NS

NSAsia-Pac stocks began the new month mixed; Crude surges post-OPEC - Newsquawk Europe Market Open

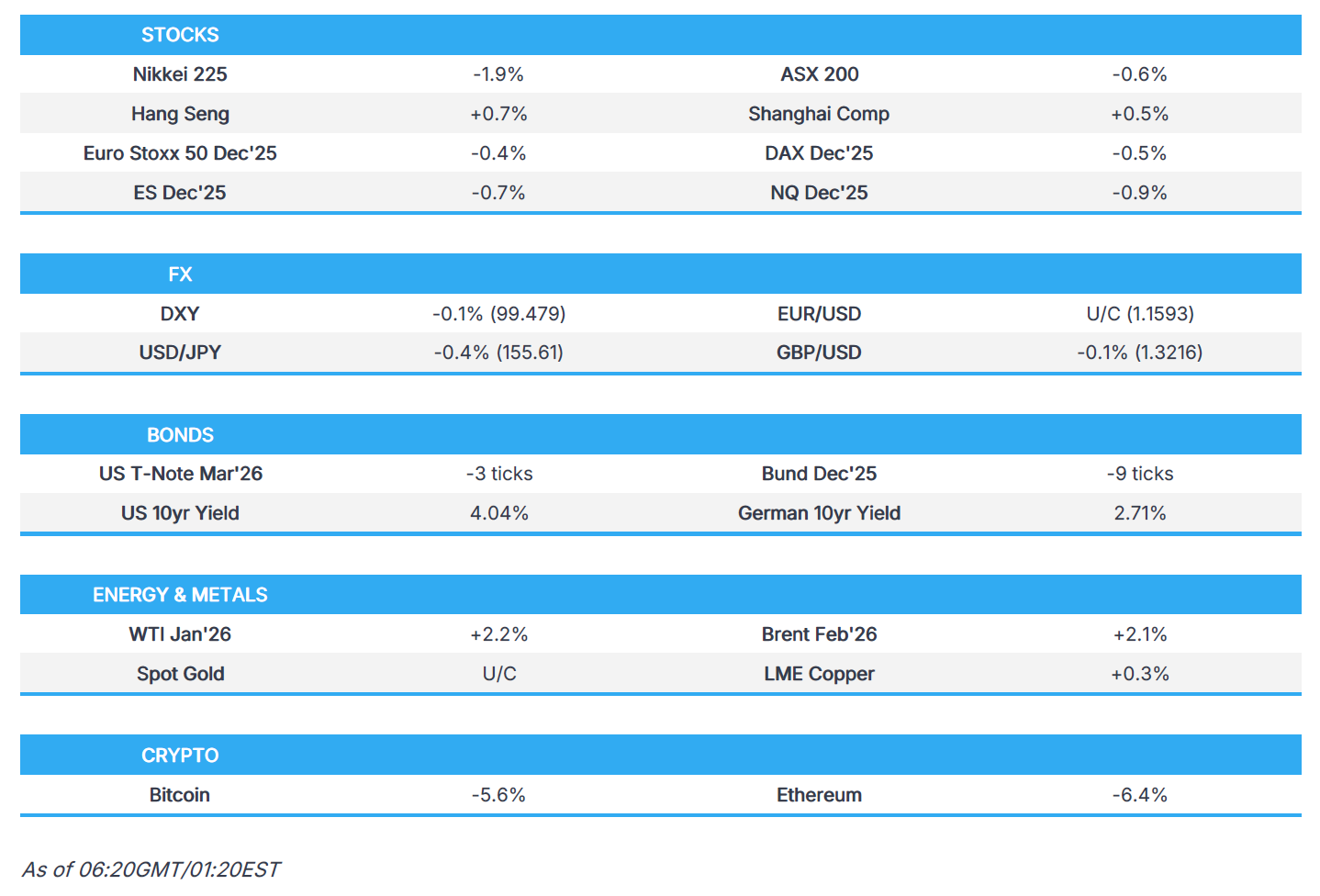

- APAC stocks began the new month mixed, with participants cautious as they digested the weak Chinese PMI data.

- GBP/USD remained choppy ahead of UK PM Starmer's speech on Monday, where he will reportedly outline the growth mission and will defend the Budget after Chancellor Reeves was forced to deny lying to the public about UK finances.

- Crude futures were underpinned from the open following the OPEC+ decision to maintain output plans throughout Q1 2026.

