Chaotic Week Ends With Stocks Down, Crashing Dollar, Precious Metals At Record Highs

As one veteran equity trader exclaimed via MSG this afternoon: "I need a fucking beer after that week!"

And we agree as a smorgasbord of headline roulette sent global capital markets into various wild reactions.

Here's a brief list of the catalysts for chaos that stuck out to us (in no particular order)

-

Greenland - Trump triggered the world with the threat of kinetic action and tariffs to take over the world's largest island.

-

Europe - Retaliation threats over tariffs

-

Japanic - PM Takaichi's 'easy' policies (and a weak auction) triggered a 'Liz Truss' moment in the world's biggest bond market.

-

Trump - TACO strikes again as the US president told the world that everything's gonna be great with Greenland and NATO, so just chill.

-

Iran - There's an armada on its way and various elites have accidentally hinted at some form of kinetic action being imminent.

-

Davos - Lots of talk of 'new world order', most notably by Canada - who got slapped by Trump and Lutnick

-

Fed Chair - Trump reiterated his view that he'd like to keep Hassett in his current role and Rick Rieder's odds are soaring

-

Yentervention - BoJ's 'hawkish hold' was softened by chatter of yield curve control to 'smoothe' the markets... and FX desks were active on rumors of intervention to save the yen (and a Fed 'rate-check'.

-

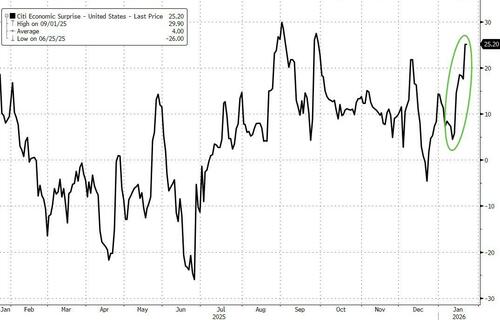

Good data - almost without exception US macro data was better than expected this week from strong GDP and consumer spending to 'meh-flation' and near record lows for jobless claims.

This has been the best 2-week surge in US Macro data since August...

Source: Bloomberg

Meanwhile, Rick Rieder's odds of being the next Fed Chair ripped higher this week (after Trump's comments)...

Source: Bloomberg

Put all that together and we ended the week with stocks lower, vol higher, the dollar crashing, precious metals exploding to new record highs, crypto ugly (despite a rebound today), crude up bigly (and NatGas exploding), and Treasury yields higher (but not as high as JGBs).

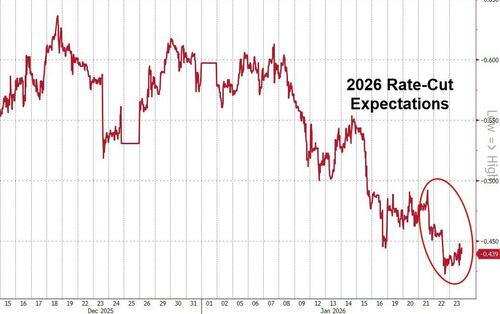

Rate-cut expectations tumbled on the week (now well below 2x25bps cuts expected)...

Source: Bloomberg

In equity-land, it was a volatile (holiday shortened) week that ended with the Nasdaq managing to hold on to some modest gains while the rest of the majors ended red (despite Trump's flip-flop)...

This is the S&P 500's first two-week loss in a row since June 2025...

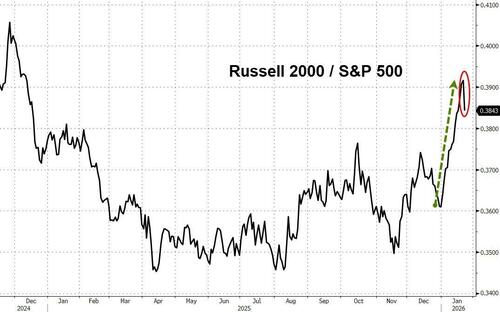

As far as equity markets are concerned, Goldman's trading desk pointed out a "notable change in the narrative today" with the RTY underperforming SPY today for the first time all year (after a record 14 day streak)...

Source: Bloomberg

Mega-Cap tech managed gains on the week, rallying strongly off the TACO Wednesday lows...

Source: Bloomberg

And thanks to today's gains, Mag7 stocks ended the week green while S&P 493 was red...

Source: Bloomberg

Under the hood of the Mag7, one name stood out - AAPL - with its 8th weekly decline in a row, the longest losing streak since May 2022...

Source: Bloomberg

And AAPL flows have been dramatically worse than its Mag7 peers...

Equity vol markets retraced all of the week's spike ('outperforming' the underlying spot markets)...

Source: Bloomberg

Treasuries were mixed on the week with the long-end outperforming and the belly lagging. The close to close change was small but plenty of vol on the way there as JGB chaos rippled across the world...

Source: Bloomberg

The dollar was clubbed like a baby seal today, suffering its worst day since August (and worst week since July) as the Dollar Index tumbled to its weakest since August...

Source: Bloomberg

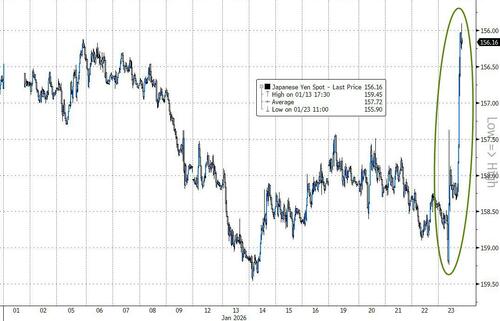

Yen surged today (following intervention chatter) to its biggest weekly gain since May 2025

Source: Bloomberg

Gold is up for 5 straight days, up for three straight weeks ripping up near $5000. This week was Gold's biggest week since March 2020 (COVID chaos)..,

Source: Bloomberg

“There is clearly hot money involved," said Goldman's Delta-One desk-head, Rich Privorotsky, "but first and foremost gold is a central bank trade… a slow erosion of the dollar’s exorbitant privilege rather than a sudden loss of confidence.”

The rest of the precious metals (and industrials) also ripped on the week...

Source: Bloomberg

With silver topping $100 (hitting $102 at its peak) for the first time amid massive Chinese demand and deserving its own chart in today's EOD wrap (Silver is up 8 of the last 9 weeks)...

Source: Bloomberg

Don't say you weren't warned...

CTFC margin changes in precious metals after the close will be wild

— zerohedge (@zerohedge) January 23, 2026

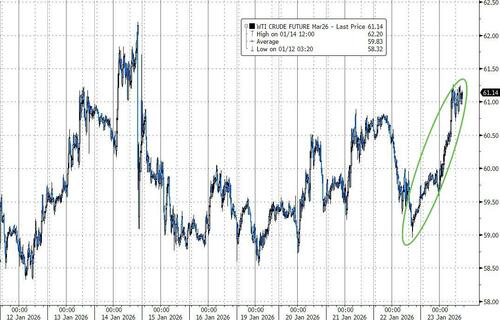

Crude prices were up large on the week amid Iran tensions (trumping the optics of easing tensions with Ukraine/Russia)...

Source: Bloomberg

But it was NatGas that really stood out, exploding over 85% from low to high intra-week!

Source: Bloomberg

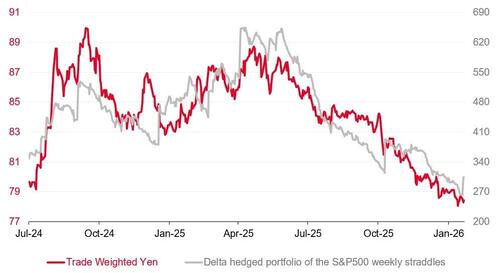

Finally, in case you wondered why an equity trader might care about chaos in the Japanese currency, here's SocGen to explain:

Since the summer 2024 equity market sell-off (the yen carry-trade unwind)...there has been a curious relationship between the Japanese currency and the performance of short-term equity volatility in the US.

The gray line represents the returns from buying very short-term volatility on S&P500, and this part of the volatility surface has significantly underperformed since June 2025.

To put it simply, if the relationship is to continue, perhaps a stronger trade-weighted yen will be an important catalyst for a risk-off sentiment for the broader equity markets.

Next week sees earnings season continue to pick up with 33% of the SPX reporting. Watch for 4/7 of the Mag7 to report, with META, MSFT, and TSLA reporting Wednesday afternoon and AAPL reporting Thursday afternoon.