The Best Trade Of 2026: Goldman Reveals How To Profit From The Ongoing Collapse Of Software Stocks

It's been a rough couple of weeks for the once impregnable Software stocks, which face what UBS Global Markets Head of Macro Equity Strategy, Aaron Nordvik, calls "an unresolvable existential threat" from AI disruption.

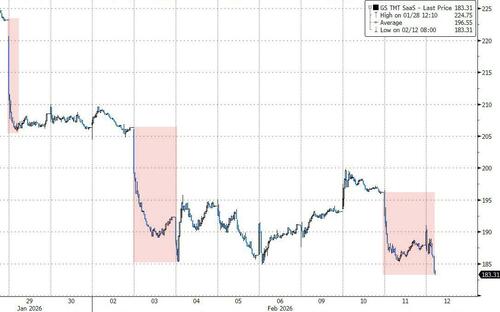

SaaS has suffered most (for now)...

Now back at its weakest since May 2025...

Knowing what inning we are in with this rotation/dispersion/panic-selling position is hardly helpful as day after day it appears the AI-disruptor beam jumps from segment to segment.

First, as we noted, it was SaaS (in particular, and Software in general), then Private Credit, then Insurance Brokers, then it was Financials/Brokers that were hammered earlier this week... and yesterday it was the turn of Real Estate Service stocks, and Logistics firms coming under pressure today.

Which has left investors scratching their heads and cowering in corners...

But Goldman Sachs may have 'resolved' the 'unresolvable' as they draw the line between 'good' software and 'bad' software stocks with a pairs trade that combines 'exposure' to the software industry with a hedge against those that face the 'existential threat'.

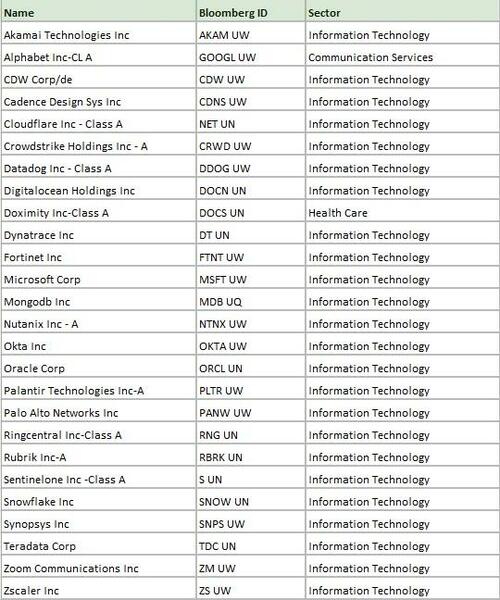

Today, Goldman's Faris Mourad details the launch of a new software pair trade (GSPUSFTX) which consists of:

-

going long software that AI cannot realistically displace because they require physical execution, regulatory entrenchment, integration complexity, or human accountability, and businesses that benefit directly from increased AI usage – compute, data infra, observability, security, hyperscale cloud, AI development platforms (GSTMTSOL), versus

-

going short software-tilted workflows that AI could increasingly automate or rebuild internally, potentially reducing need for outsourcing (GSTMTSOS).

Goldman expect GSTMTSOL to recover from the recent software sell-off while GSTMTSOS lags behind.

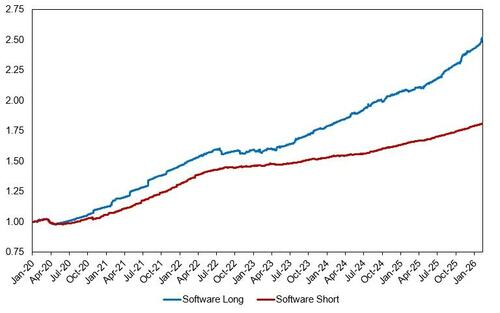

Performance of the baskets:

Performance of the pair:

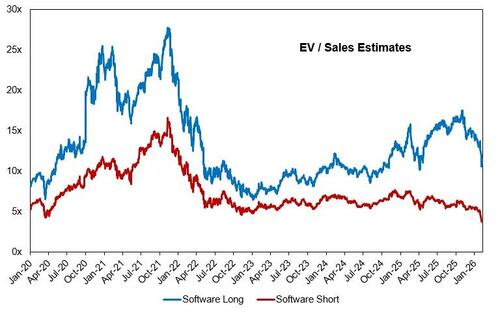

Sales estimates of GSTMTSOL has more than doubled, while GSTMTSOS sales have stagnated since 2023:

EV to Sales of GSTMTSOS does not reflect true valuation considering there are non-traditional software companies included:

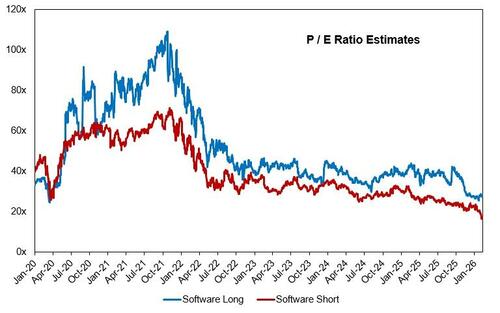

From a P/E perspective, we notice the valuation is starting to diverge:

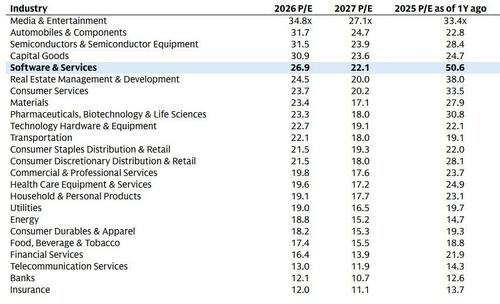

If we consider software to be valued on a P/E instead of a EV/EBITDA basis, it is fair to say that the software industry has definitely rerated to a level more comparable to the rest of the market.

Exactly one year ago, software was trading at a P/E multiple of 51x, making it the most expensive industry in the equity market.

Today, software trades at a P/E multiple of 27x and is not the most expensive industry. Media, autos, semis, and capital goods are trading at a higher multiple.

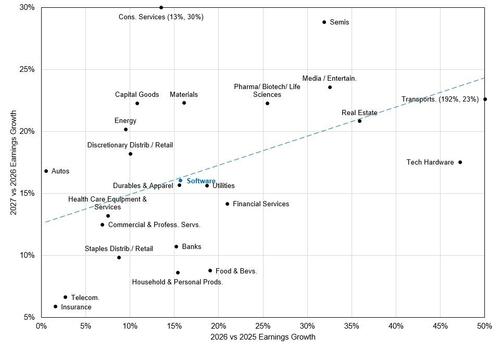

From an earnings growth perspective, we notice no changes comparing 2026 vs 2025, and 2027 vs 2026. The software group is expected to grow earnings by ~16% both years. This could indicate a change in standards in the way equity investors view the software space, and cannot justify different valuations unreasonably higher P/E than other industries. It is worth pointing out that transportation is growing earnings by ~192% this year vs last, and is a true winner of AI Productivity.

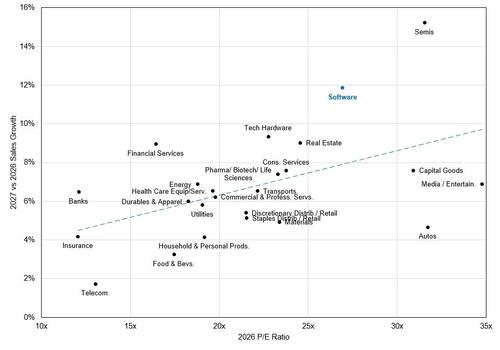

From a Sales growth perspective, Software still stands out significantly relative to the rest of the equity market.

Here's the components

Software Losers

Software Winners

Will this pair be the "Trade of the Year"? We don't know, but it certainly provides a platform for reducing the dispersion risk within your portfolio, avoiding potholes, and offers a starting place for reducing exposure (or adding - given the almost record low net length) in the software stack.

Much more in the full Goldman note available to pro subs.