Bitcoin Bruised On Boxing Day, Bonds Bid As Precious Metals Rip To New Record Highs

Boxing Day brought its usual triumvirate of exhaustion, indigestion, and low-liquidity price action for markets as stocks ended broadly unchanged today (Small Caps dumped). On the week, Small Caps ended unchanged while the rest of the US Majors managed solid gains around 1-1.5%...

Another record high for the S&P as the 'Santa Rally' continues despite the hangover...

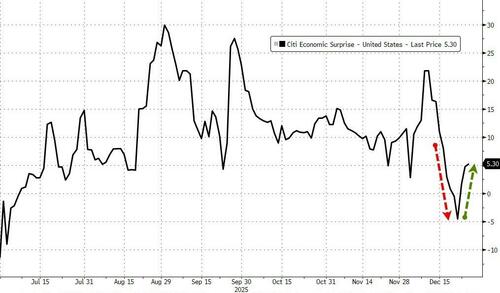

While investors have been digesting a lot of Christmas cheer, this holiday-shortened week offered a lot to chew on with a batch of relatively important data that seems to confirm (for now) that the US consumer continues to act with more confidence than they feel.

Source: Bloomberg

Third quarter (yes, way back in the summer) included a 3.5% increase in consumer spending, while current consumer confidence remains low (down at the level we were experiencing during the depths of the pandemic)...

Source: Bloomberg

And as Goldman's Chris Hussey notes, as a result of the disconnect between actual consumer activity and the surveys, investors are understandably concerned about the durability of consumer activity in the year ahead that is admittedly filled with stimulus (for some).

Source: Bloomberg

After a strong start to the week, Cyclicals lagged as a Defensive bid dragged the pair (Cycs/Defs) back to unchanged on the week...

Source: Bloomberg

But tech stocks outperformed on the week, while Staples lagged...

Source: Bloomberg

Small Caps suffered the most this week as 'most shorted' stocks could not maintain Monday's squeeze bid...

Source: Bloomberg

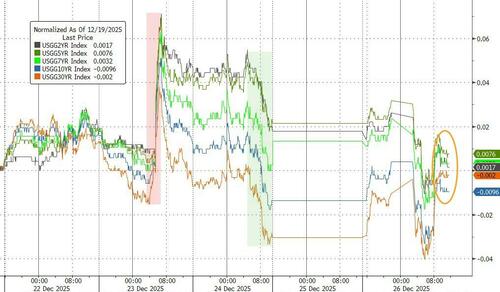

Treasuries ended the week basically unchanged after a volatile Tuesday/Wednesday...

Source: Bloomberg

The dollar suffered its worst week since June to end the week at its lowest since the start of October...

Source: Bloomberg

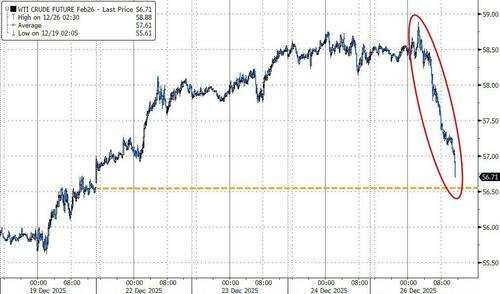

Crude oil prices had a solid week... until today... as investors assessed a step forward in long-stalled Ukraine peace talks which could lead to a deal that allows more Russian oil into global markets grappling with oversupply.

Source: Bloomberg

But the week's biggest news makers were the precious (and industrial) metals with copper, gold ($4550), silver ($78.50), and platinum ($2470) all soaring to new record highs.

Source: Bloomberg

Bloomberg's Michael Ball notes that precious metals have benefited from easier global monetary policy, while fiscal drift pulled retail buyers back in and dollar diversification kept central banks a firm bid. More broadly, tight supply plus tariff and geopolitical frictions provided the perfect setup for a banner year in metals.

Gold grabbed the majority of the attention over the year, despite its little sister silver outperforming... sending the Gold/Silver ratio plunging down to 57x - the lowest since April 2013...

The precious metals complex benefited from a shift in a number of macro factors creating a growing buyer base.

Fed cuts and falling US real yields pulled investors back in just as central banks kept buying gold, supporting a rotation into other precious metals. Increased buying from stablecoin firms and corporate treasuries also helped, and speculative derivative flows added fuel to the fire.

Silver benefited from supply constraints due to mining disruptions and deteriorating ore grades, hitting a market that was already thinner than gold. Retail demand for jewelry also benefited as gold prices rose and buyers traded down. That made it vulnerable to the kind of speculative surge that can turn a rally into a squeeze due to bullish option markets forcing a physical chase in tight inventory conditions.

