Bitcoin Battered As Everything Else (Ex-MSFT) Bounces Back From Early Bloodbath

A sea of red in risk assets with no FedSpeak trigger, Trump tweet catalyst, or macro fearmongering event, as "the smell of liquidation" fears wafted across markets early on...

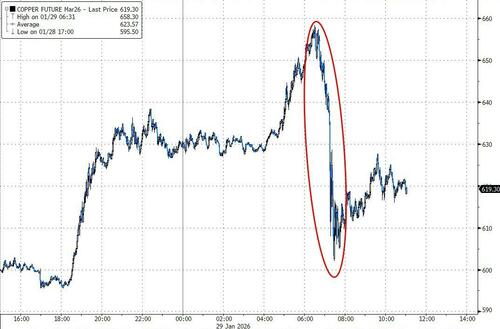

No one knows why, but right around the US equity market open, the floor fell out across markets with some suggesting copper's crash was the trigger of the widespread liquidation, others saw Breakevens crack first, but most desk chatter seemed to focus around the pain in MSFT and forced selling that hit right at the moment cash equity markets opened.

But, around the time that European markets closed, we saw stocks stabilize, metals rebound, and the dollar drop back...

Copper ripped higher overnight... then really ripped higher into the US equity market open, before the carnage started. There was not much comeback, but it ended up over 4% on the day...

Source: Bloomberg

Breakevens broke down early, then bust...

Source: Bloomberg

Copper's decoupling from stocks early was notable (and triggering maybe on the downswing)...

Nasdaq led the charge lower this morning. The bounce-back maintained the same order with The Dow and Small Caps managing to get back to green (and S&P almost)...

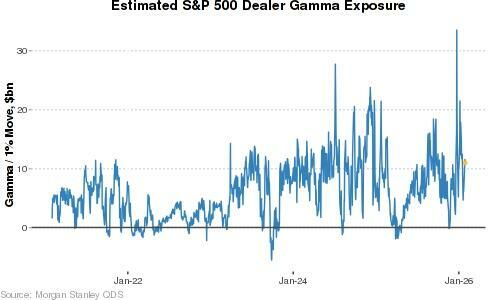

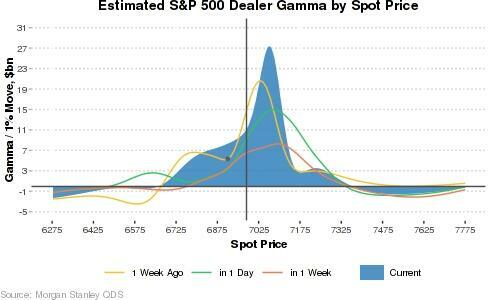

Perhaps this is why we did not see the crash accelerate: Morgan Stanley's quant desk estimates that the S&P 500 dealer gamma position is largely stable at long $11.0bn.

In English, positive gamma means a mean-reverting pressure to markets (as opposed to negative gamma where dealers are forced to chase trends to keep neutral).

On an increase in the market dealer gamma positioning would be max long at an S&P 500 level of ~7065, while gamma would turn negative if the market were to decline to ~6660, assuming constant option positioning.

Interestingly, while the S&P 500 Index is trading lower today - and Mega-cap Tech stocks are down even more (except META and AAPL) - there are more stocks in the index trading UP than trading DOWN today - highlighting the broadening of the market that our strategists have been anticipating

Source: Bloomberg

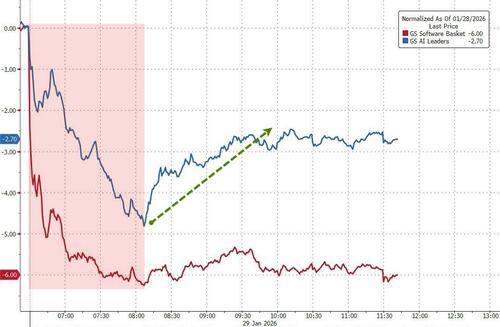

While the broad Mega-Cap Tech basket was battered early on, it bounced back from early wreckage to end in the green!!...

Source: Bloomberg

...Software continues to lag dramatically...

Source: Bloomberg

This is quite a chart! Did AI just napalm all the Developers?

Source: Bloomberg

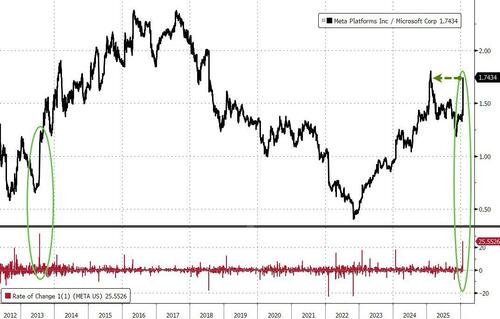

META (+12%) MASSIVELY OUTPERFORMED MSFT (-13%) today - the biggest spread (over 2500bps) since July 2013 - lifting the META/MSFT ratio to its highest since Feb 2025...

Source: Bloomberg

Goldman's Chris Hussey sums up the market's response: META was able to deliver returns today that are being rewarded today, while MSFT remains focused on the future more than today.

Today was the second biggest market cap loss for any stock ever (NVDA's DeepSeek Day loss was only one bigger)...

TSLA was the other big name from last night (EPS for the quarter were solid as it generated more sales outside the US at a higher margin but Goldman notes that focus on TSLA's AI-related efforts (FSD, robotaxis, Optimus) is likely to intensify as the company raised capex plans and announced it is replacing factory floor space that was being used to build Model S and X cars to now be used to build its Optimus humanoid robots)...

