Bonds Bid Amid Market Mayhem Ahead Of Biggest OpEx In History

It's like deja vu all over again in markets today with early gains across risk assets (MU earnings supporting the AI dream) suddenly clubbed like a baby seal amid massive levered long liquidations, with stocks (alone) recovering in the afternoon (only to slide back lower as gold and crypto extended losses)...

It was a stressful day for some...

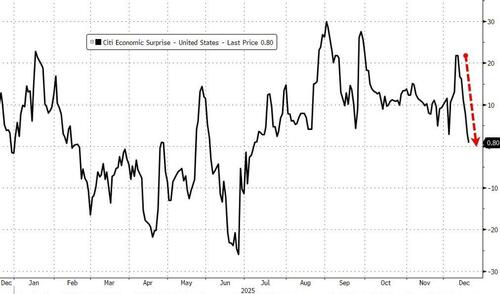

The morning started with a dove-inspiring cooler-than-expected CPI data dump (admittedly full of holes) and jobless claims data that signaled no pain in the labor market (but a really ugly Philly Fed supported the need to 'do something').

This pushed the US Macro Surprise Index down to almost zero...

Source: Bloomberg

All of which pushed up March rate-cut odds..

Source: Bloomberg

Investors started the day with optimism, reacting to MU's results reported last night, where the company guided far beyond already elevated expectations. Results also suggest that there is ongoing tight supply/demand dynamics in the NAND market. the memory shortage that MU's results reinforce, supports the need for more equipment to produce semiconductors in the world. MU ended dramatically higher on the day but was hit with a wave of selling pressure on the cash equity open...

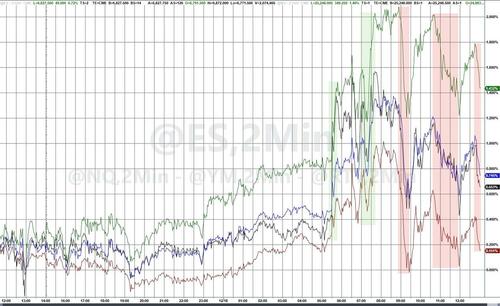

This supported the overall market overnight. Then CPI's "cool miss" sent stocks higher into the cash open, extending gains to the highs of the day led by Nasdaq. Then, at around 12ET, the floor suddenly fell out... for everything (stocks, gold, crypto). There was no clear headline catalyst for this but we do note that Nasdaq had rallied up to its 50DMA and perhaps that triggered some systematic selling pressure...

That selling wave lasted around 30 minutes before dip-buyers came back into stocks (again led by Nasdaq). That took us back to the highs of the day before some late-day weakness spoiled the party - though all the majors ended the day green (Dow was the laggard, Nasdaq the biggest gainer)...

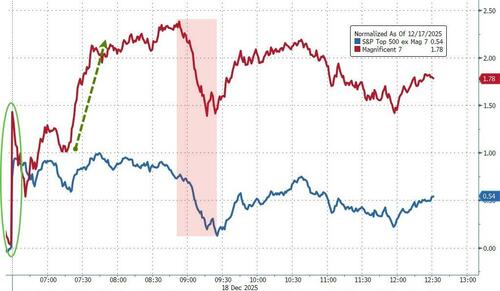

Mag7 stocks dramatically outperformed S&P 493 today...

Source: Bloomberg

AI-related stocks (TPUs and GPUs) both managed small gains today...

Source: Bloomberg

Cannabis stocks tanked on news that the Trump admin was reclassifying marijuana...

Source: Bloomberg

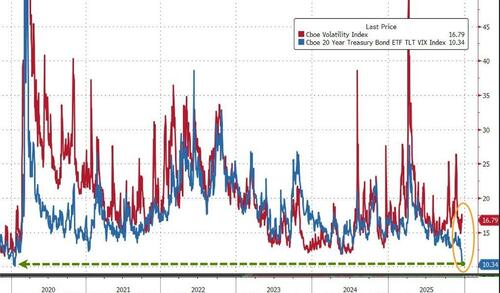

Equity vol (VIX) was down modestly on the day (as the event risk catalysts are passed through and ahead of tomorrow's record-breaking OpEx), but remains dramatically decoupled from bond vol, which fell today to its lowest since January 2020...

Source: Bloomberg

Treasuries were bid once again with the long-end outperforming on the day. The belly of the curve remains the winner on the week...

Source: Bloomberg

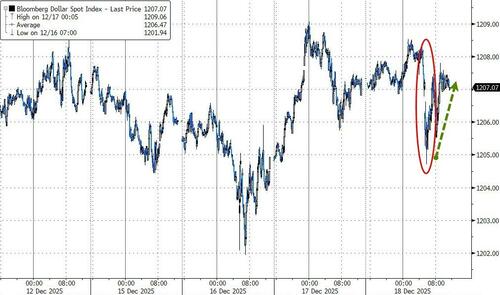

The dollar dumped and pumped to end unchanged today...

Source: Bloomberg

Bitcoin continued its chaotic week, spiking back above $89,000 before rapidly puking back to an $84k handle...

Source: Bloomberg

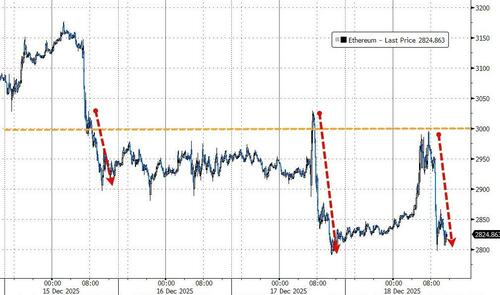

Ethereum moved along a similar roller-coaster path but the trend was lower than bitcoin, unable to hold the $3,000 level...

Source: Bloomberg

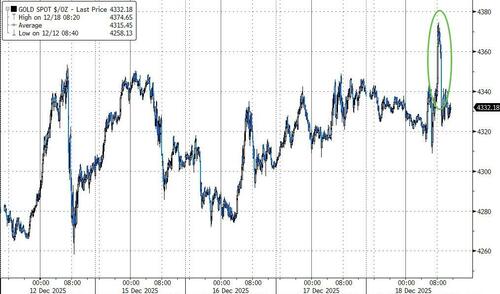

Gold tracked stocks higher and lower to end the day unchanged...

Source: Bloomberg

Silver ended lower on the day, losing $66...

Source: Bloomberg

But silver continues to trade above crude oil prices...

...with WTI hovering around the $56 handle today...

Source: Bloomberg

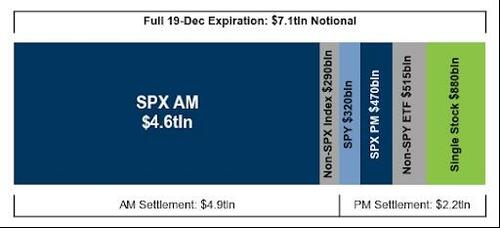

And finally, all of this happened ahead of the largest options expiration in history...

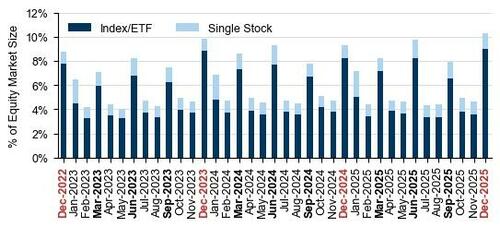

Goldman's options guru John Marshall estimates that this December options expiration will be the largest ever with over $7.1 trillion of notional options exposure expiring, including $5.0 trillion of SPX options and $880 billion notional of single stock options.

Source: Goldman Sachs

While December expirations are typically the largest of the year, this one breaks all past records.

Source: Goldman Sachs

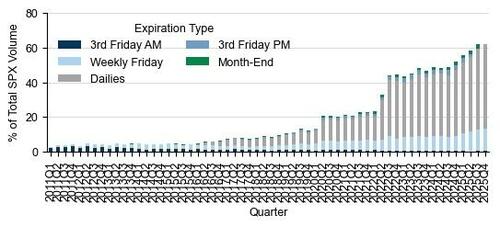

SPX zero-day options volume is at its historical high, representing over 62% of the total options volume...