- US and Ukraine negotiations on Sunday focused on where the de facto border with Russia would be drawn under a peace deal, while the five-hour meeting was said to be difficult and intense, but productive, according to two Ukrainian officials cited by Axios.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 0.3% on Friday.

- Looking ahead, highlights include EZ/UK/US Manufacturing PMI Final (Nov), US ISM Manufacturing PMI (Nov), Saudi-Russia Business Forum, EU Supply.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid on Friday during the shortened day of trade, with equity futures modestly higher from levels seen before the CME outage in the morning, while gains were broad-based, with the vast majority of sectors closing green, although healthcare bucked the trend and was pressured by Eli Lilly's (LLY) weakness following the November rally.

- Furthermore, T-notes were lower across the curve as stocks moved higher, with little macro information to digest on account of Thanksgiving on Thursday.

- SPX +0.54% at 6,849, NDX +0.78% at 25,435, DJI +0.61% at 47,716, RUT +0.58% at 2,500.

- Click here for a detailed summary.

TARIFFS/TRADE

- China was reported on Friday to have banned imports of pigs, wild boars and related products from Spain's Barcelona province, according to a China Customs document. In relevant news, Mexico’s Agriculture Ministry also suspended pork product imports from Spain due to a swine fever outbreak.

NOTABLE HEADLINES

- US President Trump said on Friday he is cancelling all executive orders signed by former President Biden using autopen and stated that any document signed by Biden with autopen, which was approximately 92% of them, is hereby terminated and of no further force or effect. Furthermore, Trump stated that Biden was not involved in the autopen process and that if he says he was, he will be brought up on charges of perjury.

- US President Trump said he knows who he will pick as the next Fed chair.

- White House Economic Adviser Hassett said he will be happy to serve if US President Trump picks him as Fed chair.

- US State Department announced a pause on visa issuances for Afghan passport holders, and the US immigration service said it will halt all asylum decisions, while the US Citizenship and Immigration Services Director said USCIS halted all asylum decisions until they can ensure that every migrant is vetted and screened to the maximum degree.

- US Transportation Secretary Duffy said they have been in close contact with Airbus (AIR FP) about the software update recall for the A320 and the airlines that use them, as well as noted that travellers should not expect any major disruptions. It was also reported that Airbus was revising down the number of jets affected by the most time-consuming A320 repairs, while American Airlines said planes impacted by the Airbus glitch have been fixed.

- Mastercard SpendingPulse noted that US retail spending on Black Friday rose 4.1% Y/Y and ecommerce spending rose 10.4% Y/Y, while Adobe Analytics noted that consumer spending rose 9.1% Y/Y to a record USD 11.7bln on Black Friday.

- CyrusOne said it restored stable and secure operations at its Chicago 1 data centre in Aurora, Illinois.

APAC TRADE

EQUITIES

- APAC stocks began the new month mixed, with participants cautious as they digested the weak Chinese PMI data.

- ASX 200 was dragged lower by weakness in healthcare, telecoms, financials and tech, while sentiment was also not helped by disappointing Chinese PMI data and weaker-than-expected Australian Gross Company Profits and Business Inventories.

- Nikkei 225 slipped beneath the 50k level amid a firmer currency and risks of a BoJ rate hike in December, while there were hawkish-leaning comments from BoJ Governor Ueda, who said that they will consider the pros and cons of raising rates at the December meeting.

- Hang Seng and Shanghai Comp were kept afloat despite the discouraging Chinese PMI data, in which the headline official Manufacturing PMI continued to show a decline in factory activity at 49.2 (exp. 49.2) and Non-Manufacturing disappointed with a surprise contraction at 49.5 (exp. 50.0), while RatingDog Manufacturing PMI missed estimates at 49.9 (Exp. 50.5).

- US equity futures retreated alongside the selling pressure in Asia-Pac bourses and gave back the Black Friday spoils.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 0.3% on Friday.

FX

- DXY traded little changed in the absence of any pertinent catalysts and with the Fed in a blackout period, while US President Trump said he knows who he will pick for the Fed chair role, but didn't give any further details.

- EUR/USD was indecisive with the single currency returning to flat territory after failing to sustain an early foray above the 1.1600 level, and with comments last Friday from ECB President Lagarde, who reiterated that interest rates are at the right level and the situation is good.

