Bullion, Bonds And Crypto Jump, Banks, Brent And Tech Dump Whipsawed By Brutal Market Rotation

In many ways today's action was an extension of yesterday's rotating roller coaster.

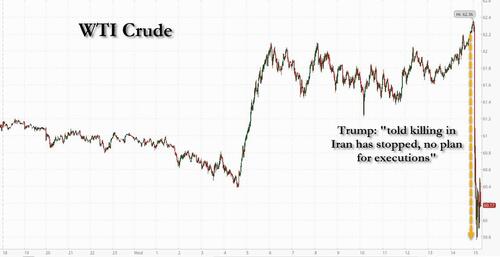

While yesterday attention was focused on Iran and European tensions amid the raging geopolitical chaos, today attention turned to Greenland, as negotiations between the US and Denmark/Greenland kicked off officially, while Iran loomed in the periphery, with everyone expecting Trump to launch an attack, when late in the afternoon Trump appeared to de-escalation tensions a bit when he said that he had been "assured that Iran would stop killing protesters." Markets immediately took that as a signal he could hold off on a threatened military response to the repression of widespread demonstrations in the nation, which in turn sent oil plunging red on the day after earlier hitting a 3 month high...

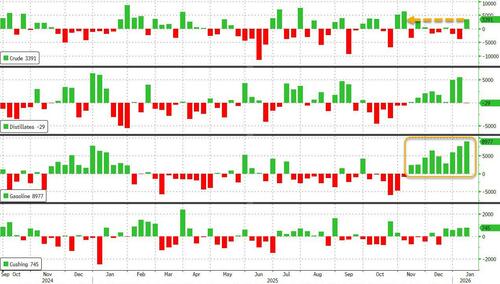

... as attention turned to the fundamental glut which saw not only the biggest crude build in 2 months but the biggest gasoline build in over 2 years, according to the EIA.

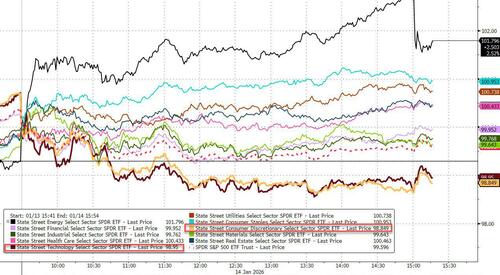

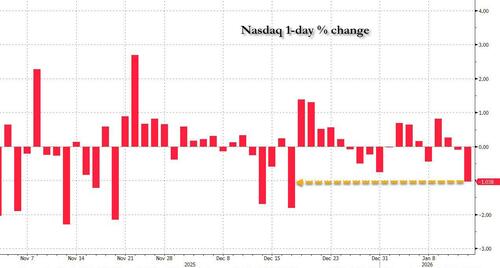

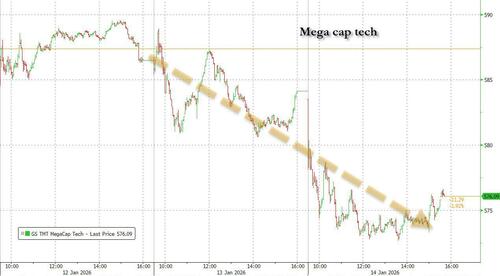

Geopolitics aside, markets ticked lower for much of the day, albeit closed well off session highs, with another day of headlines, earnings, and a potential IEEPA ruling (that did not come today). The ongoing painful rotation that has seen investors bail from tech....

... in favor of more economically sensitive industries picked up speed, sending the Nasdaq 100 to its worst drop in a month...

... while lifting the majority of companies in the S&P 500. While the S&P 500 fell 0.5%. Its equal-weighted version added 0.4%, while the Nasdaq 100 slid 1.1% and the Russell 2000 rose 0.7%.

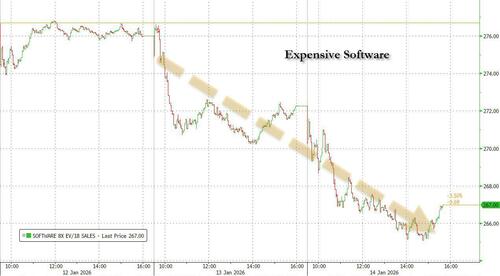

Amid today's rotation, Goldman's desk writes that standouts include Expensive Software (GSCBSF8X) -2.3%...

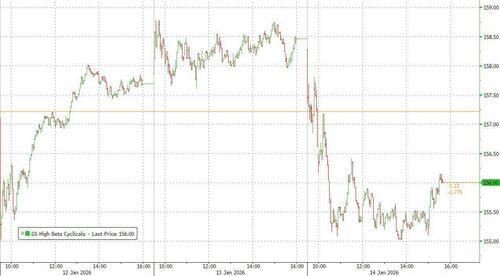

... High Beta Cyclicals (GSXUHBCY) -2%...