Source: Goldman Sachs

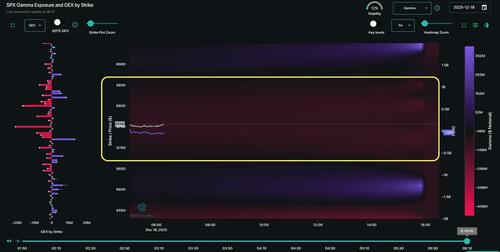

As SpotGamma notes, the field of play remains wide, as negative gamma reigns from 6,900 to 6,700.

Risk Pivot holds at 6,800 - if that level is recovered then we think its a signal of our hereto over-talked "Xmas rally".

-

Above 6,800 we would look to add 12/31 6,900 area call-spreads/flies.

-

Sub 6,800 the favor sits with downside, and quite frankly there is no material positive gamma below. Like, anywhere.

The issue with this is that a rally to 6,800 could easily fade, whereas >6,800 we'd anticipate put sellers coming in to add positive gamma support.

Source: SpotGamma

Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma).

For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period.

Plus those >=60 day puts are fairly prices since put skew has been muted on this recent drawdown.

While that's the technical view, Goldman's Chris Hussey expertly summarizes the more fundamental backdrop ahead:

-

The Economy. Jan Hatzius and team raise our US GDP growth slightly to an above consensus 2.6%, and also continue to forecast 4.8% GDP growth in China -- both helping to drive a 2.8% Global GDP growth pace for 2026. Strong productivity gains will suppress job growth (particularly in the US), but inflation should also subside, and we continue to see a path for the Fed to cut rates by 50bp in 2026 to 3-3.25%.

-

Markets View. A tension persists between a constructive macro economic outlook -- manageable inflation and unemployment -- and stretched valuations across stocks and credit. Look for potentially volatile upside in the year ahead as high valuations make risk assets susceptible to any bad news.

-

Equities. Peter Oppenheimer remains constructive on global equities for 2026 as earnings continue to grow, but we forecast lower index returns than in 2025, amid a broadening bull market. Our 12-month equity forecasts, weighted by regional market cap, would give 13% price returns in 2026, 15% with dividends, in USD. Diversify across sectors, geographies, and factors (growth vs value). And pick stocks -- stock correlations have fallen and are likely to remain low.

-

Bonds. Better growth could challenge rate cut expectations (not our base case). But benign inflation should limit upward pressure on long-dated yields (as long as fiscal deficit concerns remain at bay).

-

FX. Sturdy global growth coupled with two more Fed cuts points to a still modestly USD bearish tilt. And the China trade surplus is set to grow to new records, putting gradual appreciation pressure on CNY.

-

EM. Sturdy global growth should also support EM assets as they move from great to good. Rotate some risk from tech-sensitive markets to domestic exposures for balance.

-

Commodities. Ongoing geopolitical competition between the US and China should push Gold higher (as central banks buy more gold and less USD), and broadly support commodities as a hedge against any adverse market or economic issues developing. The push to build out compute capacity also favors copper over aluminum (China is likely to build too much supply in aluminum). In energy, oil looks to be oversupplied going into 2026 while global nat gas is likely to be oversupplied in 2027.

-

The Risks. A fragile job market could spark recession fears. And equity markets may eventually question the value of AI-related revenues. How to hedge? Alongside diversification, seek protection in rates, FX, gold and equity volatility.

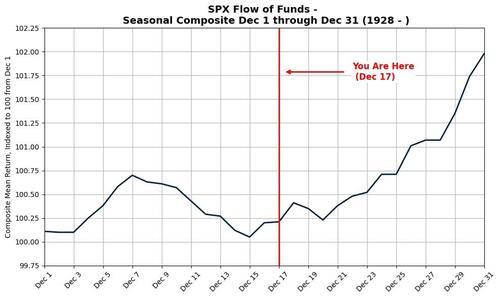

And don't forget... it's the most-wonderful time of the year...

Will it be different this year?