Concerns Mount Over Europe's Below-Average NatGas Storage Levels Ahead Of Winter

A report from the European Network for Transmission System Operators for Gas (ENTSOG) shows that while the EU is well-prepared for the 2025–26 winter, natural gas storage levels across the bloc are significantly lower than this time last year and remain well below the 10-year average. Europe relies heavily on stored NatGas to meet winter heating demand. Entering the cold season with reduced reserves could drive prices higher, as consumption is set to rise steadily with colder weather ahead.

Key points from ENTSOG's report:

-

The EU gas system reached a storage level of 83% on 1 October, showing resilience in case of further disruption to gas supply from Russia and limited supplies of LNG. This level is in the range observed in the years prior to the energy crisis.

-

Even without Russian pipeline gas imports, winter can end with EU storage filled at 35%. This would provide a good basis for refilling gas storage facilities next summer.

-

In scenarios where there is further major disruption in supply, the EU gas system is resilient enough to increase LNG imports and compensate for the loss of supply. This resilience can also limit the need to reduce demand for gas in case of extreme weather conditions.

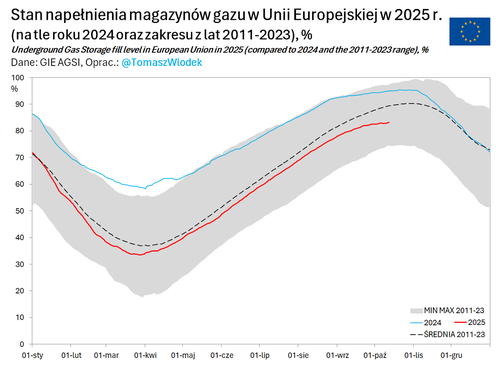

However, not everyone was as confident as ENTSOG. NatGas researcher Tomasz Włodek pointed out on X, "The level of natural gas storage in the EU is 83% and is significantly lower than last year's (95%) and lower than the multi-year average (89.4%)."

Włodek continued, "Taking into account preliminary weather forecasts, the maximum storage level is unlikely to exceed 85%."

Underground Gas Storage fill level in the European Union in 2025 (compared to 2024 and the 2011–2023 range), %

In Germany...

🇩🇪EXTREMELY LOW GAS STORAGE:

— Lord Bebo (@MyLordBebo) October 14, 2025

- The filling levels of German gas storage facilities are 76%

- Last year, it was 98.3% at this time

- With a share of around 56 percent, gas heating is the most widespread type of heating in this country.

- In October, the new heating season… pic.twitter.com/wHYhhUY7cB

And the Netherlands.

Same in The Netherlands. 😐 pic.twitter.com/j1WF3cWcts

— Dendemen🐭 (@Dendemen1) October 14, 2025

Russian news TASS reports...

Europe depends heavily on stored NatGas to meet winter heating and power demand when consumption spikes. Storage acts as a shock absorber when it is full; when it is low, it triggers panic buying.

Especially after the Ukraine-Russia war, Europe's NatGas system now depends far more on LNG regasification terminals in Spain, France, and the Netherlands.

Analysts and traders watch weekly storage reports that will heavily influence Dutch TTF Natural Gas Futures, the benchmark for Europe's gas trading, power prices, and carbon contracts.

TTF futures are trading at 31.750 a megawatt-hour late Tuesday, range-bound between 30 and 35 since summer.

Let's just hope Europe doesn't have a fierce winter.