With 18 More Closing Bells Left In 2025, Top Goldman Trader Reviews What Mattered... And What's Next

With 18 more closing bells to go in 2025, top Goldman Sachs trader, John Flood, takes a moment to look back at what mattered this year... and how that may drive what happens next year.

What Mattered...

The market’s positive momentum from 2024 promptly carried into January as investors remained optimistic on everything AI and a probusiness administration squarely focused on deregulation.

The first real test of the year came on January 27th AKA DeepSeek Monday.

The Chinese AI company released its chatbot which led to a sharp drawdown in global technology stocks. Investors worried that the AI hardware and large-model business architype might be disrupted with significantly cheaper (yet still efficient) models like DeepSeek potentially having the ability to knock off some of the biggest players. However, these fears tuned out to be relatively short lived as the AI complex quickly regained its footing and soared higher over the course of the year (with some volatility along the way).

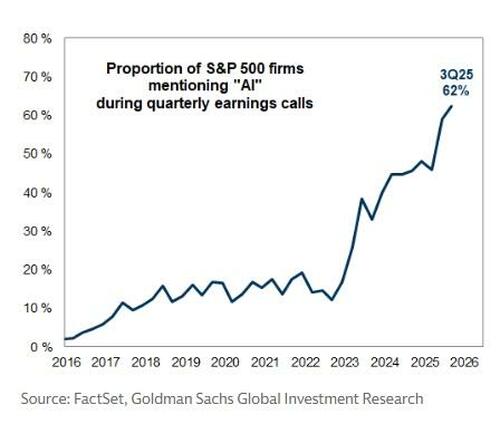

The share of companies discussing AI on earnings calls continues to grow...

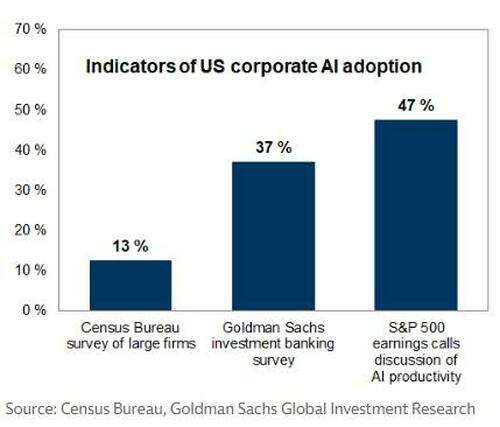

Estimates of US corporate AI adoption...

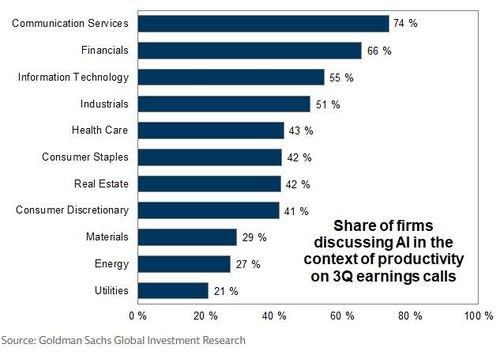

Mentions of AI in the context of productivity by sector...

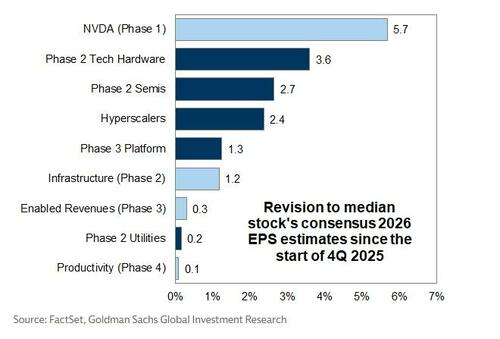

Earnings revisions across AI-exposed equities since the start of 4Q 2025...

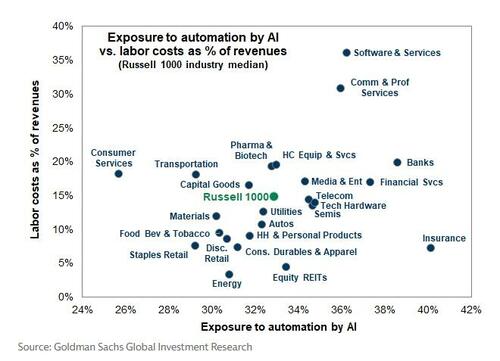

Industry exposure to AI-related productivity enhancements...

