The "Canary In The Coal Mine" Just Froze: Here Is What Is Really Happening At Blue Owl

Back in November, when following investor outrage Blue Owl abandoned its plan to merge its OBDC II fund with a publicly traded vehicle which would result in losses as high as 20% for some investors, CEO Craig Packer appeared on CNBC and tried to clam fears by saying "there is no emergency here. (2:47 into the interview)."

As it turns out, there was an emergency because as we reported earlier, Blue Owl Capital - with $307 billion in assets under management - just permanently halted investor redemptions at its retail private credit fund, OBDC II.

But since there is also a lot of confusion, we will provide a more detailed analysis of what actually happened, using a report published this morning from Barclays (available to pro subs).

Blue Owl's (OWL) announced a $1.4bn sale of private credit assets – including a material number of software loans which readers will recall sparked the latest panic surrounding the private credit sector (as discussed in "Private Credit Stocks Crash After Shock Report Reveals Huge Exposure To Collapsing Software Sector") – just below par, which according to management is positive for the credit of its BDCs.

1. The good

Addressing the positive aspects of the transaction first, Barclays notes that this was not a forced sale, and provides some strategic clarity to two (OBDCII and OTIC) of the three BDCs that participated in the sale. Proceeds will be earmarked to reduce debt and leverage of the BDCs, as well as fund OBDCII redemptions as it nears the scheduled end of its lifespan as an investment vehicle. Since the largest sector represented in the portfolio is software, it reduces the exposure to a sector facing AI disruption uncertainty (even if it does nothing to ease fears about the quality of software assets that is in large part behind the recent SaaSpocalypse).

One of the three selling BDCs, Blue Owl Capital Corporation II (OBDC II), which is also in the spotlight today as investors will no longer be able to redeem shares on a quarterly basis, and which instead will return capital through periodic distributions funded by loan repayments, asset sales or other transactions - has actively been considering strategic options to provide liquidity to its investors given its status as a finite life private BDC. In Barclays' view, this transaction is a step toward winding down OBDCII (selling $600 million of assets), given management said it will distribute about 30% of its NAV to shareholders this quarter with sale proceeds.

Another fund, Blue Owl Technology Income Corp (OTIC) has no IG bonds and is a private perpetual BDC, but recently experienced a sharp increase in investor redemptions at 15% of NAV in 4Q 25. Here Barclays believes that this portfolio sale by OTIC (selling $400 million) materially enhances its financial flexibility to deal with potentially continued investor withdrawals. OTIC said it will use proceeds to pay down debt, and it expects to have cash, undrawn debt capacity and liquid loans in excess of $1.6bn as of January 31, 2026. For context, the 15% drawn on OTIC's NAV last quarter was $0.5 billio , illustrating its capacity to handle potential additional outflows which after today will almost certainly come.

The third selling BDC is Blue Owl Capital Corp (OBDC), also selling $400mn, which is Blue Owl's largest publicly traded BDC (and therefore does not face redemption risk). While questions will linger why this third fund is also selling assets since there is no redemption risk, the silver lining is that the sale will reduce pro forma leverage by 0.05x (1.19x net debt/equity at 4Q25 vs. 1.22x at 3Q25). According to Barclays, the portfolio sale only represented 2% of OBDC's total investment commitments, but still increases confidence in some of its marks, modestly diversifies the portfolio and enhances liquidity.

The biggest positive from today's transaction to the Blue Owl complex is that it reduces portfolio uncertainty. Blue Owl said the assets were direct lending investments sold through separate definitive agreements to four leading North America public pension and insurance investors. The purchase price of the portfolio was 99.7% of par value as of February 12, 2026. Management (and Barclays, which has an Overweight rating on OWL stock) believes that this should increase confidence in the fair value marks of the assets owned by Blue Owl's BDCs. As a reminder, ever since last summer's turmoil involving First Brands and Tricolor, is that private credit loans are wildely mismarked by asset managers, and as such any "clearing event" that provides comfort in the market should be viewed as positive.

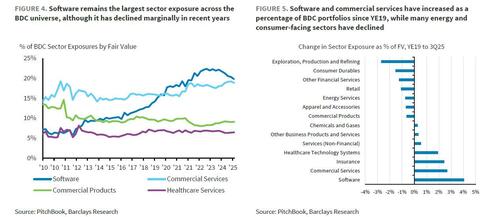

Blue Owl expects the settlement of the sale to be completed this quarter. One concern is that the largest industry represented in the portfolio being sold is internet software and services, at 13% of the total (more on this below). Dumping software loans may boost some confidence in Blue Owl's balance sheet but will only inflame concerns about the underlying fundamentals of the Software space (and how it is funded). After all, with the Software sector losing $1 trillion in market cap in recent months as a result of AI disruption fears, any incremental event that derisks exposure to software is unlikely to be viewed positively by the market. Understandably, Barclays believes that demonstrating liquidity for private credit software loans is a positive for OWL's BDCs, as well the BDC sector more broadly (albeit less direct), given software is the largest sector exposure in the BDC industry, as we noted earlier this month (as an aside, it is likely that most if not all, of the loans sold are private credit assets, as opposed to broadly syndicated loans (BSLs).

