What's Going On With Silver: Goldman's Commodity Desk Chimes In

Some commentary on the ongoing insane move in silver from Goldman specialist James McGeoch..

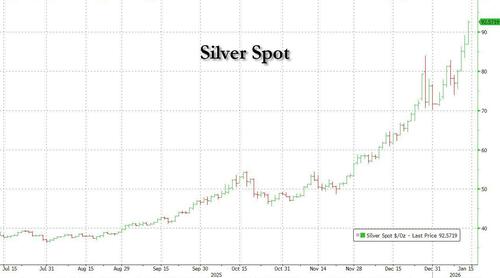

Silver a total standout, you read all these X threads about banks being stopped in and racing to cover to deliver etc, those in the know just laugh at this, its not the way its done.

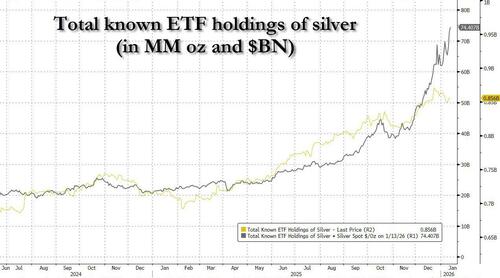

What we can say is physical metal pull, market convinced itself in the west to get short the move (CME positioning flattened almost completely, see CTA monitor bottom), silver is a superconductor, robotics (think China 5Yr plan) and the moves continue to be in the Asian session (SHFE premium has sustained for some time) think export bans.

Gold/Silver pair down to 52x - the lowest since Dec 2012.

One thing for sure: Fresnillo production update on 28/1 (need to wait for HOC and KGH into March).

Will dig more in this channel today, instinct naturally on the move is to trim, however already had a few chats this am and those who called it very early are not of a mind to trim (conviction is a beautiful thing to behold!).

Go back to Monday and GS hosted Global Strat conference - Copper is the standout commodity. 45% expect Copper to deliver the highest price return in 2026, tripling last year’s share. Gold remains popular, with 41% expecting prices to stay around $4,000–$5,000/toz and 52% seeing further rallies. Bitcoin enthusiasm has faded sharply.

Oil outlook is bearish. 54% expect Brent crude to drop below $60/bbl, a dramatic shift from last year (when only 5% expected this). Only 10% see prices rising above $70/bbl.

Remember commodities index rebalances end Today (5 days from Jan 8), just another case of how seasoned this was (remember huge selling in Silver over the period was the standout).

I mean its not just me who is excited: Metals Are in History-Making Mode (nothing new here, just a different voice of support).

More in the full Goldman note available to pro subs.