'Deal, Or No Deal' - Big Week For Stocks, Bonds, & Bitcoin Despite World Questioning Trade-Talks

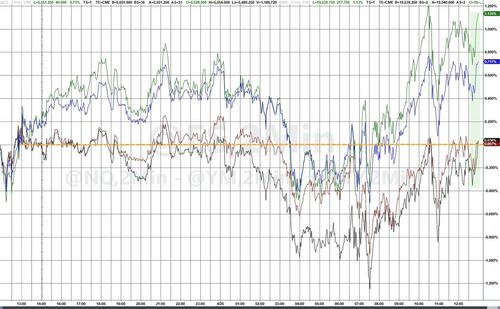

Choppy, range-bound and quiet is how to characterize today's session as we head into the weekend with a strong performance for both stocks and bonds (and gains for the dollar and bitcoin), despite the legacy media constantly playing down any progress The White House claims to have made on trade talks.

The main topic for discussion today was whether 'talk's are ongoing between US and China with the mainstream media and establishment types seemingly siding with Beijing (who denied any meetings) over The White House (and a full story - with photographs - from South Korean media showing US and Chinese delegates getting together for talks).

'Deal, or No Deal' was the week's theme...

We saw another week of slumping 'soft' data' and strengthening 'hard' data...

US futures dipped early today (pre-market) as Trump was reported to have commented that 'total victory" would be 50% tariffs still in place on China in a year's time. Additionally, China issued a statement that there were no tariffs talks at all ongoing with Washington. Then the market shrugged all that off and squeezed higher until around 1340ET when this headline hit *TRUMP: WON'T DROP CHINA TARIFFS UNLESS THEY GIVE US SOMETHING sending stocks lower.

But again, stocks shrugged that off - while legacy media continued to claim there are no talks (at which point Scott Bessent announced along UK"s Reeves that US-UK trade talks had made progress)... which lifted stocks to the highs of the day. The Dow and Small Caps underperformed on the day, managing to scramble back to unchanged by the close as Nasdaq outperformed...

A big week for stocks with Nasdaq up 4 days in a row (including 3 days gaining more than 2% in a row - the most since 2001). The Nasdaq's 6% gain was the second best week since Nov 2023 (the best week was two weeks ago after the 'pause'...

Nasdaq's rally brought it within 1% of erasing all the post-LIberation-Day gains...

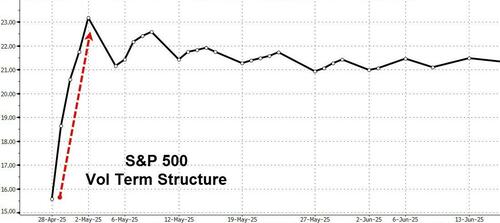

VIX fell to a 24 handle today (still above the 21 handle ahead of Liberation Day...

Looking ahead to next week: it’s gonna be busy - 40% of SPX is set to report earnings (including AAPL, AMZN, META & MSFT) + a number of key macro data points across the back half of the week (PCE, GDP, ISM, NFP) - and vol is expected to rise notably...

Treasury yields were all lower this week (from Thursday's close) with the long-end outperforming...

With the 5Y yield back below 4.00% (which coincided with Liberation Day levels)...

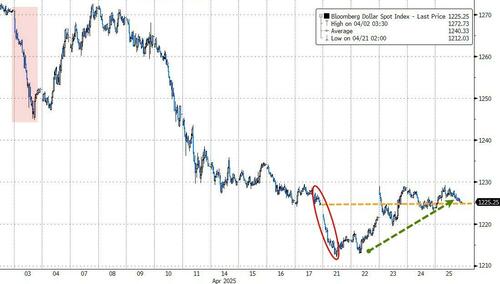

After 3 straight weeks lower, the dollar managed very modest gains on the week (rallying back from weakness early in the week)...

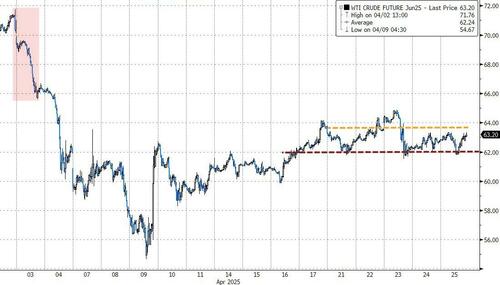

Oil prices ended the week unchanged with WTI finding support at $62...

Gold 'suffered' only its 3rd down week of the year (losing 0.5%), after tagging $3500 record highs mid-week...

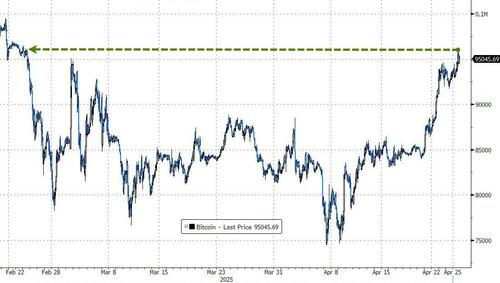

Bitcoin topped $95,000 today for the first time since February...

...with ETF inflows soaring the most since January...

...busting back above all the key technical levels...

Finally, bitcoin has dramatically outperformed the traditional 60/40 portfolio since Liberation Day (as has gold)...

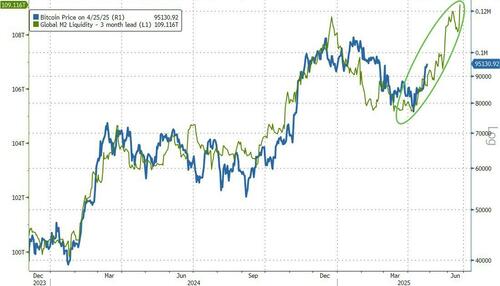

...and given the surge in global liquidity it looks set to continue...

...with BTC bouncing perfectly off the elections lows relative to gold...

So, do you feel lucky? 'Gold' of 'Digital Gold' from here?