Buypolar: Latest Wall Street Survey Finds Record Number Say AI Is A Bubble, As They Pile Into Stocks

While regular readers are well aware that our views on the monthly Bank of America Fund Managers Survey are that it is a noisy, useless echo chamber devoid of any signal, in which respondents say whatever they think they should (so as not to offend someone?), not what they actually believe or do, and is therefore at best a contrarian indicator to be faded, the October Fund Manager Survey which was conducted between Oct 3 and 9 was especially useless as it took place right before the violent sentiment reversal last Friday, Oct 10, when with one social media post, Trump sparked trillions in losses (which were then promptly recovered over the weekend amid another follow up de-escalatory post).

So having discussed how especially useless this particular FMS is, here is what survey organizer Michael Hartnett found after he polled the 193 panelists who somehow manage $468 billion in (echo chambered) funds.

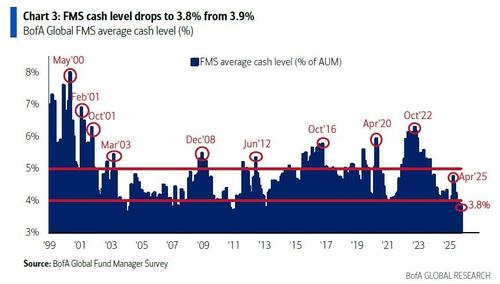

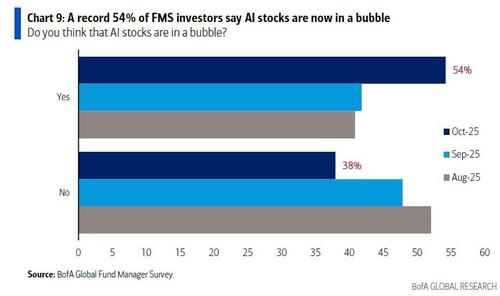

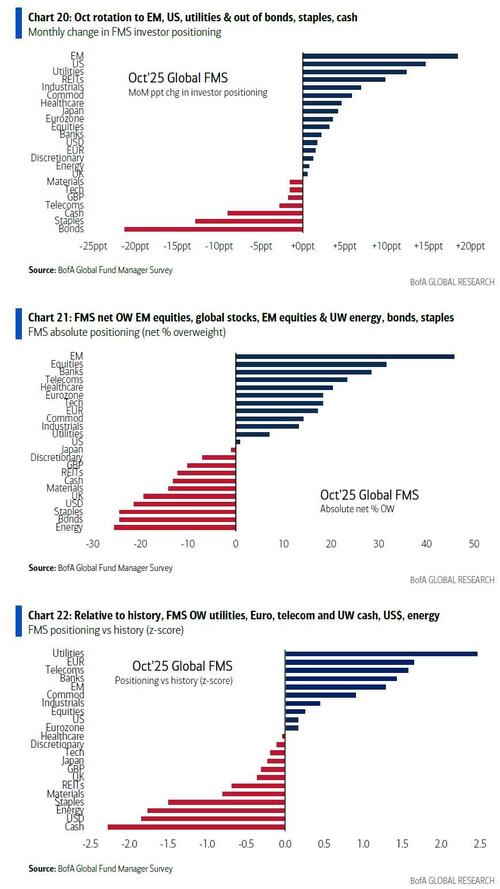

According to the October FMS (available to pro subs in the usual place), investor sentiment was the most bullish since Feb’25; stock allocation were at 8-month highs, and while bond allocations were lowest since Oct’22, FMS cash levels were even lower, at a paltry 3.8%. Adding to the sentiment, liquidity conditions were rated best since Sep'21 (although one day later all this would change), and yet the full-bull sentiment was tempered by growing concerns of private credit event and AI bubble. What is most ironic, however, is that while a record number of respondents said AI was a bubble, and stocks have never been more overvalued, Wall Street professionals have rarely been more invested in the same stocks they admit are a bubble.

No wonder the title of Hartnett's latest monthly FMS report is Buypolar.

We urge readers to go through the latest report at their own leisure to pick through the nose-bleedingly stupid contradictions which prompt some to ask just how did 90% of Wall Street professionals get their jobs, but here are some of the highlights we would like to point out:

On Asset Allocation

On the one hand, investors are the most underweight cash since Dec'24 (as Hartnett notes, average cash levels declined from 3.9% to 3.8%.; the “sell” signal for BofA Global FMS cash rule was last triggered in July when cash fell from 4.2% to 3.9; note FMS cash level at or below 3.7% is a hard “sell” signal)...