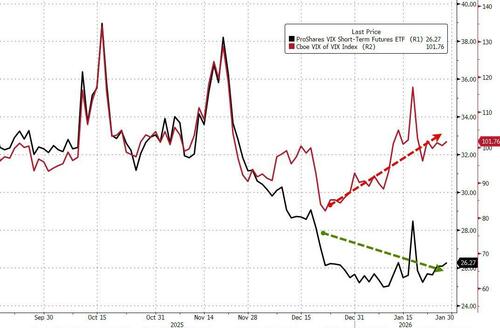

While equity vol relaxed off its intraday highs as spot indices rebounded, skew remains extremely elevated...

Source: Bloomberg

And VIX options are still priced for trouble ahead...

Source: Bloomberg

Dollar pumped and dumped to end unch...

Source: Bloomberg

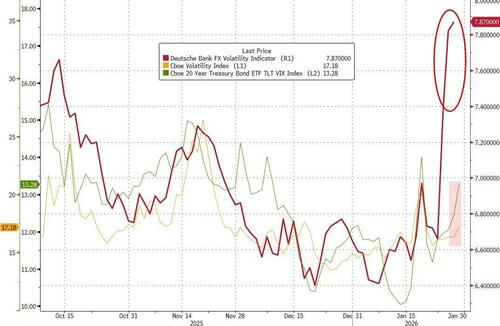

While today did see Equity and bond vol rise, it's nothing compared to the surge we have seen in FX vol...

Source: Bloomberg

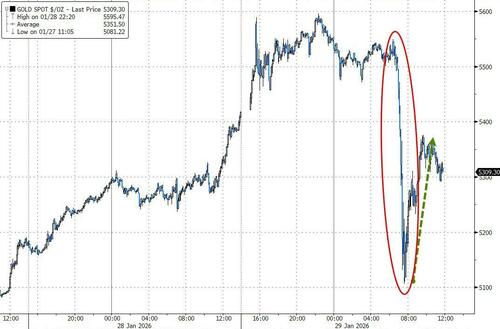

While the dollar managed to end unch, gold did not, ending down over $100 on the day (but well off the lows - which erased all of the gains of the last two days). Gold came within a few bucks of $5600 overnight, smashing through Goldman's $5400 year-end price target. That was a $500 high to low swing in the price of spot Gold... we would imagine by far a record intraday variance...

Source: Bloomberg

Silver rallied to almost $122 this morning before the crash (back down to $107) before bouncing back to $114...

Source: Bloomberg

Kind of an interesting chart doing the rounds on a few desks - did the BTC/Gold ratio just find support?

Source: Bloomberg

Treasuries were bid during the chaos and ended lower in yields on the day, led by the short-end...

Source: Bloomberg

Crude pries surged into the US equity open and then crashed lower with everything else. But, oil stabilized quickly and kept lifting after President Trump ramped up geopolitical tensions with threats of a military strike on Iran.

"With the Middle East tinder box looking set to ignite again, oil prices have moved sharply higher, lifting shares in listed energy giants," said Susannah Streeter, chief investment strategist at Wealth Club.

Source: Bloomberg

What is it that commodities know that bonds don't (or vice versa)?

Source: Bloomberg

Finally, while the rest of the risk assets rebounded (but remained lower on the day), one notably did not - Bitcoin.

Spot the odd one out...

Source: Bloomberg

This was Bitcoin's biggest drop since March 3, 2025 (the Trump Bitcoin Reserve clusterfuck), crashing to its lowest since Nov 2025...

Source: Bloomberg

“Today’s weakness underscores crypto’s persistent role as leveraged beta to traditional risk assets, with digital markets amplifying the broader risk-off tone as equities - particularly tech - continue to face pressure.” said Chris Newhouse, head of business development at Ergonia.

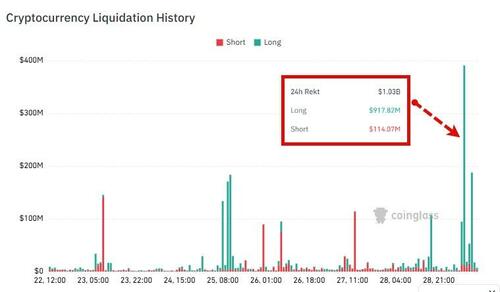

“The move lower is being compounded by leveraged position liquidations as over-leveraged longs get flushed, adding mechanical selling pressure to an already fragile tape.”

Support at the 2026 yearly open, as well as nearby moving averages, failed to hold back sellers as crypto liquidations passed $1 billion in the last twenty-four hours...

Adding to the pressure has been the unwinding of popular strategies such as the yen carry trade in traditional markets, according to Matt Maley, chief market strategist at Miller Tabak & Co. The strategy involves borrowing the relatively low-yielding yen and investing in other currencies offering higher returns.

“Bitcoin and other cryptocurrencies are assets that tend to move with liquidity. When liquidity is more plentiful, cryptos rally, and when it’s less plentiful, they decline,” Maley said. “Well, one of the best indicators for the level of liquidity in the system is the yen carry trade.”

Source: Bloomberg

Investors are now eyeing the $80,000 price level for support, he said.

@AkaBitBull_ posted some thoughts on X that caught our eye:

-

Rate cuts can't pump BTC.

-

Pro-crypto President can't pump BTC.

-

Weak dollar can't pump BTC.

-

Institutional adoption can't pump BTC.

-

Fed injecting liquidity can't pump BTC.

-

Stocks new ATH can't pump BTC.

Is there anything that could pump BTC now?

Which comes first? BTC $300k or a massive suck out of global liquidity.