamiya, who told clients that concerns about rising memory prices and the absence of top-down tailwinds had sent Nintendo shares spiraling.

Fast forward to Monday: Goldman analyst William Chan warned clients:

Memory shortage is real and accelerating due the AI infra demand, leaving a significant shortage for the conventional side of the industry, think smartphones, PCs and other consumer electronics which require high-bandwidth memory:

Micron Technology Inc. said an ongoing memory chip shortage has accelerated over the past quarter and will last beyond this year due to a surge in demand for high-end semiconductors required for AI infrastructure.

On Friday, Chinese media outlet Jiemian reported that major Chinese smartphone makers including Xiaomi Corp., Oppo and Shenzhen Transsion Holdings Co. are trimming their shipment targets for 2026 due to rising memory costs, with Oppo cutting its forecast by as much as 20%. All three did not respond to requests for comment.

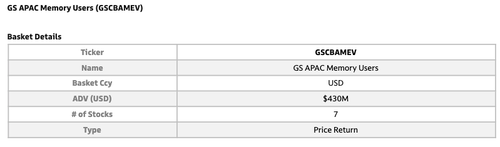

Chan's desk created a basket of Asian consumer electronics companies, where profit margins or volumes are likely to be impacted by soaring memory prices. That basket is GS APAC Memory Users (GSCBAMEV).

GSCBAMEV details:

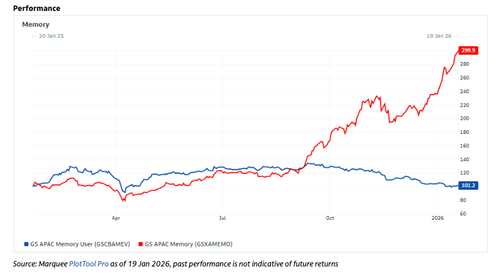

Memory companies vs. GSCBAMEV ...

Related:

-

"Entered New Era": SK Hynix To Build $13 Billion Memory Plant As Nvidia CEO Says AI Demand Soaring

-

"Market That Never Existed": Nvidia CEO Sparks Frenzy In Memory Stocks

-

Soaring Memory Costs Sink Nintendo Shares; Goldman Says Selloff Is Buy-The-Dip Opportunity

-

UBS Says Soaring Memory Chip Prices To "Turbo-Charge" Samsung Earnings

TrendForce expects 70% of high-end memory chips produced this year will be consumed by data centers.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal