"Violent Moves": Stocks Start H2 With Momo Massacre & Massive Short-Squeeze; Bullion Bid & Bonds Battered

A quick glimpse at the broad market today and you could be forgiven for thinking 'meh' as its a low liquidity holiday-shortened week (admittedly with some sizable event risk).

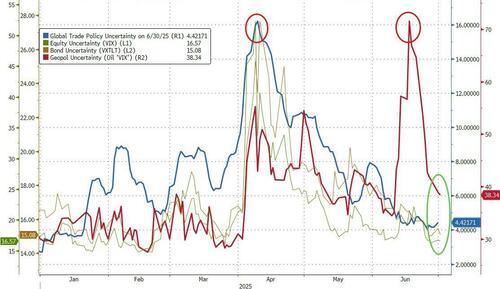

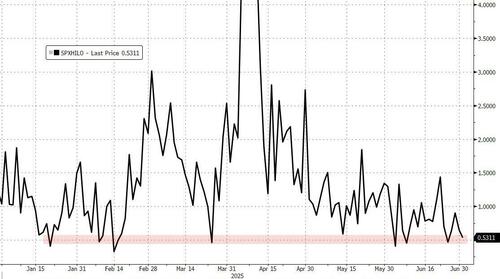

'Uncertainty' continues to tumble...

Source: Bloomberg

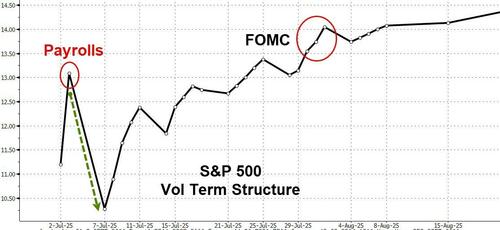

But, the S&P's vol term structure is ready for 'some' fireworks on Thursday (NFP)...

Source: Bloomberg

However, there were some "violent moves" under the surface, according to Goldman's trading desk.

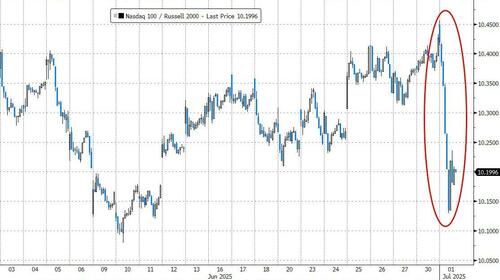

The divergence between Small Caps (outperforming) and Nasdaq (lagging) is significant. Late in the day, this HL: "TRUMP: NOT THINKING ABOUT EXTENDING TARIFF PAUSE PAST JULY 9" dragged all the majors lower...

In fact this was the biggest relative underperformance (NDX/RTY) since Nov 6th (election day)...

Source: Bloomberg

A look under the hood explains why as there has been a massive momentum unwind today - the biggest move since January's DeepSeek dump (with the long leg selling off and short leg squeezing)...

Source: Bloomberg

There is a significant selloff in the AI trade whilst laggards like Tariff Losers and Housing jump higher...

Source: Bloomberg

No clear catalyst for the big move in Momo but Goldman's trading desk think it’s a combo of:

1) Start of a new quarter (new ideas, reversions play, reluctance to sell YTD winners until after Q2)

2) Powell comments (not necessarily new… wait and see, expect higher inflation, but wouldn’t take July cut or any meeting off the table)

3) Profit taking ahead of NFP - (GS +85k, consensus +113k, last +139k)

Sparking more pain, we saw yet another massive short-squeeze as the BTFD swings are becoming wild...

Source: Bloomberg

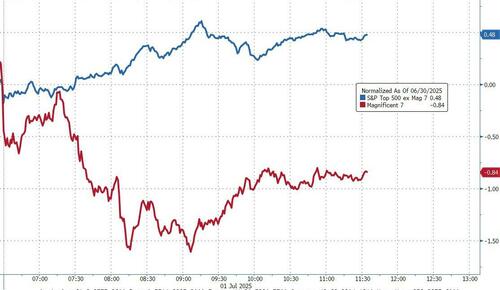

While the S&P ended around unchanged, Mag7 stocks were the big laggard as the S&P 493 managed gains...