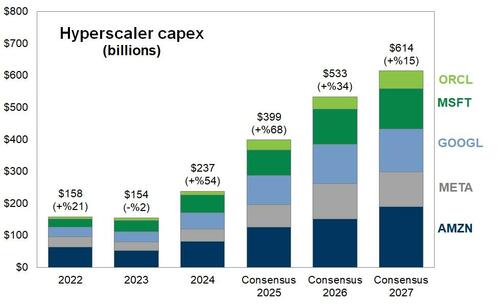

Hyperscaler Capex Ex Projections (billions)...

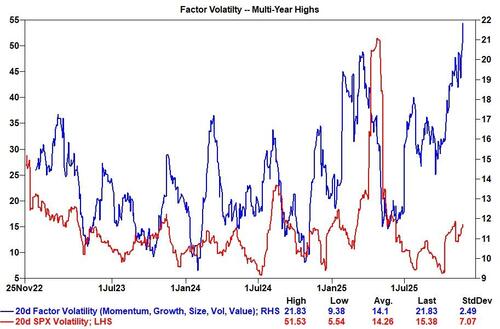

Due to a bout of extreme factor volatility 3/7 and 3/10 will go down as one of the worst two day stretches of HF performance in years (multistrat-mageddon). The momentum factor experienced a 4+ standard deviation drawdown which led to forced derisking across various types of HF strategies. Fortunately this episode led to cleaner positioning as traders braced to enter the second quarter...

Donald Trump’s “Liberation Day” will be remembered as the most impactful event on the U.S. stock market in 2025. After the market close on 4/2 the president announced sweeping new tariffs on imports and famously held up his big boards with startling rates for the world to digest. The S&P 500 promptly lost 13% from 4/3 – 4/8 and closed sub 5k on 4/8 which was good for the low close of the year.

However, on 4/9 Donald Trump announced a 90 day pause on tariffs causing the S&P 500 to experience it sharpest intraday reversal since 2008 (the index closed +952bps on the day). This set the stage for the S&P 500 to make 33 additional record closes in 2025 (there have been 36 total this year and I think there are several more to come over the next 3 weeks).

