"If You're Bearish, You're Consensus...": Bitcoin & Big-Tech Surge As Trump Says "Buy Stocks Now"

"If you’re bearish, you’re consensus..." warns top Goldman trader Brian Garrett, adding that "doesn’t mean you are wrong, but you are in the majority."

The AAII survey has been published every week since 1987 (investors are either bullish, bearish, or neutral).

In the history of this survey, investors have *never* been this consistently bearish… for 11 straight weeks, >50% or respondents have been negative on the market...

Prior record was in 1990 @ 7 straight weeks … 2008 max was 4 … 2022 max was 5

Which leaves the natural follow up, "if everyone is so bearish, who is buying?"

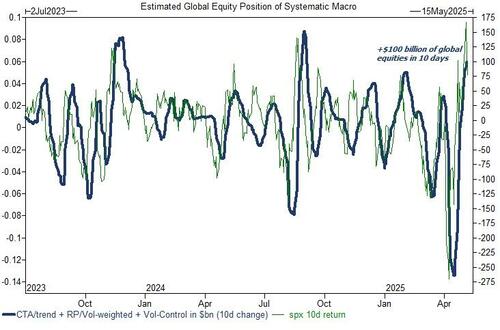

(Un)natural answer = systematic community who have purchased ~100bn of global equities in the last 10 days …

"natural follow up, "if everyone is so bearish, who is buying?" - (un)natural answer = systematic community who have purchased $100bn of global equities in the last 10 days" - GS FICC

— zerohedge (@zerohedge) May 8, 2025

always great value when people "splain" why something happened after the fact https://t.co/DGk3TxAkLX

A meaningful sell-off will be more difficult if everyone is anticipating it...

4700-5700 trading band is often referenced (fear of missing out is happening today as we break that top end)...

...despite the high rally, sentiment has yet to flip positive (that needs to happen for stocks to resume sell off)

But, today, everything is awesome (apparently)...

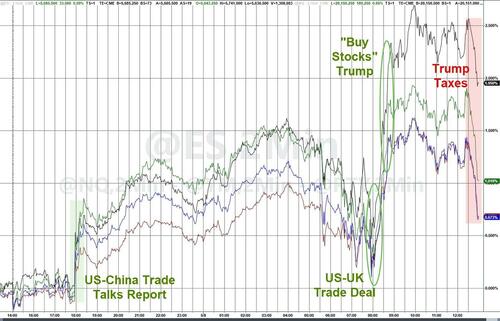

Risk assets are rallying after more details regarding reports on changes to Biden's last minute rules about what countries were allowed to buy the latest chips; optimistic talk by Bessent and Trump about this weekend's planned trade talks with China; Trump's 'big beautiful bill' is progressing and he suggested investors "better buy stocks now" ahead of it (recall the last time Trump preemptively told us to buy stocks on April 9 which resulted in a casual 952bp rally for the S&P 500); the Brits signed a trade deal with the US (the first major deal) and reports of a big plane purchase are rumored (but not confirmed); and finally, jobless claims data improved once again, refusing to fall prey to the pessimism pontificated by the mainstream media.

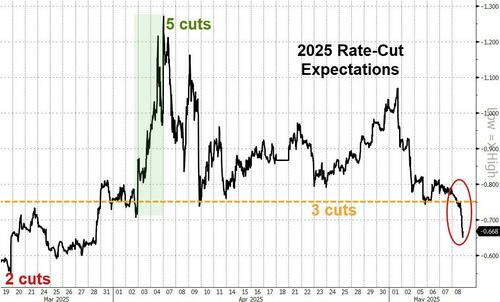

All this 'good' news sent rate-cut expectations (hawkishly) plunging (now back below 3 cuts priced in for 2025 - less than before Liberation Day)...

Source: Bloomberg

Are we about to see 'soft' survey data reverse higher (like it did in Q2 2021)...

Source: Bloomberg

As Academy Securities' Peter Tchir highlighted that there are more positives than negatives today, but we need to see what deals look like from trading partners running large surpluses with the U.S. look like, as that in theory is what the administration is trying to balance.

The tariffs remaining in place give me some pause for concern, but the movement on the chip side of things is quite important.

Another pivot by the President and the original policy by Biden, which confused many allies, is worth rethinking. I’m hoping this means we can see some progress on the remaining Chips Act money.

It also seemed positive that the President, while disagreeing with Powell avoided talk of firing him or anything else that might have roiled markets!

I continue to think that to drive markets higher, from here, the 2026 Budget and the focusing on “build baby build” will be key.

The results of all that is a surge in the dollar, stocks, crude, and crypto; with bonds and bullion battered.

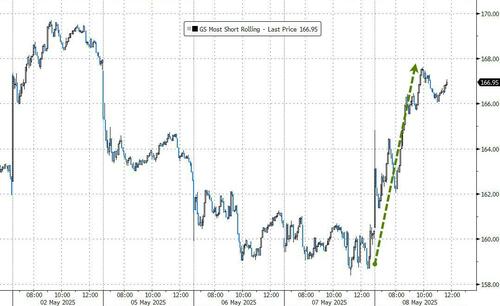

Among the US Majors, Small Caps outperformed (on the heels of a massive short squeeze - up 6% off yesterday's lows)...

Source: Bloomberg

But all the majors were up significantly (with Nasdaq outperforming The Dow and S&P 500) before the now ubiquitous late-day selling pressure hit (driven perhaps by the headlines around Trump tax hikes for extremely high income earners), dragging everything down pretty considerably. Additionally, VP Vance told Fox News that Fed Chair Powell has been “wrong about almost everything,” adding that “he was way too late in combating the Biden inflation."

Stocks ended well off their highs...

