A Big Rebalancing Is Underway In The Market's January Rotation

By Michael Msika, Bloomberg Markets Live reporter and strategist

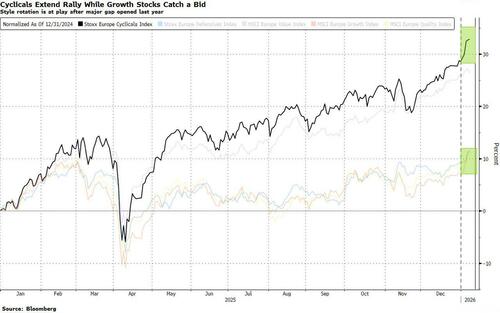

There’s a major rebalancing at play between some late-2025 laggard and winning sectors.

Favorable seasonality for stocks under the so-called January effect is getting an additional boost for now from investor rotation. Defense stocks are giving resurgent industrials a lift, while tech stocks are advancing again thanks to demand for semiconductor names.

By contrast, some groups that rebounded in the past quarter, like luxury, food and beverages or energy, are under pressure from investors locking in gains from the relief rally. A few key sectors are carrying on where they left off, with miners, utilities and health care still in favor after a strong finish to last year.

“Our base case of cyclical recovery and a sustained AI supercycle tilts our allocation toward cyclical sectors, balanced with selective defensives like health care,” say Barclays strategists led by Emmanuel Cau. “We have shifted toward a more balanced stance between last year’s winners and laggards, given extreme performance gap driven by AI exposure, tariffs and FX sensitivity. Amid geopolitical risks, strategic autonomy anchors our positioning, with overweights in tech, defense and mining, plus overweight banks to capture both structural and cyclical upside.”

The strategists are positive about the outlook for European stocks this year, but warn that January still holds the potential to serve up shocks, given elevated positioning, geopolitics, and an overwhelmingly bullish consensus. Consequently, investors should stay hedged, especially given subdued volatility.

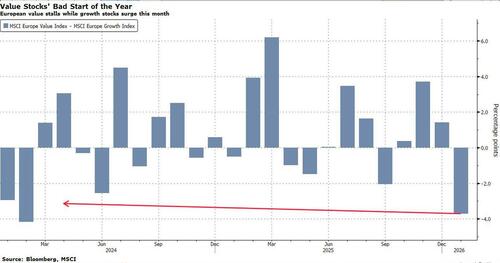

Value, last year’s big winner in Europe when it comes to investing styles, is struggling to follow up on its record annual outperformance over growth. The MSCI Europe Value gauge is barely higher this year, while its growth equivalent has already climbed nearly 4%. With expensive sectors like tech and industrials back in favor, the rotation out of value may have legs, especially with US interest rates expected to drop further this year.

Panmure Liberum strategist Joachim Klement’s main style preference for 2026 is for growth stocks to outperform value. “We expect this to happen even though many interest-rate sensitive sectors like real estate are now in the value basket.”

The strategist notes that utilities and real estate will benefit from lower bond yields, but that their weight in the value cohort is small compared to the dominance energy and banks tend to hold in such portfolios. By contrast, more expensive sectors such as health care, support services, technology and defense have lower correlations to bond yields. “Value stocks have more to lose from lower yields,” he says.

Seasonality is regarded as typically positive in January across equity markets, but over the past 35 years, returns have actually risen only about half the time. Looking at the S&P 500 since 1990, Pictet traders note that in cases where gains have exceeded 40% over a two-year period, the benchmark has tended to consolidate. They view the current configuration as “not especially favorable,” adding that the trend should become clearer later in the month.

“When examining the average performance trajectory of the S&P 500 throughout January, we notice that the second half of the month is often pivotal, typically hosting the main acceleration — whether upward or downward,” they say.