BCA: Friendliest Fed Meets Narrowest Rally - 10 Key Views For 2026

Authored by Dhaval Joshi via BCAResearch.com,

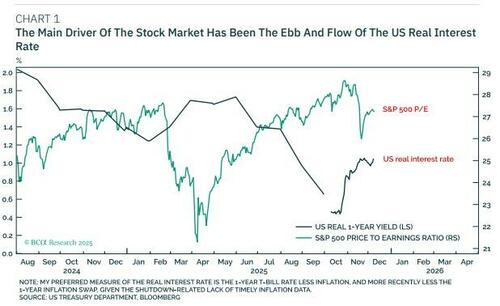

I get high with a little help from my friends, sang the Beatles. The Lennon-McCartney ditty says everything you need to know about the stock market in 2025. Contrary to the popular narrative, the main driver of the market has not been Trump’s trade war. Nor has it been AI euphoria. The main driver of the stock market has been the ebb and flow of the US real interest rate (Chart 1).

In 2025, the stock market got high with a little help from the Fed. In 2026, an even friendlier Fed could help the market get even higher.

That said, even the best friends can’t work miracles. Entering 2026, the big challenge to further gains is that the stock market rally has been the most concentrated ever.

The global stock market is now two-thirds concentrated in the US stock market, of which 40 percent concentrated in just ten stocks, whose fortunes are concentrated in just one bet: that they will all become winners of the gen-AI boom. The upshot is that over a quarter of the world’s stock market value is directly exposed to that bet going sour.

Thus, the bull versus bear battlelines are drawn for 2026: The friendliest Fed meets the narrowest rally. In this last report of the year, I will go through 10 key views for 2026 that emanate from this fascinating setup.

Key View 1: Down Years Are Rare

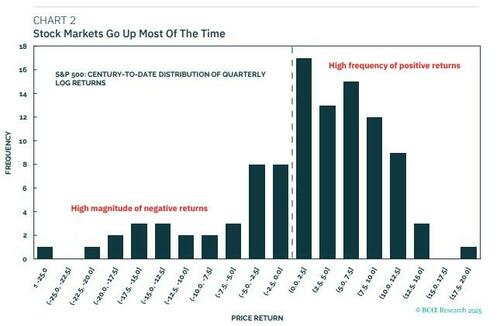

Stock markets go up most of the time. Yet the higher frequency of positive returns is offset by the higher magnitude of negative returns, an asymmetry known as negative skew (Chart 2).

In the 21st century-to-date, the S&P 500 has had only 7 down years, but 5 of these were severe down years (2000, 2001, 2002, 2008, 2022).

The upshot is that we should underweight stocks very rarely – only in the fifth of the time that we anticipate severe bear markets.

These bear markets can be triggered in one of two ways: by a stock market bubble bursting; or by a deep recession.

Key View 2: In 2026, The Greater Risk Is Not That A Recession Triggers A Market Crash, But That A Market Crash Triggers A Recession

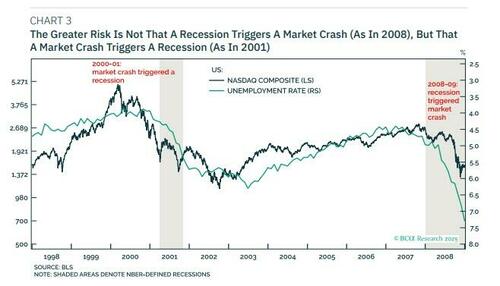

There are deep recessions that trigger stock market crashes: for example, the recessions of the early-70s, early-80s, and the global financial crisis of 2008.

Then there are stock market crashes that trigger recessions: for example, the Wall Street Crash of 1929, the Japanese bubble bust of 1990, and the dot com bust of 2000 (Chart 3).

In 2026-27, my sense is that the greater of these two risks is that a stock market crash triggers a recession – as I now explain in my Key View #3.

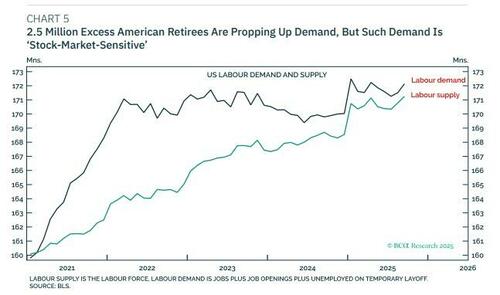

Key View 3: 2.5 Million Excess American Retirees Are Propping Up US Demand, But Such Demand Is ‘Stock-Market-Sensitive’

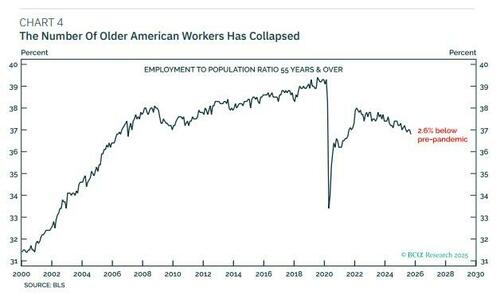

The most important structural shock in the world economy that nobody is talking about is the ongoing collapse in the number of older American workers (Chart 4).

