Booms/Busts Have Become The Norm: BofA Breaks Down The New Bubble Era

Some say clear bubble, others say nonsense.

As we have pointed out previously, a bubble may be hard to avoid as big tech leaps since 19th century led to big bubbles - and AI is government-backed.

As BofA's Global Research team warns, the biggest IPO gains since 90s, record dip-buying, fear & vol show bubble’s progression and the promise of a magical future just out of reach may usher new era of booms/busts.

An "era of bubbles" ahead

Major technological leaps since the first industrial revolution in 19th century Britain and including the roaring 20s and 90s Internet boom have led to major multi-year asset bubbles, as we noted in Jun 2024. Given the growing consensus on AI’s likely profound impact, and 2025’s bubble-like progression, the chance of avoiding one seems low. Unlike prior tech leaps, this one has the support of governments, as it represents a critical capability relevant to geopolitical superiority.

Thus, while not a certainty, an eventual bubble seems likely. But are we seeing signs yet? A hallmark of bubbles is prices becoming unstable as they near the peak. Our Bubble Risk Indicator does suggest froth around the edges, but not yet in the core of US tech.

With bubbles comes risk, as volatility rises into the peak and keeps rising after; and the AI boom is likely too big to avoid a bust. The biggest challenge is timing. While our 2025 outlook highlighted similar bubble risks compounded by stimulative US policy (some still forthcoming), US equities have lagged global markets in 2025, especially in USD terms. Cheaper valuations, underweight positioning and fears of “peak US exceptionalism” dominated. This could continue but is antithetical to an AI bubble peaking, as bubble-assets typically outperform until the pop. This also suggests the top is further out. Valuations in core AI not yet at extremes, a lack of obvious leverage (present in past bubbles) and a Fed easing (not hiking) argue it’s still early days.

We see potential for a bubble-prone era where booms/busts are more the norm, driven by the promise of “abundance” always just out of reach and magical AI moments fueling FOMO.

But bubbles have unique signatures and recognizing that can be helpful in their navigation.

Often led by value-insensitive retail, they create a real dilemma for fundamental investors: chase or risk underperforming until the pop.

Key is having a plan.

What is the chance we can avoid a bubble?

Big tech leaps result in big asset bubbles

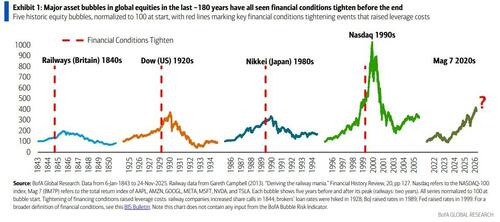

The history of major technological leaps is one of major asset bubbles. The first industrial revolution led to numerous booms in railroad stocks in 19th century Britain, the roaring-20s in the US emanated from the invention of automobiles, radios & electronics, and the internet resulted in the late 90s tech bubble. These bubbles all built over multiple years and resulted in multi-year busts (Exhibit 1).

As we outlined in June 2024, bubbles form when investors coalesce around the idea that technology will create a magical future but with high uncertainty on its magnitude and timing. Two further ingredients were present in all three of the technology driven bubbles: retail participation and leverage, often via the expansion of credit.

Government support makes this time different

The 1920s was further inflated by laissez-faire economic policy including tax cuts and deregulation – some of which was mimicked by the current US administration and may still impact markets. However, a major difference today is the amplification of the bubble coming from government support. Many sovereigns see integrating AI into their economy as necessary to remain competitive on the world stage. And given the perceived existential threat AI dominance presents to geopolitical power, many fear the US and China are entering a new cold war in which AI is next critical weapon. Given this backdrop, the likelihood of avoiding a significant asset bubble in AI seems low. The question in our view is not if we will see a bubble, but where are we in the process?

Measuring bubble threats: BofA Bubble Risk Indicator

A hallmark of asset bubbles is prices becoming more unstable as they rise (Exhibit 2 & Exhibit 3). This is the opposite of typical behavior, as normally asset volatility falls as prices rise and rises when prices fall.

When prices become more unstable on the way up, it can be due to extreme one-sided positioning due to the fear-of-missing-out (FOMO). Assets often decouple from fundamentals in part due to fundamentals themselves being very ephemeral when their future value is highly uncertain (as during technological leaps). This doesn’t just occur during technological driven bubbles but is pervasive across a broader spectrum of asset bubbles, as shown in Exhibit 2 & Exhibit 3.

Informing bubbles from the first 4 moments

The overly exuberant sentiment and lopsided positioning backdrop during an asset bubble often bleeds into price action in the form of instability. Rallies get larger and faster, but with volatile swings and rapidly bought drawdowns. To quantify the degree of this bubble-like instability, the BofA Bubble Risk Indicator (“BRI”) takes inspiration from the way the first 4 moments describe a statistical distribution: returns, vol, momentum and fragility. Indeed, high returns coupled with high vol, high momentum, and elevated fragility have characterized the exuberant price action that most asset bubbles have shown over the past century, especially at their frothiest points. Recall that fragility represents the degree of “local tail events” an asset displays, as we first introduced in our 2016 outlook.

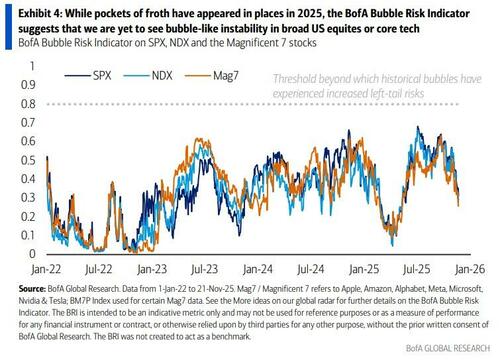

Focusing on today, the Bubble Risk Indicator suggests that we are yet to see typical bubble-like instability in broader US equity markets and including the core of US tech (Mag 7), which tends to be more acute when the indicator exceeds 0.8 (Exhibit 4).

To be clear, the BRI is not saying a bubble is not possible from these levels, but rather that broad US markets are not experiencing the “typical” instability we have seen near the peak of past asset bubbles in the last 100 yrs. Some markets, however, such as US nuclear-related and quantum computing stocks along with Asian equity indices like Nikkei & Kospi have been experiencing bubble-like instability (see Exhibit 5 & Exhibit 6)

Valuation and late-stage momentum also say more room to run

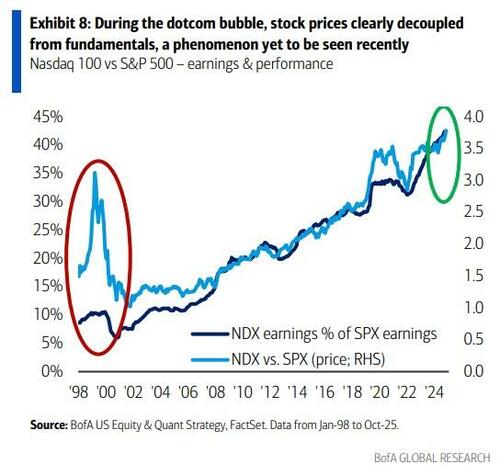

While US tech valuations have risen materially since 2022, they remain below the levels that were seen during the frothiest points of the late ‘90s dotcom bubble (Exhibit 7).

More broadly, the dotcom bubble saw a clear decoupling of stock prices from fundamentals, which we are yet to see in the broader market (Exhibit 8).

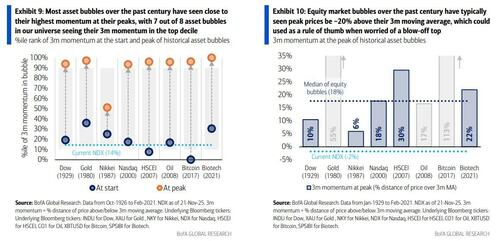

From this perspective, valuations (and hence prices) may still have room to expand. As another indication there may be room to run, US equities/core AI are yet to see the rapid acceleration in momentum typical near bubble peaks. Indeed, seven out of eight asset bubbles within our universe saw nearly their highest upside momentum at their peaks (Exhibit 9), with the subset of equity bubbles (not including Gold, Oil and Bitcoin which are not tethered to “fundamentals”) typically seeing peak prices ~20% above their 3m moving averages (vs approx. -2% in the Nasdaq today; Exhibit 10).

Bubble signs aplenty in 2025 even if not in AI core

Like the growing political polarization, we see a similar divide in the bubble debate. Some argue AI is clearly a bubble about to pop (or maybe it has), while others say no bubble at all. The nuance in part hinges on where you look, and we agree it’s not obvious it’s in the core of US AI stocks. However, we still see evidence of US markets moving towards a more bubble-like state in 2025. Why?

-

One simple observation is that the rise of the Nasdaq since the launch of ChatGPT in Nov-22 is following a similar trajectory (so far) to the period following Netscape’s launch in Oct 94 (maybe just a coincidence?)