Source: Bloomberg

Cyclicals continued to outperform Defensives as the market's 'goldilocks' view of an easy fed saving the world remain in play...

Source: Bloomberg

So much for a slow week, Goldman's trading desk noted that overall activity levels are a 6/10 and inbound questions around the unwind are HIGH. Our desk 8% better for sale.

-

LOs have a 22% sell skew, $1.5bn net sold so far. Biggest sell skews in TMT, Fins, Cons Discret.

-

HFs have a 12% sell skew evenly mixed long and short. HF sell skew is in the 98th %-ile over the past 1yr.

Notable that we are better for sale across ALL sectors with the largest being in TMT, Fins, and Industrials

-

TMT (Pete Callahan): seems to be primarily driven by a sharp reversal in YTD winners. SE, SPOT, RBLX, NVDA, AVGO, AMD, NFLX, META all stand out // not seeing a ton of flow on our desk TODAY specifically to substantiate this, our sense is most of these moves are related to the calendar flipping to Q3 // we saw a ton of LO movement into quarter-end last week across Sectors, and wonder if there was a reluctance to sell/trim some of the big YTD/thematic Winners until after Q2 ended // Notably, AAPL (-18% ytd) stands out as one of the best assets today in TMT

-

HCare (Jon Chan): after exiting 2Q with the XLV/SPY pair at relative lows (levels not seen since ‘01) – the group is extra springy today – with Managed Care (+2-3%), Pharma (+1-3%), Tools (+2%) all leading the way – while more well-owned Medtech lagging marginally – suggestive of positioning driven rotations/momentum unwind with the turn of the quarter // No overarching fundamental driver from what we see – though can frame a couple headlines as being favorable for group – (i) with Senate progressing towards voting on final amendments for BBB (read: clarity on Medicaid/gov’t exposed), (ii) headlines over AZN discussing moving listing to US (read: could this be part of drug price negotiations?), (iii) incremental M&A headlines (more neg EV deals with IGMS, MRK GY says looking at more Life Sciences deals).

-

Consumer (Scott Feiler): Tons of inbounds as to “why is consumer working so well today?” // Think it could be as simple as Consumer Discretionary is the most net sold sector YTD on our PB book and is in the low-single digit percent in terms of exposure vs other sectors on a 1, 3 and 5-yr basis. Feels like a catch-up trade to the market on day 1 of 3Q // JOLTS job openings up, oil is at steady levels and positioning (according to PB data) in the space is light // The names moving are largely the shorted ones (see AEO/ANF/VSCO/KSS etc) vs some of the more owned names underperforming like RL, AS, TPR etc.

-

Fins (Alex Mitola): Performance seemingly driven by Powell's comments regarding the possibility of a July rate cut "can't say whether July is too soon to consider a cut" sparking a rotation toward cyclicals/value/small caps. Within Fins, seeing this in retail broker weakness (HOOD IBKR, LPLA, SCHW), regionals > large caps, and weakness in defensives (exchanges, pockets of insurance) most notably. Our Fins Pairs say it all – Long MoMo, High Growth and and Low Value baskets all underperform

The S&P's intraday range was near the YTD lows today...

Source: Bloomberg

VIX was higher again today having troughed when we noted the 'Spot Up, Vol Up' panic buying (green square) last week...

Source: Bloomberg

Treasury yields soared today after some overnight buying. Rates started to rise on Powell's comments and then surged higher on the ISM/PMI beat (seemingly ignoring the construction data's dismal print). The long-end underperformed...

Source: Bloomberg

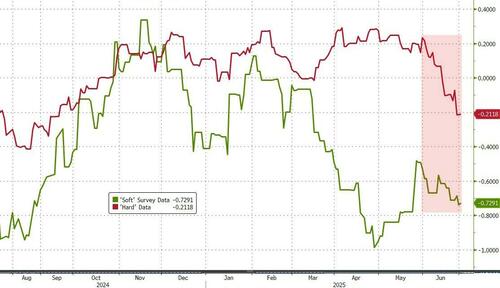

Meanwhile, as Bloomberg's Simon White noted today:

The wait might soon be over for President Donald Trump.

