Why The Price Of Uranium Is About To Soar

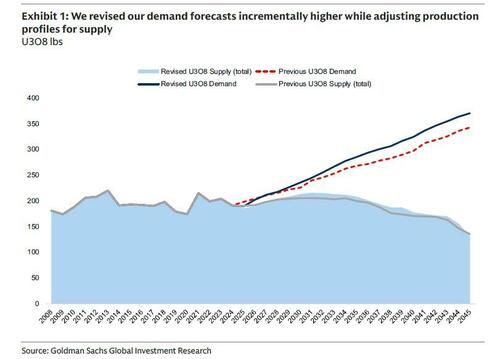

In its December Nuclear Nuggets report (a must read for everyone curious about the latest developments in the nuclear industry) Goldman has published a chart that affirms not only why uranium prices are set to soar over the next few years, but why uranium may very well become the next gold.

But let's back up a little.

As Goldman strategist Brian Lee writes as he updates his supply/demand and pricing model for the up- and downstream nuclear industry, there is risk to the upside for both spot and term prices in 2026, despite different mechanics driving each market.

Starting with the former, the spot market tends to look more near-term, with pricing mainly driven by market shocks like production cuts, significant demand increases, trust related capital raises (e.g. Sprott) and purchases as well as deltas between spot market pricing and long term prices resulting in increased demand from opportunistic carry trades.

The term market is where a majority of utility contracting takes place and as utilities typically contract for delivery between 3-10 years into the future, Goldman views the term market is a better reflection of long term supply and demand.

Since August, long-term prices have increased from $80/lb to $86/lb as countries continue to advance plans to build out new nuclear. Additionally, utility contracting was light for 2024 and for a majority of 2025 up until October. In the past 2 months, however, there has been a a pick up in contracting volumes and this momentum is likely to continue into 2026. Additionally, the long-term price of $86/lb only reflects the fixed portion of contracts while commentary from CCJ highlights floors and ceilings for market related contracts are $70/lb-$130/lb, implying a mid-point of ~$100/lb (Goldman's company-specific models for CCJ and UEC imply spot U3O8 pricing should end 2026 around ~$91/lb (vs. ~$76/lb currently)). And it's all uphill from there.

Next, Lee takes us through the revisions to Goldman's revised uranium supply/demand model, which as we will show in a second, is a doozy.

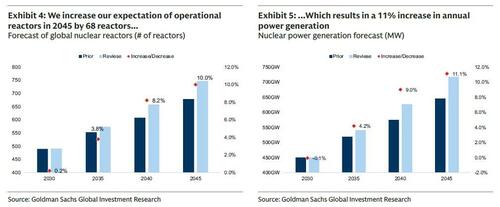

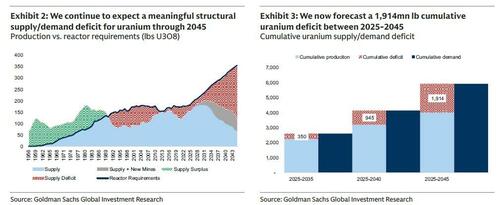

Here is the punchline: according to Lee's updates of his uranium supply/demand model for global announcements of new reactor builds as well as refinement of the supply side estimates, the result in an increase to the cumulative net deficit of 211mn lbs between 2025-2045.

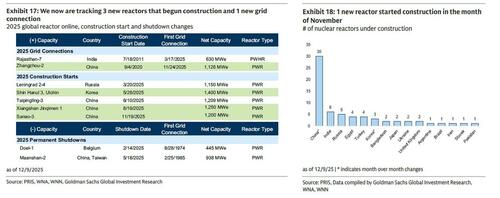

On the demand side, the key changes reflect continued execution from China on reactors brought online and reactors beginning construction (don't worry, there will be no competition from the US which is in no hurry to start any new nuclear reactors).

The update also includes additional Russian reactors on the back of the country announcing plans to double the country’s nuclear power fleet (here).

And while the rest of the world is far ahead of the US is new reactor builds, that won't always be the case (one hopes) and Goldman is also increasing its estimate for reactor builds in the US on the back of the executive orders to have 10 reactors under construction by 2030 as well as the +$80bn government partnership (here) with CCJ, Westinghouse, and BAM to accelerate nuclear reactor build-outs in the US.Goldman also includes announced incremental restarts like Palisades, Three Mile Island, and Duane Arnold as well as resumption of abandoned construction at VC Summer.

In addition to these reactor additions, Goldman's new model also reflects fuel product assays on a more granular level, as well as updates to forward estimates of capacity factors by reactor per country and increase the assumption for average reactor life to 80 years (vs. 75 prior) due to expectations of increases in subsequent license renewals given power demand trends.

Finally, the bank pushes out expectations for a few reactors to come online as it takes a more conservative view on select construction timelines. As a result of these changes, Goldman's cumulative supply/demand deficit between 2025-2045 expands to 1,914mn lbs (vs. 1,703mn lbs prior). This represents a cumulative (~13%) shortfall between 2025-2035 which expands to a cumulative (~32%) shortfall between 2025-2045, which will result in a massive price increase

Taking a closer look at term prices, here too we have seen an increase on the back of increased demand expectations. Uranium term prices continue to rise as the long-term supply/demand dynamic continues to be supportive of higher prices. Term prices remained at $80/lb through August 2025, then increased from $80/lb to $86/lb between September and December.

The increase in term prices coincided with mid-September announcements from Russia to double its reactor count followed by announcement in late October of a US government partnership with Westinghouse to provide capital to accelerate the deployment of nuclear reactors in the US. As a result, the long-term demand picture meaningfully changed between September and the beginning of December.

In the US, Goldman estimates that between 2025-2045, there are 20 new reactors built as a result of the government partnership with Westinghouse as well as Fermi’s plans to construct new reactors.

Additionally, Goldman anticipates 3 reactor restarts and the resumption of construction on 2 reactors at VC Summer. As a rule of thumb, annual reactor requirements are 500k lbs of uranium per 1GW of nuclear generation. This results in annual reactor requirements for the US increasing by 12.5mn lbs of uranium annually once all reactors are online.

Typically, initial fuel loads are 3x annual reactor requirements, which would imply initial fuel loads for US reactors would result in an incremental 37.5mn lbs of uranium. For Russia, despite the goal of doubling the country’s reactor count, which currently stands at 36, Goldman has included an additional 15 reactors of varying sizes constructed between 2025-2045, resulting in ~5mn lbs of annual reactor requirements, implying ~15mn lbs of demand for first fuel load.

As a result of all these announcements, the long-term demand profile significantly increased in a 2-month span while long-term supply projections remained unchanged. It's why we have started to see long-term contracting pick back up in October and November, with November volumes of ~27mn lbs, representing ~33% of 2025 YTD volumes. Still, YTD volumes remain well below 2024 levels which were down (40%) vs. 2023 levels, however, despite the declining contracting volume, term prices continued to rise over the past 2 years. This is a good indicator of future demand - not taking into account the staggering cumulative deficit through 2045 - despite recent lower contracting volumes. This trend will likely continue, with Goldman viewing the significant increase in contracting volumes in November as the start of another contracting cycle.

Much more in the gull Goldman nuclear nuggets report, available to pro subs.