... and Megacap Tech (GSTMTMEG) -1.9% at the bottom of the pack.

In a note titled “Not as Bad as It Looks,” Steve Sosnick at Interactive Brokers says a deeper look shows a more mixed market than the declines in major indices might indicate.

“This is a demonstration of what occurs when rotation affects the stocks that dominate key indexes,” he said.

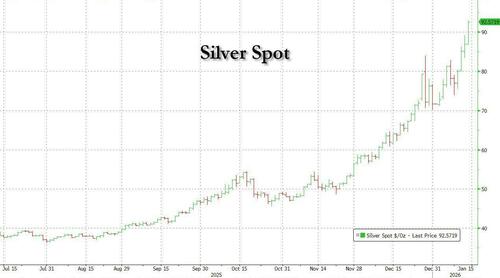

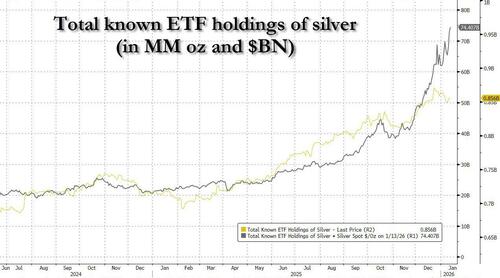

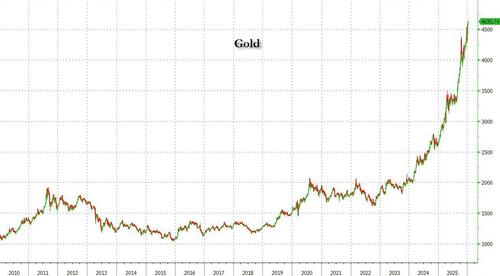

As tech sold off, metals continued their melt up to record highs (copper, tin, etc), while silver rose another 5% to trade above $92...

... as hedge funds chase the precious metal via ETFs...

... while gold (+95bps) is also flirting with all-time highs.

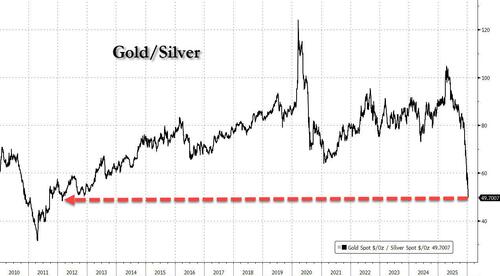

Today's move pushed the Gold/Silver pair lower by more than 2 turns, dropping from 52x yesterday to below 50x for the first time since February 2012.

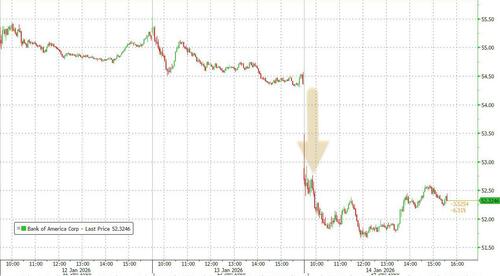

Another big story of the day is the continued rout in banks: yesterday it was JPM (which missed on underwriting fees and Jamie spooked investors with credit card cap commentary) and today it was Wells and Bank of America, which also missed on underwriting fees and also spooked investors with its credit card cap commentary, despite reporting generally very strong results.

As Goldman, which is on deck to report, writes while the reports have been mixed, the performance in the market has consistently been weak, with BAC -4.8%, WFC -5.2%, and C -3.9%....

... and adds that "it feels like headlines on credit card interest caps have spawned skepticism and subsequently, outflows within the sector." Here are the main highlights:

- BAC (+/=): 4Q results look solid led by a 1.5% beat on NII alongside a beat in trading. Big focus here is on the guide, and the worry/debate was on FY26 expenses. They project 200bps of operating leverage in 2026, which seems good enough. Ultimately, better than expected NII alongside promising 200bps of operating leverage should be well received (spoiler alert: it wasn't)

- WFC (=/-): Soft print, 2026 NII guide not as bad as feared. They’re telling us $50bn in FY26 NII, which is smack in line with Visible Alpha consensus. The FY26 expense guide is about ~1% better than expected too, so in the context of positioning right now, the stock seems fine to us, and would go so far to say there’s a world any weakness on 4Q miss gets bought.

- C (=/+): Messy quarter, good NII guide may be enough in our view. The focus is on the guide here, 1) they’re saying NII ex markets in FY26 to be +5-6%, consensus in the ~3% range, 2) credit guide implies trends look solid, 3) they’re saying ~60% efficiency ratio in FY26, which is slightly better than consensus. Overall, C is one of the more crowded names in the Financials community, and trend past couple of days has been money coming out of Financials though C has held up despite having card exposure.

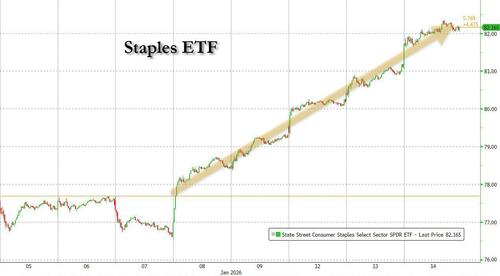

Finally, the staples squeezed again: XLP has traded +7% over the past 5 sessions. Which makes sense since staples were the most sold sector per Goldman Prime Brokerage data last week, so this move higher is likely a squeeze/reversion, along with strength in some of the larger cap names and solid earnings from SMPL and STZ.

Bonds were bid for a second day, with the only difference from yesterday is that the belly/long end outperformed, while the short-end trailed.

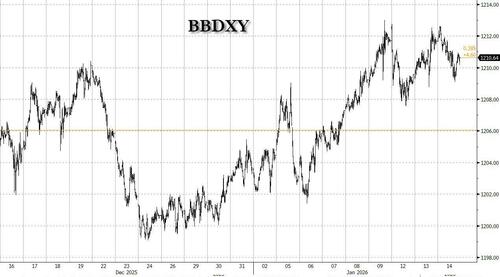

The dollar was choppy on the day but ended slightly lower, though still near a one month high.

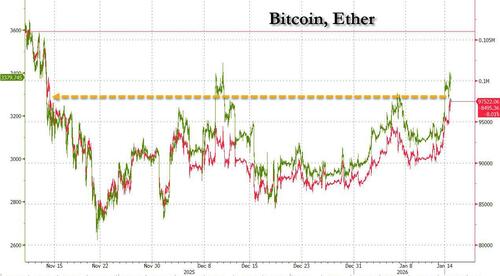

And while it had been left in the dust for much of the past two months, crypto continued its recent big move, with Bitcoin rising to a two months high of $97,500 and set to break above $100,000 on short notice.

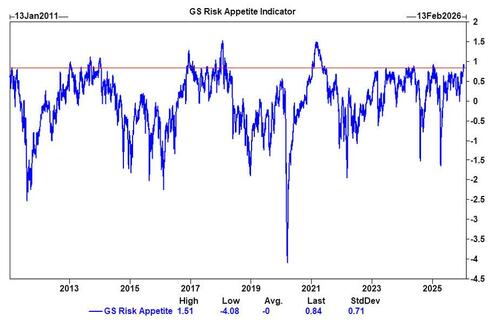

And while some are looking at the recent weakness as an "all clear" signal in the market, keep this in mind: Goldman's Risk Appetite Indicator is now at 0.9, a 96th percentile reading looking at historical data and the highest level since the start of 2025.

Optimism in global growth has surged, and this move has been apparent within the US cyclical complex, namely looking at the outperformance of the Russell 2000 vs. the Nasdaq Composite at the largest on record. In short, while rotations out of tech and into small caps may continue, the broader market remains priced for perfection.

Finally, another potential red line: after the VVIX topped the 100 "Maginot Line" suggesting someone (well more than one) is buying upside vol protection, "setting the table” for acceleration flows to the downside into a Spot Eq selloff / modest Vol squeeze as per Charlie McElligott, today the VVIX rose another 4 points to a two month high of 104.73.

* * *

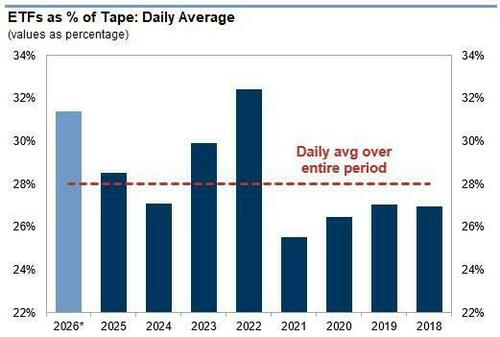

Bonus chart from Goldman's ETF desk: the bank points out that elevated ETF volumes (traditionally a short hedge to broader market selloffs) have been a common theme to start the year, including today with levels at 38% of the tape vs the 28% average. Looking on a year-by-year basis, the daily average of ETF as percentage of the tape has been elevated in 2026 YTD relative to previous years.