Barbarous Relic Trumps Digital Gold In 2025, AI Leads Stocks To Record Highs After Tariff Tantrum

Investors have digested a lot this year, from tariffs to AI, and from geopolitical risks to stimulus, in a stock market that has acted pretty much the same as it has every year since the 2021 Tech bubble burst... up and to the right.

AI remains the dominant theme in markets and Goldman's analysts worked hard throughout the year to provide context around what we are seeing today both in the economy and in markets.

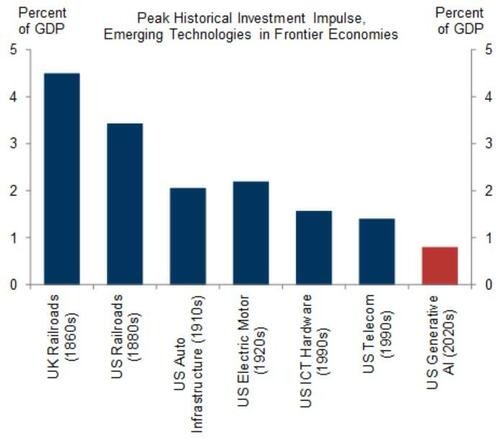

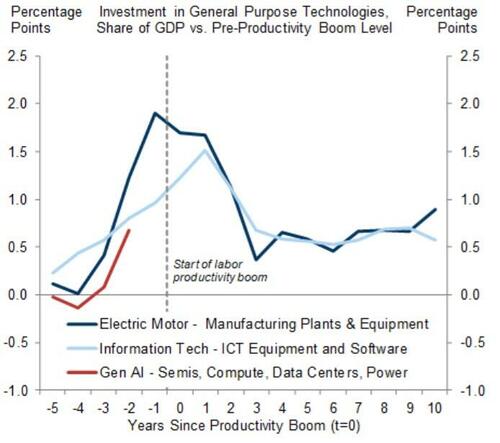

Joseph Briggs highlighted how the capital investment that has gone into the AI revolution so far pales in comparison to the investment (as a % of GDP) that we saw in prior productivity transformational investment cycles like the electric motor of the 1920s and the Technology boom of the 1990s.

Dominic Wilson, however, points out that investors are prepaying for the productivity transformation 'promise' that comes with the AI investment cycle. Stock valuations by one measure are already above those of the 1920s and nearly at the peak we saw in the late-1990s (see final chart below).

A key question still to be answered: Will AI deliver the profit boost that the electric motor and the rise of hardware and software did?

And of course, NVDA managed to top $5 trillion in market cap at its peak this year...

Source: Bloomberg

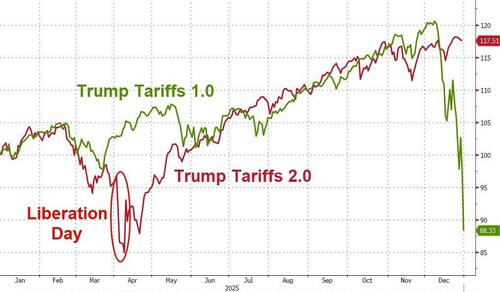

But, away from AI, in April, we were told the world would end - dogs and cats living with each other, and all the worst parts of the bible - when Trump unleashed his Liberation Day tariffs... but by the end of the year, initial jobless claims are near record lows, the economy is growing solidly, and the S&P 500 is up around 18%, massively outperforming Trump's first tariff term (which was admittedly hit at the end by the repo crisis collapse)...

Source: Bloomberg

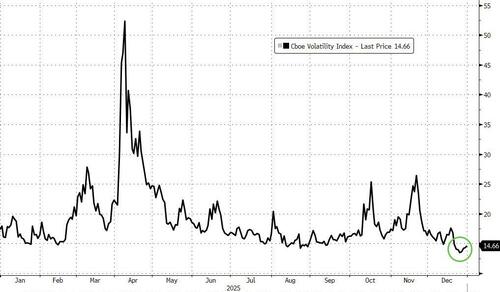

Everything from stocks to crypto to commodities experienced a rollercoaster ride that amounted to what felt like an especially volatile year... but by the end of the year, expectations for volatility had collapsed to calmness as DeepSeek, Liberation Day, trade tantrums, and various geopolitical crisis moments all faded into the background...

Source: Bloomberg

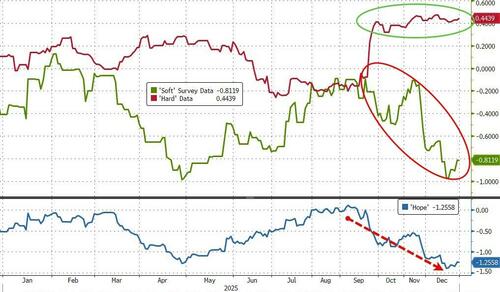

US macro data ended the year on a stronger note than it started (despite the government shutdown haitus)...

Source: Bloomberg

The 'macro' gains were dominated by 'hard' data improvements while 'soft' survey data plummeted, dragging down 'hope' to the lows of the year...

Source: Bloomberg

All the major US equity markets were solidly green on the year led by Nasdaq and its tech-heavy components...

Source: Bloomberg

As Bloomberg's Breandan Fagan notes, at first glance, 2025 looked like another equity-led cycle.

Risk assets rebounded forcefully after April’s tariff-induced selloff, with US stocks ultimately clawing back losses and finishing the year firmly higher. Volatility around trade, fiscal and political flashpoints proved episodic rather than systemic, and dip-buying remained the dominant reflex. By midyear, equities had clearly reasserted themselves as the market’s shock absorbers, delivering steady gains even as uncertainty lingered.

The more durable story emerged outside traditional risk.

Precious metals, led by gold and silver, steadily outperformed as the year progressed and sharply overtook equities into year-end.

What began as a hedge against policy noise evolved into a runaway freight train: looser fiscal trajectories and persistent deficits globally pushed investors to diversify. That same impulse supported stocks in the rest of the world, which outpaced US assets as capital rotated toward jurisdictions perceived as insulated from American policy shocks. The dollar’s relative softness reinforced the shift, amplifying returns outside the US.

2025 was the year when diversification finally paid off. Equities delivered, but metals took the crown on erosion of confidence and a repricing of policy risk.

Tech & Materials outperformed in 2025 while Staples and real Estate ended the year in the red...

Source: Bloomberg

On a local currency basis, Japanese stocks outperformed the other global majors...

Source: Bloomberg

But, on a dollar basis, European stocks were the best while the US was the biggest loser (although all were positive)...

Source: Bloomberg

Of course, one cannot discuss 2025 without mentioning AI front-and-center as it massively outperformed on the year (despite treading water for the last two months)...

Source: Bloomberg

The stalling of the AI trade appears to represent a split in the AI ecosystem between the Google (TPU) ecosystem and OpenAI (GPU) ecosystem...

Source: Bloomberg

But beneath the surface, it was credit stress that prompted the biggest drag on the AI narrative as CapEx expectations were questioned amid negative FCF...

Source: Bloomberg

Momentum stocks ruled the waves for much of the year - but did suffered some sizable drawdowns too (as the short leg outperformed the long leg)...

Source: Bloomberg

One of 2024's big winners - Anti-Obesity drugs - had a much more volatile year in 2025

Source: Bloomberg

But, despite the big gains for NVDA and so on, precious metals were the year's biggest winner as crude lagged badly along with the dollar...

Source: Bloomberg

Silver and Platinum were best precious metals plays and copper also outperformed bigly on the year (nth derivative AI play) hitting record highs...

Source: Bloomberg

It wouldn't be fair to move on from PMs without noting the last few days tempest as exchanges hike margins and China export restrictions loom...

Source: Bloomberg

2025 was gold's (and silver's) best year since 1979...

Source: Bloomberg

But while the barbarous relic was roaring, crypto was snoring. After hitting record highs intra, Bitcoin ended the year down around 6% (its worst annual loss since 2022)...

Source: Bloomberg

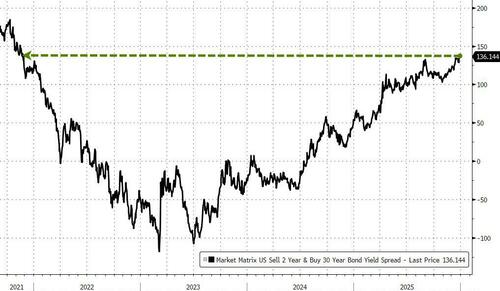

Bonds were mixed on the year with the long-end underperforming (+4bps on the year), while the short-end was aggressively bid (down almost 80bps)...

Source: Bloomberg

...dramatically steepening the (2s30s) yield curve ( to its steepest since Nov 2021)...

Source: Bloomberg

While foreign equity markets outperformed the US markets, USTreasuries dramatically outperformed Bunds and JGBs on the year...

Source: Bloomberg

While equity risk expectations have fallen back to multi-year lows, US credit risk expectations remain elevated (thanks to AI supply), but off the recent wides...

Source: Bloomberg

This chart remains one of our faves... as Tech credit now trades wider than the broad credit market for the first time ever...

Source: Bloomberg

HY Tech spreads are notably wider on the year (despite the surge in tech stocks)...