Federal Reserve Chair Jerome Powell has the cover to reduce rates as most of the soft, ie market and survey based, data has become sufficiently stressed, with Powell today indicating he would be open to a rate reduction as early as July.

The Fed historically first eases policy not when the hard data weakens – by then it’s often too late to stave off a recession – but when stressed soft data tells it to.

The Fed aims to nip a downturn in the bud by responding to weaker soft data. Whether stocks remain supported at current lofty valuations will depend on when and by how much policy is loosened.

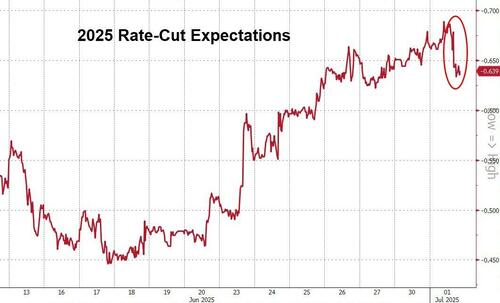

Rate-cut expectations dropped today also...

Source: Bloomberg

The last two days have seen the biggest flattening of the yield curve (2s30s) since the first week of May...

Source: Bloomberg

The dollar ended basically unchanged after rallying back (after Powell and PMIs) from overnight selling...

Source: Bloomberg

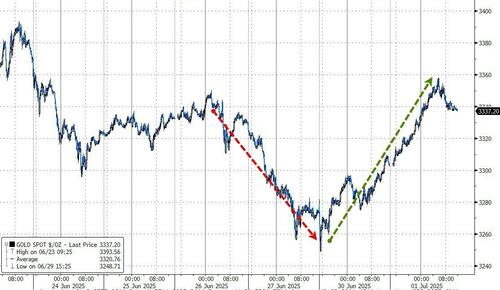

Gold, interestingly, correlated strongly with the dollar today, bouncing back from yesterday's end of quarter tumble...

Source: Bloomberg

Gold bounced off its uptrend channel and is now back above the 50DMA...

Source: Bloomberg

Oil prices were marginally higher today... though in the context of last week's Israel-Iran 'peace' plunge, its dead-stick still...

Source: Bloomberg

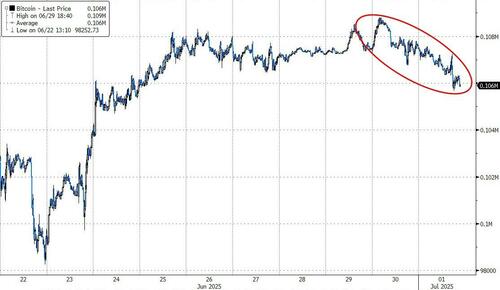

Bitcoin tracked lower with tech stocks, testing a $105k handle...

Source: Bloomberg

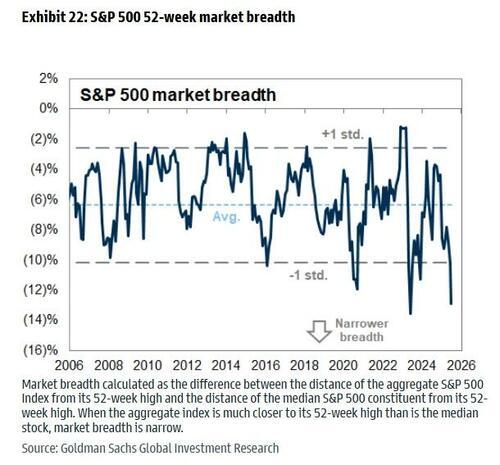

Finally, as we noted yesterday, this is the lowest breadth record high in US equity history...

...and while seasonally, the next week or two are the strongest of the year for the broad market:

This week into the 4th of July has one of the highest historical win rates, with July 3rd especially standing out.

The other key seasonal dynamic is the underperformance of small caps... historically, the July rally has been almost entirely a large-cap phenomenon

July has been the worst month for the Momentum Factor since 2021...

... the 'risk' catalysts are building and July 17th looms. Have investors front-run this positive seasonality?