With Big-Tech Earnings Looming, Here's Goldman's Top 5 'Uncorrelated' Trades

While the world and their pet rabbit is waiting on big tech earnings, Goldman Sachs traders share their top US 'uncorrelated' trades...

1.Global obesity drugs (GSHLCBMI) vs unhealthy lifestyle (GSCBUHLT)

We like going long our global obesity drugs basket (GSHLCBMI) since it provides exposure to the leading companies (LLY and NVO) as well as potential emerging leaders in this space: market is moving beyond the dominance of a few key players, with new entrants and diverse therapeutic approaches intensifying competition. Large pharmaceutical companies are actively engaging in M&A and licensing deals to replenish pipelines and acquire next-generation obesity assets, as evidenced by Pfizer's acquisition of Metsera and Roche's deal with Zealand Pharma in late 2025.

We notice equity investors are also focused on the industries that could face challenges as obesity drugs become more popular. We consider a handful at risk: junk foods, alcohol, tobacco, and health care companies that may be impacted in the medical tech, tools, services, and managed care space. We created a basket that combines all: global unhealthy lifestyle (GSCBUHLT) that can trade $200m in one day at 10% of volume.

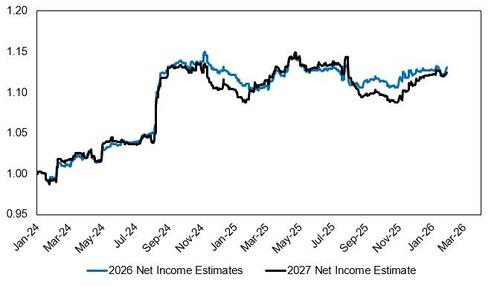

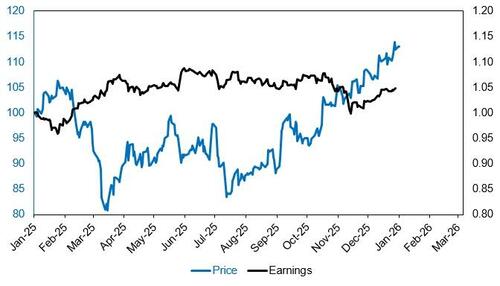

Our research team highlights 2026 as a pivotal year for the development of obesity market, with the launch of NVO’s Wegovy pill (approved by the FDA in late Dec25 and expected commercial rollout in early 2026) and Lilly’s Orforglipron (expected FDA approval in 2026), together with the initial unlock of the Medicare population, potentially significantly increasing the addressable population for obesity medications. We expect the focus in the first half of the year to be on the launch dynamics for the Wegovy pill and orforglipron, with sales estimates 25-35% ahead of company consensus for 2027-29. That being said: street consensus estimates show no changes to 2026 and 2027 revenues driven by Oral obesity drugs and the group traded below earnings expectations for the majority of the last year.

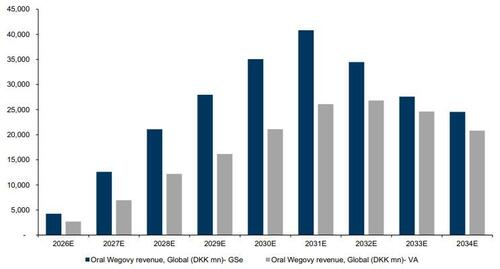

GS research is significantly ahead of consensus on the revenue potential of oral Wegovy:

Oral Wegovy revenue, Global (DKK mn) – GS estimate vs Visible Alpha Consensus Data

Source: GS Global Investment Research, NVO: Wegovy pill likely drives sentiment, where we see scope for upside; remain Buy.

Meanwhile street consensus estimates show no changes to 2026 and 2027 revenues driven by Oral obesity drugs:

Obesity drugs traded below earnings expectations for the majority of the last year:

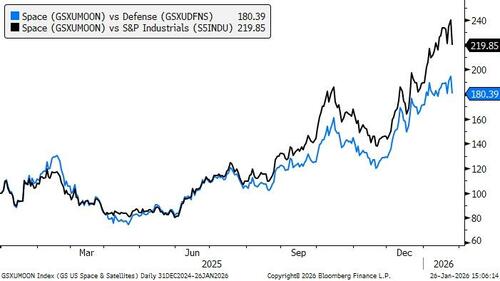

2. To the Moon – Space exploration and satellite technologies (GSXUMOON)

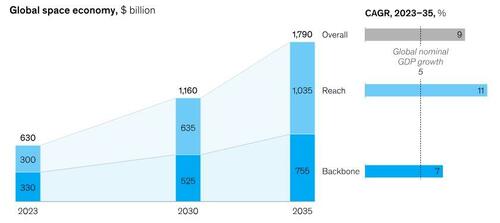

McKinsey announced that the global space economy will be worth $1.8 trillion by 2035, up from $630 billion in 2023. This figure includes both established applications such as satellites, launchers, and broadcast television or GPS, making up slightly more than half of the total space economy in 2023, as well as future applications, those for which space technology helps companies across industries generate revenues. Uber, for example, relies on the combination of satellite signals and chips inside smartphones to connect drivers and riders and provide directions in every city.

Our Space/Satellites basket (GSXUMOON) consists of companies involved in space exploration activity and the development of satellites, successfully isolating this group from the broader defense and industrials sector, outperforming both by ~2x in the last year.

Space applications are expected to grow at a faster rate than global nominal GDP over the next decade:

Source: McKinsey, Space: The $1.8 Trillion Opportunity for Global Economic Growth.

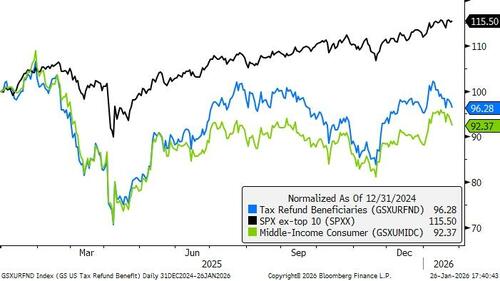

3. Tax refund beneficiaries (GSXURFND)

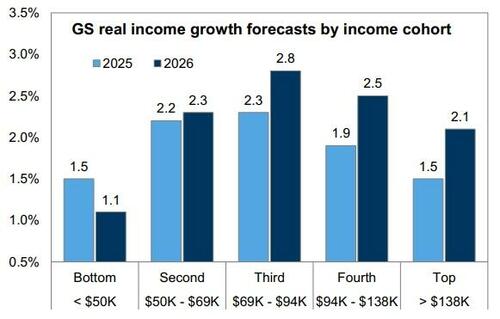

GSXURFND is a new basket that consists of US-listed companies in the consumer sector we expect to benefit from tax refunds as it excludes big-ticket items that households tend to prepare for in advance, and focuses on smaller-ticket items that tend to benefit from slightly higher discretionary spending. GS research expects revenue growth for middle income consumer stocks should accelerate in early 2026. Our economists forecast 2026 real income growth exceeding 2.5% for the third and fourth income quintiles as the tariff boost to inflation diminishes and the tax cuts passed in last summer’s fiscal package translate into refunds. Labor market stabilization should also support income and spending growth. We would use small cap weakness in the short term as an opportunity to enter into the tax refund trade.

Our economists expect strong and accelerating real income growth for the middle income consumer in 2026. They believe slow job growth and elevated inflation have weighed on consumer income growth in Q4, but expect a reacceleration in early 2026 as a result of a diminishing inflation impulse from tariffs, tax cuts passed in the One Big Beautiful Bill Act, and a stabilization of the labor market. They forecast a particularly strong fiscal tailwind to income growth for the middle income consumer. The lowest income households will likely experience a deceleration in income growth due to SNAP and Medicaid cuts.

Source: Global Investment Research, Holiday deals for investors in middle income consumer stocks.

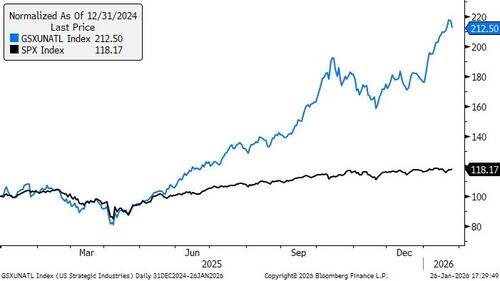

4. Strategic national interest (GSXUNATL)

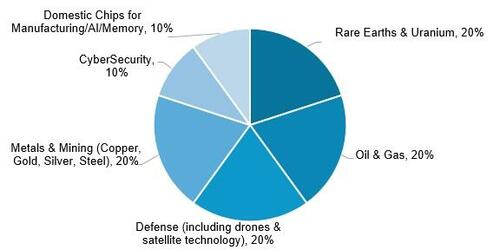

In the new year, the new administration published a handful of documents defining national security strategy, pointing to a few industries that could be perceived to be important to US economic security. This includes a balanced trade, securing access to critical supply chains and materials, reindustrialization, reviving defense, and energy dominance. Our National Interest basket (GSXUNATL) represents those industries best, across rare earths & uranium (20%), oil & gas (20%), other metals & mining companies (20%), defense including drones and satellite technologies (20%), cyber-security (10%), and domestic chip-providers for manufacturing machinery / AI / data storage (10%). The basket can trade $300m in one day with no name exceeding 10% of volume.

Breakdown of GSXUNATL:

5. Being more selective across cyclicals – buy cyclicals laggards (GSCBCYDP)

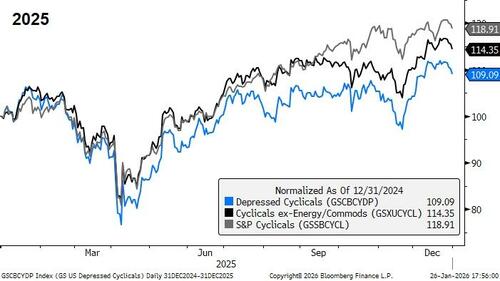

In 2025, we notice a handful of cyclical themes lagged the broader sectors by roughly ~10pp, relative to S&P cyclicals. These cyclical themes include industrials that tend to benefit from bonus depreciation, onshoring beneficiaries, analog semis, transportation companies, as well as non-tech and non-AI companies that we consider to have successfully integrated AI into their workflows.

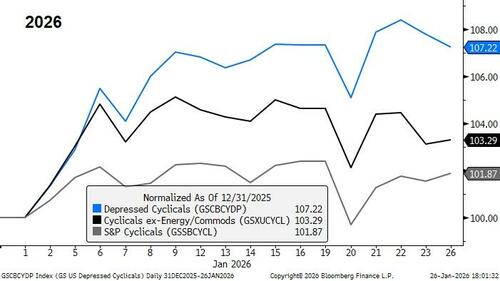

Year-to-date, we notice last year’s laggards outperforming broader cyclicals as equity investors lean towards value and less positioned pockets of the market to get better exposures to reflation. We expect this trend to continue as long as the economy presents a favorable environment to the broadening trade:

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal