Goldman Upgrades Copper Price Forecast Weeks After Warning About "Circular Melt-Up"

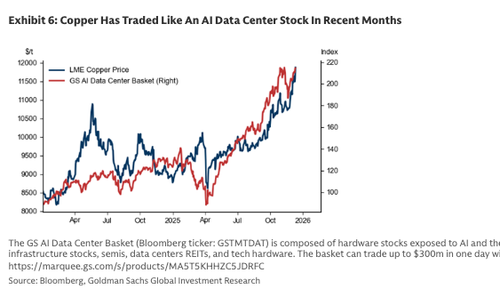

Copper futures on the London Metal Exchange hit a new record high late last week at $11,952 per ton, and are now trading near $11,700 per ton, up more than 33% year to date. The explosive move, which has copper trading like an AI data center stock in recent months, prompted Goldman analysts to warn earlier this month of a “circular melt-up.”

Now, a separate team of analysts from Goldman, led by Eoin Dinsmore, has upgraded their LME copper 2026 price forecast from $10,650 to $11,400, based on the "lower probability of a refined copper tariff being implemented by H1 2026 as affordability concerns take priority."

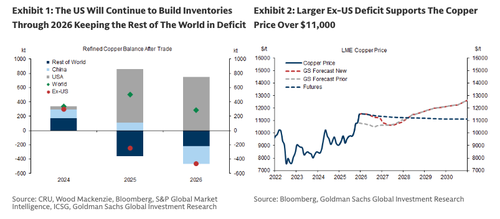

"A later tariff implementation should result in a larger-than-expected ex-US market deficit. We have kept our 2027 price forecast of $10,750 unchanged, as we expect the LME price to edge down once a tariff is in place and global inventory levels come back into focus," Dinsmore wrote in a note to clients on Tuesday.

Dinsmore noted the ex-US copper deficit is projected to widen from 250 kt in 2025 to 450 kt in 2026, thereby further impacting global prices, adding that anticipation of future tariffs should continue encouraging elevated US prices and more stockpiling.

The commodity analyst continued:

We believe the copper price is increasingly being set by the ex-US market balance, which we forecast will tighten from a ~250kt deficit in 2025 to a ~450kt deficit in 2026. We think of the later refined copper tariff implementation as equivalent to a tightening in the ex-US copper market, as expectations of a future tariff should keep the US copper price at a premium to the LME and drive US stockpiling. However, we also lift our 2026 global market surplus to 300kt from 160kt, as the higher price drives higher scrap collection (100kt) and lower demand via additional substitution to aluminium (40kt).

Later Tariff Implementation Supports Copper Around $11,400

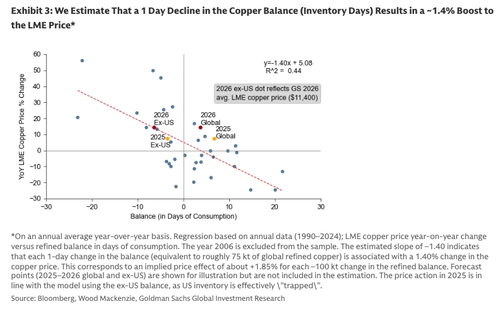

We think the ex-US copper balance is now the key driver of the LME price, while historically the price has been driven by the global market balance. Our rule of thumb is that a 1 day decline in the copper balance (in terms of inventory days of consumption) results in a ~1.4% boost to the LME price (on a YoY annual average basis) (Exhibit 3). Because US inventory is effectively "trapped", we apply our model to ex-US inventory changes in 2025 and 2026. In 2026, our base case is that ex-US copper inventory draws by ~450kt - which allows a 750kt build in the US (similar build to 2025), given our estimated 300kt global surplus. Our upwardly revised 2026 average LME price forecast of $11,400 is in line with the model-implied price change from this inventory change.

Lifting Our Copper Price Forecast Due to Later Tariff Implementation

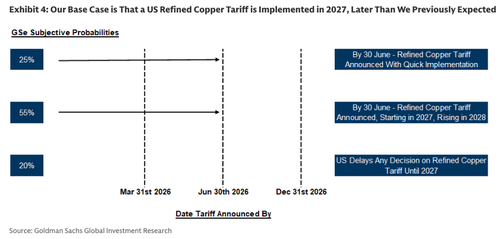

We lower the probability that a US refined copper tariff is implemented in H1 2026, which was previously our base case view, to 25%. Our new baseline forecast (55% probability) is that a 15% tariff is announced in H1 2026 to be implemented in 2027 (Exhibit 4), with the possibility of an increase to 30% in 2028. Given the focus on limiting disruption to US businesses, we think new tariffs in 2026 are unlikely, as seen in the 9th December decision to implement tariffs on Nicaragua which only come into effect in 2027 (10% in 2027 rising to 15% in 2028).

Our new base case of a H1 2026 tariff decision and delayed implementation means that we expect the US Administration to stick to its previously suggested timeline to implement a refined copper tariff. We do not expect copper tariffs to be announced alongside the Critical Minerals Section 232 decision (due by end Jan-2026), which may not feature any import tariffs. In a scenario where the US Supreme Court blocks the IEEPA tariffs (by end Jan-2026), and the US administration could then enact tariffs under Section 122/232/301 we don't expect them to increase or expand copper tariffs in response.

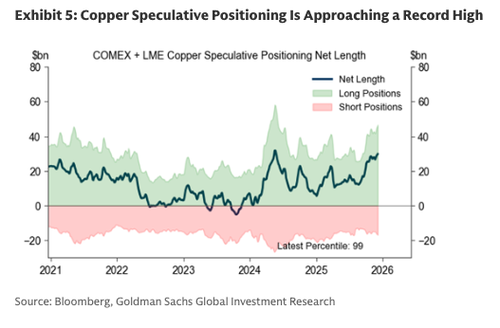

But the outcomes remain highly uncertain, and we still place a 25% probability that a tariff is implemented in H1 2026, which the administration could justify to drive investment and deliver jobs. This would likely result in a rapid copper price correction, especially as net speculative length is close to record levels. There is also a risk that the administration goes quiet on copper tariffs and no announcement is made in 2026, and refined copper tariffs are placed indefinitely on hold (20% probability). In this scenario we would expect a similar 2026 price path to our base case as prolonged uncertainty keeps the COMEX price at a premium to LME and flows into the US continue.

Elevated Risk of Price Correction On Stretched Speculative Positioning And AI Optimism

Trading like an AI data center stock...

What's clear is that any shift around artificial intelligence or economic data could dampen broader risk appetite for the industrial metal, even with stockpiling trends in the US and a growing global deficit (ex-US). It appears that, for now, Goldman expects prices to remain at $11,000 as the new normal. All eyes on the Trump administration's copper tariff implementation.

ZeroHedge Pro subs can read the full note in the usual place.