"Cleanest Hedge On The Board": The Best Defense Against Continued Volatility

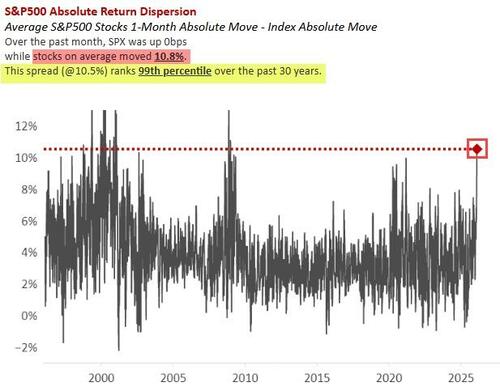

As we detailed yesterday, the amplifier of stock market dispersion has gone to '11'...

What is the above showing you?

That over the past ~1 month (Jan 15th through yday), the SPX is “unch” at 0.0%…but get this….the average S&P 500 stock saw an ABSOLUTE MOVE of 10.8% over the same window.

That level of dispersion is extreme to say the least but, as we note, is generally well hidden by the index moves.

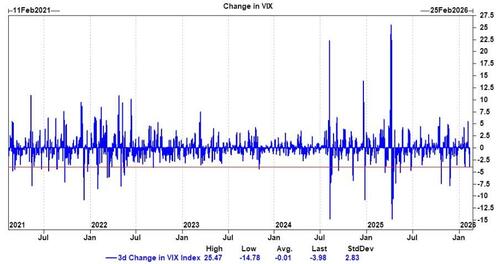

Meanwhile, top Goldman Sachs trader Cullen Morgan notes that VIX has reset quickly as we’ve rallied from the local lows, but fear is still high.

-

SPX dealer gamma is near peak length, keeping spot pinned.

-

Realized factor vol has exploded higher creating an uneasy overhang in the market.

Over the last few sessions, we have seen implied volatility in equities come in meaningfully.

When looking at VIX, we have seen the index reset nearly 4 vols from the highs just a few sessions ago.

The market has by no means ‘relaxed’.

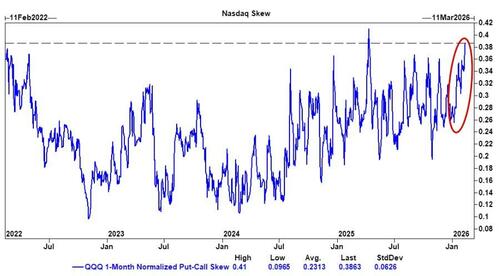

Other pockets continue to show signs of fear and stress – take Nasdaq put-call skew for example…

Even with the rally from the recent lows, put-call skew is still near levels not seen since the liberation day drawdown last year.

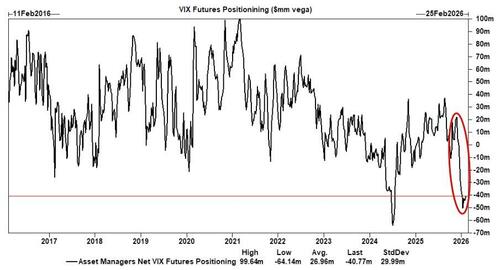

Despite the fear, we still see a rather large short base in VIX futures.

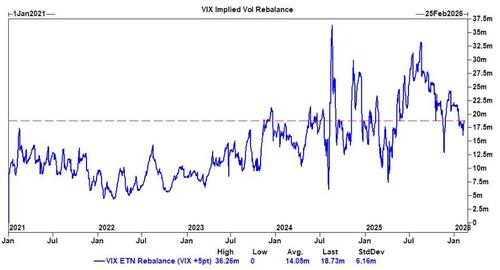

We see the VIX ETP complex long ~$105m of vega. These products act as short gamma and have to buy on up days / sell on down days.

In a scenario where VIX is up 5pts, we see these funds will have to buy nearly $19m of vega -- combined with the above, a spike in VIX can be dramatically exacerbated.

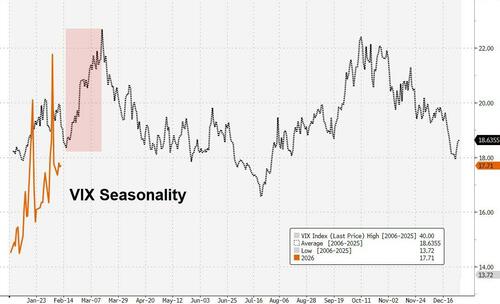

Lastly, to make the set up even more compelling, we are entering a period that has historically seen VIX spike.

Going back 20 years, on average from mid February to mid March, VIX rose over 4pts.

And so with all that in mind, Morgan suggests that for those nervous of another pull back over the next month, VIX call spreads are one of the cleanest hedges on the board.

They take a lot of the timing aspect out of the market, are independent of SPX spot (i.e. don’t have to restrike on rallies), and have a more convex profile in any risk-off scenarios.

The structure Goldman prefers to implement this view is simple: VIX 18March’26 20 / 40 call spread costs $1.45 (ref 19.32f, 13.7x max payout)

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal