Banks & Big-Tech Lift Stocks As 'De-Escalation' Sends Oil, Gold, & Crypto Lower

Despite some easing of tensions today, global geopolitical uncertainty remains extremely elevated... but stocks and bonds just don't care (as fiscal fuckery is dominating every risk-averse narrative)...

Source: Bloomberg

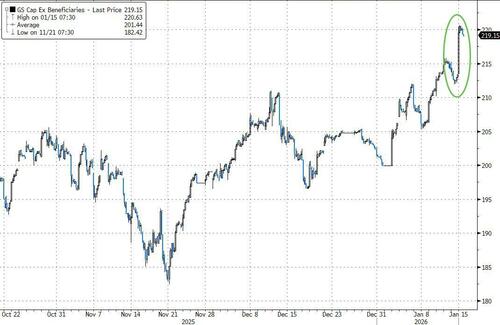

Stocks rallied today with Tech leading gains post TSMC's very strong results (and upbeat outlook) overnight, lifting the broader AI/Semi trade as evidenced by Goldman's CapEx Beneficiaries basket surging to its best day since May...

Source: Bloomberg

Mag7 stocks massively outperformed today but remain laggards relative to the S&P 493 on the week (and are still down on the week)...

Source: Bloomberg

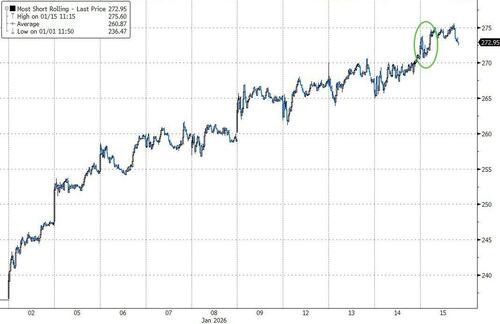

Small Caps outperformed on the back of yet another big short squeeze (biggest surge in most shorted stocks to start the year since 2021)...

Source: Bloomberg

Elements of the broadening out trade are still prevalent with RTY>NDX>SPX which follows the widest spread btw RSP and SPX yesterday since late Nov. All the majors ended well off their highs of the day...

Note that NDX was leading into the US open and then dramatically reversed relative to RTY

Source: Bloomberg

We do note that the announcement of the US-Taiwan deal prompted selling in tech stocks and crypto as TSMC reversed some of its earlier gains (sell the tariff deal news?)...

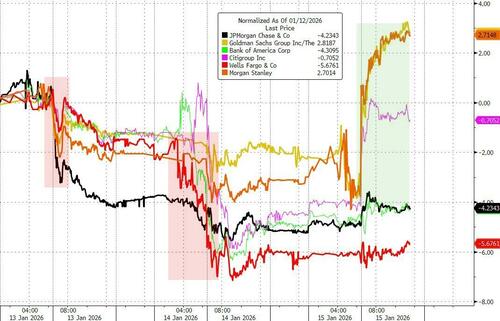

Banks rebounded on the back of Goldman and Morgan Stanley's results but Wells Fargo and JPMorgan remain laggards on the week...

Source: Bloomberg

However, despite today's gains, Goldman's Delta-One desk head, Lee Coppersmith points out that the broader theme still looks like capital rotating away from the U.S. toward ROW.

Speculative positioning globally appears elevated, with length built across several markets.

AAII Bull–Bear just made new one-year highs, a sentiment data point worth respecting.

The tape likely stays supported into expiry, but flow dynamics could shift next week as supply increases.

Talking of OpEx, SpotGamma notes that if you look at the SPX GEX positions, you see positive, supporting gamma (blue) across nearly all strikes, suggesting there is no negative gamma in the 6,900's to help drive trending price action. Given this we must continue with the monotonous view of remaining long of equities while SPX is >6,900, and leaning short if SPX <6,890. Said another way: >6,900 = Buy the dip, sell the rip.

Once again, S&P futs were unable to hold 7,000...

