BofA: Cheap Hedges If Santa Fails To Deliver

Before this morning's AVGO/ORCL-driven hiccup (which pushed VIX back above 17 briefly)...

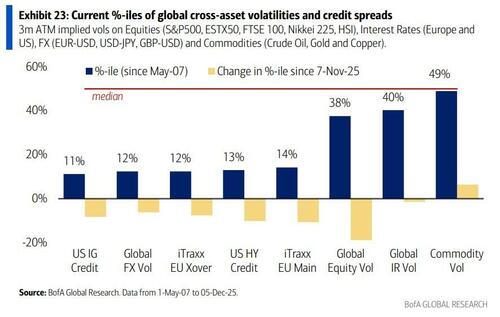

Cross-asset volatility has eased significantly in recent weeks, following the brief bout of turbulence in mid-November, triggered by AI-bubble fears in equity and credit markets (with Oracle’s 5-year CDS widening to its highest level since March 2009), sharp reversals in crypto and uncertainty over the Fed’s policy path.

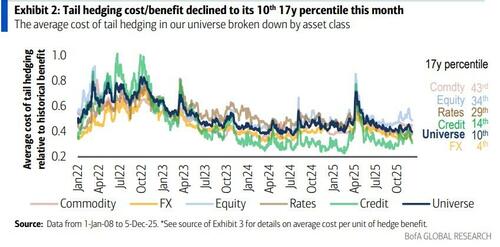

As BofA's cross-asset-hedging team notes, equity and credit had led the easing of cross-asset risk, with credit vol dropping below its 15th 17-year percentile and equity vol at its 38th percentile (down from the 58th percentile last month).

Commodities are the only asset class showing an increase in vol, on the back of volatile rallies in Gold and Copper.

Overall, with the average cost of tail hedging at its 10th 17-year percentile, BofA believes it’s a timely opportunity to lock in cheap protection while staying invested into year-end.

Buy cheap FX & Credit hedges, as December could surprise

Year-end often brings calm, but a prevalence of central bank speak along with lofty AI valuations and bubble fears could dampen a seasonal ‘Santa’ rally.

Additionally, against a backdrop of a potential Fed chair announcement and a wave of post-shutdown economic data, December may deliver more surprises, and volatility, than usual.

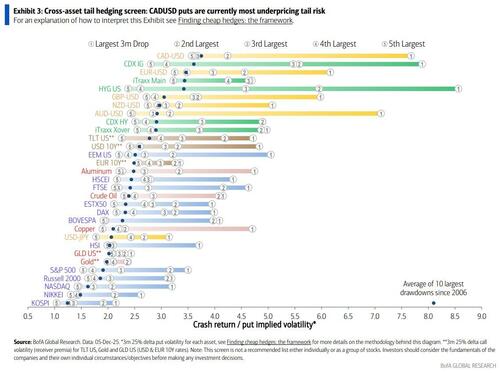

The chart below shows crash returns of different assets during historical tail events per unit of current OTM option implied volatility.

We measure tail events by the 10 largest 3m drops since Jan-06.

-

Credit hedges back at the top: After last month’s concerns over potential credit “cockroaches”, credit vol has receded sharply, making Credit hedges among the most attractive tail hedging opportunities alongside FX puts.

-

Commodities (Gold/Copper) rank expensive: Commodities are the only asset class with higher volatility this month, led by Copper and Gold. Structural supply deficits in Copper and persistent macro-driven demand for Gold could keep the rally volatile.

-

Equity hedges still sit at the bottom, even as equity vol drops: Nasdaq, Nikkei and KOSPI puts continue to rank expensive despite lower volatility vs the previous month, whereas EEM US, HSCEI, and European equity puts offer better value.

Ranked by the average, FX and Credit hedges, particularly CADUSD puts, CDX IG payers, and EURUSD puts, rank as the cheapest in our universe, offering the best value at current prices.

They can also serve as proxy hedges for equities, where tail protection remains relatively expensive, particularly for U.S. equities, Nikkei and KOSPI.

Professional subscribers can read the full chartfest post from BofA's team here...