China Factory Activity Contracts In Longest Stretch On Record As Economy Sinks

China’s factory activity staged a slight improvement in November, but once again printed below the median estimate and extended its streak of declines to a record as the country’s economic slowdown deepens.

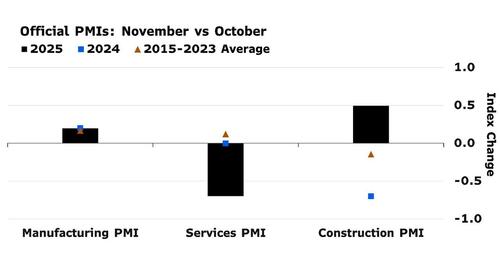

The official manufacturing PMI rose to 49.2 from 49.0 in October but remained below the 50 mark that separates growth and contraction for an eighth month. The median estimate of economists surveyed by Bloomberg was 49.4.

Adding insult to injury, the official non-manufacturing PMI fell to 49.5 from 50.1, below the 50.0 consensus forecast, and dropping into contraction for the first time since the economy reopened in 2023l it was driven by weakness in the real estate and residential services sectors.

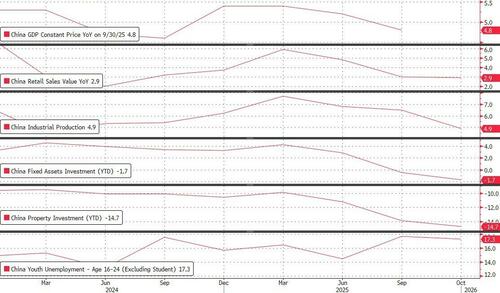

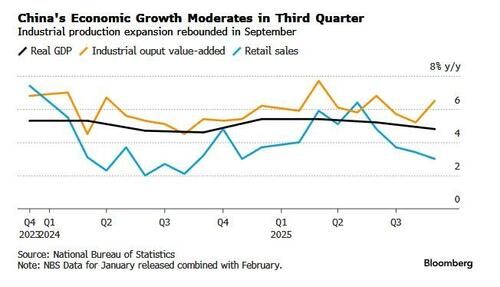

The readings offer a preliminary glimpse of how the world’s second-biggest economy fared in November, after months of global trade turbulence and an unprecedented decline in investment. They suggest that GDP extended its decline and is now well below the 4.8% level Beijing pretends China is growing at. So far this quarter, industrial production had its smallest gain since the start of the year...

... while exports unexpectedly contracted, as global demand failed to offset the slump in shipments to the US.

According to Bloomberg Economics, the November PMI pointed to continuing broad economic weakness and hinted at a further down-drift in consumption. Services dropped sharply into contraction, a stark contrast to the flat reading in 2024 after the long October holiday. Manufacturing and construction also remained in contraction, despite a modest seasonal rebound.

The good news is that tensions with the US eased modestly after a temporary truce last month following a meeting in South Korea between Presidents Donald Trump and Xi Jinping. Even so, key details of the deal, including questions over Chinese shipments of rare earths, are still being negotiated, underscoring the fragility of the agreement. In fact, as reported here previously, there is still no actual rare earths agreement.

Meanwhile, a diplomatic spat with Japan in recent weeks has added to trade uncertainty, as China contemplates economic countermeasures.

Beyond geopolitical risks, weak domestic demand is still casting a pall over the outlook for Chinese factories. Growth in retail sales slowed for the fifth straight month in October, the longest such streak since the country shuttered shops because of the Covid pandemic more than four years ago.

As Bloomberg notes, the recent downswing in the economy doesn’t mean that additional stimulus measures are on the table. Chinese policymakers are in no rush to act now that their annual growth target of around 5% for this year looks to be within reach. Meanwhile, China's credit growth - previously the envy of the western world - has slowed to a trickle as the demand simply isn't there, as Beijing is scared to making China's massive debt bubble even bigger.

China already injected additional stimulus worth 1 trillion yuan ($141 billion) since late September, including unused bond quota for provinces to expand investment and repay arrears owed to companies, as well as new funding for policy banks to spur investment. That, however, has not been enough, as we reported recently in "China Prepares New Property Stimulus Package As Housing Crisis Enters Year Six."

Looking at the next five years, Beijing has made clear it plans to keep tech and manufacturing as the top priorities even as it pledged to “significantly” boost the share of consumption in its economy. Net exports contributed nearly a third of China’s growth this year.

China’s economic growth decelerated last quarter to the slowest pace in a year. Analysts see a further slowdown, forecasting the weakest this quarter since the final three months of 2022, when the nation was nearing the end of its Covid Zero lockdowns.