Where AI & Crypto Converge: Goldman On The Rise Of The Agentic Web

The digital assets market has wasted no time asserting its dynamic nature in 2026. While many entered the year with considerable optimism for a favorable macro environment and clearer regulatory landscape, these expectations have yet to fully materialize, particularly within the cryptocurrency sector.

Indeed, as Goldman Sachs crypto king, Mathew Mcdermott points out in his latest note, cryptocurrencies got caught in the crosswinds of a broader risk-off environment, as bitcoin broke through the key $70,000 level.

The sentiment was initially sparked by the nomination of Kevin Warsh, a long-standing critic of quantitative easing and ultra-accommodative policy.

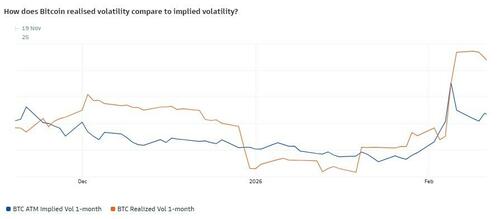

Then came the overarching concerns over AI disrupting the software sector, which created a difficult backdrop for risk assets broadly. Cryptocurrencies (and bitcoin especially) followed suit, experiencing changes in volatility.

This environment has reignited all too familiar questions around the utility of this cryptocurrency in investors' portfolios.

Is it a risk asset? An inflation hedge? A debasement play?

While sentiment for liquid cryptocurrencies is undeniably risk-off, it's crucial to recognize the underlying resilience and expansion of the broader digital assets ecosystem.

Verticals such as tokenization, stablecoins, and AI-driven use cases continue to demonstrate robust growth.

Institutional engagement remains strong; major global sell-side firms are establishing dedicated digital asset desks and refining their market strategies, a trend mirrored on the buy-side.

Looking ahead, that initial optimism for an improving regulatory backdrop and a more stable macro environment hasn't faded.

We believe these developments will eventually provide the framework needed for even bigger institutional participation, reinforcing the long-term potential of this transformative technology.

And, among the most 'top of mind' current themes is the intersection of AI x blockchain...

In focus: Blockchain and the future of agentic web

Historically, blockchain technology and Artificial Intelligence (AI) have operated siloed, but the future outlook on AI-enabled services could benefit from the synergistic use of blockchain. Immutability, transparency, verification, encryption – all of these are attributes of blockchain that could add value to AI use cases. On their own, the two tech verticals are transformative, but they can be equally transformative and synergistic to one another - blockchain has the potential to improve AI, but AI can also improve pain points across the blockchain ecosystem.

One of the areas that has been attracting media attention is how the convergence of AI and blockchain technology is paving the way for a new era of autonomous AI agents and how blockchain could be embedded into the foundation of the future 'agentic web'. Mike Novogratz, the CEO of Galaxy Digital expects AI agents to become the biggest stablecoin users. Elsewhere, Tether's CEO Paolo Ardoino predicts that in the future, every AI agent will have a self-custodial wallet. a16z has been vocal about AI benefitting from blockchain technology, where "blockchains [could] restore trust, raising the cost of impersonation, preserving human-scale interaction, decentralizing identity, enforcing privacy by default, and giving agents native economic constraints. If we want an internet where AI agents can operate without destroying trust, blockchains are not optional infrastructure: They are the missing layer that makes an AI-native internet work".

(Agentic web is a broad term used here to refer to the potential future evolution of internet where AI agents can autonomously operate on users' behalf and a departure from the current human-driven to machine-to machine driven web interaction.)

The rise of the agentic web

We are inching closer to a reality where AI agents, operating autonomously on users’ behalf, may upend the current internet stack, revolutionizing our digital interactions. Already today AI is changing user behavior – fewer of us call a helpline, relying instead on digital assistants, and many are shifting from traditional internet browsers to popular LLMs. The agentic web will likely accelerate this, creating a new technological stack where user interfaces evolve beyond human-centric dashboards. AI agents will navigate the underlying technology layer directly via APIs and database access.

These agents are expected to enhance productivity and redefine how businesses operate. Estimates on adoption and expected market size vary. McKinsey estimates that by 2030, the global B2C retail market could see $3-5 trillion in orchestrated revenue from agentic commerce. Elsewhere, BCG estimates that AI agents are expected to grow with a 45% CAGR between 2024-2030 across tech applications. At Goldman Sachs, we are in early stages of exploring the use of AI agents to automate a number of functions.

A transition from a centralized web to one that seamlessly supports AI agents is rapidly advancing, with major technology companies collaborating to create the foundational layer for AI agents to meaningfully participate in the internet economy through the development of protocols and standards. Among these are emerging protocols such as Model Context Protocol ("MCP") or Agent-to-Agent protocol ("A2A"). This acceleration of innovation across the agent-driven economy was also evident at the WEF 2026 in Davos (here, here & here), with the focus no longer limited to theory, but production.

