November Jobs Preview: "The Asymmetry Is Towards A Negative Surprise"

After a two and a half month BLS hiatus, Novemberʼs delayed employment report, due Tuesday at 8:330a, will incorporate October payrolls, although Octoberʼs unemployment rate will be absent after the government shutdown halted household survey collection. In terms of expectations, there is no consensus for the October report. For November, analysts expect 50k jobs to be added to the economy, down from 119k in September, although Fed Chair Powell recently warned that Bureau of Labor Statistics data may be overstating job growth by around 60k per month (something we first said two years ago). The November unemployment rate is seen rising to 4.5%, up 0.1% versus September, and in line with the Fedʼs median year-end projection of 4.5% from its Summary of Economic Projections.

Labor-market indicators have been mixed. The Chicago Fed unemployment rate estimate has edged higher from the September BLS rate, while ADP data was mixed, showing job gains in October and losses in November. Meanwhile, the RevelioLabs NFP proxy saw job losses in both October and November. Initial jobless claims fell in the November reference window compared with the September and October survey periods, with four-week averages trending lower since September. JOLTS data showed improvement from late summer into October. As Newsquawk notes, during the latest Fed presser, Powell struck a dovish tone at the press conference, appearing more concerned about the labor side of the mandate than inflation. Money markets are pricing in two additional 25bps rate cuts in 2026, more than the Fedʼs median projection of one, though projections vary widely; many banks - such as Goldman - expect 3 rate cuts.

EXPECTATIONS:

- Headline nonfarm payrolls for November are expected to show an increase of 50k jobs, with estimates ranging from -20k to +130k. It would be down more than 50% from the 119K in September.

- Private payrolls are seen at 50k, vs the 97k in September.

- Morgan Stanley expects the drop in October to reverse in November (sees +50k) primarily due to federal government layoffs.

- The November unemployment rate is seen at 4.5%, up 0.1% from September's 4.44%, with forecasts ranging between 4.3% and 4.7%. If accurate, the US unemployment rate would be the highest since Oct 2021.

- October payrolls will be released at the same time, but the October unemployment rate will not be published because of data collection issues during the government shutdown.

- Average hourly earnings are expected to rise 0.3% M/M in November from 0.2% in September, while Y/Y growth is seen easing to 3.6% from 3.8%.

Although there is no consensus for the October payrolls report, Morgan Stanley expects 30k job losses, JPMorgan looks for -25k, Citi -45k, Wells Fargo -60k, Barclays 0k, Goldman +10k (70k private) in October, and Jeffries sees +85k. The negative prints are driven by the government worker contribution to the total, and the impact is the result of the DOGE deferred resignation program. Goldman estimates that private payrolls increased by 70k in October and 50k in November (vs. consensus +50k for November). The bank describes the factors it considered in its forecast in greater detail below.

Note, ahead of the data, the BLS announced the November Household Survey has a slightly larger standard error, and the BLS household poll's higher standard errors may last a few months.

LABOR MARKET PROXIES:

According to Newsquawk, the Chicago Fedʼs real-time unemployment estimate rose to 4.46% in October versus the official 4.4% print in September, pointing to a gradual softening in labour conditions ahead of the release, while the November estimate saw a minor improvement to 4.44%. High-frequency indicators remain mixed. For the traditional November survey window covering the week of the 12th, initial jobless claims stood at 222k, down from 232k in October and matching the September reference period. On a four-week average basis, November claims averaged 224.75k, compared with 227.75k in October and 240.25k in September. However, ADPʼs report – despite its widely noted limitations as a predictor of official BLS data – showed private employers shedding 32k jobs in November and described hiring as broadly flat through H2 2025. Weakness was concentrated in manufacturing, professional and business services, information and construction, while ADP flagged a continued slowdown in pay growth. The October ADP report showed 42k jobs added. Meanwhile, the RevelioLabs NFP proxy saw total nonfarm payrolls at -9k in November and -15.5k in October. The JOLTS report for October showed job openings rising to 7.67mln from 7.66mln in September, a notable improvement from 7.23mln in August.

ARGUING FOR A STRONGER-THAN-EXPECTED REPORT

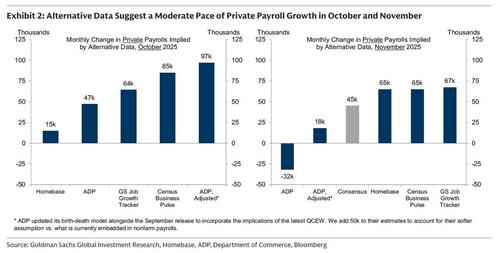

- Big data. Alternative measures of employment growth indicated a moderate pace of private sector job growth in October and November. The indicators that Goldman tracks averaged 62k in October and 38k in November, or 65k and 52k respectively if excluding the officially reported ADP measure. (The ADP measure’s birth-death assumption was recently updated to incorporate their estimate of the signal from QCEW data—imposing a monthly drag of roughly 50k which is not currently embedded into nonfarm payrolls.) Goldman's broader job growth tracker improved from its stagnant pace of the summer to 64k/month in October and 67k/month in November.

