Morgan Stanley's Top 4 Themes, And Top 10 Predictions For 2026

By Stephen C Byrd,Stanley global head of thematic research at Morgan Stanley

Thematic work has long been a focus of Morgan Stanley Research, and in periods of extreme market volatility, we believe that a thematic lens can identify the most attractive investment opportunities:

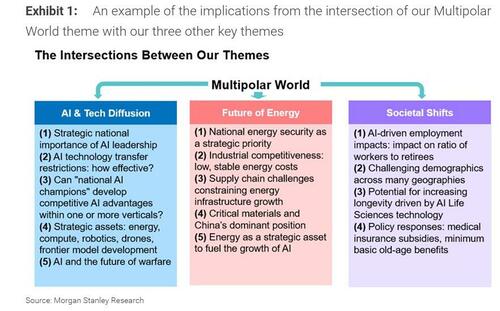

Our four key themes for 2026 (full note available to pro subscribers) are

- AI/Tech Diffusion,

- The Future of Energy,

- The Multipolar World, and

- Societal Shifts.

Three of our themes are the same as last year, whereas Societal Shifts represents an evolution and expansion of one of our prior themes, Longevity.

How do we define our new key theme, Societal Shifts? We see multiple trends driving broad societal impacts around the world, with effects felt across a surprisingly wide range of industries. The ripple effects of AI-driven employment disruption/evolution, an aging population, changing consumer preferences, the drive for healthy longevity, and challenging demographics across many geographies will continue to matter for governments, economies, and corporates.

Thematic investing is a powerful driver of alpha: In 2025, our thematic stock categories on average outperformed MSCI World and the S&P 500 by 16% and 27%, respectively.

Within our four key themes, we have developed 21 categories of stocks that embody specific facets of a particular theme. Interestingly, the top three performing categories were all driven by Multipolar World dynamics.

In our 2026 Thematic Insight note, we make 10 predictions tied to our four key themes:

- "Two worlds" of LLM progress and AI adoption: American frontier LLMs achieve a step-change increase in capabilities in 1H26 that is not matched within the same time frame by Chinese competitors; 1H26 concerns with AI adoption rates transition to bullishness by 2H26 on the growing magnitude of AI adoption benefits, as the non-linear increases in AI capabilities are felt.

- Compute demand exceeds supply: Driven by a proliferation of AI adoption and increasing complexity of AI use cases, the supply growth in compute falls short of exponential net demand growth. Our new "Intelligence Factory" model allows investors to gain an in-depth understanding of the economics for LLM developers at the data center level (spoiler alert: the economics are attractive).

- A robust US policy agenda: The Trump administration takes more robust action than expected with respect to securing domestic supply of critical minerals, uranium and metals, supporting the re-shoring of manufacturing, increasing military spending (with an emphasis on innovation), and reducing consumer costs.

- AI tech transfer, coupled with push for national self-sufficiency and greater "gross domestic intelligence": In response to predictions 1-3, China exerts pressure on the US to permit more extensive AI technology transfer to China. Inequalities in AI capabilities at the national level can impact trade dynamics.

- The politics of energy: Rising energy costs around the world result in a backlash against data center growth, policy support for low-cost energy, and "off-grid" power supply strategies for data center projects.

- Greater convergence of AI + energy: Key AI players take steps to gain greater control of energy infrastructure, in order to control their destiny, secure the lowest-cost, most reliable energy as quickly as possible, insulate other power customers from impacts driven by AI growth, and leverage AI to drive energy/power efficiencies.

- China grows global technology manufacturing market share, while the US experiences a "re-shoring renaissance": China brings considerable capabilities to bear and grows global manufacturing market share in key (tech-heavy) industries. For the US, with structural tech diffusion reducing the benefit of low-cost labor, the scales tilt back towards domestic production. Regions with high cost structures, high regulation, and low access to AI lose market share.

- In Latin America, a trifecta of change: Policy shifts, changing geopolitics, and peak interest rates drive LatAm toward a new investment cycle, a bull case driven by investment rather than consumption.

- Re-skilling initiatives + AI job loss policy intervention: A wide range of corporate and government initiatives seek to re-skill workers in response to AI-driven job shifts. Political sensitivity to real and/or perceived job losses from AI adoption results in a range of policy interventions.

- "Transformative AI" drives deflation, higher capex, changes in asset valuations, and national competitiveness: In 2H26, there are early signs of rapid price declines in a range of economic activity, which in turn drives greater wage inequality, greater capex, the risk of upward pressure on interest rates, and rising value for assets that cannot be "replicated" by AI.

Enjoy your Sunday.

More, including the full list of stocks how to play the bank's key themes, in the full report available to pro subs.