As we noted earlier, Goldman echoed much of this sentiment, stating that it is positive for the BDCs to be selling loans at/near par, while using proceeds to delever / buy back stock (OBDC bought back stock at ~86% of book from Nov – Dec). Additionally, Goldman hammered the mismarking angle, saying that this is a positive "proof of concept" that the marks are in a good place (particularly software, the largest industry in the sale), although this is offset by FPAUM getting impacted (although considering where valuations in the sector are, what matters is durability/quality/question of underwriting rather than small movement in mgmt fees).

2. The Bad

Increases Interconnectedness

Perhaps the biggest negative aspect of the deal is that, according to Barclays, at least one of the insurers that is taking exposure to the portfolio through the sale is Kuvare, a life insurer owned by OWL... which effectively makes it a related party transaction (!), and eliminates much if note all of the "mark clarity" provided by the clearing event. Blue Owl disclosed that "some of the Institutional Investors [ie, the buyers] are investors in funds managed by affiliates of the Company’s investment adviser." This means that the assets being sold will go into CLOs managed by OWL, the rated liabilities of which potentially will be (or already are) purchased by Kuvare. Translation: out of one Blue Owl pocket, and into another (as an aside, life insurers are large CLO buyers because they are capital efficient instruments for them, so this would not be an unusual aspect of the transaction).

Understandably, Barclays is quick to address the immediate investor outcry that this is a not an arms-length transaction, writing that "having an affiliate be part of the purchaser group is consistent with an arms-length transaction (OWL owns Kuvare, OWL does not own the OWL BDCs)", and while that may be correct theoretically, the optics are terrible. Worse, Barclays writes that this could establish a template that other private credit managers could follow given how interconnected the insurance and private capital industries have become. As such, the Blue Owl deal could become a precedent because many private credit managers either own or are affiliated with an insurance company.

The immediate risk here, potential accounting issues aside, is that if similar transactions are repeated frequently, it would deepen the ties between these two parts of the non-bank sector, which could make it more difficult to track the risk. And it would add additional leverage to private credit assets, given BDCs lever their equity about 1x and CLOs lever theirs 9-10x. The issues of interconnectedness and higher leverage throughout the financial system are not the subject of this report, but were addressed in some level of detail in another recent Barclays report, available to pro subs (see Risks and Opportunities of NBFI Lending).

Blue Owl Deal Absorbs Scarce Secondary Demand for Private Credit Assets

While it is unclear how deep the secondary market for private credit assets is, to the extent demand is relatively scarce, a transaction of this size could dry up market liquidity. If that assumption is true, other BDCs looking to exit portfolio investments could be jeopardized. Recall the immortal line from Margin Call: "Be First, Be Smarter, or Cheat."

Well this could very well be Blue Owl's "Be First" moment... "Sell it all, today." Of course, it may be the case that the secondary market is only deep for higher quality private credit assets, like the ones in the portfolio OWL is selling. For example, OWL said all of the $1.4bn of assets it intends to sell were rated the highest quality based on its internal measure of risk (all 1s or 2s on a scale of 5), although that is like Jeffrey Epstein auditing himself, and finding he did nothing wrong. Here even Barclays concedes that if this transaction dries up secondary liquidity for private credit assets (or proves that the bid is only there for higher quality assets), it could be negative for other BDCs exploring portfolio sales, namely NMFC, which has said it is pursuing the sale of $500mn of its portfolio (17% of total investments as of 3Q25).

Why Were OCINCC and OTF not in the Seller Group

Blue Owl manages several BDCs and only three are participating in the portfolio sale. Excluded were OWL's largest BDC, Blue Owl Credit Income Corp (OCINCC), and its publicly traded tech-focused BDC, Blue Owl Technology Finance Corp (OTF). One way of looking at the deal (the optimistic one) is that it is not negative that OCINCC was not in the selling group because it does not need to sell assets for liquidity or financial flexibility purposes (redemptions have been moderate). OCINCC may also have voluntarily chosen not to participate in the portfolio sale because it is currently under-levered (0.8x gross, 0.7x net as of 3Q25), using the assumption that some proceeds would have been earmarked for debt reduction.