- GBP/USD remained choppy ahead of UK PM Starmer's speech on Monday, where he will reportedly outline the growth mission and will defend the Budget after Chancellor Reeves was forced to deny lying to the public about UK finances.

- USD/JPY retreated as risk sentiment in Japan deteriorated and with downside also facilitated by recent comments from officials including Japanese Finance Minister Katayama who said it is “clear” that volatile swings in the FX market and the rapid weakening of the yen aren’t based on fundamentals, while BoJ Governor Ueda reiterated the BoJ will continue to raise the policy interest rate in accordance with improvements in economy and prices if their projections of economic activity and prices materialise. Furthermore, Ueda stated that the likelihood of their baseline scenario for economic activity and prices being realised is gradually increasing, as well as noted that the BoJ will examine and discuss economic activity and prices at home and abroad, as well as market developments, based on various data, and consider the pros and cons of raising rates at the December meeting.

- Antipodeans lacked conviction alongside the mixed risk appetite and disappointing Chinese PMI data.

- PBoC set USD/CNY mid-point at 7.0759 vs exp. 7.0709 (Prev. 7.0789).

FIXED INCOME

- 10yr UST futures remained subdued following last week's holiday-thinned conditions and with little fresh pertinent catalysts.

- Bund futures lacked demand following light weekend newsflow, while participants await EU supply and November final PMIs.

- 10yr JGB futures retreated from the open with further downside exacerbated amid several hawkish-leaning comments from BoJ Governor Ueda.

COMMODITIES

- Crude futures were underpinned from the open following the OPEC+ decision to maintain output plans throughout Q1 2026.

- OPEC+ agreed to keep group-wide oil output unchanged for Q1 2026, while it stated that participating countries approved the mechanism developed by the secretariat to assess participating countries’ maximum sustainable production capacity. Furthermore, it announced that the 41st OPEC and Non-OPEC ministerial meeting will be held on 7th June 2026.

- Gas exports from Iraq's Khor Mor gas field resumed just days after a drone attack.

- Spot gold initially climbed in tandem with the upside seen in other precious metals, including silver which rallied to a record high, before fading most of their earlier gains.

- Copper futures extended on gains which saw LME prices hit fresh all-time-highs above the USD 11,200/ton level, but then pulled back from their best levels amid the mixed risk appetite and disappointing Chinese PMI data.

CRYPTO

- Bitcoin slumped overnight from north of the USD 90,000 level to beneath the USD 86,000.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said if their projection of economic activity and prices materialise, the BoJ will continue to raise the policy interest rate in accordance with improvements in economy and prices, while he added that even if the policy interest rate is raised, accommodative financial conditions will be maintained and the likelihood of their baseline scenario for economic activity and prices being realised is gradually increasing. Ueda also commented that at the December meeting, the BoJ will examine and discuss economic activity and prices at home and abroad, as well as market developments, based on various data, and consider the pros and cons of raising rates. Furthermore, he said it is important for FX to move stably reflecting fundamentals and that a weak yen works to push up consumer inflation, while they must be mindful that FX moves affect inflation expectations and underlying inflation in guiding policy.

- Japanese Finance Minister Katayama said it is “clear” that volatile swings in the FX market and the rapid weakening of the yen aren’t based on fundamentals.

- China’s financial regulator guides banks and insurers to fully provide financial support services related to the Hong Kong fire and said insurance institutions should promptly handle claims and other procedures for disaster-affected customers, while it added that banks should strengthen financial credit support and actively assist in disaster reconstruction.

- Indonesia said at least 303 people died in three provinces after severe rains caused floods and landslides.

DATA RECAP

- Chinese NBS Manufacturing PMI (Nov) 49.2 vs. Exp. 49.2 (Prev. 49.0)

- Chinese NBS Non-Manufacturing PMI (Nov) 49.5 vs Exp. 50.0 (Prev. 50.1)

- Chinese NBS Composite PMI 49.7 (Prev. 50.0)

- Chinese RatingDog Manufacturing PMI Final (Nov) 49.9 vs. Exp. 50.5 (Prev. 50.6)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu submitted a letter to President Herzog, while Netanyahu said in a video statement addressing the pardon request that his personal interest was to complete the legal process until the end, while he added that the military and national reality, and national interest, demand otherwise, and that ending the trial immediately would advance much-needed national reconciliation.

