Bond Market Faces Historic Shock As Mag 7 Giants Turn Cash Flow Negative To Fund Capex Tsunami

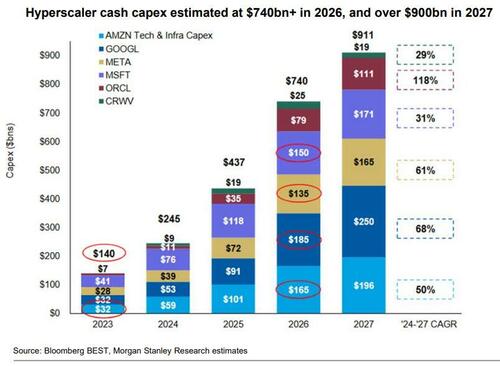

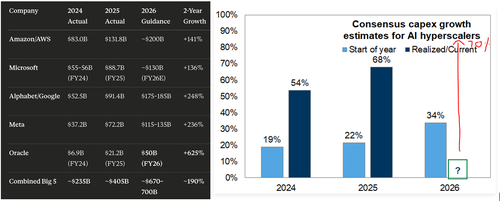

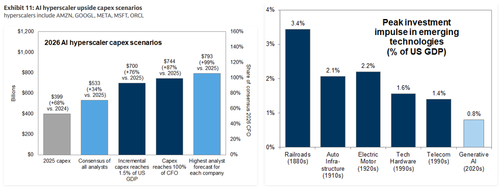

There were audible gasps of shock over the past two weeks when first Alphabet and then Meta and Amazon revealed capex plans for 2026 that blew away expectations. It wasn't just them: the entire hyperscaler complex (AMZN, GOOGL,MSFT, META) projected capex guidance for 2026 that was a staggering $650BN... and if you throw in ORCL and CRWV it rises to $740BN...

... which represents 70% yoy growth or double he 35% growth expected by consensus at the end of 2025!

The numbers were so massive we immediately joked that with all free cash flow (and then some) going to pay for capex, the Mag 7s would not afford any buybacks in 2026 (and perhaps beyond).

There will be zero buybacks among the Mag 7 this year.

— zerohedge (@zerohedge) February 5, 2026

In retrospect, we were correct, but we'll get to that in a few minutes.

First, let's take a look at what this massive capex buildout means. First, as Goldman's Sheeti Kapa writes, there is the return on investment angle.

Having first emerged in 2024 when Goldman asked point blank if Gen AI was nothing more than "too much spend, too little benefit." i.e., a giant capital drain that will never lead to positive long-term returns for investors...

... this debate has never been fully resolved (instead the numbers just keep getting astronomically bigger). And so, inevitably the capex vs ROI debate is once again back top of mind, and rather ominously, none of the hyperscalers were rewarded by the market on what were otherwise great EPS prints - especially GOOGL which reported best Search numbers in 3 years and the best Google Cloud numbers in 4 years; but also Amazon (fastest y/y AWS growth in ~3 years), MSFT (~37% Azure growth); and META (~24% topline growth)

The capex anxiety is understandable: as Kapa $700 billion if reached is effectively 100% of hyperscaler cash flows, and this kind of spending registers close to the peak investment impulse that totaled 1.4% of GDP in the late 1990s (if still below the industrial revolution).

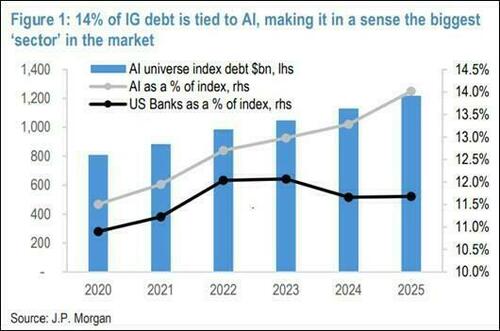

And while the IRR debate will rage for several more years, and most likely at least until the time OpenAI has to start making good on its $1.4 trillion in payment commitments to hyperscalers, the massive capex spending plans have kicked another hornets' nest, something we first wrote about last October in "AI Is Now A Debt Bubble Too, Quietly Surpassing All Banks To Become The Largest Sector In The Market" and what Bloomberg piggybacked on two months later in "Everyone’s Watching Stocks. The Real Bubble Is AI Debt."