-

Fears of a bubble by some sentiment measures are the highest since the GFC. An AI bubble is the #1 risk expressed in our latest BofA Fund Manager survey. Perception of risk (even if irrational) can result in assets behaving as if the risk is real.

-

Our bubble indicator has broadly continued its uptrend in AI-exposed assets since ChatGPT’s launch in Nov-22. It has also shown signs of froth in subsectors such as nuclear and quantum computing.

-

US tech IPOs in 2025 have seen some of their best first-week performance since the late 90s tech bubble.

-

Markets are snapping back from drawdowns at a pace only commonly seen during the 90s tech bubble and buy-the-dip strength is near 100yr extremes, typical of when FOMO dominates.

-

Vol in the US has reset higher in ‘25, despite markets rising (vol up/spot up), with the VIX floor increasing from 12 to 15.

-

Importantly, it was profitable to carry long vol positions in 2025, whether via VIX futures paired with long S&P (which continues to reverse prior years of underperformance), or via the NDX upvar structure we recommended last year.

-

Dispersion, a classic hallmark of bubbles, has continued to rise. This is true both for equal-weighted returns dispersion as well as cap-weighted vol dispersion, which has been higher only 11% of the time since 1995, primarily in the dotcom bubble.

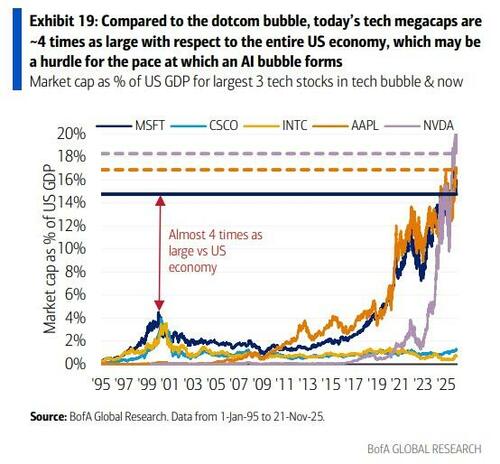

Size, the real risk this time is different

While our base-case is that a larger AI bubble will develop before it’s over, as we first noted in Jun 2024, it may require the market to broaden into a wider and smaller set of AI winners. Large-cap US tech may struggle to generate the instability common in an asset bubble simply due to its sheer size and profitability.

Markets are more concentrated than any time in history, and currently NVDA is worth more than any country in Europe. With earnings forecasts continuing to outpace its share price, it may be difficult for NVDA to decouple from fundamentals in the way the largest stocks in the 90s tech bubble did. For example, if NVDA were to re-rate to Cisco’s peak P/E in 2000 (~200), it would be an $20.8tn company.

The risk would be that a negative surprise in forward earnings expectations cause it to sell-off without ever generating the instability typical of stocks in bubbles.

What about the risk AI doesn’t live up to the hype?

This is the risk we are already in a bubble. Many project a multi-fold increase in demand for AI in the next several years. Jensen Huang, CEO of NVDA, believes we could see $3- $4trn/year in AI spend by 2030, and $5trn/year long-run given its potential to amplify the productivity of the global knowledge economy. In addition, McKinsey (see report) projects ~$7trn of cumulative spending by 2030 on data centers.

However, machines making steady progress towards fully replacing humans is a hot debate in the AI world and key questions remain:

-

To what extent does the projected “double exponential” in token demand (from exponential AI user growth on top of the exponential growth/user as AI becomes more capable at reasoning) depend on progress towards AGI (humanlevel intelligence)? Most believe token demand is coming even if AGI is still far out.

-

Can LLMs (Large Language Models) even get us to AGI, or will new technological breakthroughs be required? While many think new methods are required, they believe we will get to AGI, though the timing is highly uncertain.

The risk is that those currently experimenting with AI are too hopeful on its potential to augment productivity, and the reality is it takes more time to progress, resulting in disillusionment and a material market pull-back.

Again, the risk simply comes back to timing as the implications of achieving AGI or even perhaps ASI (super-human intelligence) are more profound than any technological achievement in human history – and until we achieve it, many will argue it’s just out of grasp. The extreme potential of AI combined with high timing uncertainty will likely leave markets susceptible to bubble-type booms/busts for the foreseeable future.

Navigating bubbles

Timing becomes the biggest risk

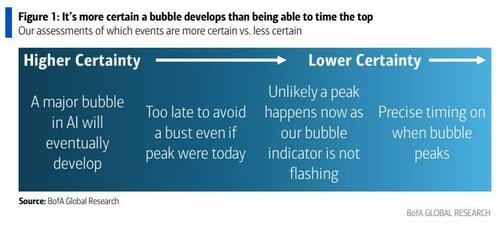

As noted, it’s easier to forecast that an eventual bubble is likely and whether markets are experiencing “bubble-like” behavior than it is to time the top. Bubbles often persist, not because you don’t know you are in one, but rather due to the inability to time the end (as Chuck Prince infamously noted in July 2007). Framing the level of conviction around what’s more and less certain is key to developing a plan for bubble navigation. The fact AI will result in a larger bubble seems most probable. Next, given today’s momentum, history suggests it’s too late to avoid a bust.

The fact the core of US tech has yet to breach the top quintile of our bubble indicator since GPTs’ launch suggesting more room to run would be next, and the least knowable is the precise timing of the top.

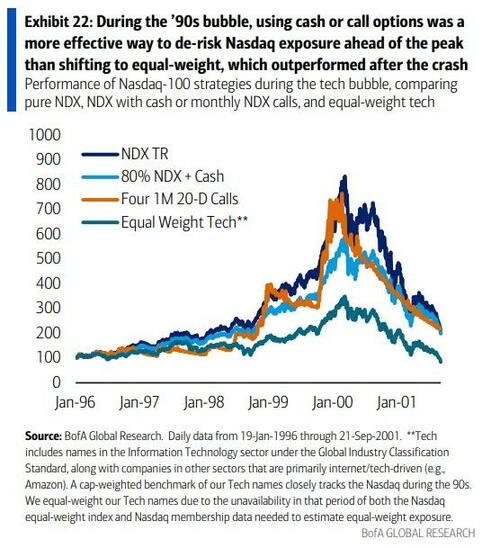

Diversify at your own risk, concentration + cash wins in bubbles

A common reaction to today’s record concentration in US equities and uncomfortable valuations is to seek safety in diversification. However, while this may feel safe, the history of asset bubbles suggests it’s sub-optimal and risky. Assets at the forefront of the bubble tend to outperform until the peak. Hence diversifying away from the leaders is tantamount to calling the top (the riskiest proposition in our view). Staying long the concentration but diversifying with cash or adding a derivatives overlay would have been superior in the late 90s tech bubble (Exhibit 22).

Going back to the roaring-20s, the history of major equity asset bubbles also shows the regions at the center of the bubble tend to outperform global markets (Exhibit 23 - Exhibit 25).

This is why the idea of “peak US exceptionalism” that took off as a theme in 2025 is antithetical to an eventual AI-bubble developing further.

Here's BofA's outlook summarized:

-

AI builds towards larger bubble: Markets became more bubble-like in 2025 & bubbles hard to avoid in big tech booms; timing the top is hard but watching for warnings is key

-

Leverage toxic for bubbles, but not yet: Fear is of toxic leverage in levered/inverse ETFs, but we don’t see it yet; private assets perhaps a risk, but we have a hedge for it

-

Too late to avoid eventual bust: Even though indications suggest bigger bubble before it’s over, the AI boom has come too far to avoid an eventual bust (20%+ sell-off)

-

Tightening financial conditions biggest risk: Kryptonite for leverage; preceded all major bubble peaks. Bond vigilantes are dormant but may not be dead: watch inflation

-

Vol stays supported: Risks rise as bubbles build; markets remain fragile & AI doom debate continues to drive fear, uncertainty & doubt, further inflaming instability

-

Europe still cheap despite outperforming US: Long-term tailwinds like German spend on Defense & infrastructure, record buybacks & pension reform favor risk assets. Poor execution, US exceptionalism, French sovereign stress & geopolitics are main risks

-

Asia seeing bubble-like catch-up but still offers AI upside + value: Korea/Japan seeing bubble-like moves, but value = more upside; AI bubble most room to run in China

Risks to the core view/plausible scenarios:

-

Grind higher as bubble takes longer: Core of US AI so big, earnings so strong, it fails to disconnect from fundamentals. Micro-bubbles boom/bust in the periphery, but too small to cause a market-wide bubble in 2026 & big upside pushed into ‘27 (not unlikely)

-

Realization AI breakthrough needed: Faith in Jensen Huang’s “double exponential” token demand growth prediction stalls; delays AI replacing humans, bear market ensues

Professional subscribers can find the full must-read 71-page research note (including how to trade BofA's 2026 themes) here or via our new MarketDesk.ai portal.