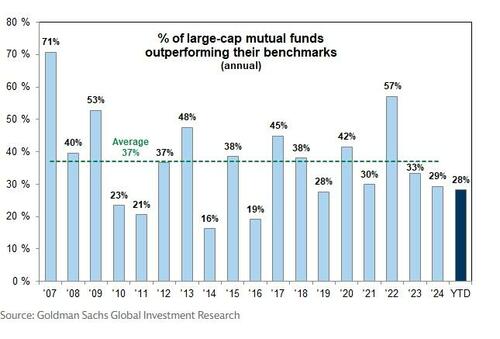

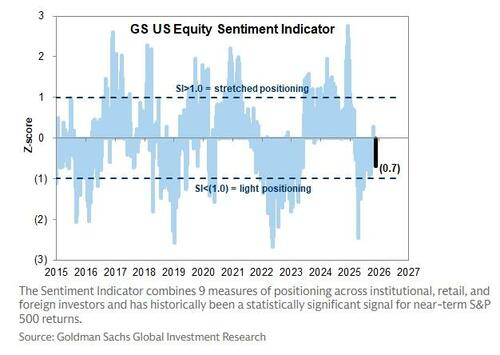

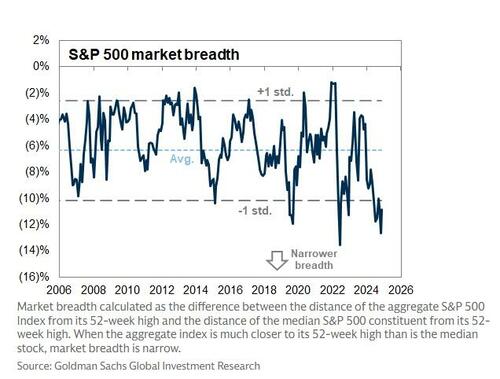

Post Liberation Day, a great majority of professional institutional investors remained skeptical of the market’s rally and stayed on the sidelines. The most common reasons cited for this skepticism were geopolitical/macro/policy uncertainty, rich valuations, and poor market breadth. As a result, fundamental L/S HF net exposure has spent most of the year well below the 50th percentile rank on 1, 3 and 5 yr look backs. MFs sat on a significant amount of cash until the 4th quarter (too late). Only 28% of large cap mutual funds are outperforming their benchmarks (the lowest share since 2019). The average fundamental long short HF is underperforming the S&P 500 by ~200bps. Our sentiment indicator has spent most of the year in negative territory reflecting relatively light institutional investor positioning. The wall of worry has been extremely high this year and remains omnipresent (bullish signal).

28% of large-cap mutual funds are outperforming their benchmark...

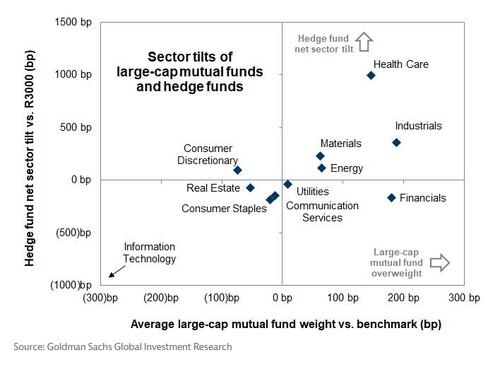

Hedge fund vs. mutual fund sector positions...

Three investor cohorts that have shown up as noteworthy buyers of U.S. stocks this year are the retail community, corporates, and foreigners. Our data shows that the well informed retail community now only consistently sells stocks when there is significant job loss (as in March of 2020). The retail cohort’s most significant buy imbalances were in early April post liberation day. Retail got it right.

Companies have once again repurchased over $1T of their shares in 2025 making it a top 3 buyback year in the history of the stock market. As authorizations continue to ramp, I believe $1T annual corporate bids will be the new norm on the go forward (recessions aside). Both retail and corporates have provided a higher floor for the market at the index level continuing to frustrate the HF and MF communities.

Despite ongoing debates around US exceptionalism, foreign investors have been the single largest source of U.S. equity demand YTD. Foreign investors bought nearly $280 billion in May and June this year, continuing the usual pattern of elevated foreign investor demand after the $ has weakened and US equities have underperformed.

During the front half of the year we saw several U.S. institutional investors build significant longs in select European equities for the first time in years. However, this demand has not carried into the back half of the year. I worry that when things get hard again these stocks will be the first out the door in a LIFO (last in, first out) phenomenon. Away from the U.S. investors are currently doing most of their work on Brazil, Korea, and India. I believe Brazil is primed to have a moment in 2026 - rate cutting cycle + change election outcome anticipated could lead to a re-rating in Brazilian assets. China remains controversial.

The Fed cut rates by 25bps in September, October, and will do so again next week. Lower rates, a weaker USD, a resilient consumer, solid earnings, 2% GDP growth, and cautious sentiment make me believe the U.S. stock market will be the best place to be in 2026. Our trading desk expects companies with high floating rate debt (GSXUHIFL) to benefit from lower rates. Currently, the trailing 12m interest expense makes up ~70% of next 12m EBIT estimates and as floating rate debt re-rates lower, this will directly boost earnings.

From my trading seat, an average of 17.5b shares traded across the U.S. equity market each day this year. For context, this number was 10.8b shares in 2020. However, trading has never been more difficult as liquidity is hard to come by as this volume growth is happening off-exchange which traders cannot access. Over 75% of off-exchange volume now trades in OTC market centers, which includes retail flow mostly inaccessible to institutional investors.

Factor Volatility hits multiyear highs...

Fragmentation in the US markets poses further challenges with 16 exchanges, over 30 ATSs and hundreds of OTC liquidity destinations. The average trade size has dropped both on and off exchange, reaching a 15-year low this year of ~150 shares per trade.

