Four Key Questions Driving Data Center Power Demand

This month marks a pivotal moment for the space-based data center theme going mainstream. On Earth, one major problem is that AI server rack power consumption is growing exponentially, straining already tight power grids, while meaningful expansion of nuclear power capacity won't close the gap until the 2030s.

Elon Musk, Jeff Bezos, and Sam Altman have all discussed the urgent need for space-based data centers in recent days and weeks.

On Saturday, we published a new report detailing how data centers in low-Earth orbit could bypass Earth-based constraints by using high-intensity solar power, passive radiative cooling to deep space, and modular designs that can be rapidly scaled and launched into orbit via SpaceX rockets.

With just 17 days left in the year, and after publishing numerous 2026 outlooks from leading institutional desks, we now turn our focus to the key questions shaping next year's outlook and the longer-term outlook for AI data center power demand.

Goldman analysts led by Brian Singer provided clients with more clarity on the AI data center power demand outlook for 2026 and beyond, outlining four key questions that frame the debate:

-

Parts & People: Will equipment and labor availability constrain power infrastructure?

-

Price & Policy: Will power demand be constrained by rising supply cost of Green and non-Green power options?

-

Productivity: Will new-gen AI chips and more efficient compute usage in the latest AI models drive lower or higher aggregate power demand?

-

Pervasiveness: When will we know not just whether AI is "delivering the goods" but what the goods are?

Those questions are answered here:

Parts & People: Will equipment and labor availability constrain power infrastructure?

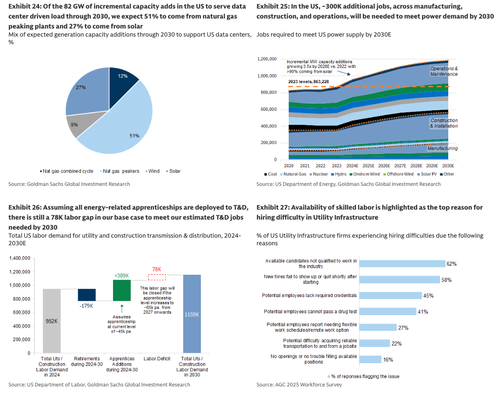

Equipment availability will be the principal driver of sourcing power capacity growth from renewables (in particular utility-scale solar and battery storage) and natural gas peaking plants in the near term, natural gas combined cycle in the medium term and nuclear in the long term. Our outlook for labor demand suggests the need for a substantive increase in skilled workers in transmission/distribution in the near to medium term.

Parts: We believe power sourcing will be governed more by availability and risk management than by supply cost. This leads to a relatively greater weighting towards utility-scale solar/battery storage/natural gas peaking plants in the near term, natural gas combined cycle in the medium term and nuclear in the long term. Our base case continues to assume that this decade, 40% of the data center power increase will be met with renewables, and we assume a modest nuclear capacity increase by the end of the decade targeted for data centers. The bulk of the remaining 60% we expect will be driven by natural gas generation -- a combination of combined cycle and peaking plants.

People: Sharp rise in demand with skilled labor needs for grid connectivity a greater area of potential constraint than generation capacity buildout. Generational growth in power demand is likely to have broad implications for a labor network already facing strain from aging and a limited pipeline of skilled labor. To meet our US/Europe Utilities teams' power demand growth estimates for 2023-2030, we estimate an additional ~510K US jobs (power & grids) and ~250K EU jobs (power) will be required. This new labor demand comes within a backdrop of an already tight labor market, adding potential constraints to the rate at which power demand can grow.

Price & Policy: Will power demand be constrained by rising supply cost of Green and non-Green power options?

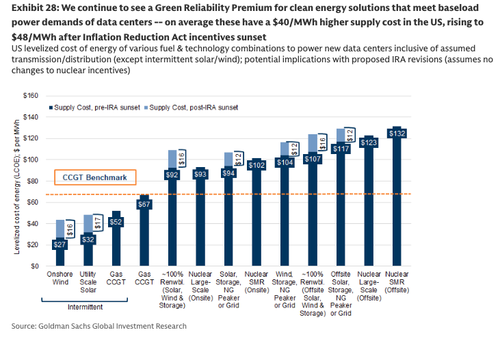

We believe Big Tech will continue to take an all-in approach to data center power sourcing, with continued willingness to pay Green Reliability Premiums while at the same time prioritizing time-to-market. We do not believe the sunsetting of Inflation Reduction Act incentives as part of the One Big Beautiful Bill Act will have a meaningful near-term impact on power sourcing.

