Dollar Crashes To Worst H1 In 52 Years As Stocks Soar To Best Quarter Since Q1 2023 Despite Tariff Tantrum

June has seen stocks up, bonds up, crypto up, oil up, and the dollar down bigly as 'uncertainty' tumbled along with US macro data.

After April's crisis crash lows, US equities have staged a massive recovery in May and June with Q2 seeing the best quarter overall for the Nasdaq 100 since Q1 2023...

Source: Bloomberg

YTD, Nasdaq is the big winner along with the S&P while Trannies & Small Caps are biggest losers...

Source: Bloomberg

The S&P and Nasdaq closed the quarter at new record highs...

While Europe and Japan are outperforming US YTD, Q2 saw US equities easily outperform China and Europe (Japanese stocks still outperformed) as the world rebounded from early April's collapse...

Source: Bloomberg

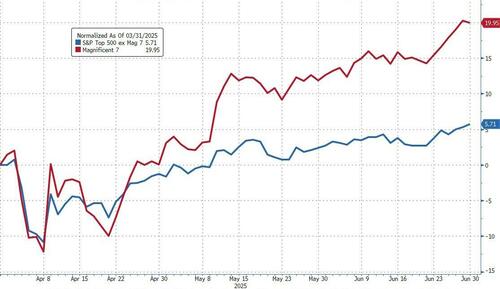

While Q2 saw Mag7 stocks dramatically outperform the rest of the market...

Source: Bloomberg

...they are still underperforming the S&P 493 YTD...

Source: Bloomberg

As 'bad news' on the macro-economic front has been good news for stocks...

Source: Bloomberg

Both 'hard' and 'soft' data plunged in June (dragging them both down on the quarter and YTD)...

Source: Bloomberg

As Uncertainty (global trade policy and geopolitical) have plummeted from crisis highs...

Source: Bloomberg

The bad news in macro has also translated into higher rate-cut expectations. However, all the quarter's dovish shift has been concentrated in 2026 with 2025 expectations (of 2-3 cuts) flat on the quarter...

Source: Bloomberg

The wall of worry still looms. (h/t Chris Hussey, Goldman)

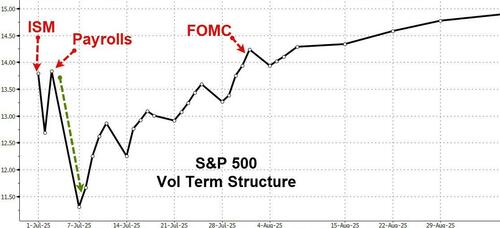

Even with potentially more Fed funds rate cuts ahead, July provides another month to climb the wall of worry -- with this week alone offering two critical rungs on the ladder (a fresh ISM Manufacturing survey on Tuesday and the June Payrolls report on Wednesday).

And next week, of course, includes the July 9th tariff pause end date -- potentially another big test for tariff levels.

Catalyst corner.

As we head into July and deep summer, a flurry of catalysts also lie ahead that could compel stocks higher or conversely, provide a broken rung on the wall of worry ladder that causes risk assets to fall. Beyond this week's and next week's macro catalysts (ISM, Payrolls, Jul-9 tariff pause deadline), we also face a few others, including:

2Q25 earnings season. Consensus is looking for only 4% yoy EPS growth in 2Q as margins contract qoq, but David Kostin expects the S&P 500 in aggregate will beat this low bar.

Budget bill. Congress will continue to refine its budget bill and Alec Phillips thinks it may be passed in late July/early August.

The Fed. The FOMC meets on Jul-29 and 30th with a statement due out on the afternoon of the 30th. Trivedi and team point out that a dovish tilt from the Fed amidst anemic inflation and still OK growth could reinforce an upside case for risk assets (see note above). And while we do not expect the Fed to cut rates at the July meeting, we now do look for the central bank to begin cutting again at the next meeting after this one, in September.

AI. The hyperscalers -- GOOGL, MSFT, AMZN -- report towards the end of July or on the first day of August, providing another datapoint around the durability of the AI infrastructure trade.

Q2 2025 also saw Treasuries mixed with the short-end outperforming and the long-end significantly lagging...

Source: Bloomberg

...but June was (almost) a one-way street bid for Treasuries as a whole (with the whole curve down 14-17bps)...