That surge lifted the S&P (along with the Nasdaq) back above pre-Liberation Day levels...

But, that late day selloff took the S&P back below Liberation Day levels...

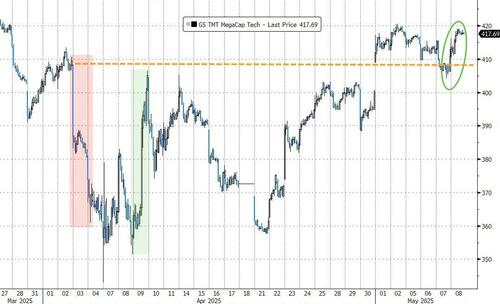

Mega-Cap Tech is holding back above the highs of Liberation Day...

Source: Bloomberg

Mag7 stocks outperformed dramatically today (+2% on the day vs +1% for S&P 493), bring it back to unchanged on the week...

Source: Bloomberg

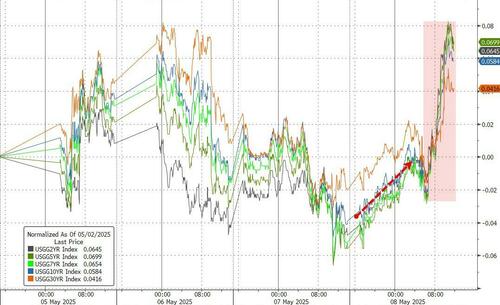

Treasuries were clubbed like a baby seal with yields up dramatically across the curve (led by the short-end 2Y +13bps, 30Y +6bps)...

Source: Bloomberg

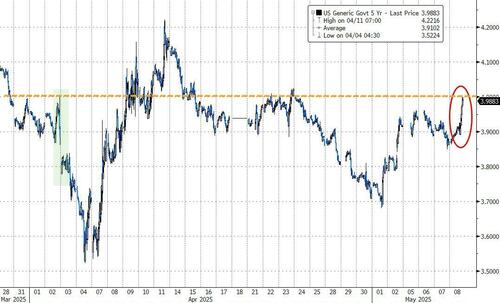

The 5Y yield surged back up to 4.00% (the level it was trading at right before Liberation Day)...

Source: Bloomberg

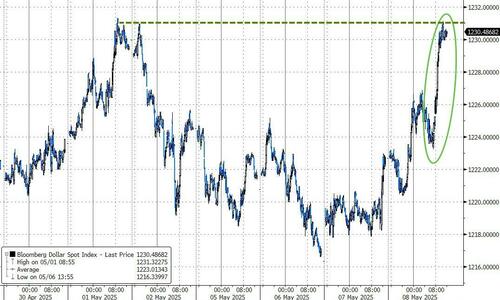

The dollar surged back to one-week highs (best day since April 4th rebound from Liberation Day losses)...

Source: Bloomberg

Gold was hit twice today back down to $3300...

Source: Bloomberg

Bitcoin spiked back above $100,000 (and $101k) today for the first time since early February.

Source: Bloomberg

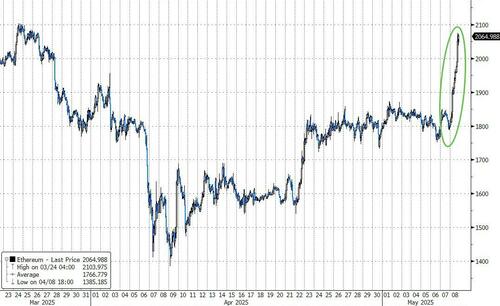

Ethereum also exploded higher today - up 15% - its best day since Nov 2022, breaking above its 50DMA and testing its 100DMA...

Source: Bloomberg

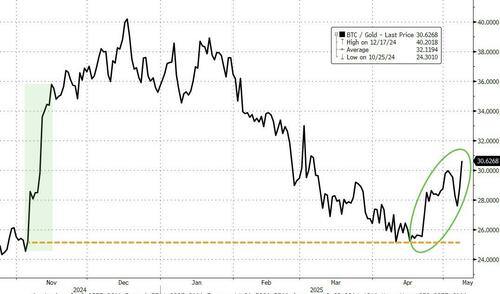

Notably, the BTC outperformance extends the trend of the last week relative to gold after finding support at election lows...

Source: Bloomberg

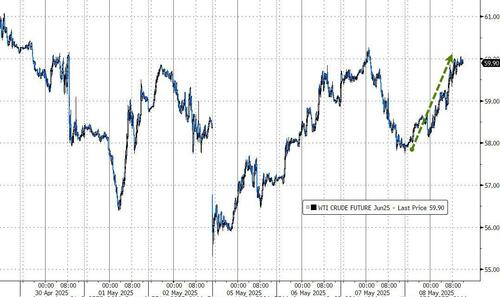

Oil prices bounced back today, erasing yesterday's losses with WTI testing $60...

Source: Bloomberg

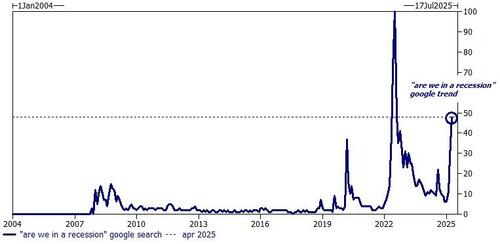

Finally, "are we in a recession" Google searches are at their second highest of all time (only behind actual recessions)...

But, not matter how upset CEOs (or the average media-brainwashed American is), actions speak louder than words...

...jobless claims refuse to inflect. It seems to us like so many of the so-called 'establishment' are "all mouth and no trousers" here - if they are literally more terrified of the economy than at the peak of COVID lockdowns, then where are the job cuts?

HAPPY RETIREMENT to Bob Pisani after 35 years with CNBC