That's right: the debt that will be needed to fund this massive spending rollout, is starting to be a big problem.

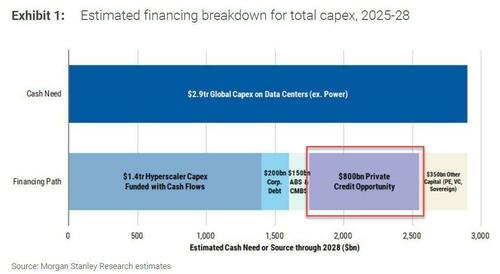

Of course, Zero Hedge readers are all too familiar with the problem: we summarized it first 4 months ago when we said that "the point we want to drive home is that credit markets will play a major role in enabling AI-driven technology diffusion" and of all the available sources of credit, the chart below shows just how big the debt hole is that private credit will have to plug. It shows that while the global data center capex needed through 2028 is ~$2.9 trillion (a number that has since grown even larger), CapEx can only fund about half of this. It means that various forms of debt: corporate, ABS/CMBS, private credit and even sovereign, will have to plug the remaining $1.5 trillion (and rising hole).

And so, six months after we first laid out the massive data center funding hole that must be plugged, others are catching up. A few days ago, Bloomberg's Credit Weekly note (available to pro subs), wrote that the biggest tech companies are "gearing up to spend even more on artificial intelligence than investors had anticipated, and money managers increasingly fear that whatever happens, credit markets will get hit."

Microsoft, Oracle and other “hyperscalers” are in an arms race to invest in AI and beat competitors in a technology that could change vast parts of the economy. Google parent Alphabet Inc. said it’s poised to spend as much as $185 billion on data centers this year, more than it has invested in the past three years combined. Amazon.com Inc. promised an even bigger outlay: $200 billion.

As we previewed, a big chunk of those investments will come from the high-grade corporate bond market (and eventually, junk bond market, once we get the first AI fallen angels), resulting in much more debt sales this year than investors had expected. Which was already a lot: recall that as of the end of 2025, IG debt tied to AI was 14% of the entire market, making it already the biggest sector in the market surpassing banks.

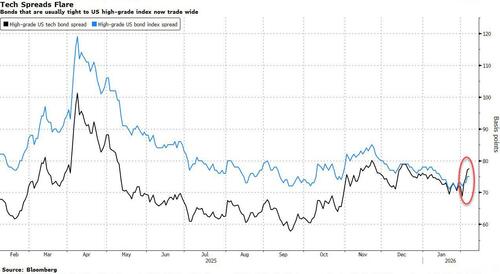

And the more tech companies borrow, the greater the potential pressure on bond valuations, Bloomberg warns, adding that "the securities are already expensive by historical standards, trading at close to their tightest spreads since the late 1990s."

“The AI spending bonanza is finding buyers today but leaves little upside and even less room for error,” said Alexander Morris, chief executive officer and co-founder of F/m Investments. “There is no asset class that can’t and won’t spoil.”

Those fears weighed on tech companies’ notes last week, which broadly weakened relative to Treasuries, including most of the $25 billion of debt that Oracle sold on Monday. In the broader market, high-grade corporate bond yield spreads edged about 0.02 percentage point wider last week.

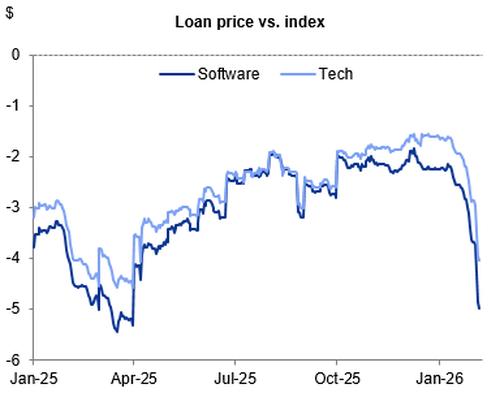

Beyond supply and demand, intensifying worries around AI’s power to disrupt have sparked tremors in the market. As companies like Anthropic PBC release a steady stream of tools targeting professional services from finance to software development, investors are starting to price in the threat AI poses to entire businesses. Meanwhile, software companies have seen their leveraged loan prices drop about 4% this year through Thursday, amid fears that AI will leave many software products obsolete.