Copper was the industrial-metal headline, and tariffs were its accelerant. Price action was driven by the movement of global inventories into the US, and a few notable mine disruptions had outsized impact because of this shift. The AI datacenter buildout is adding to the longer-term electrification theme as copper is needed to support expanding the grid. Meanwhile, aluminum is winding up 2025 at yearly highs and tin has also found a bid as the industrial complex repriced.

Sitting over all metals is what Goldman is calling the “commodity control” world, where supply concentration and geopolitical competition raise the insurance value of secure commodity supply chains. Export restrictions on rare earths are the template, and other more common metals may follow suit. In that framework, metals aren’t only cyclical trades. They’re strategic assets, and markets are starting to price them that way.

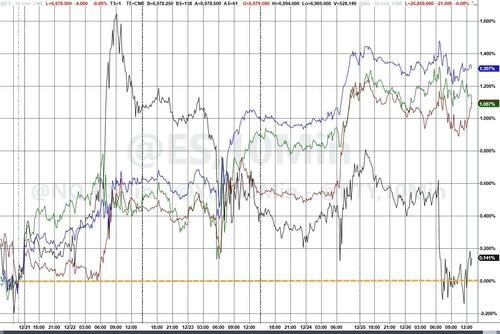

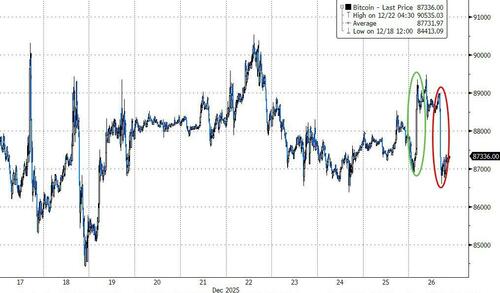

On the other side of the alternative currency wall, crypto had another tough week with bitcoin down for the 4th straight week. Today saw yet another pump and dump move in Bitcoin as it tested above $89,000 only to suddenly puked at 10amET (again) back below $87,000...

Source: Bloomberg

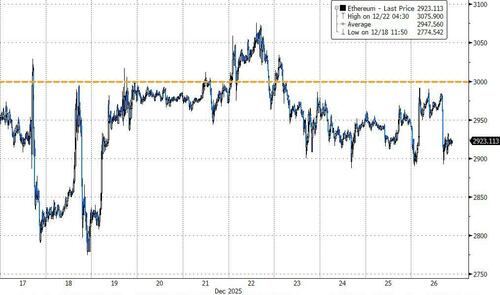

Ethereum was unable to get back above $3,000...

Source: Bloomberg

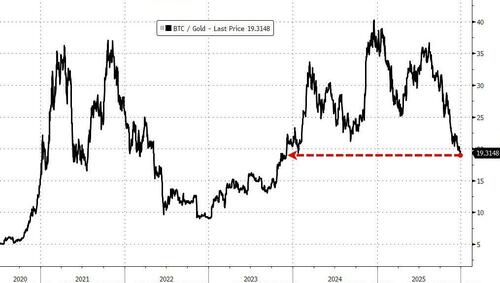

Bitcoin is now at its lowest relative to gold in over two years...

Source: Bloomberg

Finally, Bloomberg macro strategist Michael Ball notes that options positioning and flows continue to explain the “daily grind” higher.

With little new long-dated positioning to pin the tape since the December option expiration, shorter-dated flows - primarily zero day to expiration or 0DTE - are steering the intraday moves higher, and thin liquidity makes that flow matter more.

The path of least resistance still points toward 7,000 on the SPX into year-end, but it’s more drift than sprint.

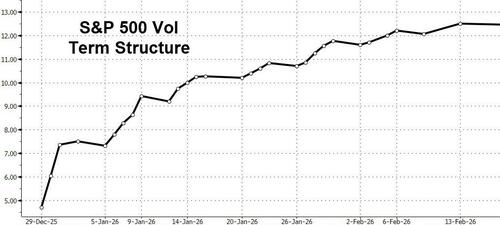

The VIX Index is pressing fresh lows in what looks like maximum crush into an event-light calendar, even as the curve sits in a steeper-than-normal contango and the VVIX Index, or “vol of vol” is stickier indicating greater worries further out.

We close out December and 2025 next week in another holiday-curtailed 4-day session. Macro release highlights for next week include the FOMC meeting minutes, a bunch of housing market reports, and the Chicago PMI (the ISM Manufacturing Index will be reported on Monday Jan-5).