Source: Bloomberg

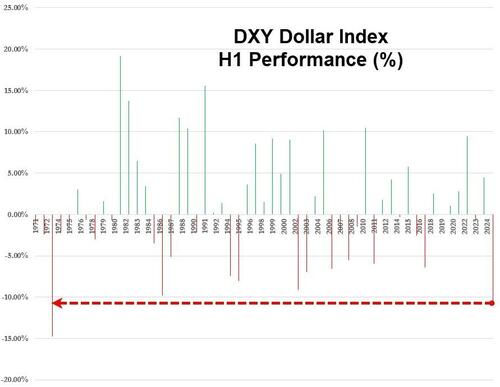

The rally in bonds comes as the dollar's demise continues with Q2 seeing the worst quarter for DXY since Q4 2022 (and the second worst quarter in 15 years) falling to its weakest since Feb 2022.

Source: Bloomberg

Worse still, the DXY dollar index is down over 10% YTD - its worst start to a year since 1973 (when the oil embargo started sending oil soaring, sparking runaway inflation)...

After rallying for the first four months of the year, gold has gone nowhere in the last two months, hovering near record highs, but unable to extend gains even as the dollar dived. Notably, the precious metal also broke below its 50DMA but found support (today) at its medium-term up-channel...

Source: Bloomberg

Bitcoin had a big quarter, rallying in all three months (but decelerating in June) to a record monthly closing high...

Source: Bloomberg

Amid Israel-Iran tensions (which have now retreated), oil soared to its best month since Sept 2023 in June (also up in May after April's collapse). However, WTI is lower from close to close in Q2...

Source: Bloomberg

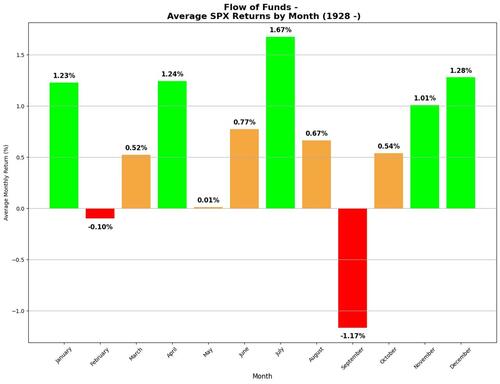

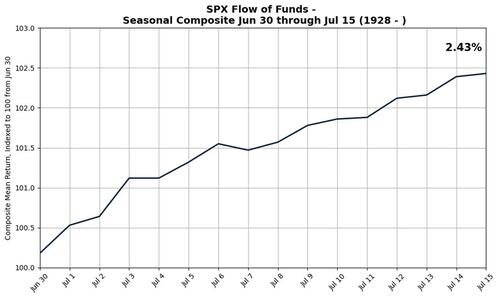

Finally, as we detailed earlier, July is the strongest (seasonal) month of the year...

...with the first half of July even better...

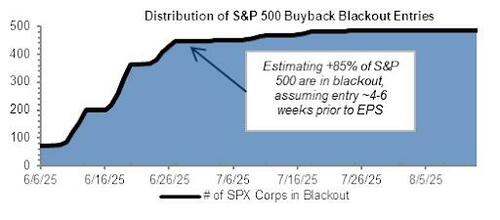

But, in the super-short-term, one leg of the supportive stool for stocks is about to kicked out as the buyback blackout begins...

...then brace for August.

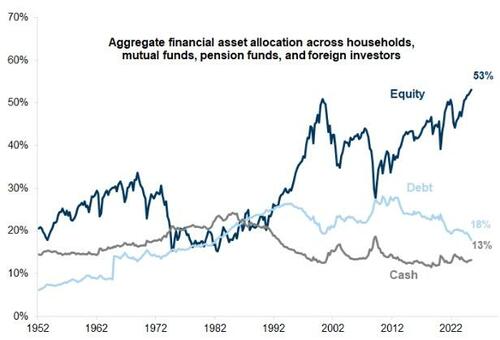

One more thing...Households hold less cash and about the same amount of fixed income assets as they did 40 years ago as Goldman's Peter Oppenheimer recently illustrated. But they have tripled their allocation to US stocks over this same period (see chart below).

Can the momentum continue or is it time to diversify? Oppenheimer recommends investors diversify across countries, sectors, factors, and size.