4th Worst Day For Momentum In History Amid IPP, Nuclear Meltdown: Here's What's Going On

While the historic meltdown in software continues, the overall selloff today is so bad that the software/semi basket is actually higher on the day: that's right, the selling in semiconductors is even worse than the relentless collapse of software stocks.

Commenting on today's meltdown, UBS writes that while the pain level was elevated yesterday, the Software sell off still helped many books. However, today, the Momentum unwind is extreme and clearly the pain level is much higher as factor moves extreme, and is driven by actives and Quants equally. "More of an unwind than rotation. More defense than offense. Retail is actually less active but also not supporting the tape. Buybacks are a at a seasonal low."

High Touch flows are balanced, looking at Long Onlys and Hedge Funds. Short activity is subdued. Tech is better for sale while net better to buy in Banks and Telcos - mirroring the action below the surface.

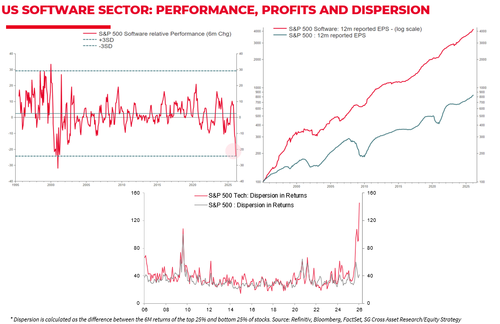

SocGen also chimes in and notes that US software stocks are down 17% YTD and have lagged the S&P 500 by almost 30% points over six months - a 3 sigma downside move for a sector that usually compounds quietly in the background. This is the outlier: a sector that has delivered 13% annualized profit growth for three decades, almost double of the S&P 500 and built its status as one of the market’s most reliable defensive engines. And all on the absurd, naive belief that a handful of hallucinating chatbots will put the entire SaaS industry out of business within years.

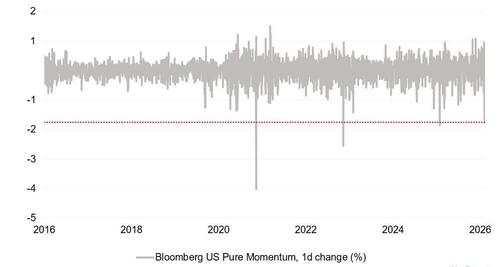

Which brings us to the big story of the day: whether it's the software slam, or the semiconductor collapse, there's one thing they have in common - today has been the fourth sharpest one-day sell-off in US momentum stocks over the past decade (based on the Bloomberg pure momentum dataset).

While the moves have been especially large in the US, the same pattern was observed in the European markets. It's so bad that as investors pile out of growth and momentum, they scramble into value and old-school defensives. Yes, the out-of-favor chemicals sector has seen the fourth largest one-day rise in the past decade!

According to Morgan Stanley's QDS team, today is momentum's worst drawdown in 3 years *exceeding* even the DeepSeek moment last January; and picking up on what we have been saying for weeks, MS notes that one can now add SaaS to the Contra AI trades

As one would expect, a historic meltdown for momentum is met with laggards rallying across every sector.

That said, there is much more focus on factor vol as Pure Momentum goes from best day on record to worst day back to back. MS goes on to highlight the clear relationship between weakness today and positioning/YTD flows: Memory -6%, AI Power -8%, Nat Security -10%, Bitcoin Miners -15%.

Meanwhile, the "Contra AI" trades are leading and part of the driver for strength in Laggards: AAPL, Early Cycle Cyclicals, Chemicals, Regional Banks.

Such a historically sharp momo move in the absence of major catalyst prompting MS QDS to double down on its "re-risking to reversal" call: high momentum exposure, increasing overlap btwn high beta + high momentum stocks + weaker retail seasonality.

Yet while the selling does appear indiscriminate across most momentum sectors, one place where there is a tangible reason is in the increasingly problematic energy+electricity space.

Recall way back last September we said that in response to soaring electricity prices, a powerful blowback is forming against data centers in particular (and AI in general), and it's only a matter of time before Trump steps in.

100% wrong. Trump is about to put a cap on power price and will crush utilities. https://t.co/WjiZe8MEnM

— zerohedge (@zerohedge) September 29, 2025

Well, the regulators have had enough, and as Bloomberg reports, Texas has so many massive AI-related data centers in development that its grid operator, ERCOT, is considering reevaluating some projects that were previously approved.

The Electric Reliability Council of Texas wants to examine projects unlikely to advance and provide greater clarity for when new sites are ready to connect to its system. Projects historically have been approved by utilities but in recent years Ercot has had to determine how this flood of new users can be served without breaking the grid.

