'Higher For Longer': Amid Equity Chaos, Goldman Sees Commodity Boost From 'Hard Asset Rotation'

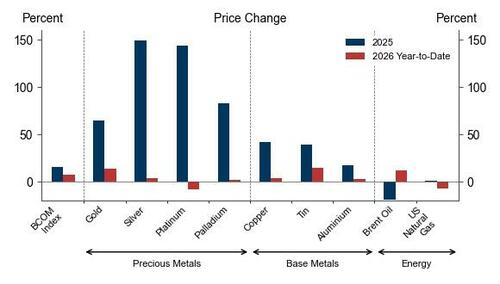

Following a 2025 metals rally, many commodities are off to a strong (though volatile) start in 2026.

Goldman Sachs Commodity Research team note that client conversations suggest that investor appetite to diversify into hard assets amidst macro and geopolitical uncertainty (sometimes associated with the debasement theme) is a key driver of the rally.

Hard assets are tangible, physical items that have intrinsic value, including commodities, real estate, infrastructure and equipment, and tend to hold value over time, especially during inflation or economic uncertainty.

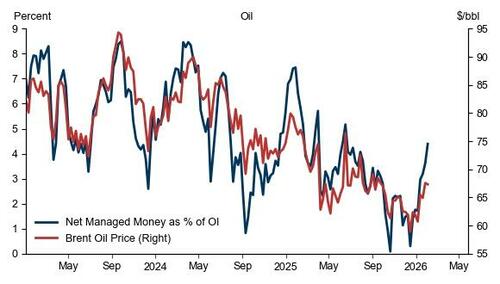

Given the rotation from soft assets (e.g. fixed income or capital-light equities) to hard assets, Goldman analyzes the link between active investor positioning and prices, which is close for commodities such as oil.

Specifically, how would a sustained rise in active investor positioning into commodities affect prices? And what are the risks from this rotation to the prices of gold, copper, and oil?

Large Boosts.

Investor diversification flows can drive large short-run price boosts because commodity markets are small vs. equities and bonds.

We see greater price upside from the hard assets rotation for precious metals and copper than for oil and natural gas for three reasons.

#1. Market size. Investor diversification flows can boost prices more in metals markets, which are (very) small.

#2. Supply response. Higher energy prices incentivize shale supply, which in turn dampens the price boost from investment flows. In contrast, supply is particularly constrained and largely long-cycle for copper and especially precious metals.

#3. Storage. Higher supply and lower demand result in inventory accumulation until hitting storage capacity limits (which are lower for energy than for metals) which can trigger large roll costs for energy futures. In contrast, roll costs remain limited on futures for easy-to-store metals, and don’t exist when owning physically backed assets such as precious ETFs.

Gold.

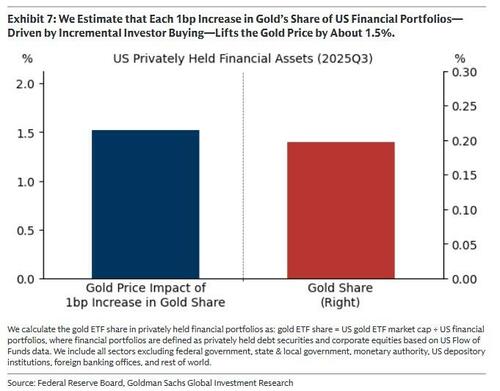

We see upside risk to our $5,400 Dec26 forecast from private sector diversification.

We estimate that every 1bp increase in the gold share of US financial portfolios--driven by incremental purchases--raises prices by 1.5%.

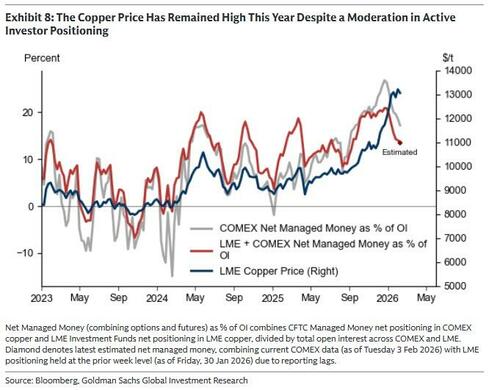

Copper.

We estimate a boost to prices from a 1 standard deviation (10pp) increase in net managed money as % of open interest of 6.9% in the short-run, which moderates to 4.2% after 1 year as scrap supply rises and demand softens.

We estimate upside risks to our forecast from the hard assets rotation and from strategic stockpiling.

Oil.

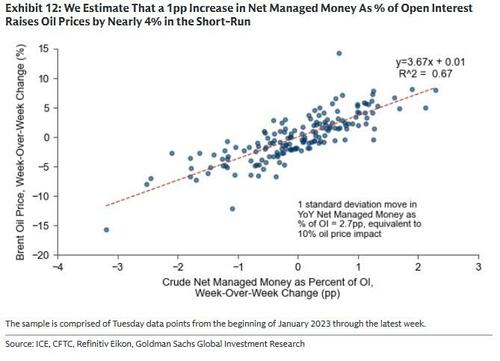

We estimate a boost to prices from a 1 standard deviation (2.7pp) increase in net managed money as % of open interest of 10% in the short-run, which moderates to 7½% after 1 year.

We estimate upside risks to our forecast from the hard assets rotation and from geopolitical supply losses.

High for longer.

Our analysis suggests that the investor rotation in hard assets can keep several metals prices high for longer, including above what physical fundamentals justify, which we think is the case right now for copper.

Professional subscribers can read the full "The Boost From The Hard Assets Rotation" note here at our new Marketdesk.ai portal