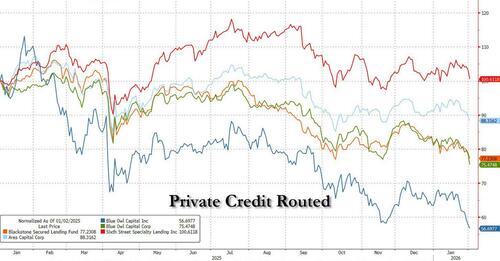

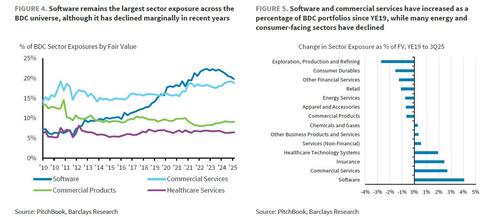

And, as we first pointed out a week ago, publicly traded private credit lenders also have extensive exposure to software, with the industry accounting for over 20% of portfolios on average, according to a note from Barclays.

“Software is the largest sector exposure for BDCs, at around 20% of portfolios, making the industry particularly sensitive to the recent decline in software equity and credit valuations,” Barclays analysts including Peter Troisi wrote in a note available to pro subs. The total exposure was about $100 billion in the third quarter of last year, the analysts said, citing PitchBook data.

As the narrative unwound, a BDC equity index fell 4.6% last week (see "Private Credit Stocks Crash After Shock Report Reveals Huge Exposure To Collapsing Software Sector")....

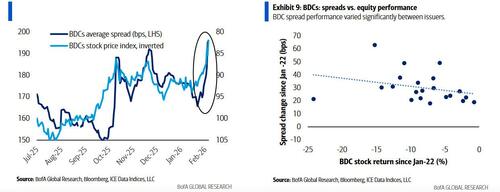

... while at the same time, the software weakness spread to BDCs, as BDC IG bond spreads widened about in line with the weakness in stocks, with a notable dispersion in spread performance.

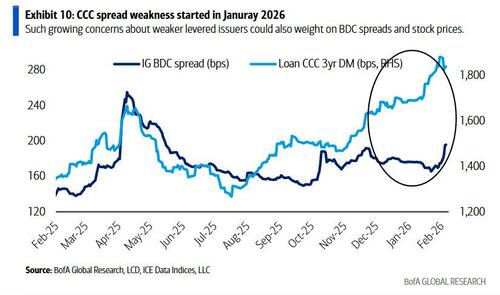

Moreover, CCC BSL loan spreads started to widen already in January, as concerns about weaker levered issuers would also weight on BDC spreads and stock prices.

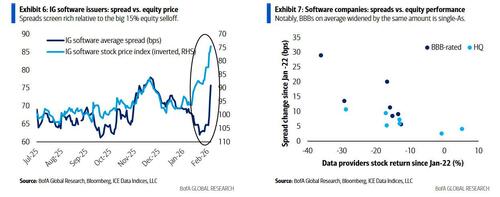

To be sure, corporate credit isn't immune to the disruption from AI: as BofA Credit Strategist Yuri Selger wrote on Friday, IG software issuer (ex. MSFT, ORCL, IBM) spreads sold off 14bps since January 22, 2026, with spreads reaching the widest levels since November 2025, as BBBs on average widened by the same amount is single-As.

"We think that makes sense, as the equity price drop likely reflects risks to the strong growth outlook rather than concerns about weaker credit quality in 2026. The threat to growth stems from AI potentially leading to better efficiency and reduced headcounts at some point in the future, and, as a result, need for fewer software licenses relative to prior expectations" Selger wrote, providing an interesting spin on the latest AI disruption.

The silver lining - for now, at least - is that in the publicly traded high-grade and high-yield corporate bond markets, software companies are comparatively less represented, accounting for around 3% of each, according to Barclays. Still, one factor that makes corporate bonds vulnerable to rising risks is valuations, which remain extremely high even with recent weakening.

The average US high-grade corporate bond spread was 0.75 percentage point at Thursday’s close, according to Bloomberg index data.

“Tight valuations make credit susceptible to potential disruption,” Barclays strategists Brad Rogoff and Dominique Toublan wrote in a Friday note.

In November, JPMorgan forecast about $400 billion of high-grade US bond sales from the technology, media and telecom sector this year. But that figure will climb as companies’ spending plans increase.

Morgan Stanley is on the same, page, and also expects hyperscalers to borrow $400 billion this year, up more than double from $165 billion in 2025. The offering spree will likely drive high-grade corporate bond issuance to a record $2.25 trillion this year, Vishwas Patkar, head of US credit strategy at the bank, wrote in a must read note on Monday (available to pro subscribers).

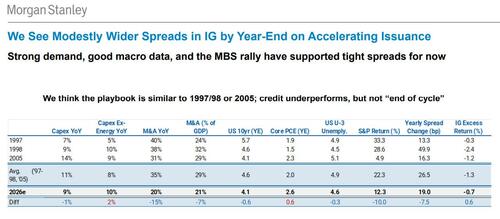

Not surprisingly, Patkar and JPMorgan’s head of credit strategt, Nathaniel Rosenbaum, expect the massive issuance to push corporate bond spreads wider.

“We think that the playbook is similar to 1997/98 or 2005; credit underperforms, but not ‘end of cycle,’” Patkar wrote, referring to a period when defaults rise and credit availability tightens.

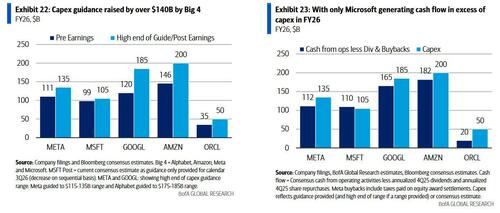

A slightly more granular forecast came from Bank of America Credit Strategist Yuri Selger, who on Friday (note available to pro subs) looked at just the 5 Investment Grade-debt issuing hyperscalers, projecting a modest $140 billion in issuance for the group. This is how the the bank came to that number: "we evolve our methodology to target maintaining cash balances at historical levels, inclusive of M&A ($50B for Alphabet) and debt maturities. This approach points to about $45B of supply from Alphabet, $30B from Meta, and $20B from Amazon for calendar 2026. We are penciling in $20B for Microsoft even though it is still able to grow its cash balance. This does not include potential investments in OpenAI as reported in the press, which could add to issuance. In addition, ORCL issued $25B of bonds this week and expects the issuance to be its only deal for calendar 2026, with the rest of funding from equity as part of its $45-50B funding plan. Combined, this brings our debt issuance estimate to ~$140B, in line with our January estimate, including $115B from the Big 4." BofA's recent US credit investor survey showed that a majority (83%) expects 2026 hyperscaler supply in the $100 to $300bn range, with the average expectation of $191bn.

Of course, Selger was quick to concede that the "risk is to the upside" with future capex guidance hikes or OpenAI stakes. As noted above, capex guidance by the Big 4 surprised by over ~$140B at the high end of ranges provided, relative to consensus estimates, mainly driven by Alphabet and Amazon. This brought aggregate capex spend to $700 billion for FY26 ($691B for calendar 2026) including Oracle.

Bank of America optimistically expects this spending to be funded mainly by cash from operating activities for the Big 4 hyperscalers, but the bank is quick to note the diminished surplus going forward, apart from Microsoft, even with no/slower buybacks in 4Q25. Furthermore, capex guide hikes in subsequent quarters would have direct implications on debt issuance, unless hyperscalers draw down aggressively on cash balances (Big 4 had $420B at YE’25 vs. $346B at YE’24). Adding to these concerns, Meta indicated the potential to become net debt positive at some point, instead of net debt neutral (and that excludes Meta's huge and growing off balance sheet obligations).

As a reminder, META is already neck deep in off-balance sheet debt. Here is a schematic of its $27.3 billion SPV with Blue Owl "Project Beignet" for the Hyperion data center. None of this touches META's balance sheet.

— zerohedge (@zerohedge) January 29, 2026

Expect hundreds of billions of these in 2026 https://t.co/794EgSiiZ9 pic.twitter.com/7hMyVW6Lno

While there is debate whether Meta issues debt sooner or later (spoiler alert: it will be sooner), BofA,notes that to get to net debt positive, Meta needs to spend cash at a faster rate than it is generating or raising it. So, if it issues in the near term, then it would be a less likely issuer in the medium term. Net cash generation is still substantial for Microsoft per consensus estimates. One salve is that revenue growth accelerated for most, however the big question is whether the revenue growth will outpace the massive growth in capex. The jury is still out, meanwhile, as the charts below show, as of this moment, only Microsoft will generate cash flow in excess of capex in 2026. That means no cash (from operations) left for buybacks at all, and any stock repurchases will have to be funded through more debt.

And speaking of off-balance sheet debt, there will be much more of that as Mag 7 lease commitments increase further pointing to additional data center funding. BofA notes that lease commitments increased by 47% qoq (+$132B qoq to $414B for the Big 4, $662B incl. Oracle). This disclosure is indicative of funding required to build data centers, funded by other issuers. This increase in lease commitments would equate to about $70B of additional funding needs by other issuers/capital markets to BofA's $300B prior estimate.

Yet ironically, for all the concerns around looming supply, it’s likely that, for now, current demand for investment-grade bonds is even greater. Money has been chasing deals this year even though spreads remain near their tightest in decades. High-grade technicals have remained robust despite record-setting issuance in the US and across the globe. Funds that invest in high-grade bonds saw $6.44 billion of inflows in the week ended Feb. 4, according to LSEG Lipper, the biggest inflow in over five years.

But as these tech giants ramp up their spending plans and sell more debt to fund their AI projects, technicals should continue to weaken, according to JPM's Rosenbaum, head of US credit strategy at JPMorgan.

And weaken they will... but not today, because early Monday morning, exactly one week after ORCL's own massive bond issuance, Google parent Alphabet stunned markets when it raised $20 billion in its biggest ever US dollar bond sale on Monday - more than the $15 billion initially expected, after racking up one of the biggest order books of all time, with more than $100 billion in orders It’s also planning debut deals in Switzerland and the UK, including a rare sale of 100-year bonds, marking the first time a tech company has tried such an offering since the dotcom frenzy of the late 1990s.

This massive bond offering - which has just one purpose: to finance the unprecedented spending plan behind its AI ambitions - comes just days after hyperscalers Meta to Amazon.said they were aggressively ramping up spending to meet their ambitious artificial intelligence plans. Their plans fanned fears that the AI arms race, and the billions of dollars of debt needed to help fund it, would weigh on credit markets. And yet investors, oblivious to the deteriorating technicals and massive tide of looking supply - pushed those concerns to the side on Monday, as the Alphabet bond sale drew more than $100 billion of orders. Demand was so high, Alphabet’s US dollar bond sale on Monday came in seven parts, with the yield on the longest portion of the offering - a bond maturing in 2066 - only 0.95% more than Treasuries, a tighter risk premium than the roughly 1.2% point discussed earlier.

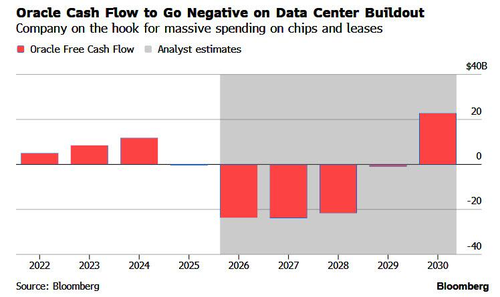

Last Monday, Oracle - already facing at least four year of negative cash flow and watching its stock price collapse as its default risk soared- raised a record $25 billion from a bond offering that attracted a record $129 billion of orders..

And last November, Alphabet tapped the US bond market when it raised $17.5 billion in a deal that attracted about $90 billion of orders. As part of that transaction, it sold a 50-year note - the longest corporate tech bond offering in US dollars last year - which has tightened in secondary markets. The company also sold €6.5 billion of notes in Europe at the time.

“Clearly we’re not in a typical capex cycle, and after previously being net savers, the companies involved are now going deep into the well for financing to secure the resources to compete,” said Andrew Dassori, CIO at Wavelength Capital Management LLC. “This is a major transition, and a critical one when thinking about potential risk and return for corporate bonds in the US.”

Major transition or not, for now the market remains in a very precarious equilibrium autopilot and no matter how big the debt offering there is more than ample demand to absorb it all. This won't change until there is another major shock to the AI trade, similar to the January 2025 DeepSeek moment, at which point the bond market will slam shut.

Which again brings us to the core binding constraint: the return on investment on AI, or as Goldman's Shreeti Kapa puts it, "the bigger question is the size and shape of profit pools resulting from investments in this new technology."

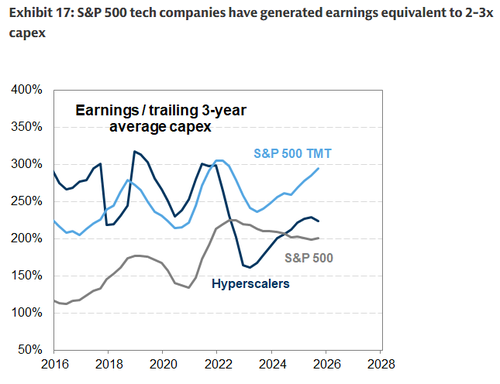

According to her calculations, during the past decade, large public hyperscalers have typically generated profits at a rate of 2-3x their trailing capex expenditures. Given consensus estimates for an annual average of $500-600 billion in capex from 2025-2027, maintaining the returns on capital to which their investors have become accustomed would require these companies to realize an annual profit run-rate of over $1 trillion, more than double the 2026 consensus estimate of $450 billion in income.

Needless to say, this is a staggering number, and not even the most optimistic strategists can see how $30/monthly subscriptions and even the occasional Enterprise contract can double hyperscaler profits on short notice.

Yet admitting the math doesn't work is not an option, which leaves us with two ways to think about how this plays out, according to Goldman:

- Bull: AI adoption follows the cloud computing trajectory where revenue growth consistently outpaced capex growth within 3 years. AI cloud revenue reaches $800 billion–$1 trillion by 2029–2030 driven by agentic AI workflows, AI-native applications and inference demand growing 10x. Capex intensity moderates after 2027 as initial data center buildout completes. Custom silicon dramatically improves unit economics versus NVIDIA GPUs. Key signal to watch: AWS achieved breakeven in ~3 years and reached 30% operating margins within a decade; if AI services achieve similar margin profiles on the existing cloud base, returns would be extraordinary. Current cloud backlogs of $1.5 trillion+ and universal capacity constraints support this narrative that demand is genuine & contractual commitments are real.

- Bear: History shows a mixed track record regarding the eventual success of first movers in periods of major technological innovation (see Global Crossing). While odds are good that some of today's largest companies achieve that success, the magnitudes of current spending and market caps alongside increasing competition within the group suggest a diminishing probability that all of today’s market leaders generate enough long-term profits to sufficiently reward today’s investors

Another way to analyze the current matrix if outcomes is through Game theory: Hyperscalers face a strategic binary choice – invest or risk falling behind, which also guaranteed the looming tsunami of debt, which in turn guarantees a debt crisis at some point in the future. Risks to not investing include:

- Permanent market share loss: AI infrastructure has winner-take-most dynamics—fall behind now, never catch up (like IBM missing cloud)

- Customer lock-in window closing: Next 2-3 years determine next 20 years as enterprises anchor AI workflows to specific platforms

- Prisoner's dilemma: If competitors invest and you don't, you hemorrhage customers; if you invest and they don't, you win the market—rational play is always invest.

- Asymmetric risk profile: Downside of missing AI = strategic obsolescence and $200-400B+ market cap loss; downside of overinvesting = delayed payback but maintain competitive position

Said otherwise, "Damn the torpedoes, full speed ahead", and this is the outcome: pulling back capex guarantees losing market share, while continuing will eventually lead to overcapacity- but preserves optionality to win if AI thesis proves correct. This dynamic creates a Nash equilibrium, in which sustained capital expenditure is rational even if near term returns compress. So the key is to find who can translate spend into defensible economics.

Those who are successful, will create generational wealth in a few years.... as long as the corporate bond market vigilantes don't wake up first and crash the party.

Much more in the full notes from Goldman, Morgan Stanley, Bank of America and Barclays, available to pro subs.