It goes without saying that without the power to feed all the new data centers in Texas, which after Virginia is the second most active state for the industry, there simply will not be enough compute, which means companies will never get their mandatory payments to fund capex, which means dogs and cats living together, mass hysteria as the AI supercycle implodes.

It's also a big reason why today's the momentum trade is getting absolutely monkeyhammered.

Under an Ercot proposal, projects representing about 8.2 gigawatts of power consumption could be subject to new review, said Trudi Webster, a spokesperson for the grid. This is demand that could be satisfied by the equivalent of eight conventional nuclear reactors.

Ercot's proposal is a bet it can both remove kinks that have bogged down projects and not undermine the state’s AI boom, which it has cultivated with business-friendly policies, abundant land, cheap power and the promise of limited regulation.

The grid operator previously had solicited feedback from dozens of companies including Alphabet Inc.’s Google, Meta Platforms Inc. and Amazon.com Inc. On Tuesday, it publicly unveiled its proposal with participants including developers, power plant operators and utilities. More than 700 people tuned it.

Ercot plans to review projects in batches to evaluate their collective impact to the grid instead of doing reviews per project that then can be subject to additional reviews. The aim is to integrate projects, make adjustments to the grid as needed, then move onto the next group. These batch studies would take place every six months, and to start Ercot has dubbed the most advanced projects as Batch Zero.

Jeff Billo, vice president of interconnection and grid analysis at Ercot, said it’s imperative to move to a system where there is “one study to rule them all.” Right now, he explained, Ercot is on the verge of going back to developers that had cleared studies to say they have to reopen them because original assumptions have changed.

Very soon, Texas will go to another proposal we made in 2025: for all hyperscalers and data centers to have their own collocated power facilities, so they do not soak up grid resources and raise everyone's electricity bills.

To prevent skyrocketing electric bills, every state has to follow the Texas example: each data center must have its own "behind the meter" onsite power generation.

— zerohedge (@zerohedge) November 23, 2025

“We believe data centers should pay for the full cost of their power,” Dominion Energy spokesperson Aaron Ruby… https://t.co/0u1owTeAs8 pic.twitter.com/8W421s3rzV

Katie Bell, energy program manager at Meta, said at the workshop some projects have been submitted for 18 months and still don’t meet the criteria of those in Batch Zero. Bell raised concerns echoed by others about the need for transparency and projects facing even more delays.

That said, the projects that could again be reviewed are a fraction of the staggering haul of those seeking connections — more than 250 gigawatts as of Friday, or about three times its total capacity today.

NRG Energy Inc., an independent generator and electricity retailer, said it supports Ercot’s move to a batch study process for large facilities “to help streamline the studies, support economic development, and maintain reliable, affordable power in Texas during this period of significant growth,” according to an emailed statement.

Putting it together, UBS explains why IPPs and nuclear stocks are getting slaughtered, writing that "the Pennsylvania governor commentary and the ERCOT news in conjunction with the broader AI unwind is doing the trick for Independent Power Producers (IPPs) today."

The broader AI trade is getting smoked amid unwinds (Momo basket -7%. AI Power -5%, AI winners -4%, Nuclear -6%, Uranium -9%, Spec Growth -8%). The ERCOT article from last night speaks to increasing scrutiny – ERCOT is considering reevaluating some AI-related data center projects that were previously approved due to a flood of new users. Overall, it’s been super frustrating as it seems like IPPs can’t catch a break these days - sell-off a bunch in sympathy with broader AI, yet do not go up as much when the AI trade doing well and then power curve hardly moves up despite demand and then any time it goes down the stocks go down more too. Inbounds have definitely picked up this week on IPPs being oversold (particularly Constellation Energy being down 27% this year versus the rest of IPPs down 10% on average) amid concerns that new load growth won't be able to contract with the existing generation.

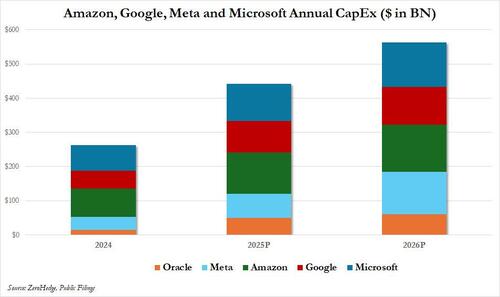

Yet one way or another, the market will have to resolve what is a nagging paradox: do markets believe that the $600 billion in projected capex spending in 2026 is coming - most of it for Datacenters which will need massive energy needs which simply can not be met with today's grid...

... or have we finally hit a bottleneck, which means no grid buildout, no capex, no growth, no memory, and - well - and S&P that trades above 50% lower as the AI supercycle crashes and burns.

Something tells us there is simply no way the market will agree to the latter for the foreseeable future.