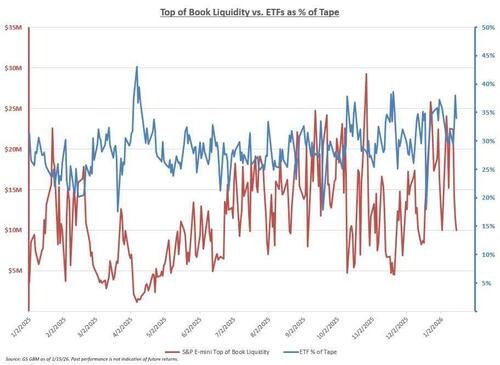

Before we leave equity-land, Goldman's trading desk noted that the ETF % of tape average to start the year is ~32%, nearly 4pp higher than the avg run rate for the last 8yrs. Yday we saw the spread btw ETFs and Top of Book liquidity at lunch-time really widen out and that theme continues today, despite a broadly better tape...

The wider the spread between these two data points, the more difficult the trading environment.

A big bond issuance from Goldman (and strong jobless claims data along with big bounces in regional Fed surveys) helped push yields higher on the day, led by the short-end (2Y +5bps, 30Y unch). The 2Y yield is now higher on the week...

Source: Bloomberg

...flattening the yield curve further...

Source: Bloomberg

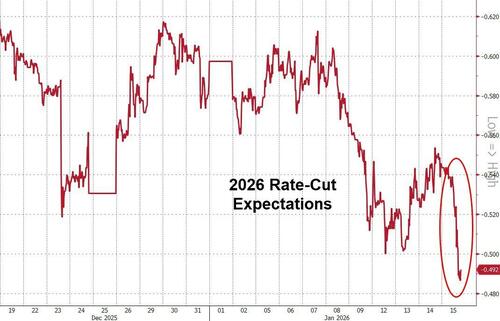

...and reducing rate-cut expectations

Source: Bloomberg

The dollar was wild today, spiking early during the European session and reversing to unchanged as US equities opened...

Source: Bloomberg

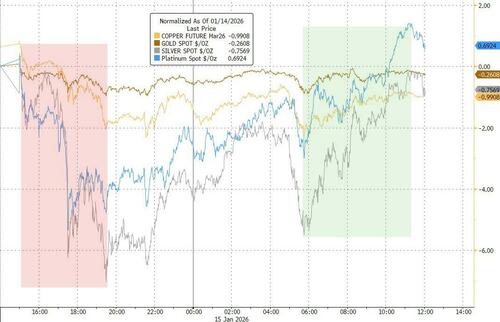

Metals look a bit heavy after the administration signaled it may not implement a new set of tariffs on critical minerals. There appears to be a fair amount of speculative length in the space, making a pullback plausible (though the afternoon saw buyers return)...

Source: Bloomberg

Silver hit a new record intraday high early on today ($93.75), before dipping... then ripping back to the highs to close unch...

Source: Bloomberg

The Gold/Silver ratio continued to plummet, breaking below 50x (14 year lows) today...

Source: Bloomberg

Bitcoin tested up to $98,000 overnight, only to fade back below $96k this afternoon as tech stocks declined...

Source: Bloomberg

Oil is also lower (after yesterday's chaos), with geopolitical risk premia easing modestly today as Trump flip-flop eased concerns around Iran.

Source: Bloomberg

However, as Lee Coppersmith notes, even if near-term escalation risk has eased, a lot of military hardware remains in the region...and some residual premium is likely to linger.

That said, being structurally bearish on geopolitics has rarely paid over the past decade...if ever.

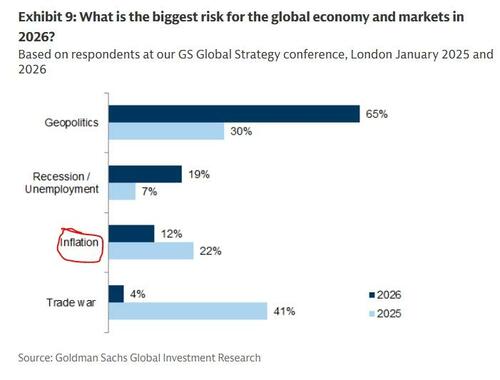

Finally, returning to where we started, as Goldman Sachs Delta-One head, Rich Privorotsky, warns, it's probably not geopolitics that we should worry about...because everyone else is...

It's not global chaos, it's inflation that nobody expects, stupid!