- Strikes. The BLS’s strike report noted that the end of worker strikes will provide a 3k boost to November payroll growth.

ARGUING FOR A WEAKER-THAN-EXPECTED REPORT

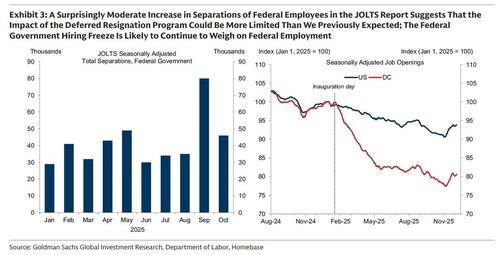

- Government hiring. GS incorporates a drag of 70k on October and 10k on November from the Department of Government Efficiency’s (DOGE) deferred resignation program. Under the deferred resignation program, certain federal employees voluntarily received paid administrative leave in exchange for their resignation at a set date. Goldman had previously expected a larger hit to nonfarm payrolls from the deferred resignation program based on reporting from the Office of Personnel Management, but a surprisingly moderate increase in federal government separations in this week’s JOLTS report suggests that the drag could be more limited than previous assumptions. After factoring in increases in state and local government employment but a modest additional drag on federal hiring from the ongoing hiring freeze, Goldman expects a 60k decline in government payrolls in October and a 5k increase in November.

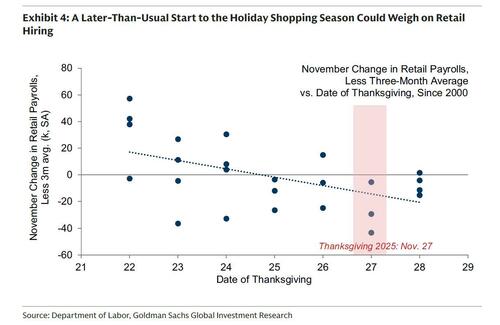

- A later-than-usual Thanksgiving. Thanksgiving—and thus Black Friday and the start of the holiday shopping season—was relatively late this year (November 27th), which could reduce the number of holiday retail employees hired in time for the November survey period. Exhibit 4 shows that retail job growth tends to be weak in years with late Thanksgivings, decelerating relative to the three-month average in six of the last seven instances. The later start to the holiday shopping season will weigh on November retail hiring by roughly 15k, according to Goldman estimates. Any drag on November payroll growth via this channel should correspond to a commensurate boost to December.

NEUTRAL FACTORS

- Layoffs. Initial jobless claims declined from 240k on average in the September payroll month to 226k in October and 225k in November. The JOLTS layoff rate rose by 0.1pp to 1.2% in October.

- Employer surveys. Goldman's manufacturing survey employment component tracker rose in both October (+0.3pt to 48.9) and November (+0.7pt to 49.6), while the bank's services survey employment component tracker declined in October (-1.1pt to 46.9) but rebounded in November (+0.9pt to 47.8). Both of the bank's trackers remained in contractionary territory. However, the signal from survey data has been less useful—and at times misleading—during the post-pandemic period and thus has little bearing on our payrolls forecast.

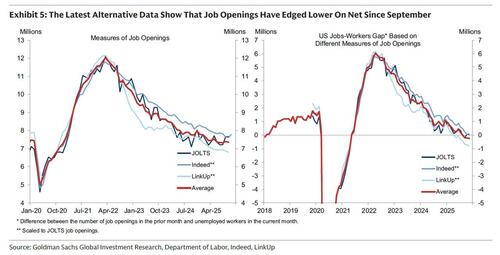

- Job availability. While JOLTS job openings increased by 453k on net since August, alternative measures of job openings declined slightly over the same period. Goldman estimates that the jobs-workers gap stands at -0.2mn in November. The Conference Board labor differential—the difference between the percentage of respondents saying jobs are plentiful and those saying jobs are hard to get—increased by 1.6pt to +10.3 in October and decreased by 0.6pt to +9.7 in November.

FED IMPLICATIONS:

The December FOMC meeting last week reinforced expectations of softer labor momentum. Chair Powell struck a notably dovish tone, emphasizing downside risks to the labor market over inflation concerns. He warned of a persistent 60k monthly overcount in nonfarm payrolls that policymakers believe has yet to be corrected, and said that while layoffs and hiring remain historically low, labor demand has clearly softened. Adjusting for the overcount implies job growth averaging around -20k per month. This implies the FOMC would interpret private payroll growth in line with Goldman's forecast as +10k in October and -10k in November

With labor supply having fallen sharply, Powell stressed the need to avoid policy settings that could push job creation into negative territory. He said AI-related labor effects were still early and not yet visible in layoffs. Markets are pricing a little over two 25bps point rate cuts in 2026, compared with the Fedʼs projection of one, reflecting expectations of a more dovish Fed chair influencing decisions over the coming year once Powell's term expires in May. A further deterioration in the labor market would bolster the case for additional cuts (a point made today by Morgan Stanley's Michael Wilson) but with Powell describing policy as within a plausible range of neutral and following a tweak to guidance, the pace of rate cuts is expected to slow after three consecutive reductions.

