Alphabet Earnings Preview: "The Most Beloved Mag 7 Name"

With Mag 7 reporting so far this earnings season a mixed picture (TSLA and MSFT have sold off, AAPL has outperformed) we now brace for the next batch gigacap tech names to report, starting with GOOGL which reports Q4 earnings after the close, in what Goldman says is a "much anticipated print from one of the most loved names in the market."

Below we preview today's most anticipated earnings print.

We start with positioning which according to Goldman is full at 9.5 / 10, as this is one of the most owned names within the Megas + the broader market. The results typically hit in the 4-4:05pm range, with call at 4:30pm ET. No formal guidance given. Options implied move = 5.8%

According to GS, long-term bullish sentiment is still very much intact (multiple secular tailwinds: Cloud, TPUs, YouTube Growth, AVs, Ads etc), but some tactical concern around the difficult setup (stock +65% last year, and big outperformer again to start this year)

UBS agrees writing that sentiment is still long and strong across both Hedge Funds and Long Onlys as the bull thesis continues to anchor to the GCP backlog trajectory, TPU monetization, AIO, Gemini and Waymo valuation all paving the way for EPS upside in the years to come.

Expectations for clean beat are expected, with investors looking for:

- Accelerating Cloud growth (ie +38-40% y/y range)

- "Stable" growth from its core YouTube and Search platforms (~mid-high-teens growth y/y)

- Enough top line growth to continue to justify the large capital intensity (CY26 capex expects broadly in the $140-handle range)

Here UBS trader Christina Dwyer adds that with the nearer-term catalyst path somewhat lighter and positioning/2026 estimates already pretty stretched already, she always gets the question if the stock is due for a breather. However, in a tape riddled with uncertainty as such, it doesn’t feel like that time is now especially with bulls playing for over 50% GCP growth year-end, but it'a slo worth noting this has become somewhat of a popular funding short across the Hedge Funds.

Next, we give the mic to JPM's Doug Anmuth how is oositive into the print as his "GOOGL checks were positive around Search & Cloud; Expect acceleration in total revenue growth from +15% FXHN Y/Y in 3Q to +16% FXHN in 4Q"

- Expect strong acceleration in Cloud growth from +34% reported Y/Y in 3Q to +38% in 4Q, fastest quarterly growth since ‘22

- AI & Cloud investments ramp, esp. depreciation (JPMe +53% Y/Y to $6.4B in 4Q), but growth acceleration & cost discipline provide offset (JPMe GAAP OI excl. 1x items +70bps Y/Y to ~33.3% in 4Q)

Here are the key buyside bogeys to watch in today's earnings:

- Q4 Reported Search Growth: up 15-16%

- Q4 Reported YouTube: up 14%

- Q4 GCP Growth: up 37-38% y/y

- Q4 Total OI: $37-38 bn

- FY26 EPS: $12-12.5

- F26 Capex: around $130 bn

For JPM, these are the key focal points today:

- Gemini 3 #1 on LLM leaderboards with rapid deployment across Google products

- AI search expansionary, with AIO & AIM now combined…

- Strong Cloud momentum with backlog +82% Y/Y to $155B in 3Q; expect revenue growth acceleration through 40s% in ‘26 w/50%+ also possible

- Heavy depreciation, but also finding core offsets

- JPMorgan forecasts 54% growth in 2026 capex to $142B, street high

Recent JPM buyside survey takeaway: GOOGL: Biggest AI Beneficiary (63%), i.e., perfection is priced in.

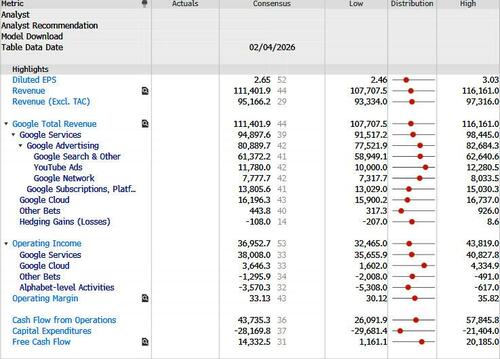

Finally, here is the sellside consensus: