Bullion, Bitcoin, & Big-Tech Bloodbath Continues; Bonds JOLT'd

"Another violent session," notes Goldman Sachs trading desk...

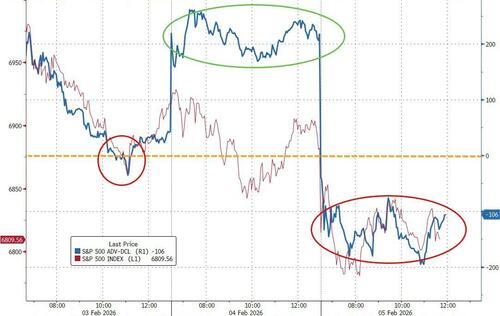

... with all the US majors tumbling (led by Small Caps for a change) after a slew of weak labor market data (Challenger job cuts soaring, jobless claims jumping, and JOLTs plunging). No late-day recovery today... for a change...

Market breadth deteriorated today with only 200 names in the SPX green on the day.

Nasdaq extended losses below its 100DMA (with the 200DMA/No lows around 24,000 ish the next stop for support)...

Momentum showed no signs of recovery from yesterday's meltdown...

...with Goldman's trading desk pointing out that a larger unwind of winners is the pain trade given where nets are in our PB book (89th percentile on 1yr).

Typically, moves like this are from fundamental shifts to the story, however this doesn’t seem like we got that.

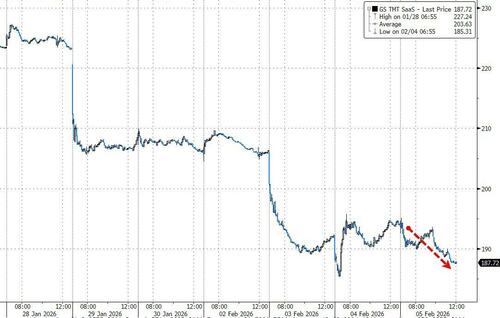

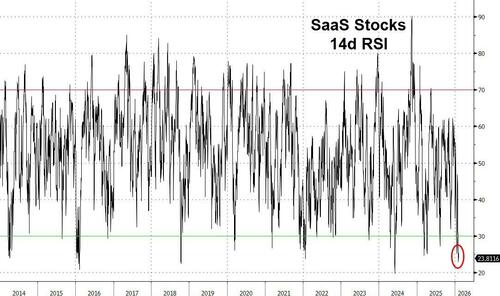

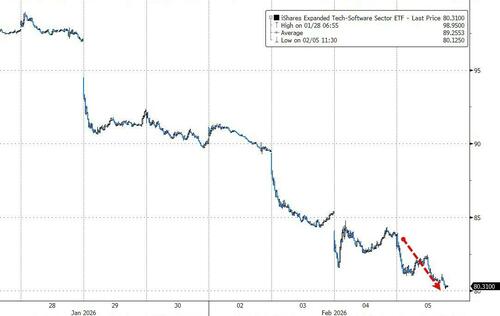

SaaS stocks continued their collapse today legging lower around 1300ET with business services/fins stocks w/data services taking a leg lower on the back of new update from Anthropic targeting fins research.

...to their most oversold since June 2024 (and one of the most oversold levels ever)...

SaaS stocks are now at their lowest since Nov 2023...

The entire Software sector's selloff entered its eighth consecutive session with UBS Aaron Nordvik warning the sector is facing an “unresolvable existential threat."

Putting that in context is ugly...

-

Systematic L/S down 76 bps, worst day since 2nd October 2025, still up 2.5% YTD.

-

Fundamental L/S down 84 bps (alpha: -64 bps), worst day since 13th Nov 2025, now up 2.3% YTD. US-Focused managers down 89 bps and TMT focused managers down 278 bps today.

-

MultiStrats equity portfolios (assuming 4.5x leverage) down 190 bps, worst day since 9th April 2025 driven by momentum sell-off, concentrated longs sell-off and crowded short squeezing. Losses coming mainly from US slice of their book. Now up 3.9% YTD.