More than 2.5 million so-called ‘excess retirements’ have happened for two reasons: first, older Americans were more vulnerable to COVID and its aftereffects; second, the post-COVID boom in the stock market afforded an extra 2.5 million older Americans to retire early.

By spending their booming pension pots and other stock market wealth, the 2.5 million excess American retirees are generating strong demand for goods and services. Thereby, they are generating labour demand. But, by definition, retirees do not contribute to labour supply. Hence, the 2.5 million excess American retirees have kept the US labour market ‘supply-constrained’, circumventing a demand-led recession.

However, a stock market crash would destroy the wealth that is funding the crucial marginal spending of the 2.5 million excess American retirees.

Key View 4: The Fed Will Sacrifice 2 Percent Inflation To Avoid A Stock Market Crash

Nevertheless, the 2.5 million excess American retirees are exacting a cost on the US economy, and that cost is stubborn inflation. The skills and experience of many older workers are difficult to substitute (think of a top surgeon, lawyer, or professor). These shortages of older-worker skills mean that the US labour market is tighter than the headline data suggests.

At the margin therefore, the 2.5 million excess American retirees are propping up US demand, but they are also keeping inflation at 3 percent (Chart 5).

The trouble is that if the Fed leans against 3 percent inflation with high interest rates, it will undermine the stock market. Because, to repeat, the main driver of the stock market has been the ebb and flow of the US real interest rate.

As I explained in Key View #3, if the Fed undermines the stock market, it will undermine the crucial marginal spending of the 2.5 million excess American retirees. Thereby, it will trigger a recession. So, as the lesser evil, the Fed will sacrifice its 2 percent inflation target. And it will use any hint of economic weakness or stock market drawdown to justify further aggressive rate cuts.

But cutting rates when inflation is stuck at 3 percent is not good for long-dated T-bonds and it is not good for the dollar.

Underweight US T-bonds in a global bond portfolio and underweight the dollar.

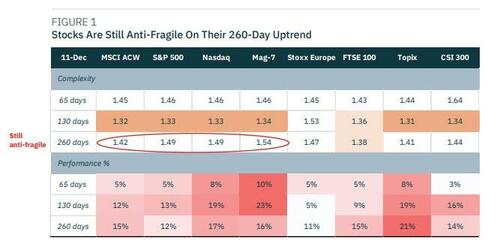

Key View 5: The Narrowness And Fragility of Market Rallies Will Signal Points Of Maximum Vulnerability

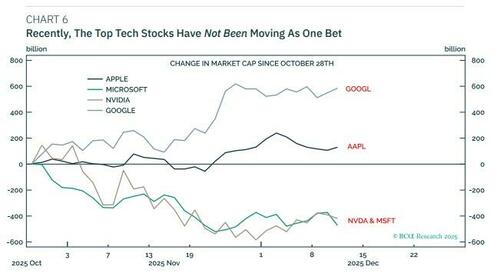

The big challenge to a benign setup for 2026 is that the stock market rally has become the most concentrated rally ever. The global stock market is now two-thirds concentrated in the US stock market, of which 40 percent concentrated in just ten stocks, whose fortunes are concentrated in just one bet: that they will all become winners of the gen-AI boom.

Suffice to say, if more than a quarter of the world stock market is just one big bet, then there will be a lot of damage if that bet goes sour. Yet an encouraging recent development is that the top stocks have not been moving as one bet. In the last month-and-a-half, while Nvidia and Microsoft each lost almost $0.5 trillion in market cap, Alphabet and Apple gained $0.6 trillion and $0.2 trillion respectively (Chart 6).

Furthermore, the still relatively anti-fragile 260-day complexity (Mandelbrot fractal dimension) of tech’s price trend tells us that value investors are still validating at least some tech stock prices. If tech stocks become one big bet again and/ or the anti-fragile 260-day trend becomes fragile, it will be a trigger to go underweight stocks (Figure 1).

Until then, the good news is that if tech winners and losers cancel each other out the market will ‘drift’ rather than crash. But it also means the end of aggregate tech (and US) out-performance.

In 2026, overweight the unloved sectors and regions: specifically, healthcare and Europe.

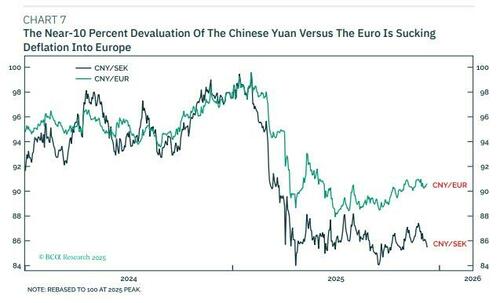

Key View 6: Europe Will Experience Low Growth With Low Inflation

Unlike in the US, there is no inflationary post-pandemic compositional distortion in the European labour market. In addition, this year’s 10 percent devaluation of the Chinese yuan versus the euro is sucking deflation into and sucking growth out of Europe. This is creating a bond friendly backdrop, at least relative to other bond markets (Chart 7).

