All Bets Are Off: Morgan Stanley Warns Selling Panic Triggers First $40 Billion In CTA Liquidations

Another day of chaos in markets thanks to geopolitics, domestic macro, and micro... and now CTAs.

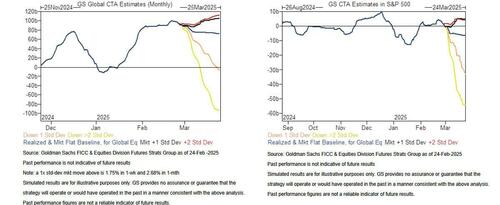

Recall that two days ago we warned that with the S&P falling below the 50DMA (and 100DMA since), but more importantly, the short-term CTA trigger level of 6045, trend-following CTAs - which were max long stocks - would start selling.

More importantly, we said that should the S&P drop below the all-important medium-term CTA trigger level of 5,887...

... all bets would be off as that's where at least $12.6BN/$58BN in S&P sales over the next week/month respectively, would be triggered.

Well... all bets are indeed off because we closed down 1.6% at the 5,861 session lows, and well into CTA MT liquidation territory.

Which is bad. It's so bad Morgan Stanley's Qquantitative and Derivative Strategy desk sent out the following warning notice:

Lots more nervous inbounds over the last 30 minutes. At -1.25% in SPX we forecast over $40bn in equities that need to be sold over the next week from macro systematic strategies, mostly from CTA as triggers are starting to flip in US equity futures (ES/NQ/RTY should all flip short in coming days).

That is partially offset by $10 to $15bn of pension/asset allocator demand into month-end.

The dealer long option gamma position has been eroded down to low single-digit billions per 1% now – but for the next 20 minutes that gamma position will rise on any further selloff due to 0DTE positions – not that that will set market direction, but could help slow the pace.

Alas for this email - which was sent out 20 mins before the close - the pace did not slow and in fact it accelerated! And now, absent a powerful reversal, all bets are indeed off as institutions, which recall had been sitting on the sidelines until today...

This is a retail liquidation. Zero institutions selling right now

— zerohedge (@zerohedge) February 25, 2025

Goldman mid-day recap: "Asset managers continue to “aggressively watch” and HFs are very active again degrossing (HF activity is a 9 out of 10 on our trading desk this AM). In TMT: We saw HFs cut risk in Megacap…

... join retail investors in dumping.

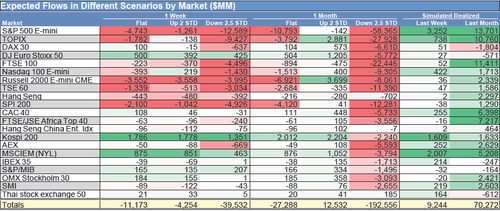

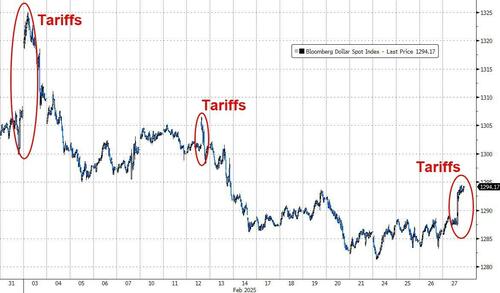

Trump stirred the pot early with clarification on his tariffs comments from yesterday which - he explained - were in no way dovish. That sent the Peso, the Loonie, the Yuan, and the Euro reeling...

Source: Bloomberg

..and obviously the dollar spiked...

Source: Bloomberg

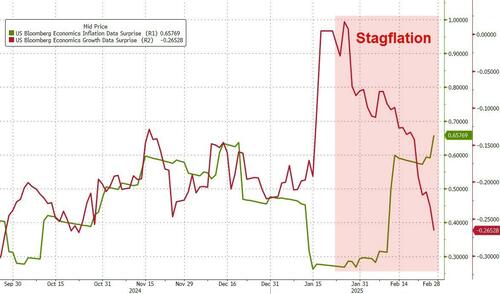

Today's macro data came in three flavors:

- Good - GDP and Durable Goods Orders better than expected (but PCE picked up)

- Bad - Initial jobless claims spiked thanks to DC's surge

- Ugly - Pending home sales puked to record lows

US Macro Surprise data continues to serially disappoint...

Source: Bloomberg

As stagflationary signals grow stronger...

Source: Bloomberg

But, of course, it was really all about NVDA. What initially looked like (and was taken by the market to be) strong earnings (and outlook 'words' from Jensen), ended up seeing significant selling pressure (from +4% to -8%)...

So we filled the DeepSeek gap down.. and are now testing back to those lows.

NVDA's market cap fell back below $3 trillion (and TSLA is back below $1 trillion)....

Source: Bloomberg

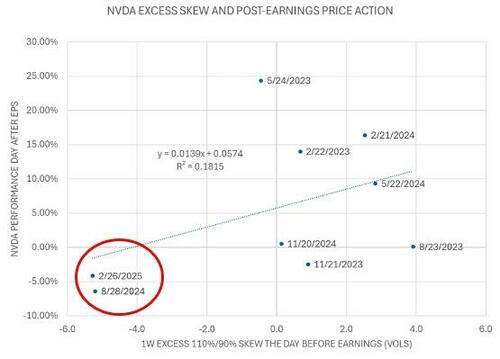

Bloomberg's Cameron Crise offers an explanation for NVDA's disappointing day - options were primed for more than normal weakness... but didn't get it out of the gate and this negative reaction is options-hedge unwinds driven:

The post-earnings price action in Nvidia may be a little disappointing, but it shouldn’t be altogether surprising.

After all, the short-dated skew in Nvidia options (the 110% strike vs the 90%) strike was extremely negative...considerably more so than was justified by the price action in the stock over the last couple of days.

We saw a similar phenomenon last August...and the stock dropped more than 6% the day after earnings.

While the correlation between the pre-earnings “excess skew” and the post-earnings price action isn’t perfect, it isn’t zero, either.

And as you can see from the chart above, today’s price action slots in very closely to what we saw last August.

...and of course that dragged the entire market down with NASDAQ leading the plunged...

All the majors blew through critical technical support today...

...and it's about to get much worse because as noted above, the S&P hits its Medium Term CTA threshold:

We close here (5887), all hell breaks loose: this is the critical Medium Term CTA threshold level, below it there is up to $200BN in sell orders pic.twitter.com/hlN9UHxgqn

— zerohedge (@zerohedge) February 27, 2025

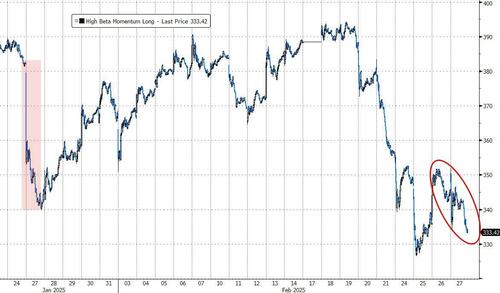

The momo meltdown continued today after a brief dead cat bounce (now back below DeepSeek lows)...

Source: Bloomberg

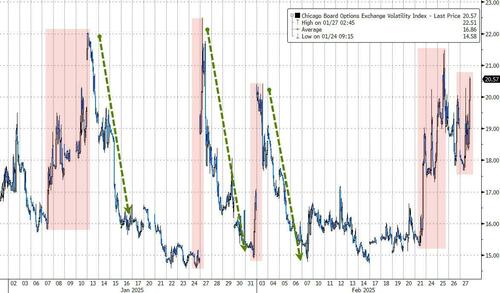

VIX pushed back above 20 today. Notably this is the 'longest' period of elevated VIX this year - each previous spike was met with a wall of vol-sellers..