GS US Equity Sentiment Indicator of investor positioning...

“Knowing where the bodies lie” has never been more important.

2025’s 50 Most Talked About Market Themes:

-

AI Acceleration

-

Open AI

-

Gemini

-

Hyperscalers

-

Trump’s Tariffs

-

Liberation Day

-

Bubble Watch

-

DOGE Risk

-

MAHA

-

Circularity

-

1997 or 1999

-

Stretched Valuations

-

Wall of Worry

-

Relentless Retail Bid

-

DeepSeek Monday

-

Private Credit Concerns

-

Gold Glistens

-

Japan Jumps

-

USD Weakness

-

One Big Beautiful Bill Act (OBBBA)

-

Fed Cuts

-

Pressure on Powell

-

Bad Breadth

-

ECM Uptick

-

Consistent Corporate Bid

-

Government Shutdown

-

FirstBrands / Tricolor

-

A Resilient Consumer

-

M&A Mania

-

Quantum Computing

-

Robotics

-

Nuclear Energy

-

CapEx Beneficiaries

-

Data Centers

-

Onshoring

-

Federal Deficit

-

Active ETFs

-

Deregulation

-

Sports Betting Boom

-

War on Endowments

-

NBLPs

-

Unaffordable Housing

-

Bearish BDCs

-

GSE Privatization

-

Factor Volatility

-

U.S. Gov’t Equity Stakes

-

Prediction Markets Growth

-

Strategic National Investment (rare earth, lithium, shipbuilding, etc)

-

Tokenization

-

24/5 Trading

What's Next?

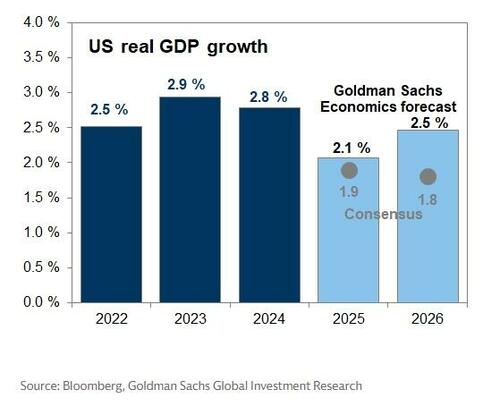

GIR’s baseline economic forecast is that growth reaccelerates to 2 - 2.5% in 2026 because of reduced tariff drag, tax cuts, and easier financial conditions.

US equity market internal pricing of economic growth...

Goldman Sachs and consensus forecasts for US real GDP growth...

Standard models suggest that this should boost job creation and stabilize the unemployment rate at a level only modestly above September’s 4.44%.

Under this forecast, our working assumption is that the FOMC slows the pace of easing in 2026H1, pausing in January but still delivering two more cuts in March and June which push the funds rate down to a terminal level of 3 - 3.25%.

Here are Goldman’s official targets for the end of 2026:

-

S&P 500: 7200;

-

UST 10yr yield: 4.2%;

-

EUR/$: 1.25;

-

Comex Gold: $4745, and

-

Brent crude: $57.

Per the usual, we must be mentally prepared for several macro scares next year, but I take great comfort in my belief in Corporate America’s ability to grow. Not to mention the M&A spike we witnessed this year should accelerate next year as companies capitalize on a more permissible regulatory backdrop and seek out cost synergy opportunities to offset persistent macro pressures.

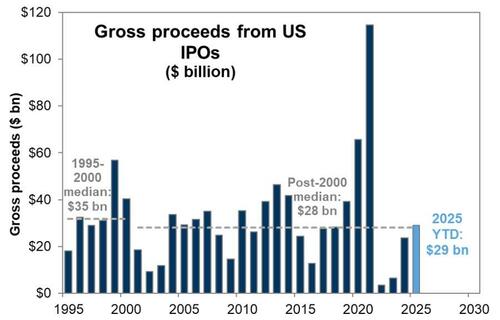

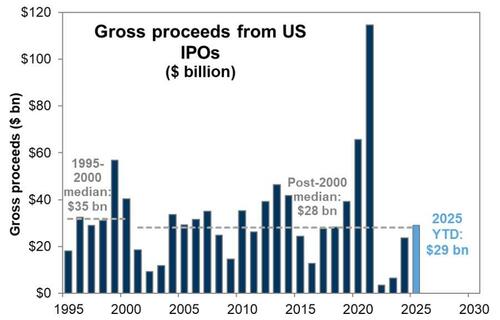

After several years of low issuance, IPOs saw a resurgence this year with a total of $29bn in proceeds raised across 56 deals. Worth noting this is still well below 2021’s peak levels...

