The AI-SaaS Debate: Goldman Highlights Signals To Watch That Could Lead To Stabilization

Investor concerns are centering on new competition for the application software companies and the ROI on CapEx for the infrastructure companies.

Goldman Sachs Technology Research team previously highlighted the two main debates in this space (available here for pro subs)

Debate #1: Will the application software layer be disintermediated?

We expect to see a heightened level of competition between yesterday’s SaaS leaders, today’s bespoke software providers such as Palantir, and the AI native companies that have enough proprietary IP to scale (i.e. more than simply an LLM wrapper).

We believe competition is particularly elevated because a) the start of a new technology cycle lends itself to more build experimentation while the packaged software vendors mature their offerings; b) there is a cohort of companies from the 2020-2021 funding cycle (where VC funding was 2x above trend) that may have smaller moats; c) the classic system-of-record stack of database + human workflows + user interface is going to look different when repurposed for both humans and agents, creating a jump ball that requires meaningful tech replatforming from incumbents.

We prefer to be selective in the app ecosystem, favoring companies that are further along in repurposing their stacks...

Debate #2: Where will the value accrue in the Software stack?

Our customer conversations suggest that every vendor will have agents.

As such, the value lies in agent and LLM orchestration that spans the infrastructure, platform and application layers.

This makes vertical integration more powerful than in the prior cloud cycle.

Simplifying, Gabriela Borges and team state that in Apps, value accrues in the orchestration layer, and evolving from SaaS (Software as a Service) to SaaS + AI is a process with some companies further ahead; for IaaS (Infrastructure as a Service) providers: diversifying across use compute use cases, PaaS (Platform as a Service) functionality, and gross margin improvement (e.g. with silicon diversification) will be key.

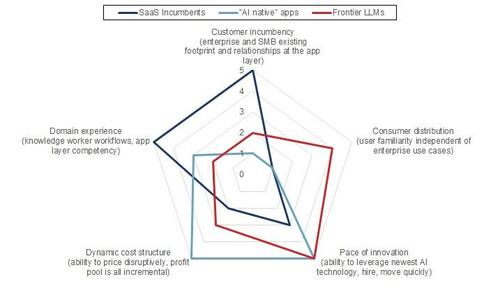

The following chart maps each cohort of competition in apps to their respective strengths and weaknesses:

With this context, Goldman's tech team outline industry dynamics to look for in order to identify the potential for a recovery:

-

Leading indicators stabilizing after ~4 years of worsening trends (in turn tied to the maturation of the cloud cycle and digestion after pull forward during 2020/2021). If revenue growth is stable to accelerating despite traditional software budgets being flat to down (excluding AI), we think it will be hard to argue that software companies are not benefiting from an uptick in enterprise AI investment. On the question of AI disclosure: adoption datapoints will likely precede monetization; and when companies do show monetization, the WholeCo needs to show stabilization; AI revenue can’t simply be a trade off in classification.

-

More customer examples of AI projects shifting to packaged software offerings from bespoke custom builds as the packaged software ecosystem matures. For example, ServiceNow has commented that it has started to see momentum shift away from custom builds as its product breadth has improved and as enterprises look to solve for security and governance controls. Any reports of security challenges tied to DIY or newer solutions would also illustrate the importance of enterprise grade controls.

-

Evidence of pricing power as the push for adoption starts converting to monetization, illustrating that the incremental cost of agents can be passed on to the customer. Consistent with Palantir's approach 18-24 months ago, companies are first focused on enabling enterprises and encouraging adoption to deliver value, and monetizing after this.

-

Clearer customer examples of why domain knowledge drives higher quality agentic outputs, and a better understanding of which use cases make sense for e.g. Claude Cowork vs. Microsoft Copilot or Salesforce's Agentforce. HubSpot published a detailed framework on business context and how it can improve the outputs in agentic CRM on 2/3.

-

An AI native company or an LLM platform potentially acquiring a SaaS business to accelerate domain experience and distribution, and address customer concerns on being “enterprise grade”. Please see our M&A report here.

-

Companies directly addressing stock based compensation dilution and the risk of employee churn, either by being more intentional with repurchases or being more aggressive in pivoting toward a new generation of AI-enabled product and sales talent (for example, Microsoft has commented that opex growth will be more tied to compute than headcount going forward).

-

Better visibility into the timing of new capacity coming online, for the IaaS companies (MSFT, ORCL, CRWV). For MSFT, more directional color on how mix will trend between internal and external use cases as capacity comes online; and for ORCL, more directional color on gross profit progression now that there is more visibility into their 2026 funding plans.

Their conclusion: We expect it will take 2-3 quarters of stable fundamentals for investor sentiment to improve – and even then, there is a scenario where the bear case simply gets pushed out to future years.

Professional subscribers can read much more from Goldman's Tech research team here at our new Marketdesk.ai portal