Bitcoin & Bullion Bounce Back From Bloodbathery, Stocks Snooze As Santa Surge Stalls

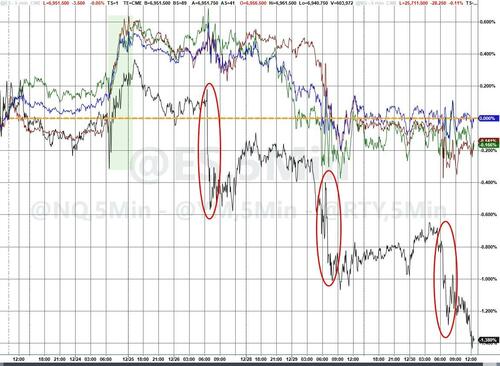

Markets chopped around today (with no reaction to Case-Shiller home prices or FOMC Minutes) but ended going nowhere with the S&P 500 clinging to unchanged for the 'Santa Claus' rally so far (while Small Caps are lagging, being sold at the cash open each day)...

But, while a quick glance at markets today suggests little change from yesterday, Goldman's Chris Hussey notes that a peek under the surface reveals a marked shift.

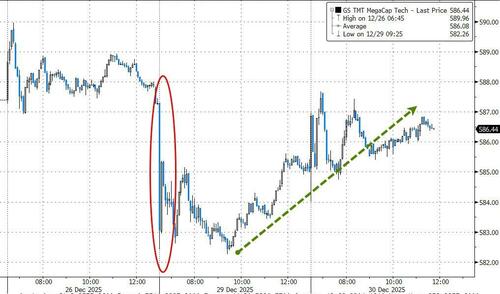

Yesterday's trading revealed a distinct risk-off posture from investors, with Mega Cap tech underperformance weighing on the entire market.

Today, that position appears to have reversed a bit, with pro-cyclical and pro-growth sectors including Communication Services and Materials outperforming today.

Source: Bloomberg

But, the tale of the tape today is even more nuanced a level deeper, with a large amount of single stock dispersion, and with more stocks flashing red rather than green.

So what do we think the market is telling us today?

-

On the one hand, we are closing in on the end of 2025, trading volumes are thin, and there isn't much news (scheduled, or otherwise) to trade on -- so potentially not much.

-

On the other, the fact that there are more laggards than leaders today could suggest a degree of trepidation as we (nearly) conclude another year of trading.

But as we've written before, there are probably more tailwinds than headwinds for markets and economy in 2026.

The caution expressed by markets today - especially amid a dearth of new news - could simply be another example of investors seeking an angle of repose as we close out the year and wait for those tailwinds to emerge in 2026.

Momentum stocks continue to underperform...

Source: Bloomberg

Bonds were also quiet again today with yields barely higher as the long-end modestly underperformed...

Source: Bloomberg

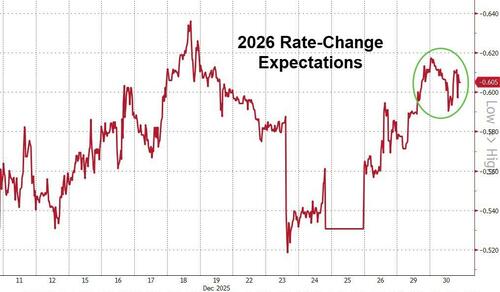

No reaction today to The Fed's Minutes with the market's expectations holding around 60bps for 2026 (well above The Fed's dot-plot expectations)...

Source: Bloomberg

The dollar accelerated higher today (on yen weakness) but remained broadly in its recent up-channel...

Source: Bloomberg

Precious metals rebounded from yesterday's panic-selling with Gold back above $4400 before fading this afternoon...

Source: Bloomberg

Silver tagged $78 on its rebound before fading a little...

Source: Bloomberg

The silver EFP spread is back to 'normal' after this week's stress...

Source: Bloomberg

Bitcoin bounced back up above $89,000 before also fading this afternoon..

Source: Bloomberg

Copper and Platinum also bounced higher today...

Source: Bloomberg

Crude oil prices ended the day unchanged after early gains were erased after sizable inventory builds as traders continue to weigh geopolitical tensions from Venezuela to Russia and Yemen against concerns about a global glut...

Source: Bloomberg

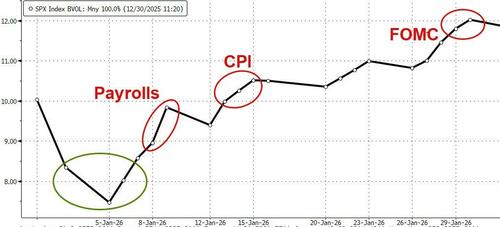

Finally, while the next few days are expected to see volatility collapse, the new year brings fresh 'catalysts' that the options market is already bracing for...

Source: Bloomberg

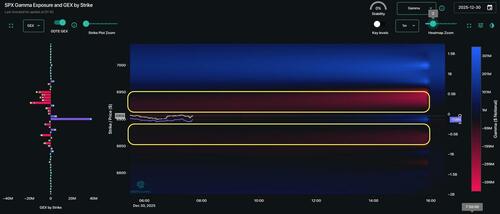

And as SpotGamma notes,there is negative gamma for 50 handles above and below current SPX prices (6,900), which suggests some potential movement is on tap...

-

Support remains at 6,900, then 6,850.

-

Resistance is at 6,920 & 6,950.

-

<6,890 remains our Risk Pivot.

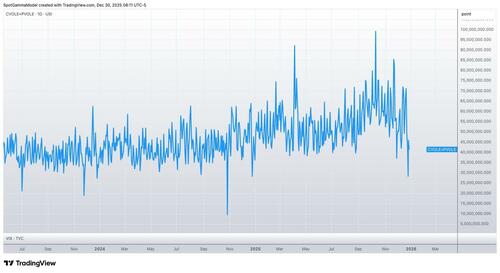

Options volumes, too, have really fallen off of a cliff. Below is total US options volume from record volumes in Q3/Q4. Put this together with vols and you come to this simple conclusion: nothing is going on.

In the immortal words of Les Mis: just 'one more day' before the new year brings 'another destiny'...