- Israeli helicopters fired in the eastern areas of Khan Yunis inside the Yellow Line, according to Al Jazeera.

- Israeli security estimates that Iran may take the initiative and carry out retaliatory operations instead of Hezbollah and estimates preparations for a Houthi response in retaliation for the killing of Hezbollah Top Commander Al-Tabatabai, according to Al Arabiya.

- Hezbollah’s leader said on Friday in response to Israel's killing of its military chief that the group has a right to respond and will set a time for it, while he added that Lebanon's government should prepare a plan to confront Israel.

- Iran’s Foreign Minister Araghchi held talks with Turkey regarding the nuclear issue and Israel, while he also held a meeting with the Saudi Deputy Foreign Minister for Political Affairs in Tehran.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said a delegation headed by the security council chief travelled to the US for talks, while it was also reported that Zelensky is to visit French President Macron in Paris on Monday.

- US and Ukraine negotiations on Sunday focused on where the de facto border with Russia would be drawn under a peace deal, while the five-hour meeting was said to be difficult and intense, but productive, according to two Ukrainian officials cited by Axios.

- US Secretary of State Rubio said the meeting with Ukrainians was very productive but noted there is more work to be done, while he added that they have been in touch to varying degrees with the Russian side.

- Ukraine’s First Deputy Foreign Minister said there was a good start to US peace talks with a warm atmosphere conducive to a potential progressive outcome.

- Ukraine’s military hit Russia’s Afipsky oil refinery, while it was also reported that Ukrainian sea drones struck two Gambia-flagged tankers off the Turkish coast on Friday, which were said to be part of a Russian shadow fleet used to bypass Western sanctions.

- Russian forces carried out a massive strike on Ukrainian military-industrial and energy facilities.

- Russia’s Foreign Minister said following a Ukrainian drone attack on the CPC Black Sea terminal, that the civilian energy infrastructure that was attacked plays an important role in ensuring global energy security and has never been subject to any restrictions or limitations, while they strongly condemned the ‘terrorist attacks’ on CPC and oil tankers.

- NATO is considering being “more aggressive” in responding to Russia’s cyber attacks, sabotage and airspace violations, according to its most senior military officer, Admiral Giuseppe Cavo Dragone, cited by FT.

- NATO is reportedly preparing for the scenario of confronting Russia with limited US support, according to a report by Bloomberg citing a wargame in Transylvania that showed European soldiers defending the continent largely without US support as President Trump reduces US deployments in Europe.

OTHER

- US President Trump declared on Truth Social that the airspace above Venezuela is closed. It was separately reported that President Trump held a call with Venezuelan President Maduro, while Trump also commented that Defence Secretary Hegseth told him that he did not order a second boat strike.

- US bipartisan lawmakers raised alarms on Sunday that Defence Secretary Hegseth may have committed a war crime following a report that he ordered a follow-on attack to kill survivors of a boat strike in September, according to POLITICO.

- Venezuela said it rejects US President Trump’s “hostile, unilateral and arbitrary” post about Venezuela’s airspace and noted that the statement shows “colonial pretentions” towards Latin America, while it added that Venezuela demands respect for airspace and will not accept foreign orders or threats.

- China’s Coast Guard carried out law enforcement inspections around the Scarborough Shoal, while the report noted that the Chinese military’s Southern Theatre Command organised combat readiness patrols in the ‘territorial’ waters and airspace of the Scarborough Shoal and surrounding areas on November 29th, according to Xinhua.

GLOBAL NEWS

- Swiss voters overwhelmingly rejected the proposal for a 50% inheritance tax for the super-rich, according to FT.

- South African President Ramaphosa dismissed US President Trump's threat to exclude the country from next year's G20 summit and reaffirmed South Africa's status as a founding member of the group, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer and Chancellor Reeves have been accused of misleading the Cabinet by using claims that there was a black hole in the public finances to justify tax rises during the run-up to the Budget, according to The Times’s Swinford, while it was separately reported by Bloomberg that Reeves denied lying about UK finances pre-Budget.

- UK PM Starmer is to defend the Budget after Reeves was accused of misleading the public, and will outline the growth mission after the Budget tax rises during a speech on Monday.

- ECB President Lagarde said on Friday that interest rates are at the right level and the situation is good, while she is optimistic about the situation in France.

- S&P affirmed Latvia at A; Outlook Stable and affirmed Lithuania at A; Outlook Stable.