Overweight German bunds in a global bond portfolio.

UK wage inflation (and thus price inflation) remains anomalously high because an epidemic of long-term illness has decimated labour supply. Nevertheless, gilts are already priced for this and will benefit as growth stagnates, and inflation comes down.

Overweight UK gilts in a global bond portfolio.

As for Europe’s major stock indexes, they are less a play on their home economies, and more a play on their dominant sectors, many of which are deeply unloved.

Hence: Sector rotation out of US tech will benefit the European stock market.

Key View 7: Japanese Bond Yields Are Too Low

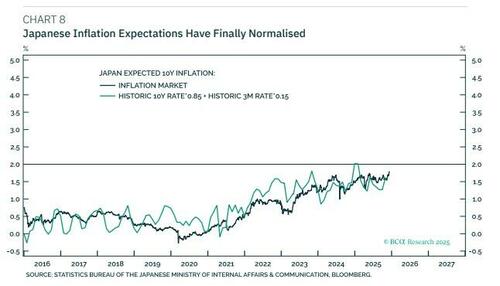

Since the pandemic, Japanese inflation expectations have trended steadily higher and are now almost at 2 percent (Chart 8).

This means that today’s 10-year bond yield of 1.9 percent equates to a 10-year real bond yield that is still near-zero. Even if Japan’s so-called ‘neutral’ real rate is low, it is unlikely to be as low as zero. With inflation expectations now at target, the real yield is too low if those inflation expectations are to stay anchored.

Underweight JGBs in a global bond portfolio.

Key View 8: Chinese Bond Yields Are Too High

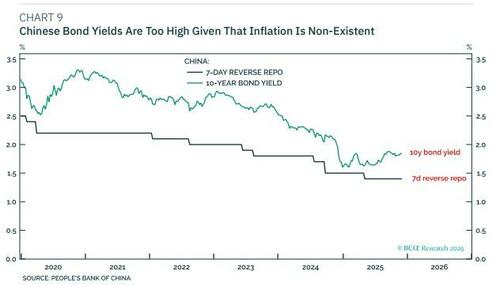

China has the opposite problem to Japan. Inflation is non-existent and the economy is in a severe ‘debt deflation’.

Meaning that today’s 10-year bond yield, at 1.85 percent, and the PBOC’s 7-day reverse repo policy rate, at 1.4 percent, are still exceptionally high in real terms, and must go even lower (Chart 9).

Overweight Chinese government bonds in a global bond portfolio.

Key View 9: Underweight Industrial Commodities

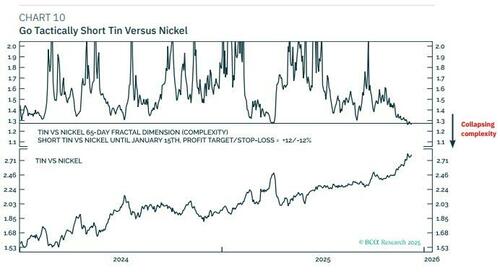

The LMEX index has surged by 20 percent through the past six months, one of its best performances in the post-pandemic era.

Yet in an era when trend global growth – and therefore industrial commodity demand growth – has gapped lower, such performances have been hard to sustain and have typically reversed through the following 12 months. Expect the same pattern to hold on this occasion.

Given the especially outsized 40 percent rally in tin, a new recommended tactical trade is to short tin versus nickel until January 15th setting a profit target and symmetrical stop-loss at 12 percent (Chart 10).

The broader message for 2026 is to underweight industrial commodities.

Key View 10: Own A Combination Of Gold, Bitcoin, and Ethereum

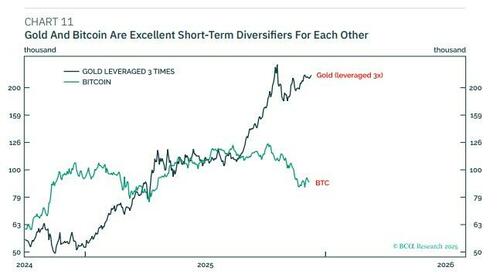

Gold is sometimes called the ‘analogue bitcoin’ just as bitcoin is often called the ‘digital gold’. This is because their value comes from the same source. They are both the insurance assets against fiat monetary debasement and/or state expropriation of wealth.

Hence, the long-term values of both gold and bitcoin are a function of nominal wealth multiplied by the ‘insurance premium rate’ to insure that wealth. The latter fluctuates with perceived risk, as well the market’s preference for gold versus bitcoin at any given moment. But because the preference for gold versus bitcoin fluctuates, gold and bitcoin do not move together in the short term and are therefore natural diversifiers for each other (Chart 11).

Meanwhile, ethereum is a long-term play on the growth of stablecoins as a ‘digital payment system’ which is displacing the current analogue system. Ethereum is the long-term play because 65 percent of stablecoin transactions occur on the ethereum blockchain.

Therefore: Owning a combination of gold, bitcoin, and ethereum will provide strong long-term gains with natural short-term diversification.