Pricing: We continue to view the Green Reliability Premium as relatively modest in the context of hyperscalers' EBITDA and strong corporate returns. While there is not a Green Premium to supply utility-scale solar or onshore wind to the grid in the US on average relative to power generated from combined cycle natural gas plants, we see a Green Reliability Premium for round-the-clock low-carbon solutions that have built-in redundancy to mitigate intermittency. The average Green Reliability Premium of the various low carbon solutions (without assuming a price on carbon) is about $40/MWh, based on our analysis. We do not believe this higher price point -- or the $15/MWh increase we have seen in both gas-fired and renewable power solutions over the 15 months due to market tightness and policy changes -- will be a constraint to AI/data center power demand. This is largely because hyperscaler balance sheets, free cash flow and corporate returns are strong. Even in a burdensome scenario in which the 8 major hyperscalers were to pay an extra $40/MWh -- consistent with the average US Green Reliability Premium -- for all global data center power demand growth in 2030 vs. 2023, we estimate this would represent a cash outflow of only 2%-3% of hyperscaler total company EBITDA in 2030E; hyperscalers corporate returns would be impacted by only 1 percentage point vs. a 2027 baseline of 30% cash return on cash invested, well above sector median of 12%-13%.

Policy: Sunsetting of the Inflation Reduction Act incentives may impact sourcing at the end of the decade but is unlikely to have a major change in power capacity growth in the near term. We do not believe the sunsetting of the IRA incentives via the One Big Beautiful Bill Act (OBBBA) will have a material impact on near-term power sourcing -- our corporate discussions suggest larger utilities and developers have received safe harbor for utility-scale solar and onshore wind projects coming online over the next four years by meeting the latest guidance from the US Internal Revenue Service to qualify for federal incentives before they sunset. At our September 25 Global Sustainability Forum, there was healthy debate, however, as to whether we will see a deceleration in renewables capacity additions post 2028; our Utilities and Clean Technology teams assume modest deceleration in their base case. Beyond incentives, permitting remains key from a policy perspective and the extent/success of pushes by federal and local policymakers/regulators to speed up timing for permitting decisions. We expect this will be a key area to watch in 2026.

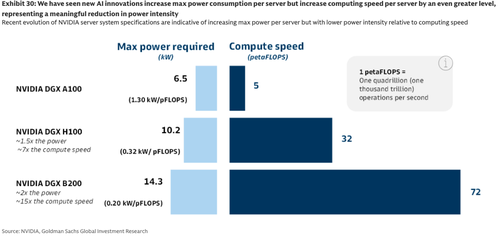

Productivity: Will new-gen AI chips and more efficient compute usage in the latest AI models drive lower or higher aggregate power demand?

We assume Big Tech cash flow/budgets will be the key constraint, leaving upside risk if there are no constraints and downside risk if compute speed or token demand are finite. As we have highlighted earlier, there are meaningful implications to budgets and equity valuations once AI token and compute demand become defined and AI moves from the Appraisal/Hopes & Dreams phase to the Execution & Efficiency phase.

Pervasiveness: When will we know not just whether AI is "delivering the goods" but what the goods are?

This will remain key to watch, particularly from a thematic perspective whether we see accelerated efficiency solutions in the health care, energy, agriculture and education sectors. In particular, we see two key areas of focus in 2026:

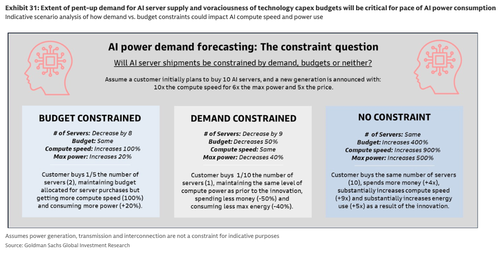

The energy intensity and overall need for the inference phase. We continue to assume a lower energy intensity set of servers relative to the training phase, though the energy demands of inference are in some debate depending on the pervasiveness and innovations in reasoning and automation. This will be a key focus area in 2026.

The elasticity of compute demand to improvements in energy and compute intensity (i.e., will these efficiencies drive increased demand for tokens/compute?), or the Jevons Paradox. In past research, we have highlighted three scenarios -- a demand constraint, when AI solutions are well delineated and efficiency gains in compute/energy drive little additional demand; a budget constraint, when efficiency gains drive increased demand without change to R&D budgets, and no constraint where efficiencies drive increased capital commitment. We assume the budget constraint at present, until there is greater confidence that AI solutions are broadly known and that corporate decisions to no longer invest incrementally in AI would not negatively impact competitive positioning.

So while left-wing progressives neutered the Western world with nation-killing de-growth climate policies under the guise of a supposed "climate crisis," China and other parts of the Eastern world have been rapidly adding massive amounts of power capacity through large-scale coal and nuclear plant buildouts.

China is *all* of the growth in global electricity per person. https://t.co/5wk8j1pTJ0 pic.twitter.com/Nu4Ml15Vou

— Jesse Peltan (@JessePeltan) December 13, 2025

And as a result, Western billionaires powering the AI bubble are now looking skyward for data center buildouts, tapping into near-unlimited solar energy as a bridge until nuclear power capacity ramps up in the 2030s.

For the full note, ZeroHedge Pro subscribers can read it in the usual place, packed with charts and deeper context on the key investing themes shaping 2026.