UBS Analysts Return From Magic Carpet Ride Across Middle East Energy Hubs With Four Big Takeaways

Brent crude has traded steadily above $60 a barrel over the past six months, with brief pumps and dumps around the $70 handle. The latest signal from OPEC points to a production increase in December, followed by a pause in additional hikes through the first quarter of 2026.

Providing more color on the Brent crude market are UBS analysts led by Josh Silverstein, who recently visited Qatar, Saudi Arabia, and the UAE, meeting with major energy producers, government agencies, sovereign wealth funds, and oilfield service firms, as well as conducting a tour of the NEOM region.

Silverstein highlighted four key insights from the team’s recent oil and gas tour across the Middle East:

-

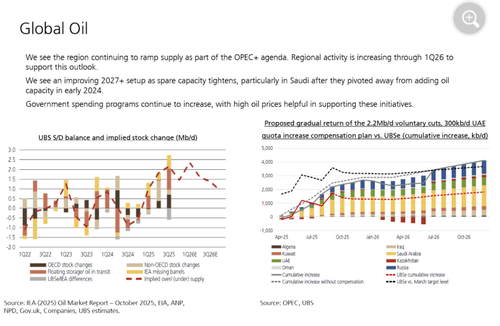

Oil Supply Outlook: Increasing oil production is expected to maintain short-term downward pressure on prices. However, UBS holds a constructive long-term view (post-2027) as spare capacity tightens, upstream activity pivots toward natural gas, and government mega-spending programs continue.

-

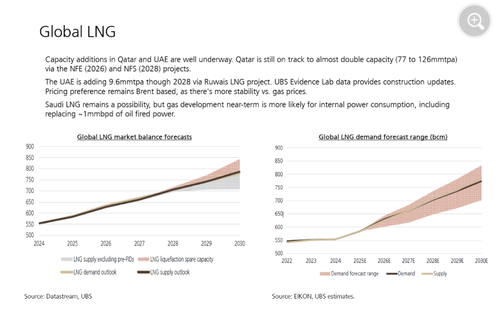

LNG Expansion: Regional LNG development projects are progressing, though capacity ramp-ups will depend on market conditions.

-

Oilfield Services (OFS): Activity is accelerating, creating a tailwind into 2026.

-

Energy Transition Strategy: Saudi Arabia and the UAE are heavily investing in data centers powered by natural gas and renewables, highlighting their push toward energy diversification and digital infrastructure growth.

Expanded view on Global Oil

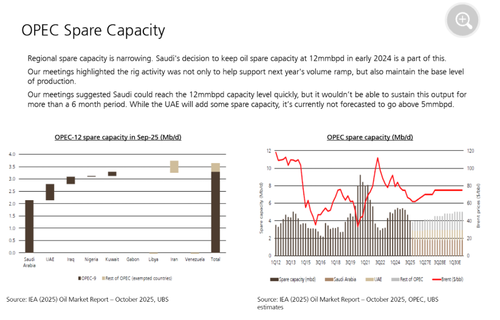

Expanded view on OPEC Spare Capacity

Expanded view on Global LNG

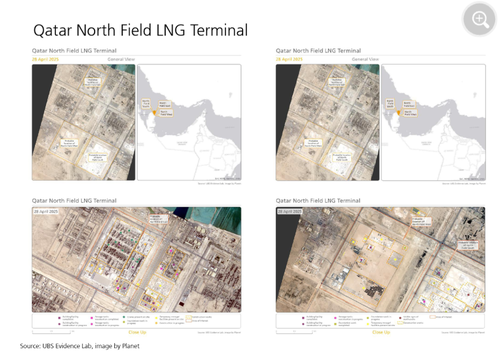

Expanded view on Qatar North Field LNG Terminal

The main takeaway from UBS is that the Middle East remains committed to expanding energy production and maintaining dominance in global supply. The analysts see short-term oil softness but long-term tightening, with LNG and oilfield service demand ramping up and massive capital flowing into “transition” infrastructure like gas-fired and renewable-powered data centers.

Meanwhile, JPMorgan and Goldman Sachs forecast further price losses below $60 per barrel, although judging by their terrible track record, it likely means $100 oil is inevitable.