Bank Lending Gives Little Hint Of Credit Market Issues... For Now

Authored by Simon White, Bloomberg macro strategist,

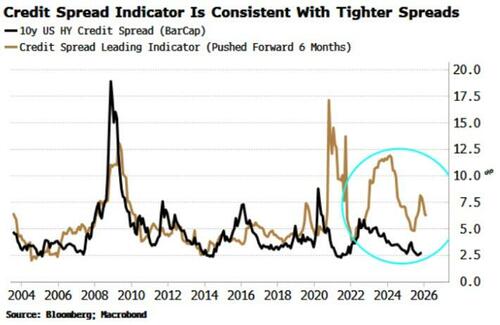

US banks are not significantly tightening loan standards, which is a factor suggesting credit spreads can continue to grind lower.

The Federal Reserve’s Loan Officer Survey for the third quarter was released Monday and gave little sign of a tightening in credit conditions.

The most leading part of the survey is loan standards.

The net percent of banks tightening standards for commercial and industrial loans fell slightly, which typically leads supply of such loans by about a year.

These tend to have the strictest underwriting standards, so they are a good proxy for lending overall.

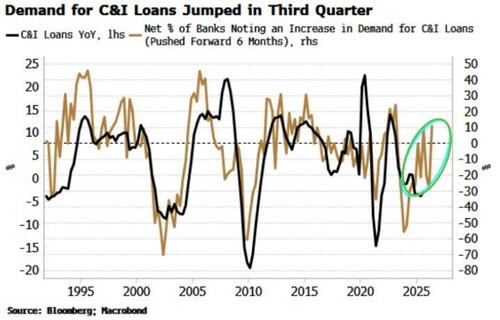

Lending standards also often lead demand for loans by about six months. There was a surge in demand for C&I loans in the third quarter (or “generally” in the third quarter, as the survey caveats).

Where this demand is coming from is not clear, but one strong candidate is from business development companies such as Apollo or Blackstone, who engage in direct lending, aka private credit. Bank loans to non-bank financial institutions have risen markedly over the last year or two.

This is of course not necessarily a “good thing,” as it deepens the channels between the off-market and opaque private credit sector and the banking system. Tech companies borrowing to fund capex are another candidate for the surge in loan demand.

Either way, for now, loan officer data suggests there is no reason for imminent concern in credit markets. Bank lending standards are one of the inputs to my model for credit spreads, which suggests they should continue to marginally tighten.

Elevated global money growth, mainly from China, is likely why the torchlight is being diverted away from more credit cockroaches.

But under the surface, whether it be fraud, poor lending practices in private credit, or tech companies over-investing, there are likely to be many problems coming to light once the liquidity taps turn off.