Source: Bloomberg

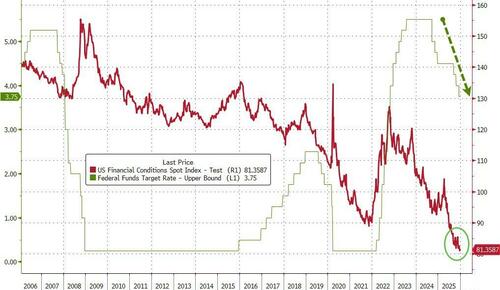

Financial conditions ended the year at their 'easiest' on record...

Source: Bloomberg

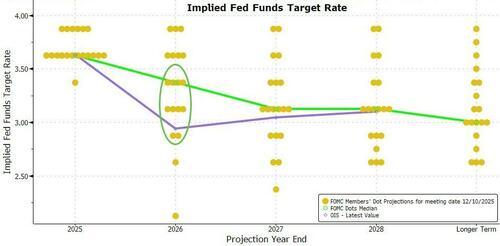

...with markets pricing in a more dovish Fed for next year that the dots expect...

Source: Bloomberg

The dollar suffered its worst year since 2017, tumbling over 8% against its fiat peers...

Source: Bloomberg

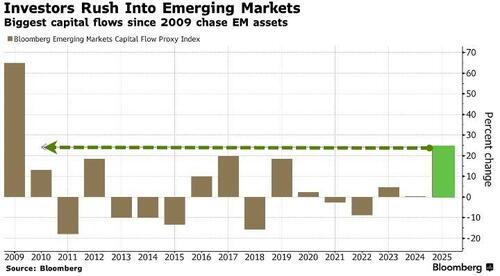

Emerging-market assets posted an across-the-board rally this year that few anticipated in the wake of US tariff shocks and a slowing Chinese economy with the biggest capital inflows since 2009...

Source: Bloomberg

Oil headed for its steepest annual loss since the start of the pandemic in 2020, in a year that has been dominated by geopolitical risks and steadily rising supplies across the globe.

Source: Bloomberg

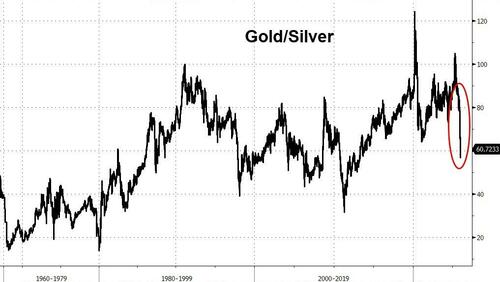

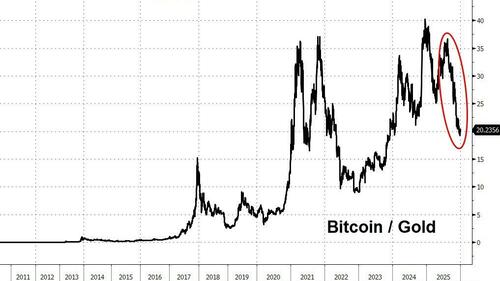

Here's a few 'ratio' charts that we found interesting to sum up the year...

Gold has plunged relative to Silver (in March 2020, an ounce of gold bought 124 ounces of Silver; today it only buys 60 ounces)...

Source: Bloomberg

Bitcoin has plunged relative to gold (a year ago, one bitcoin bought 40 ounces of gold; today it only buys 20 ounces)...

Source: Bloomberg

Gold has soared relative to the stock market (a year ago, it took 17 ounces of Gold to 'buy' The Dow; today it only takes 11 ounces)...

Source: Bloomberg

Finally, not everyone is happy as the 'k-shaped' economy continues to make headlines.,..

Source: Bloomberg

One way to visualize the decoupling between Wall Street and Main Street is the number of hours it takes to 'buy' The Dow... which has surged in the last 20 years from around 400 hours to almost 1300 hours...

Source: Bloomberg

Will 2026 bring the jaws of this giant alligator of doom to close? ... stocks down or sentiment up?

Amid all the surging asset classes this year, we also found it notable that both bank deposits and money-market AUM soared to new record highs...

Source: Bloomberg

Goldman says its baseline forecasts are friendly for equities and many EM assets in 2026.

Markets have already priced better US growth and lower US inflation, but we think our forecasts are even more benign.

We think the cyclical backdrop is likely to dominate valuation concerns, but the tension could increase volatility while more focus on re-leveraging may lead credit to underperform.

The key risks are that a fragile job market sparks recession fear or the equity market questions the value of AI-related revenues.

Shorter-term US rates exposure should be protective in these situations, but good growth, large fiscal deficits, and the possibility of renewed worries about Fed independence are likely to limit the downside in longer-term yields.

Goldman still thinks the USD should weaken over time unless stronger US growth leads markets to scale back easing hopes, though more against pro-cyclical crosses.

Simply put: the macro backdrop remains conducive for equity risk into 2026 - global growth of 2.8% coupled with Fed easing and CapEx expansion.

But... the market has never been this expensive... ever!

See you in 2026...