After Record Shorting, Hedge Funds Bought The Most Tech Stocks Since 2021

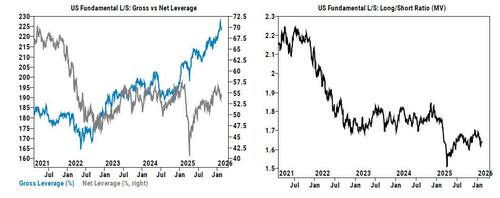

After last week's record shorting of single stocks (see "Largest Short Selling In History Transforming Into Brutal Short Squeeze"), followed by the "Biggest Shorting Of Software Stocks Since 2010" last Wednesday, we have seen signs of rapid de-grossing by the hedge fund community as US L/S Gross leverage decreased for a second straight week by -1.5 pts (-6.4 pts MTD) but remains elevated (98th percentile 5-year), according to the latest Goldman Prime Brokerage data.

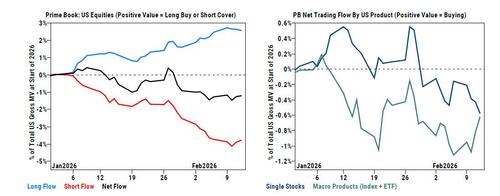

Just as notable is that, after 4 consecutive weeks of net selling, hedge funds modestly net bought US equities this week, driven by long buys in Macro Products outpacing short sales in Single Stocks. Over the week (including Wednesday's rout) Info Tech saw the largest $ net buying since Dec ’21 (but still net sold YTD), led by buying in Semis + cessation of supply in Software, while Consumer Discretionary was the most net sold and saw the largest $ risk unwinds in more than 5 years.

Here are the details from the latest Goldman Weekly Rundown note (available to pro subs):

- Macro Products (Index and ETF combined) were net bought for the first time in three weeks (+0.9 SDs 1-year), driven almost entirely by long buys as short flows were relatively muted. US-listed ETF shorts decreased -0.5%, driven by covers in Tech, Small Cap Equity, and Asia-Pac ETFs partially offset by shorting in Large Cap Equity, Corporate Bond, and Financials ETFs.

- Single Stocks collectively were modestly net sold (-0.3 SDs 1-year), driven by short sales outpacing long buys (2.4 to 1).

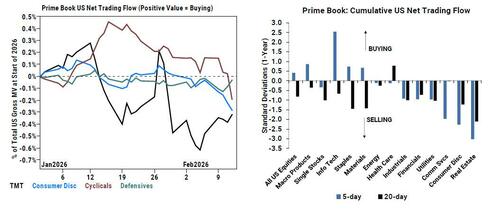

- 8 of 11 sectors were net sold, led in $ terms by Consumer Discretionary, Comm Svcs, Real Estate, and Industrials, while Info Tech, Consumer Staples, and Materials were net bought. More importantly, Goldman notes that Info Tech saw the largest $ net buying since Dec ’21, though still net sold YTD, driven by long buys + short covers (2.8 to 1).

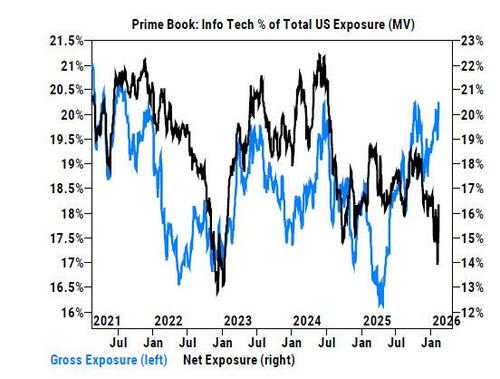

- Semis & Semi Equip was by far the most net bought, followed by Tech Hardware, Software, and IT Svcs. Gross exposure across Info Tech (as % of total US Prime book) is near 5-year highs in the 95th percentile, while net exposure is relatively low (52nd percentile 1-year, 25th percentile 5-year) because long exposure in Semis & Semi Equip and short exposure in Software are at/near their respective record high levels on our records.

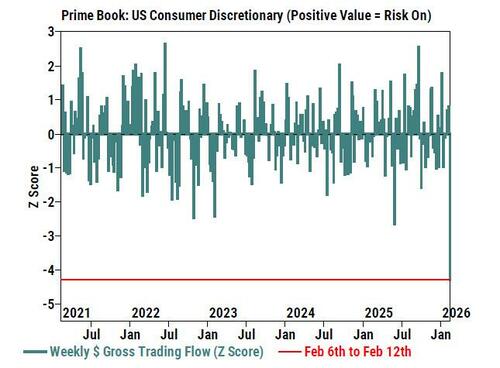

- On the other hand, Consumer Disc was among the worst performing sectors and the most $ net sold (-2.3 SDs one-year), driven by risk unwinds with long sales outpacing short covers (2.5 to 1) – this week’s $ de-grossing, long sales and short covers combined, was the largest in 5+ years (-4.3 z score). Nearly all subsectors were net sold, led by Hotels, Restaurants & Leisure and to a lesser extent Autos, Specialty Retail, Textiles, and Apparel & Luxury Goods. Consumer Disc gross exposure continues to hover around 5-year lows in the 0th percentile, while net exposure is now approaching multi-year lows as well in the 7th percentile/19th percentile vs. the past three/five years.

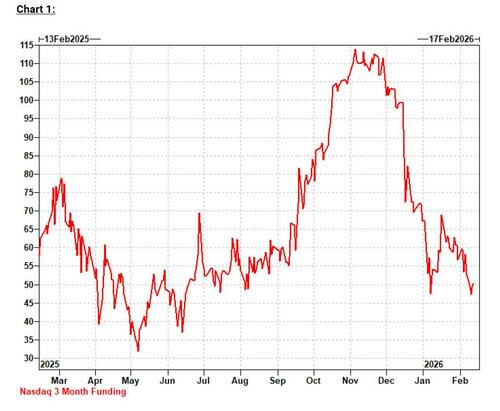

Shifting away from the Prime Brokerage and turning to futures sales trading, Goldman's Robert Quinn writes that the software weakness surrounding month-end induced significant Asset Manager selling in Nasdaq futures: $3.6bn from January 27th – February 3rd per Commitment of Traders (one week delayed, which means here too it is likely there was a major bounce). This marked the largest 1-week amount since March of 2025. New shorts accounted for 85% of the total. Broader Non-Dealer selling was smaller due to contrarian demand across Hedge Funds.

Since then, Software has stabilized somewhat and Goldman observes covering on a few sessions. However disappointing price action in Mega-Cap Tech weighed on the index. And overall leveraged sentiment remained poor. That is, Nasdaq funding cheapened on an outright and relative basis

At the same time, option flows contributed; 3 month normalized 25 delta put-call skew richened to a multi-month high.

From a futures perspective, watch for any cracks in Non-Dealer futures gross longs. As mentioned, shorts, which are more volatile, represented a larger portion of selling on the initial gap lower. A shift in gross longs would be quite meaningful; the 2 year rank as of February 3rd was 83%.

More in the full Goldman Weekly Rundown available to pro subs.