MARKET REACTION:

Turning to the market, the option-implied move for the market tomorrow is a relatively tame 0.65%, one of the lowest closing-bell swings on a labor day in years. Which is understandable: the Fed already cut rates and launched QE lite ahead of tomorrow's event, so the only ail risk is what a number could mean for rate cuts in 2026.

Below we share some thoughts from around the Goldman trading desk:

Vickie Chang (Global Macro Research)

This is obviously an unusual report given that it contains two months of information and is delayed. During that time, the labor market has likely continued to cool. Our baseline forecasts are for +55k on NFP and for the unemployment rate to rise to 4.5% in November. Chair Powell's comments about the labor market at last week's FOMC press conference signaled concern about the downside risks to the labor market, and he did not lean more strongly into a January pause. That, combined with the fact that markets are not pricing recession worry, means that the asymmetry especially in rates is towards a negative surprise. Our forecasts are not for that kind of outcome, and given the market focus there has been on this event, an outcome along the lines of our economists’ expectations would probably lead to some relief as a major risk passes, and our broader macro outlook is also a benign one. But in the case of, say, a larger rise in the unemployment rate to 4.6% or above, and with the market pricing only ~20bps of cuts over the first three meetings in 2026, front-end longs offer good insurance against recession worry. Depending on core exposures, equity puts or positioning for the joint outcome of lower equities and front-yields into the print as protection may also make sense.

Ryan Hammond (US Portfolio Strategy)

Cyclical US equities have rallied sharply during the last few weeks and outperformed Defensives on 14 consecutive days, the longest stretch in over 15 years. The Cyclicals vs. Defensives basket pair (GSPUCYDE) has rallied by 11% since November 20th, surpassing the high reached in mid-September. Despite the consensus economic optimism among clients and strong recent performance of cyclical equities, we think markets are still not fully pricing the likely strength of the US economy next year. Specifically, sector rotations within the equity market appear to be pricing an outlook for only slightly above 2% real GDP growth. Our Global Markets team's cross-asset tools suggest a slightly more conservative growth outlook that is roughly in line with the consensus forecast. If the labor market strengthens, we believe there is room for broad equities, and cyclicals in particular, to continue to move higher. While some labor market weakness could be balanced by incremental Fed easing, the equity market remains vulnerable to a material negative surprise in the labor market.

Karen Fishman (Senior FX Strategist)

We’ve been of the view that the bigger potential headwind to Dollar shorts would be the labor market data rather than the December FOMC, and the more dovish tone from Powell last week, despite the dissents, allowed the Dollar to weaken as cyclical assets across markets generally benefited. Our economists’ forecasts of a moderate pace of private sector job growth and a roughly stable (rounding-up) of the unemployment rate could get markets refocused on US reacceleration risk, and weigh most on JPY, CHF, and EUR. There’s probably a limit though to how high yields can go, especially since Powell also emphasized that the likely volatility in the data will require a “skeptical eye,” implying an inclination to discount some of the numbers. That should leave EM carry trades well supported and cyclical FX (e.g., AUD, NZD, SEK) broadly less sensitive to a big surprise in either direction. Worth noting that EM carry has become higher vol lately on AI wobbles and political noise in Brazil and Hungary. But we still have high conviction in being long ZAR and think it should be even more appealing now given the noise in other carry favorites—on top of its already-attractive fundamentals, including its lower vulnerability to greater trade competitiveness from China, which is likely to be a key theme in 2026. Our preferred expression has been to fund out of CAD to reduce its risk beta and vol, which hasn’t played out as expected due to the hawkish BoC repricing over recent weeks. But we may have reached the limit on how many hikes the market can price as long as the BoC is still signaling that it’s firmly on hold. Meanwhile, a significant miss on the labor market data should be the most positive for JPY, particularly given the extent of tactical short positioning. But the scope for Yen strength in that outcome will depend on how much rates and equities reprice, and again, there may be a more muted response there than usual.

Joe Clyne (Index Vol Trading)

Both the market and implied vol have drifted lower into tomorrow's NFP as dealer long gamma continues to keep the market fairly pinned. We think good news is good news for the stock market and a stronger jobs number should lead to stocks broadly higher alongside a continuation of cyclical outperformance. We think there continues to be room for vol to come in on a rally as dealers get longer options to the topside and the front end is still not on year to date lows in implied terms. We would rather be in short vol trades than long gamma trades with the one day straddle going out roughly 65 bps. Flows have been quiet into the print, but we have seen a small uptick in customer hedging before the number.

More in the full preview folder available to pro subs.