Goldman Warns DRAM Shortage Not The Only Bottleneck In AI Data Center Buildouts

We've coined the term "The Great Memory Crunch" to describe how data centers are absorbing a massive share of the world's high-bandwidth memory (HBM) supply, diverting much-needed capacity away from consumer devices.

The downstream risk is tighter memory supplies and soaring input costs, which could squeeze margins for consumer electronics companies such as Nintendo and its peers. Industry insiders also warn that consumers may want to pull forward purchases of devices exposed to HBM-related supply chain snarls, as memory markets are set to tighten further.

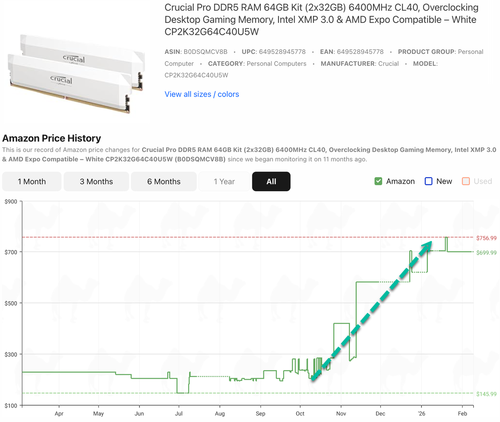

CamelCamelCamel pricing data for Amazon sellers shows Crucial's Crucial Pro DDR5 64GB kit at around $700, up from $145 just six months ago, underscoring how quickly the memory crunch hit the market.

Last week, Qualcomm and Arm Holdings warned that the HBM crunch will cap smartphone production and slow near-term growth.

Goldman analyst William Chan recently warned clients, "Memory shortage is real and accelerating due to the AI infra demand, leaving a significant shortage for the conventional side of the industry, think smartphones, PCs, and other consumer electronics which require high-bandwidth memory..."

In a separate note, Goldman's Allen Chang recently revised his global PC shipment forecast lower for 2026-2028 due to the memory crunch.

The latest from Goldman analysts, led by Katherine Murphy, is a note to clients on Monday that summarizes a conversation with Alex Veytsman, Chief Technology and AI Officer at Micro Data Center, suggesting the memory crunch will likely persist for roughly two years and is "reminiscent of the COVID-19 era" shortages.

Murphy's key takeaways from her conversation with Veytsman are below. But the most concerning point, flagged at the end, is that the entire data-center buildout supply chain appears increasingly snarled.

Bottom line:

Robust AI-driven demand & disciplined supplier actions should keep DRAM supply tight & prices elevated for the next ~2 years;

AI infrastructure buyers are likely to absorb higher memory costs in order to prioritize on-time GPU deliveries;

Beyond constraints in DRAM, several other critical data center physical infrastructure components also face multi-month to multi-year backlogs.

Expect DRAM supply tightness & elevated pricing for next ~2 years. The IT hardware industry is entering a structural scarcity phase as AI infrastructure demand triggers a massive supply-demand imbalance in the memory sector. DRAM and NAND are experiencing multi-month lead times reminiscent of the COVID-19 era, with HBM particularly constrained due to packaging complexity and yield learning curves. This scarcity is exacerbated by supply discipline among major players (SK Hynix, Samsung, Micron), which has an outsized impact on low-end consumer electronics and non-AI segments that are struggling for allocation. Buyers of memory prefer to engage in long term agreements (v. spot pricing), with a focus on volume commitments, priority access, and allocation guarantees. Mr. Veytsman expects DRAM supply to remain tight & prices to remain elevated for the next ~2 years

AI infrastructure buyers are willing to absorb higher prices. Mr. Veystman expects buyers of AI data center infrastructure will largely absorb higher costs related to memory, because while the cost increases are substantial, they remain a secondary concern for AI data center operators compared to the risk of delayed GPU deployments. He highlighted potential opportunities to "de-spec" AI infrastructure to partially offset higher memory price including redesigned power delivery, more targeted cooling infrastructure, and optimized network fabrics. Separately, he expects that enterprise-oriented OEMs like DELL will manage higher component costs by raising prices on deployment services or financing rates, which spreads the higher costs out over 3-5 year contract

DRAM is not the only bottleneck in AI data center infrastructure projects. Beyond memory, the industry faces multi-month to multi-year backlogs in several critical data center physical infrastructure components including: turbines, transformers, advanced packaging, power supplies, liquid cooling components, fans, optical switches and fiber, NICs, and chassis. To broaden supply, some vendors are looking to qualify Chinese suppliers like CXMT and YMTC for lower-end and APAC markets, but Mr. Veytsman expects that the lack of a competitive HBM offering ensures that the high-end AI ecosystem will remain tethered to the current supply-constrained leaders.

Professional subscribers can learn more about the memory industry on our new Marketdesk.ai portal.