High velocity feeling some pain with Bitcoin Sensitive (GSCBBTC1) -765bps, Global Rare Earths (GSXGRARE) -560bps, Non Profitable Tech (GSXUNPTC) -500bps, and Liquid Most Short (GSXUMSAL) -495bps, which are all seeing -1.5sigma moves or greater. Retail Favorites (GSX1RETL) -243 reverting lower after yesterdays session in the green.

After their brief respite yesterday, BDCs were battered again today...

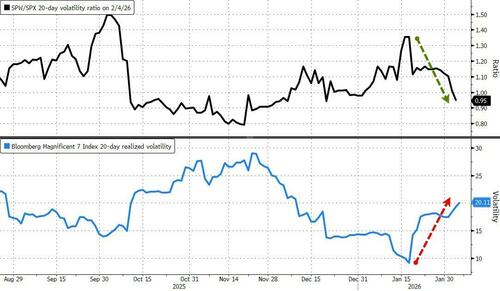

Mag7 vol is accelerating notably which is dragging the realized vol of the equal weight S&P down relative to the cap-weighted...

Today was a 6 out of 10 in terms of overall activity levels and skewed 2.8% skewed for sale across the floor with both LOs and HFs skewed for sale

-

LOs supply most concentrated in industrials, utilities, fins, and energy vs demand in comm svcs, consumer discretionary, and consumer staples

-

HFs are skewed better for sale with supply in macro products, fins, and materials vs modest demand in utes, comms svcs, and industrials

Crash Risk

Before we leave equity-land, here's Nomura's Charlie McElligott with a notable point of concern:

Equities Index Options Market for the first time today began to price in some real discomfort / actual “Crash” -risk, with implied and realized Vols getting jumpy, and vVol showing Tails “bid” on now heightened credibility of much wider distribution of outcomes - especially as the recent “AI disruption” turmoil into legacy over-indexed Tech / Growth / SaaS / Compounders goes viral, having recently spread its “dis-ease” within (Private) Credit / BDCs / PE, which are sitting on big chunks of these exposures at top-tick valuations from (recent) past vintages

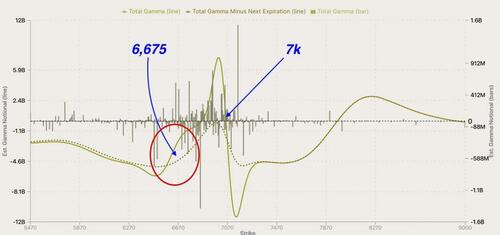

The S&P broke through its 50DMA and tested the 100DMA (6,794)...

When the S&P tagged the 100DMA it found a bid just below 6,800, where Bloomberg's Michael Ball notes a pocket of 0DTE added positive gamma was, helping decelerate the selloff.

The daily pattern is the same: early weakness drives short-dated put and call selling around key downside levels, then position unwinds supporting a better bid into the close.

The net effect is a stair-step lower in the S&P 500.

SpotGamma’s read is that the early day weakness isn’t a fear trade but instead 0DTE traders harvesting elevated premiums, which temporarily creates supportive gamma pockets below that slows declines eventually.

Later, the bounce has been lining up with the closure or reversal of these positions as seen in better call buying. This is why the market can look broken at 10 a.m. and fine by 3 p.m.

The problem is that below roughly 6,900, the longer-term gamma backdrop looks less supportive, so a loss of that 0DTE flow means a more significant drop could easily occur.

That’s why implied vol is creeping higher and no longer concentrated in single names or certain sectors. The VIX curve has been flattening while put/call skew has steepened, showing traders are pay up for tail risk protection.

Key gamma strikes in the VIX have been growing and shifting higher, increasing the risk of a squeeze higher in the vol index if the equity market accelerates to the downside.

VIX saw a 23 handle, the most elevated level since Nov ‘25 and seeing three consecutive days with a >20 handle.

Spit-balling, but what stops the bloodshed in Software?

I dunno, said McElligott...

Buffett in the old days...

maybe Thoma Bravo symbolically doing something (just written up in FT a few weeks ago (“Private equity giant Thoma Bravo eyes software deals as shares fall”)?!

Looking for something to keep it honest...

but sheesh what a bet that would be...

Is capitulation imminent?

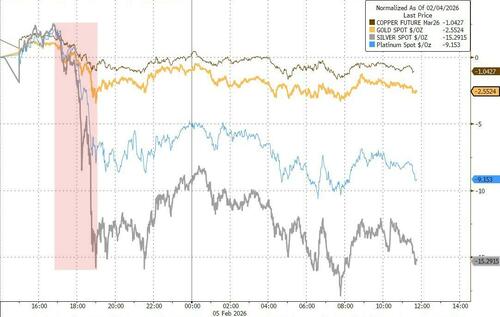

Overnight carnage in precious metals

Goldman's Adam Gillard noted liquidation across base and precious metals on Shanghai, unclear the catalyst - perhaps Lunar New Year risk management (rarely will they hold a position during the week long holiday), or the SHFE margin limit announced post close hinting at increased regulatory focus?

Spec positioning on SHFE gold and silver is back at the lows.

The physical bid remains firm however as MCX (India), SGE and SHFE continue to outperform CMX and LBMA; desk view remains that a significant driver of the blow-off top (especially silver) was China + India competing for physical units (regional basis important at this juncture). GLD reported a 119k oz drop in holdings during Friday’s sell-off; that notional traded was greater than some Mag-7 stocks, but physical length barely moved is bullish IMHO.

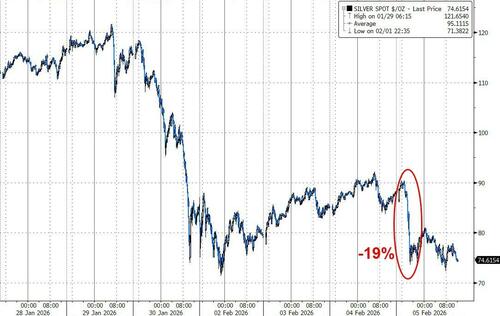

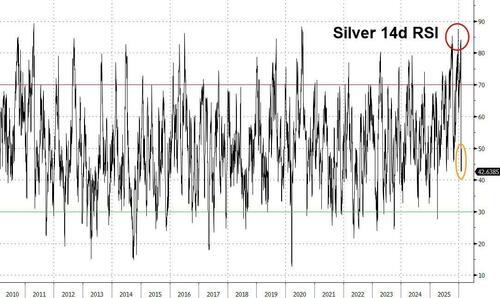

Silver crashed 19% overnight... 19!!

Silver is not 'oversold' yet, but has wiped away scent of being overbought...

Spot Gold tried briefly above $5000 but that was destroyed as China opened...

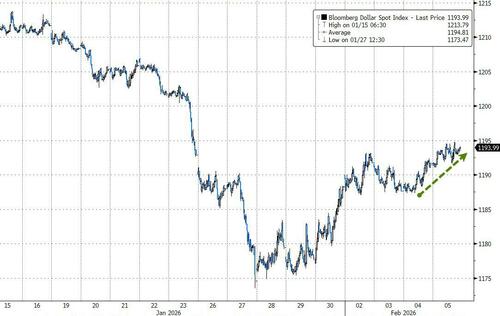

The dollar extended yesterday's gains (helped by dovish holds at ECB and BoE)...

A really ugly JOLTS report sent stocks and bond yields significantly lower at 1000ET, extending earlier declines (finally started to catch down to equity's weakness). The belly very modestly outperformed on the day...

This was the 10Y Yield's biggest daily drop since Nov 2025 (as it broke back below its 50DMA)...

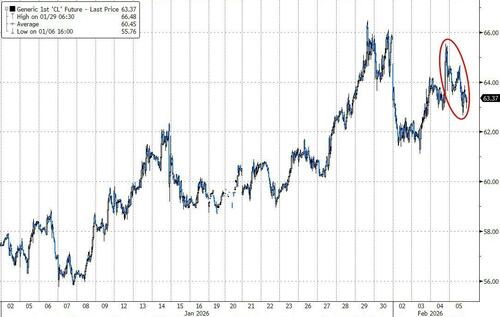

Yields' decline was in line with the drop in crude today...

Crypto collapsed

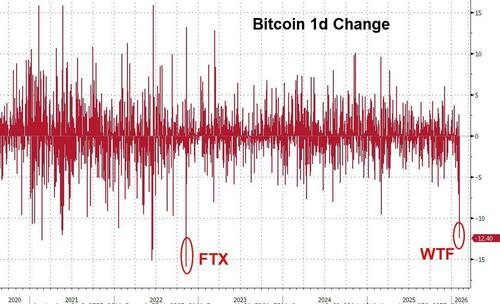

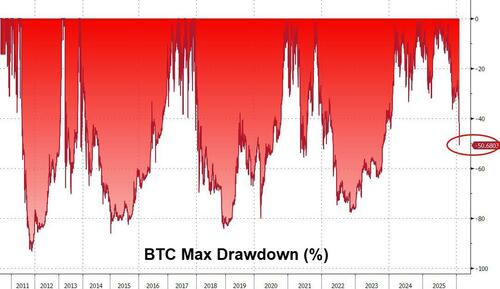

Bitcoin traded back below Trump election lows with a $62k handle today (at the same level it was at in Nov 2021)...

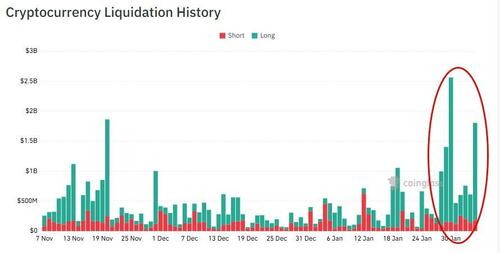

Biggest daily drop in Bitcoin since the FTX collapse... that is a five sigma crash relative to the last three years...

Bitcoin is now down 50% from its highs...

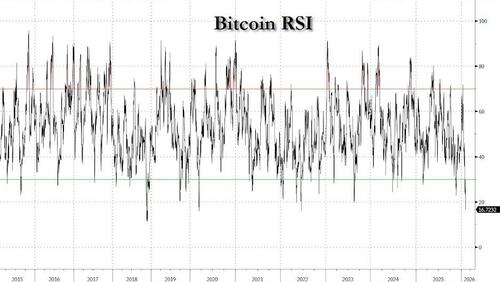

And this latest purge has pushed Bitcoin to 3rd most oversold ever...

Some traders have suggested we are reaching support - judging by the BTC/Gold ratio...

...but to be frank, it's broken every other line of support so far, so why would this one hold?

The one-way nature of the selloff has all the hallmarks of margin calls and forced deleveraging rather than just discretionary risk reduction. CoinGlass data show more than 333,000 traders liquidated over the past 24 hours, with total liquidations around $1.5 billion.

As one wise old crypto player told us: 'feels like this won't stop until all the levered longs are liquidated'.

Finally, and perhaps most notably, WTF happens next?

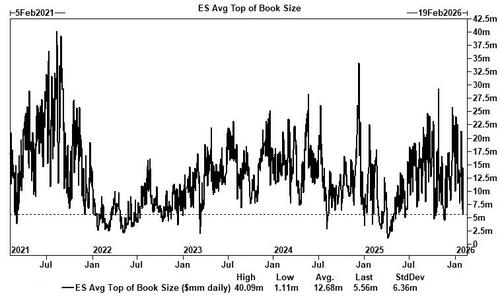

Liquidity is evaporating from the US equity market and Metals volatility is just too damn high...

Extreme moves this week, as the intraday swings in single stocks have led to unease amongst investors...

Goldman's trading desk thinks the large moves in the market will continue with liquidity drying up at the futures level.

Goldman's metals traders have a similar view as they pointed out that they went home flat last night, frustrated that gold had bounced so quickly off $4,650/oz and they'd missed it, then they wake up to silver 10% lower on nothing.

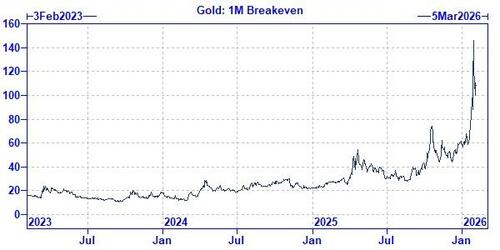

The lesson: it's hard to hold significant length whilst 1M gold breakeven is still >$100/oz

Although we are starting to see selling from vol funds + macros; we need to see 1M ATM sub 30% for significant directional re-engagement given the amount of pain likely under the hood.

Their desk view is vol needs to drop before they re-engage. They remain bullish medium-term but need to see 1M LBAM <30% (33v last) and 6M around 23% before we put on significant length.