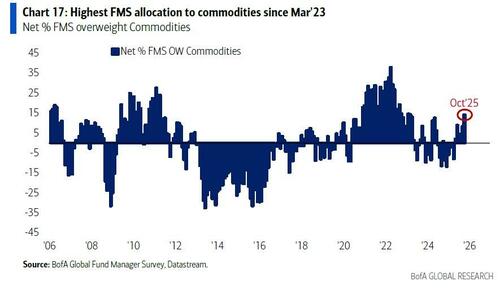

... most are overweight commodities since Mar'23 (net 14% are overweight a 6% rise to highest allocation since Mar'23.)...

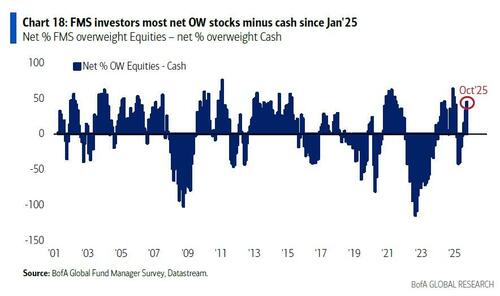

... and most net overweight global stocks since Jan'25 (at 45% net, some 32% of FMS is net overweight stocks while 13% are net underweight cash).

On the other hand, a majority - and record - 54% of investors say AI is a bubble...

... and an even higher record 60% say global stocks overvalued!

That, however, doesn't stop Wall Street's FOMO-frenzied crowd to chase returns even though they know it will end badly.

How does on reconcile this glaring contradiction? Well, one can't, although it appears that the prevailing belief on Wall Street is that everyone will be able to sell just before the bubble bursts. Spoiler alert: that will not happen.

On Macro & Policy

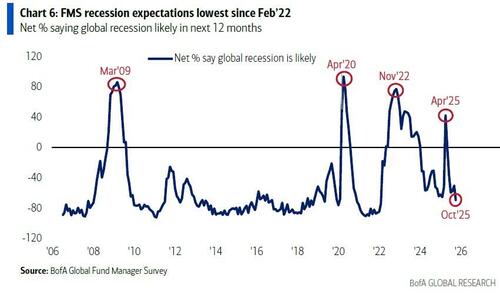

Global recession concerns at lowest level since Feb'22 (net 69% say global recession is unlikely. In Apr’25, a peak net 42% of FMS investors said global recession was likely, showing you just how useless prevailing consensus on Wall Street truly is)...

... biggest 6-month surge in growth optimism since Oct'20 (The net share of FMS investors expecting a weaker global economy declined in October to 8% from 16%, it was 82% in April, and the gap between the price of US stocks and the FMS global growth expectations is narrowing)

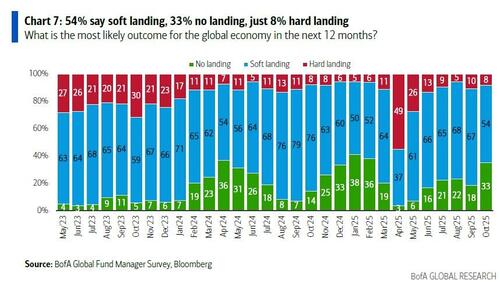

... and expectation of soft landing 54% vs. no landing 33% and hard landing 8% (Note the jump in “no landing” expectations (+16ppt) in October is the largest on record since the survey question was introduced in May’23.)

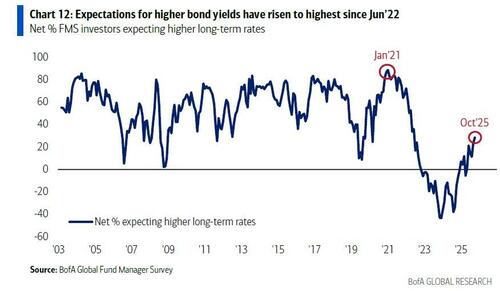

... why the number of investors forecasting higher bond yields now is highest since Jun’22.

Of course, it will surprise no one at all, just a few days after this survey was taken, the 10Y yield tumbled below 4%, the lowest since the April liberation day.

On Risks & Crowds

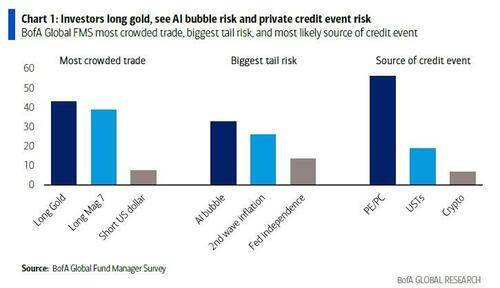

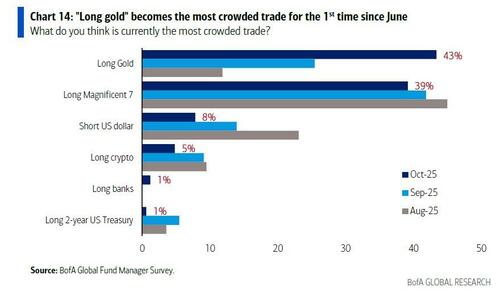

And here is where the wheels of the echo chamber bus really come off: on one hand, for the first time ever, respondents believe that the #1 most crowded trade in October is “long gold” (43%)....

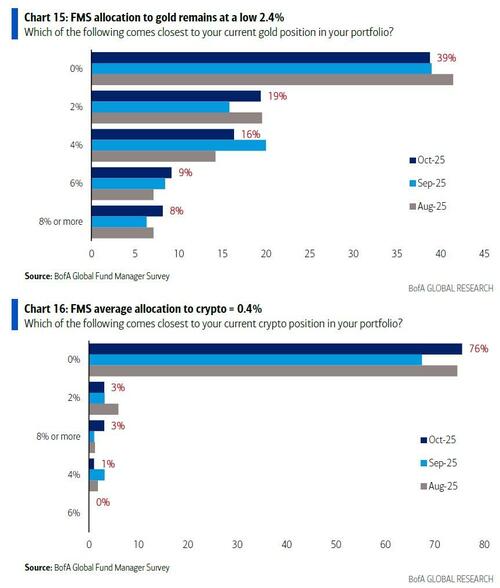

... which is especially absurd because in the very next question, they admit that they don't own any of it: to wit, when asked about allocation to gold, a whopping 39% of FMS investors said their current gold position is closest to 0%, while 19% have a 2% allocation, and 16% have a 4% allocation. As Hartnett calculates, the weighted average FMS allocation to gold is just 2.4% (4.2% among FMS investors who are allocated to gold). In other words, gold is by far not the most crowded trade. And, tied to that, the average allocation to crypto is much less than that: the weighted average FMS allocation to crypto is 0.4% (4.9% among FMS investors who are allocated to crypto).

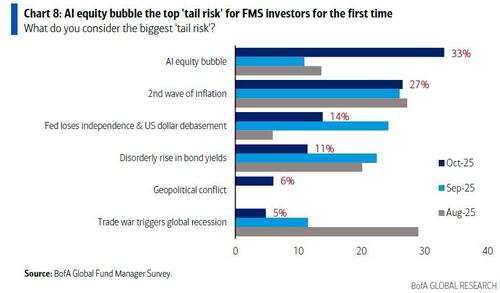

Yet while paranoid Wall Streeters are obsessing over how much gold their neighbor has bought, they are for once correct that the #1 tail risk is “AI bubble (33%)...

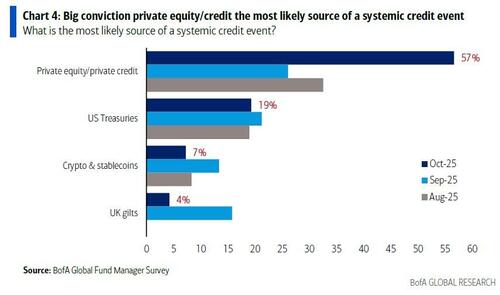

... and enough of the respondents have read about the recent bankruptcies of Tricolor and First Brand to conclude wisely that the #1 systemic credit event source is now seen as “private equity/credit” (which surges to 57%)...

... and yet despite a record number of Wall Street pros replying that AI is a bubble, and despite an even greater record number seeing stocks as the most overvalued ever, the latest FMS positioning shows investors see returns outweighing risks, as the equity allocations rose 4% to a net 32% overweight, the highest since Feb’25.

Contrarian Trades

Realizing just how stupid the FMS survey has become, Hartnett - perhaps on the verge of giving up - musters what little signal he can, and says that based on FMS positions, the best contrarian trades for Oct are: long bonds-short stocks, long UK-short EM, long staples-short banks, long energy-short industrials.

More in the full FMS report available to pro subs.