'Dead' Bitcoin Is Simply Doing What It Always Does Best

Authored by Vassilis Karamanis, FX/Rates strategist via Bloomberg,

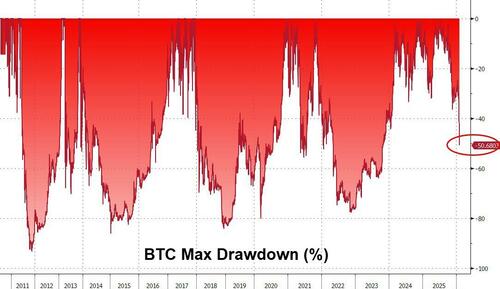

Reports of Bitcoin’s death are once again trending, but for anyone who has lived through a halving cycle, this 50% haircut is just scheduled programming: liquidating the impatient and dying all over again.

Bitcoin fell below the $70,000 mark on Thursday for the first time since 2024, and barely managed to hold above $60,000 this morning.

This steep retreat from the record high of around $126,000 again raises the question: is the crypto market finally broken?

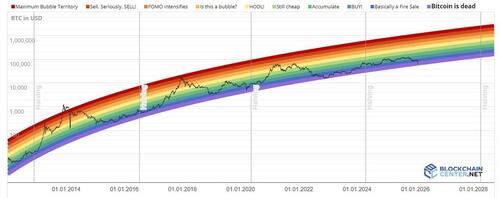

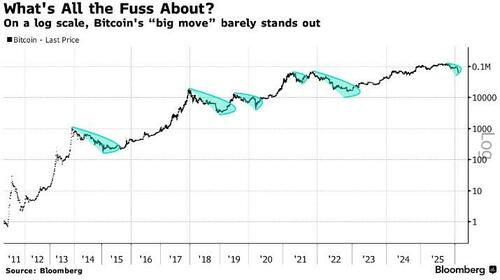

If you look at the popular Rainbow Chart, a logarithmic regression model beloved by long-term holders, we have officially entered the purple territory.

That is the zone historically labeled as “Bitcoin Is Dead,” following the so-called Fire Sale.

For the veterans, this is not a sign of the end, but a signal that the speculative crowd has been sufficiently bleached out of the system.

What is different this time, though, is the pain threshold for the new investors in town. For the first time since the 2024 launch of US spot ETFs, the average institutional buyer is underwater. With the ETF complex and corporate treasuries having an estimated entry range significantly above spot levels, we have moved past a simple correction and into a genuine test of institutional resolve.

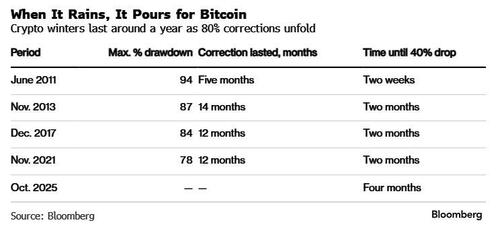

If history is any guide, we might only be halfway to a bottom. In the world of crypto, a 40% drop can be seen as the threshold where a correction matures into a bear market.

The pace of this decline has been more measured than the flash crashes of 2017 and 2021.

It’s taken roughly 120 days to reach this point, compared with 60 days in previous cycles.

That suggests a steady erosion of conviction rather than a retail panic.

If the historical correction pattern holds, a macro bottom won’t be found until the $20,000 to $35,000 range, way below the signaled trough of another holder-favorite model, the power law one.

There is a growing debate on whether the four-year halving cycle is actually dead this time, even though it seems to be holding as strong as ever. Some strategists argue the asset has matured into a macro beast that follows global liquidity and the ISM Manufacturing index rather than mining rewards.

For now, the old rhythm of high-to-low drawdowns seems to be the only thing still holding firm.

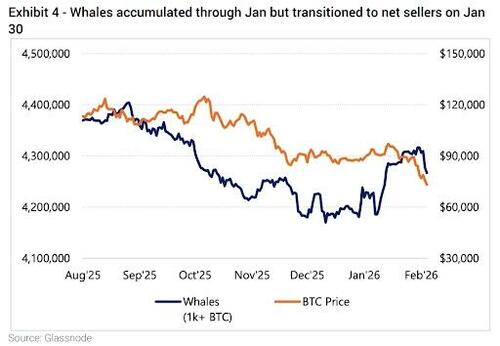

The selling pressure itself tells a story.

According to the chatter on crypto social media, it is the OGs (Original Gangsters) or at least long-term holders who are doing the heavy lifting on the sell side since the fresh all-time-highs, not necessarily the ETF newcomers.

Can you blame them?

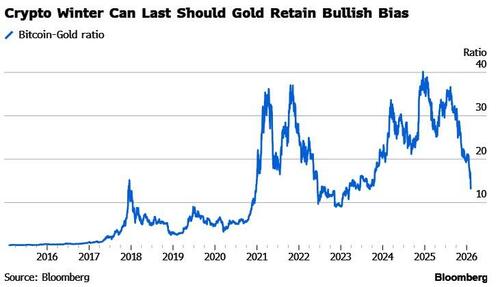

If you have been in since the triple-digit days, or you bought during the last crypto winter in 2022-2023, you are used to this volatility and happy to offload into whatever liquidity is left during a dead phase — especially when metals prices provide a volatile alternative.

Right now, the bid is simply missing. While treasury companies are still buying via OTC desks, that liquidity does not help the retail crowd trying to fade the dip on exchanges.

The fundamental principle of Bitcoin’s scarcity hasn’t changed, but you have to wonder if it’s being questioned now that the asset can be paper-traded so easily through derivatives.

When the narrative breaks, Bitcoin follows nothing.

Stocks can be up or down and rates can be doing their own thing, but the cryptocurrency will still slide if sentiment has turned.

It’s also worth noting that the heaviest selling consistently happens during New York hours, suggesting US-based desks are leading the retreat, which may be linked to expectations that the Clarity Act, a cryptocurrency market structure bill, would have already passed.

For Peter Schiff and other Bitcoin skeptics and quantum-doom advocates, this is the beginning of the end.

JUST IN: SAIFEDEAN AMMOUS JUST SCHOOLED PETER SCHIFF ON WHY #BITCOIN SURVIVES CRASHES AND GOLD DOESN’T

— The Bitcoin Historian (@pete_rizzo_) February 4, 2026

“GOLD BEAR MARKETS CAN LAST DECADES. #BITCOIN ADJUSTS” LEGEND🔥 pic.twitter.com/K27d6teyXH

Yet, if you pull up a log chart, it all looks like noise.

Bitcoin is just being Bitcoin - testing everyone’s patience, entering the dead zone of the rainbow, and liquidating the leveraged until only the true believers are left to start the next climb.