Bitcoin More Attractive Than Gold In The Long-Term: JPMorgan

ETF outflows and futures contracts liquidations have dramatically weighed on crypto markets recently, but as JPMorgan's Nikolaos Panigirtzoglou writes in his latest 'Flows & Liquidity' note, the large outperformance of gold vs. bitcoin since last October coupled with the sharp rise in gold volatility has left bitcoin looking even more attractive compared to gold over the long term.

Crypto markets came under further pressure over the past week as risk assets and in particular tech came under pressure and as gold and silver, the other perceived hedges to a catastrophic scenario, saw a sharp correction. Solana’s Step Finance suffered a $26mn hack, further denting investors confidence in crypto markets.

We have seen crypto position liquidations over the past week, but more modest compared to those seen last quarter.

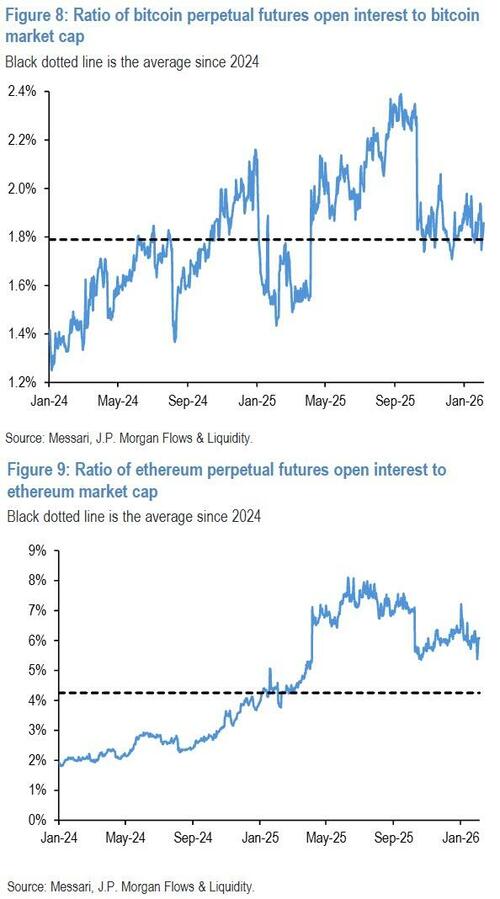

In particular, deleveraging in perpetual futures, which we proxy by dividing the open interest in bitcoin perpetual futures relative to bitcoin market cap and ethereum perpetual futures relative to ethereum market cap, have been less pronounced than those seen last October.

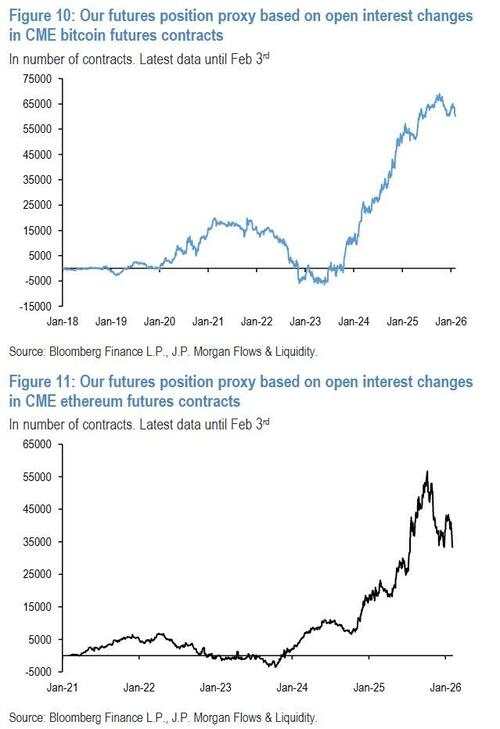

Also, there have been liquidations by non-native institutional investors in CME bitcoin and ethereum futures, but again more modest than those seen last quarter.

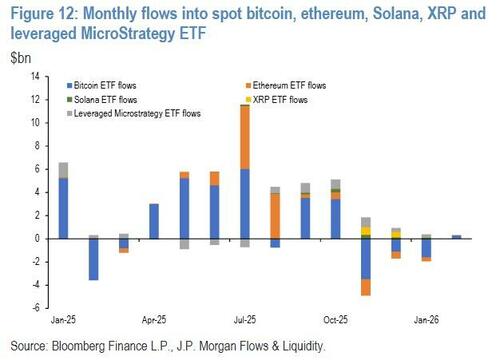

Spot ETFs continued to suffer outflows, suggesting that negative sentiment is widespread and encompasses both institutional and retail investors.

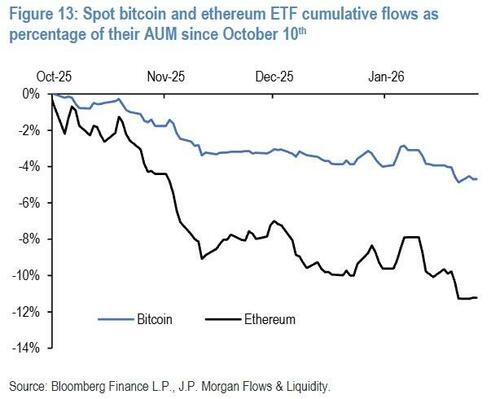

The cumulative outflows from spot bitcoin and ethereum ETFs as a percentage of their assets under management since the October 10th MSCI announcement show that ethereum ETFs have experienced three times more outflows than bitcoin relative to their size, highlighting the greater liquidity vulnerability of altcoins as even modest dollar outflows can have a big market impact.

In addition, stablecoins have seen some contraction over the past weeks in dollar terms, amplifying the negative sentiment.

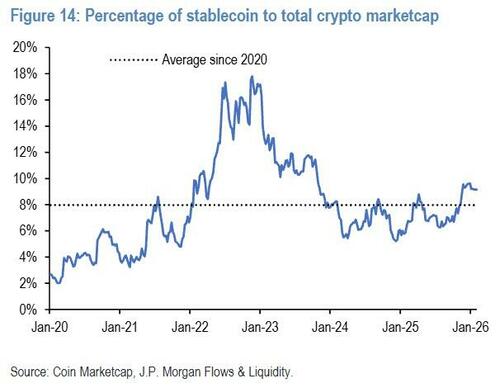

Although there is a temptation to view the recent outflows from stablecoins as a sign that investors are exiting the crypto ecosystem, we view the recent stablecoin contraction as a natural and delayed reaction to the shrinkage of overall crypto market cap.

As we explained previously, the ratio of stablecoins to crypto market cap has been mean reverting historically, and as the overall crypto market cap has shrunk by so much since last October, it is natural for participants in the crypto ecosystem to need less stablecoin collateral in dollar terms.

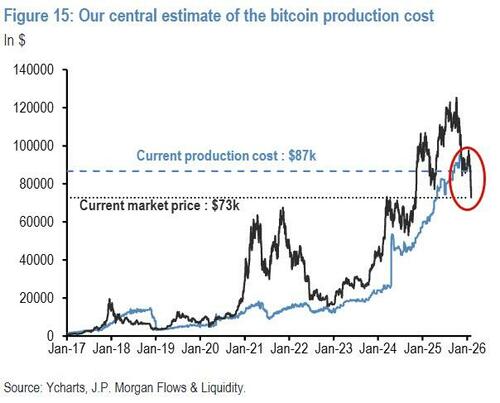

The recent market correction has pushed the bitcoin price further below the estimated production cost, which has historically served as a soft price floor.

That said, if the bitcoin price remains below this threshold for an extended period, unprofitable miners are likely to exit the market, driving production cost even lower. Our current central estimate of the bitcoin production cost is $87k.

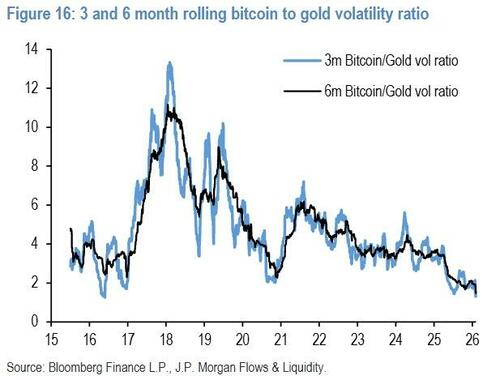

The large outperformance of gold vs. bitcoin since last October coupled with the sharp rise in gold volatility has led to bitcoin looking even more attractive compared to gold over the long term.

The chart below shows that the bitcoin-to-gold volatility ratio has been drifting to 1.5, a new record low.

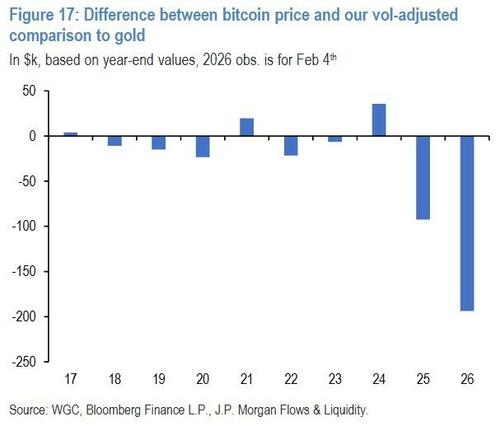

On a volatility-adjusted basis, bitcoin’s market cap would in theory have to rise to $266k to match private sector’s investment in gold (around $8tr excluding central banks).

This $266k volatility-adjusted comparison to gold is in our opinion an unrealistic target for this year, but it shows the upside potential over the long term once negative sentiment is reversed and once bitcoin is again perceived equally attractive to gold as a potential hedge to a catastrophic scenario.

Professional subscribers can read JPMorgan's full note here at our new Marketdesk.ai portal