Agentic web and risks

This transformative shift towards an agentic web also has the potential to introduce new risks around accountability, interoperability, data integrity, privacy, impersonation and security. To mitigate these risks, blockchain technology, with its inherent immutability, transparency, and traceability attributes, could play a crucial role in establishing the necessary guardrails and building a trusted, auditable settlement layer for this evolving digital frontier. To reiterate, blockchain isn't the only technology that can act as an effective guardrail or settlement layer for the agentic web - industry protocols and standards (as noted above) will play a crucial role, too.

As AI agents begin autonomously making decisions and handling money, the question becomes: how do we ensure they act in the user's best interests? Risks can emerge in several ways: an AI agent might absorb misleading information (“memory poisoning”), follow a distorted set of instructions, or appear to be working correctly while deviating from the user’s true goal (“intent-breaking”). Over time, these systems risk becoming “black boxes,” where their decision-making processes are opaque. Finally, there is the risk of AI accessing private data, when it shouldn’t, or impersonating a user. How do we establish safeguards for traceability, privacy, and security? This is where blockchain could help.

Blockchain – the trust and coordination layer

As an immutable record, blockchains enable us to track the origin and history of data, which can enhance data provenance, and is especially important for sensitive applications where biased or manipulated data can lead to unfair outcomes. By recording the parameters of AI models on a distributed ledger, we could create an unchangeable audit trail that prevents malicious modifications and allows for a verifiable audit of the agent’s decision-making.

To address privacy preservation, zero-knowledge proofs could be deployed to allow AI agents to utilize the user’s sensitive data, without exposing the raw information to the protocol or to another agent. A “zero-knowledge proof” is a cryptographic method that allows us to confirm the truth of a statement without sharing any of the underlying sensitive information. Consider an AI agent tasked with rebalancing an investment portfolio. This agent needs access to private financial data to work correctly. By using zero-knowledge proofs, the agent can perform its duties, then generate cryptographic proof confirming that all actions were compliant with financial regulations. This proof is shared for verification, but the actual trading strategy, account balance, and specific investments remain completely confidential. The verifier learns nothing, other than the fact that the agent acted as represented.

As a coordination layer, blockchain has the potential to make information and value transfer accessible to agents. This is vital for AI agents who, in order to act fully autonomously, need to access information, deploy code and transfer value without human intervention. Unlike managing several user profiles across platforms, AI agents will require a singular identity across all – this is where having a settlement layer, on which applications are built and that is interoperable with other protocols becomes crucial. In this context, it is evident how AI agents are inherently better suited to interact with blockchain protocols, especially when operating across multi-protocol economies.

AI agents and digital money

One of the more obvious applications of this synergy is enabling AI agents to efficiently transfer value using digital money, such as stablecoins, tokenized deposits, or other forms of “currency on blockchain”.

To unlock the true potential of AI agents and payments, there has to be a shift away from human-centric interfaces and optimization for intent-based agents who, by design, will operate in a digitally-native, 24/7, cost-effective and programmable environment. For this, payment rails that operate continuously across borders and free from traditional banking hours are essential. Programmability allows agents to translate and embed intents into smart contracts, facilitating automated payments and settlement.

In terms of infrastructure, we are not there yet to fully realize this potential, but we are seeing advancements in this sector, including:

-

Google released open Agentic Payment Protocol (AP2) standard that establishes how agents and users communicate trust and authorization in the context of agent-initiated payments. x402 as an extension to AP2 will enable agents to handle payments, ideal for micropayments and pay-per-use payments.

-

Ethereum has unveiled the ERC-8004 proposal that would set the foundational standards for AI agents to operate within decentralized ecosystems. It addresses the trust element in an agent economy by creating a decentralized infrastructure for AI agent identity, reputation, and validation, allowing them to interact and transact securely across platforms.

-

Coinbase in partnership with Cloudflare has launched x402, a payment protocol that will allow AI agents to make payments directly, without any form of human intervention, just machine to machine transactions. Coinbase has also launched Payments MCP, which will enable language models such as Claude or Gemini to access blockchain wallets and payments.

The foundation and guardrail for the agentic web

Ultimately, as AI agents transition from sophisticated tools to autonomous economic actors, the digital infrastructure must evolve to support their unique requirements for verifiable actions, secure transactions, and our trust in them. While AI provides the intelligence, blockchain can offer the immutable ledger, programmable money, and a trustless coordination layer, essential for these agents to operate securely and in our best interest. The true promise of the agentic web lies not just in smarter AI, but also in building a foundational layer of verifiable trust and seamless value exchange.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal