Brutal Start To The Year For Quants

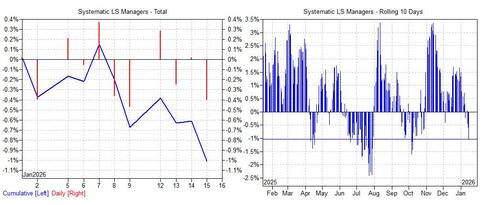

After a strong 2025, the start of the new year has been very challenging for Systematic Long/Short managers, i.e. quants.

As Goldman's Kartik Singhal writes in a note published earlier today (available to pro subs), across the cohort tracked by the bank, performance is down 1% globally YTD (as of Thursday's close). This 10-day drawdown may not sound like much, but it is the worst since early October.

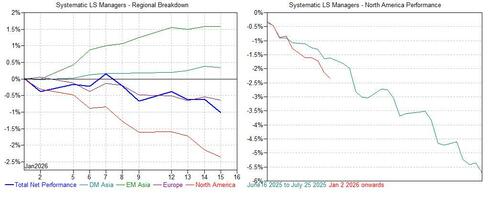

Beneath the headline, the losses have been driven particularly by US equities, with European equities contributing to a lesser extent.

Over the past two weeks, contribution of performance from US Equities stands at -2.4%, a similar pace to the June-July quant drawdown, which besides Liberation day, ended up the worst drawdown of 2025.

While that earlier episode ultimately reached a larger trough (approximately 5.7% from US equities at its worst point), the speed of the decline has been comparable.

In this context, the lack of a broader market swoon suggests globally diversified quant books have been more resilient than U.S.-centric strategies during this drawdown, at least for now.

From a factor standpoint, the pressure has come mainly from from crowded positions (-0.5%), high beta names (-0.5%) and idiosyncratic returns. Momentum has partially offset these headwinds.

The Idiosyncratic drag has been driven predominantly by the short book, similar to the June-July drawdown.

More in the full note available to pro subs.