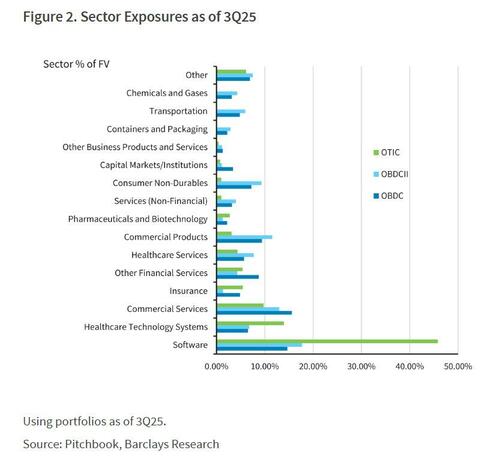

At the same time, the exclusion of OTF could be reviewed more negatively by credit investors, given its high software concentration (55% of its total portfolio by fair value at 3Q25) and wider unsecured spreads. In other words, some may view this as a missed opportunity for OTF to reduce its portfolio concentration (in a sector deemed risky by investors) through an risk-transfer on economic terms, sale given the par bid for the assets at the other three BDCs. The worst way to view OCINCC's absence from the selling group is that there simply was no demand for its software loans at prices anywhere near to where they are currently marked. In light of the recent turmoil in the space, this is hardly inconceivable.

3. Asset Sale Details

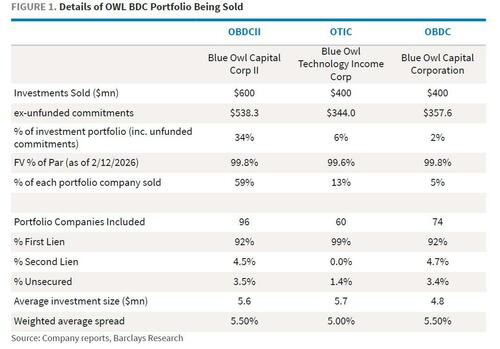

Blue Owl announced its agreement to sell $1.4bn of direct lending investments across three BDCs at 99.7% of par value as of February 12, 2026, including $600mn from Blue Owl Capital Corp II (OBDCII), $400mn from Blue Owl Technology Income Corp (OTIC), and $400mn from Blue Owl Capital Corp (OBDC). This represents 34%, 6%, and 2% of total investment commitments at each BDC, respectively, and includes unfunded commitments. Unfunded commitments make up 11.4% of the $1.4bn sale.

- Each asset sold reflects a partial exposure to an individual portfolio company, rather than a full exit.

- The assets sold across the three BDCs span 128 portfolio companies across 27 industries, with internet software and services (13%) being the largest exposure. This is consistent with sector allocation in the BDCs' overall portfolios, with software representing 11.1% of OBDC's investments (as of 4Q25) and 12% of OBDCII's investments (as of 3Q25)1 .

- The assets are primarily first lien, with 97% consisting of senior secured debt, and an average investment size of approximately $5mn.

- 100% of investments sold by each BDC were rated a 1 or 2 on Blue Owl's internal 5-point ratings scale, with 1 representing the strongest credit quality. The flip side is that one can view the 2% and 6% reductions, respectively, to OBDC and OTIC's higher-quality assets as materially diluting their overall portfolio quality (ie, there is the risk that the remaining portfolio is much lower risk than the portfolio being sold).

Use of Proceeds

OBDCII plans to use proceeds to pay down secured revolving credit facilities and to pay a special cash distribution of up to 30% of NAV as of December 31, 2025. OBDCII has also terminated its dividend reinvestment plan, and will pay the special dividend and its regular dividend in cash. OBDCII said it will replace tender offers with quarterly return of capital distributions, which likely will be larger than tender offers, which are typically capped at 5% of NAV. OBDCII said these distributions may be funded by earnings, asset repayments, other asset sales or strategic transactions. OBDC expects the sale transaction to reduce leverage by 0.05x (1.19x net leverage as of 4Q25), and OTIC plans to pay down indebtedness.

4. Which Assets are the Funds Selling?

The high level information provided about the portfolio sales does not allow to say with certainty which assets are being sold from each BDC's investment pools. However, because of the elevated attention placed on BDC software exposures in recent weeks, Barclays evaluated whether portfolio exposures at these Blue Owl BDCs had outsized sector concentrations. The technology-focused fund unsurprisingly stands out as having the most meaningful software exposure, at over 40% of fair value as of 3Q (Figure 2). It would not be surprising if in its portfolio reconfiguration, Blue Owl attempted to manage exposures away from this sector across its funds given the elevated degree of scrutiny that the investor base is placing on software investments, i.e., it sold as much Software as it could. Confirmation will come in time.

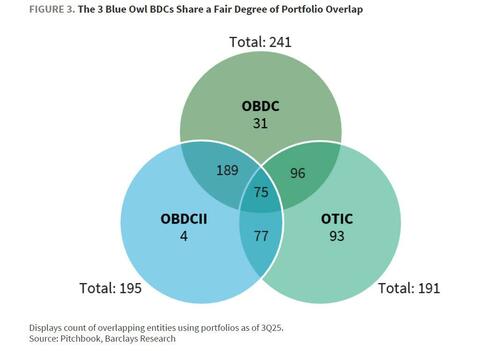

Beyond just sectors, we can evaluate the portfolio overlaps among the Blue Owl BDC funds in an effort to show where these asset sales may be concentrated. Across the three funds, there is a high degree of overlapping positions. The next chart displays the count of unique entities within each BDC's portfolio, and which of those it shares with the other two funds.

Because of the coordination that is likely required to manage a complex asset sale across multiple funds in unison, Blue Owl would likely attempt to target similar exposures across its three portfolios (ie, the bullseye of the Venn diagram above). To determine which investments this may affect, Barclays listed the twenty largest entity exposures (by aggregate amortized cost) across the three funds in Figure 4.

We will have to wait for more public disclosure to ascertain whether the bulk of Blue Owl's asset sales took place across the Software sectors in order to "destigmatize" the associated portfolios.

We conclude with some bearish client feedback that Goldman Financial Specialist Christian DeGrasse shared this morning regarding the Blue Owl transaction:

- The deal impacts OWL’s fee-paying AUM (FPAUM) and thus the company's base management fee & Part 1 fees (the $1.4bn loan sale is estimated to impact firmwide revenue by ~1%), though more OBDC II runoff in future could continue to weigh slightly. A bullish counter here, from Barclays, is that considering where valuations in the sector are, what matters is durability/quality/question of underwriting rather than the modest reduction in management fees.

- Concerns that Blue Owl is cherry-picking the best loans, leaving only the lower rated, and thus more difficult to liquidate, loans on the books.

- We don’t know the duration on these loans – a great point here from Goldman that credit spreads have mostly tightened over the past few years, so shouldn’t these loans be sold at above-par

- Today's sale may indicate even higher redemptions are coming (as noted above, the big non-traded BDC OCIC is not participating in the loan sale so not a read through there, but perhaps at OTIC?)

- Some are wondering whether OWL’s own affiliates participated - and indeed as noted above, at least one of the insurers that is "taking exposure to the portfolio" (i.e., buying loans) through the sale is Kuvare, a life insurer owned by OWL... which optically makes it a related-party transaction.

- Goldman is getting a lot more inbounds from the macro community about gating redemptions OBDC II (they are saying they’ll return capital through distributions funded by loan repayments, asset sales or other transactions)

Looking ahead, the debate around OWL will focus on the company’s earnings growth profile, which remains in part dependent on direct lending (as well as the final close of OWL’s GP Stakes flagship, upcoming digital infrastructure flagship, and growth in new wealth vehicles like ODIT and OWLCX). Barclays is keeping a close eye on OCIC, a significant FRR contributor, which should report February gross inflows next week and Q1 redemptions in a few months.

Finally, an apocryphal anecdote from George Noble who reminds us that Blue Owl's co-CEOs have pledged $1.9 billion of their own company shares as collateral for personal loans - proceeds used, in part, to acquire the Tampa Bay Lightning.

The stock is down 33% this year (and much more last year) meaning that collateral has shed $260 million since January. Or said otherwise, "Founders leveraging company stock for hockey teams while retail investors queue up for their own money. Wall Street's version of noblesse oblige."

And Noble's parting thoughts:

This isn't about Blue Owl. Blue Owl is a symptom.

The disease is a $3.4 trillion private credit industry built on opacity, conflicts of interest, and the polite fiction that illiquid assets can offer liquid redemptions. Morningstar DBRS reports the trailing default rate has risen to 4%, up from 2.8% a year ago.

Downgrades outpacing upgrades. Outlook negative. UBS warns defaults could reach 13% if AI disrupts the software companies making up 17% of BDC loan portfolios. Payment-in-kind loans (where borrowers can't pay cash interest and simply pile it onto the debt) have surged past 11% of BDC income. When your borrowers are paying you with IOUs, the word "income" deserves quotation marks.

And the government's response? Open YOUR 401(k) to private credit.

Trump's executive order directed regulators to do exactly that. They want to "democratize" an asset class whose flagship retail product just permanently locked investors out. The KKRs. The Blackstones. The Apollos. Everyone loaded up on private credit is exposed.

When the tide goes out, you find out who's swimming naked.

In April 2007, New Century went bankrupt. Most of the financial world shrugged. 17 months later, Lehman made the point impossible to ignore. And Blue Owl permanently halted redemptions today.

More in the full Barclays and Goldman notes available to pro subs.