Source: Bloomberg

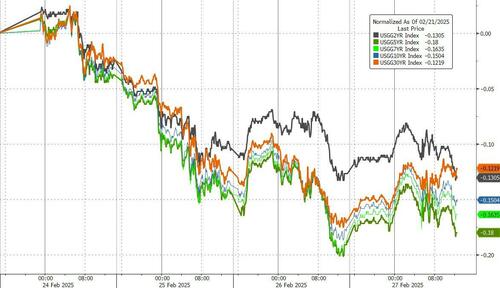

Treasury yields were mixed today with the long-end lagging (2Y unch, 30Y +4bps). The belly of the curve remains the best performer on the week...

Source: Bloomberg

Meanwhile the yield curve is flashing stagflationary signals (3m10Y inverted once again)

Source: Bloomberg

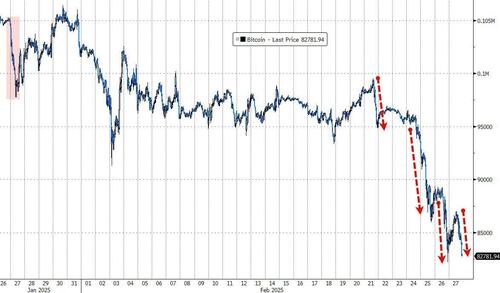

Following another large ETF outflow yesterday ($700mm), bitcoin ended the day lower after a sizable bounce early on faded as tech stocks were clubbed like a baby seal...

Source: Bloomberg

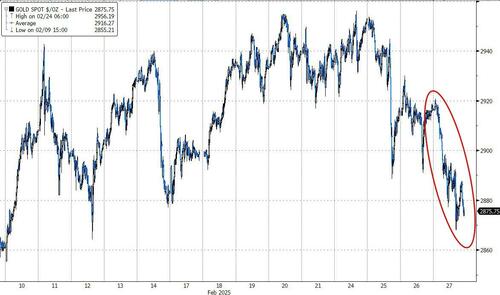

Dollar strength weighed on gold today (2nd worst day of the year)...

Source: Bloomberg

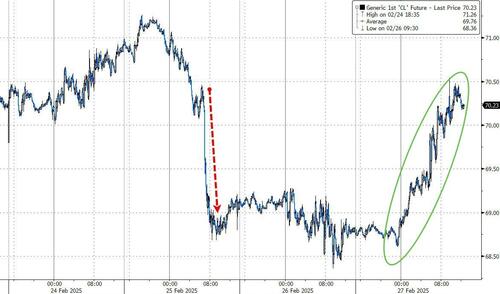

On the bright side... for some... oil prices spiked back erasing yesterday's losses with WTI back above $70...

Source: Bloomberg

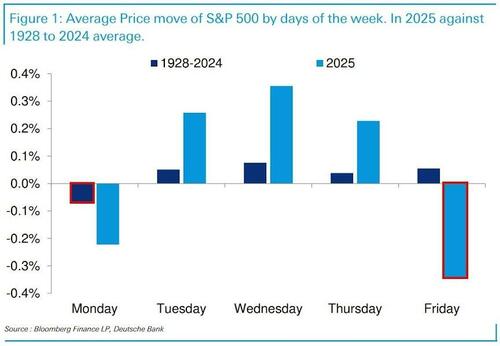

Finally, don't forget, we don't like Fridays in 2025...

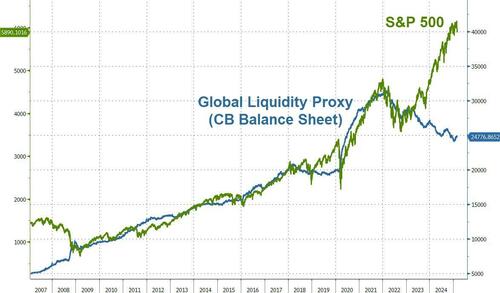

Still, no rush, there's a long way to catch down to global liquidity...

Source: Bloomberg

...or are central banks about to unleash hell?