>$700bn in YTD public M&A announced making 2025 best M&A year since 2020...

The IPO backlog is also extremely promising / exciting. The Retail bid should remain strong as tax refunds spike in early 2026 (2025 were never adjusted to reflect OBBBA and therefore many will be due a large refund).

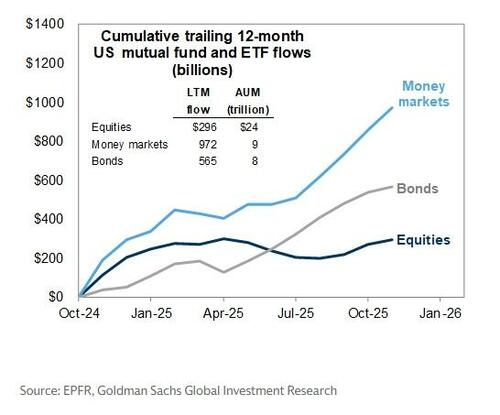

Recent mutual fund and ETF flows...

S&P 500 52-week market breadth...

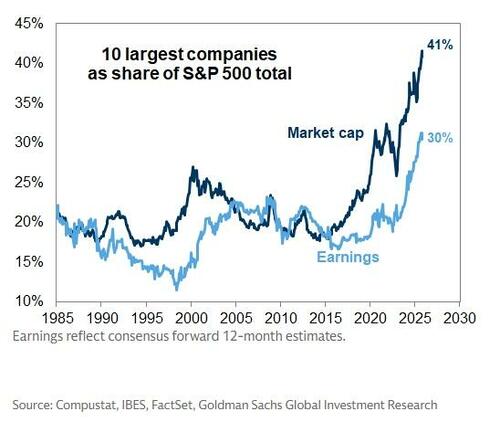

Concentration of S&P 500 market cap and earnings in the 10 largest index constituents...

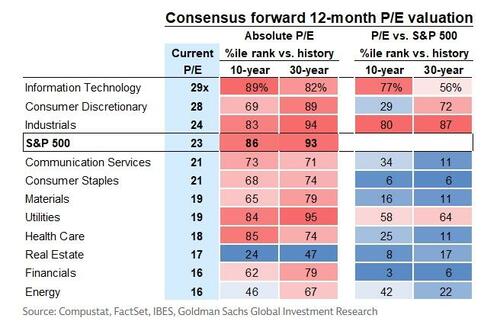

S&P 500 sector P/E valuations relative to history...

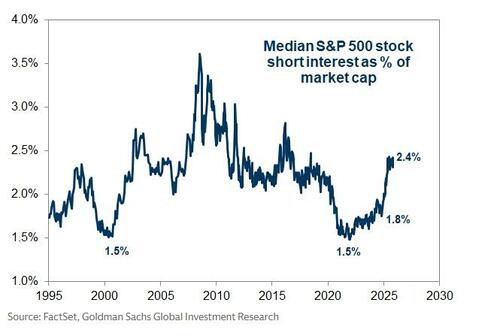

The median S&P 500 stock carries above-average short interest...

Throwing these dynamics into a blender makes me believe the S&P 500 has a very viable path to 7800 next year.

Flood ends with a quote worth paying attention to:

"May your choices reflect your hopes, not your fears."

-Nelson Mandela

And finally, his favorite trade for 2026 is getting long some of the more under the radar AI productivity beneficiaries. Our US AI Productivity basket (GSXUPROD) is composed of non-Tech and non-AI companies that have mentioned specific plans to implement AI into their workflows, allowing them to reduce costs and improve margins, across: banks, retailers, transportation, HC services and the restaurant industry.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal