And We're Off: Fed Monetizes $8.2BN In T-Bills In First Of Many Open Market Operations

And we're off.

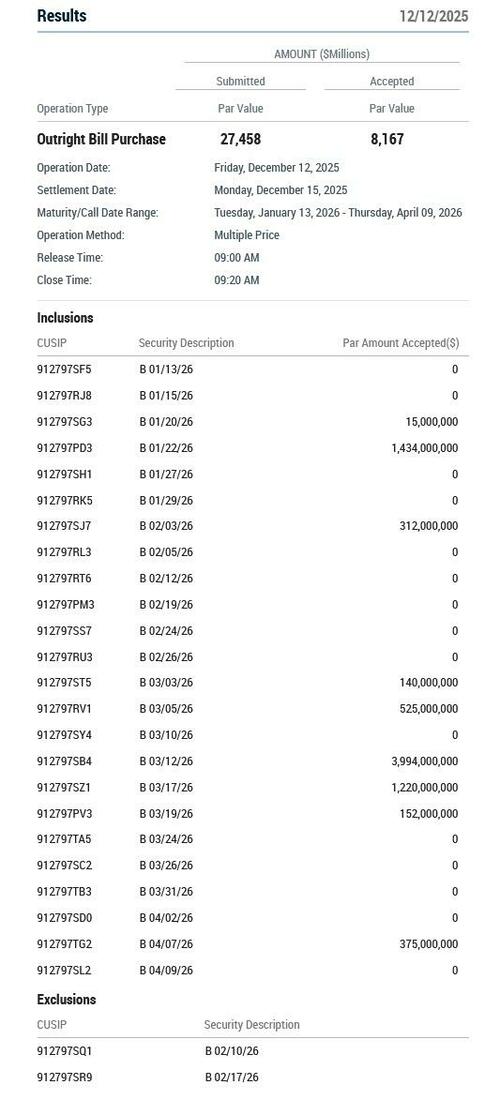

As we previewed yesterday, the Fed's open market asset purchases - also known as QE-Lite, NOT QE, or more technically, Reserve Management Purchases - have restarted (as we first said he would a month ago, when this idea was once again highly contrarian), and this morning at 9:20am the Fed concluded its first T-Bill monetization procedure, purchasing $8.167 billion from Primary Dealers and other authorized open market participants.

As shown in the breakdown below, the bulk of purchases was in the 1-3 Month bill space, with the largest purchases targeting the bucket maturing in mid-March. However, what is very notable, is that the purchases can (and will) go well beyond the Bill sector and could include UST coupons with maturities out to 3Y.

While regular readers are well aware of our view on the Fed's "NOT QE", aka RMP, overnight Bloomberg's chief rates strategist Ira Jersey wrote that "Reserve Support More Aggressive Than Anticipated" (well, virtually nobody except ZH "anticipated" RMPs to come as soon as Wednesday so that statement is rather wrong but anyway), adding that the Fed's reserve-management purchases (RMPs) "appear to be structured to prevent the need for repo operations from the Fed. The Fed will purchase $40 billion of Treasury bills (or short coupons) over the next 30-days for RMPs alone, well above estimates of steady-state reserve growth. This is to permanently boost bank reserves back above "ample," which we see at about $2.9 trillion, to satiate reserve demand. Purchase amounts will stay elevated through April's tax season, which temporarily drains reserves as the Treasury General Account (TGA) climbs. The pace of purchases will taper off toward steady-state growth, which the Fed sees at about $20-$25 billion per month."

Of course, after April, Powell is out at which point Trump will appoint his dovish puppet and all bets are off.

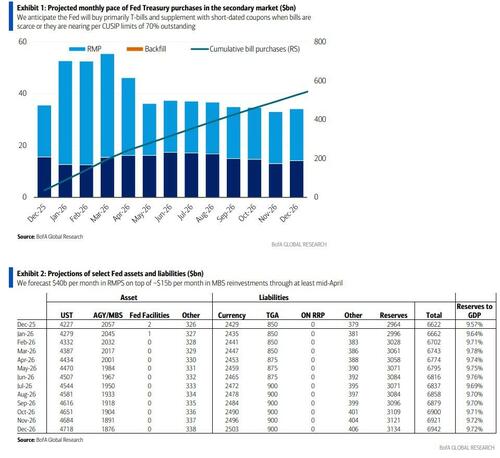

In a note from BofA's Mark Cabana, the strategist writes that the Fed RMP pace is expected to continue at $40b/m until the mid April tax date He notes that "after April the Fed likely expects slowing the pace of RMPs to $20b/m; we use this as our base case for now (Exhibit 1, Exhibit 2)." That said, Cabana disagrees that the Fed will sunset RMP and sees "RMP risks as skewed to a higher pace of purchases for longer."

That's because, the current pace of RMPs will only see the Fed add back $80b of cash above natural liability growth by mid-April; as such Cabana continues to believe the Fed will need to add back $150b to achieve their ideal money market rate outcome.

One final point: the inclusion of Treasury coupons out to 3Y is likely to limit the displacement bill investors out of their preferred habitat, according to BofA which notes that "the Fed will likely shift purchases out of bills & into coupons if they perceive that bill investors are being adversely impacted."

Translation: this is just another warm up for full blown QE and, subsequently, Yield Curve Control as Michael Hartnett has been warning for so long.

Oh, and last but not least, on the semantics of what to call it, here is Michael Hartnett from his latest Flow Show:

"Fed QE (buying $40bn short-dated USTs per month) nixes “peak liquidity” concerns."

So there you have it.

More in the full Mark Cabana note available to pro subs.