China Is Pumping Cash To Fill A $456 Billion Liquidity Shortfall

By Tian Chen, Bloomberg Markets Live reporter and strategist

The People’s Bank of China is boosting the supply of money available to banks to ensure they can meet the surge in demand for cash during the Lunar New Year holidays.

The central bank injected a total of 600 billion yuan ($86.4 billion) via a 14-day repurchase agreements late last week, ending a two-month hiatus for such operations. Industrial Securities forecasts the PBOC to add as much as 3.5 trillion yuan of funds via similar tools before the holidays kick off on Sunday.

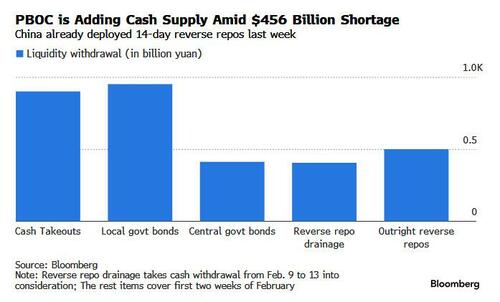

The injections would address a roughly 3.2 trillion yuan liquidity gap identified by Bloomberg calculations. Withdrawals related to holiday spending, heavy government bond issuance and surging corporate demand for the yuan are all expected to drain funds from the banking system.

For the PBOC, keeping the financial plumbing well-greased is essential to ward off a seasonal cash crunch and maintain economic momentum against mounting headwinds. Before the latest move, the PBOC doubled its bond purchases in January and added a record 1 trillion yuan of medium- to long-term funds into the banking system.

“The central bank has ample room to roll over liquidity,” said Ming Ming, chief economist at Citic Securities.

“It is expected that the PBOC can offset the funding gap by combining injections through conventional liquidity tools with a steady scale of bond purchases,” he said, adding that “liquidity conditions in the bond market will remain steady.”

Some of the liquidity pressure the PBOC must offset stems from household behavior. Analysts from Huaxi Securities expect a liquidity drain of 900 billion yuan from holiday travel and the tradition of gifting cash in red envelopes during the Lunar New Year festivities.

On top of that, some 405.5 billion yuan of PBOC’s reverse repos will mature this week, according to Bloomberg calculations, further draining cash from banks. An outright reverse repo maturity will take out another 500 billion yuan.

China is front-loading government bond sales ahead of the holidays, according to Guolian Minsheng Securities, which may exacerbate the liquidity shortage.

Local authorities plan to sell about 950 billion yuan of bonds in the first two weeks this month, some 18% more than the amount issued in all of January, Bloomberg data show. That’s on top of 412 billion yuan of issuance from the central government.

Exporters converting dollar earnings into yuan will further tighten liquidity, according to Sinolink Securities. This demand follows a 2.6% rally in the yuan since end-October, driven by capital inflows, a weakening dollar and the PBOC’s tolerance for appreciation.

In addition to the latest cash injections, the PBOC also let the interest rate on a one-year policy loan to banks drop to a record low of 1.5% last month, according to people familiar with the situation, to aid recovery.

Looking ahead, economists expect China to slash banks’ reserve-requirement ratio by 50 basis points this year and cut interest rates. Inflation data this week will help guide expectations for the extent of policy support from the PBOC for the economy.

And although short-term funding costs have picked up from the lowest level since 2023, analysts expect these rates to be subdued. This reflects the PBOC’s commitment to supporting the market during seasonal peaks.

“The last thing the markets need to worry about this year is the PBOC’s tendency to keep liquidity ample,” Huachuang Securities analysts wrote in a note. “Despite volatility in repo rates due to seasonal factors, the supply of cash still feels very loose.”